Fixed income breeding rewards

Fixed yields in Decentralized Finance (DEFI) provide a clear advantage over traditional finance (TradFI). They are changing the way people use financial services.

Enhanced accessibility and financial inclusion: The Defi platform does not have the strict barriers commonly found in tradfi. There is no extensive paperwork or high minimum deposit. Anyone with an internet connection and a digital wallet can access these services worldwide. This promotes enormous financial inclusion.

As of early 2025, more than 15 million unique addresses interact with the DEFI protocol. This is 120% higher than in 2022. It shows a growing global user base. It also highlights visits from underserved populations.

For more information: A comprehensive analysis of earnings and payment stability

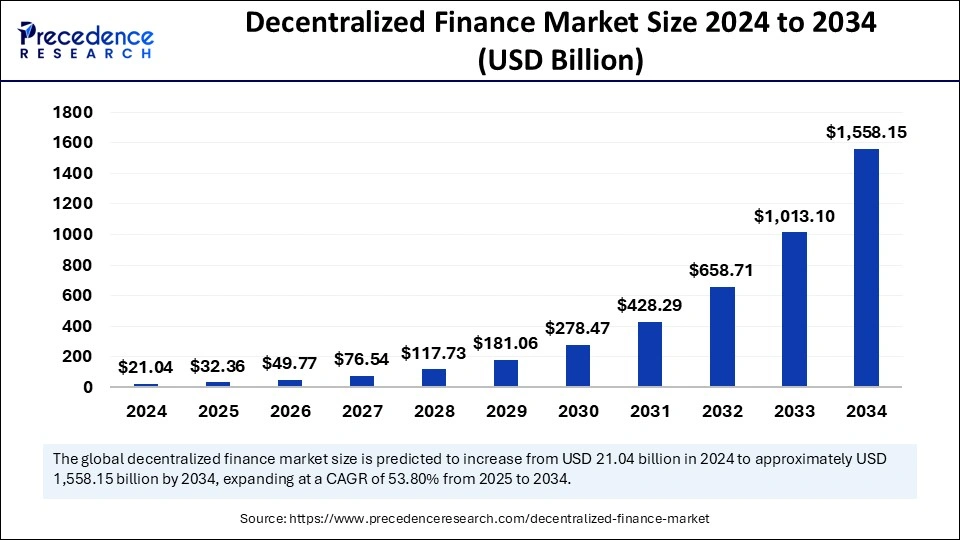

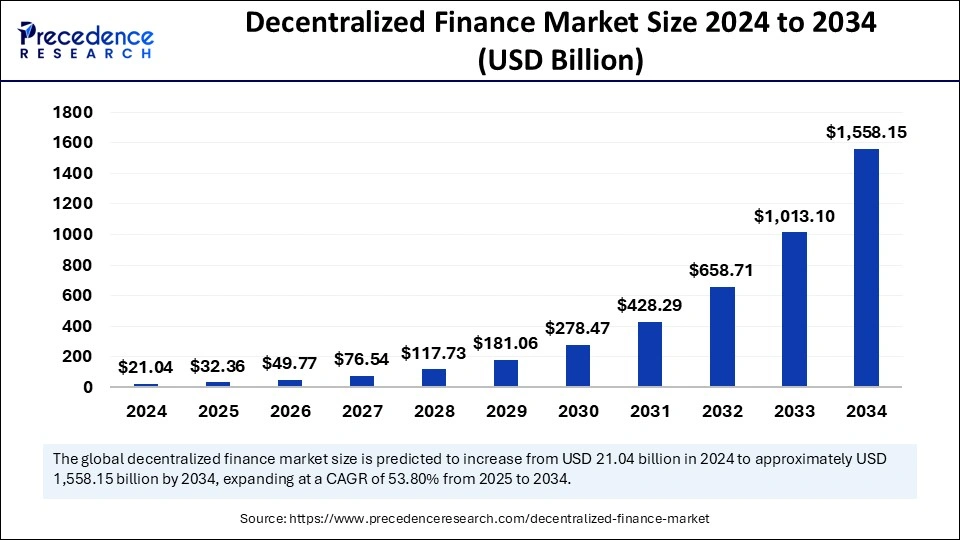

Defi market size to reach $1558B in 2034

Unparalleled transparency: The cornerstone of Defi is its inherent transparency. All transactions are recorded in a public, immutable blockchain ledger, allowing users to track and verify their funding and protocol activities in real time.

This is in stark contrast to the often opaque “behind the scenes” actions of traditional financial institutions. This public validation reduces hidden costs and enhances accountability to build trust among users.

Higher efficiency and lower cost: By cutting back on intermediaries like banks, brokers and clearing houses, Defi Transactions is significantly faster and cheaper. For example, the cost of remittances through traditional channels is an average of 6.5%, while the Defi platform can reduce it to less than 1%, making international fund transfers more accessible.

In addition, the settlement time for international transactions has decreased from an average of 3-5 bank entrepreneurial days to less than 5 minutes in 86% of Defi transactions, an improvement of about 99.8%. This direct peer-to-peer model reduces operational overhead and translates into higher profit margins for participants.

Authorized self-customer and user control: In DEFI, users directly control their digital assets through their private keys and interact directly with smart contracts. This eliminates the need to entrust funds to central authorities, fundamentally mitigate the risk of opponents and empowers users with greater financial autonomy. This is in stark contrast to traditional banking, where users rely on institutions to manage their funds.

Accelerate innovation and new product development: Defi is a rapidly growing industry that constantly uses new protocols and financial products to innovate, which push the boundaries of traditional finance.

The modular nature of Defi, commonly known as “Money Legos”, allows seamless integration and synthesis of different protocols. This has promoted the sustainable development of new generation strategies and structured products. For example, Alchemy listed the total number of DEFI DAPPs in 2025 at 354, and the continued development has led to the infeasibility of new financial originals and services in conventional systems.

Limits and risks compared to traditional fixed income

Despite its compelling advantages, the fixed yield of diversified financing (DEFI) has inherent limitations and risks, often less general or different in traditional fixed income. Understanding these differences is essential for smart investment decisions.

For more information: The Rise of Stablecoins: Market Updates and Key Statistics for 2025

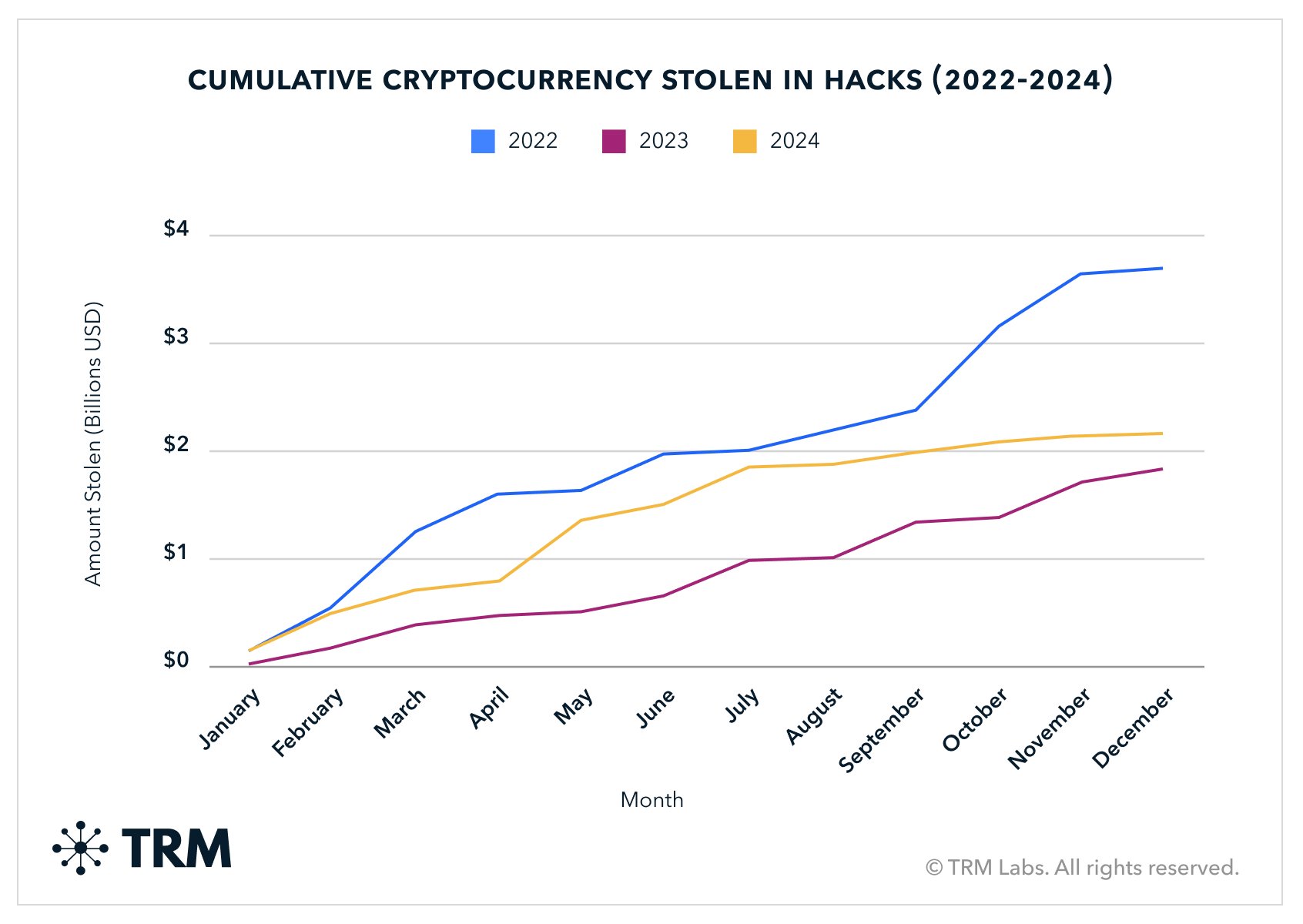

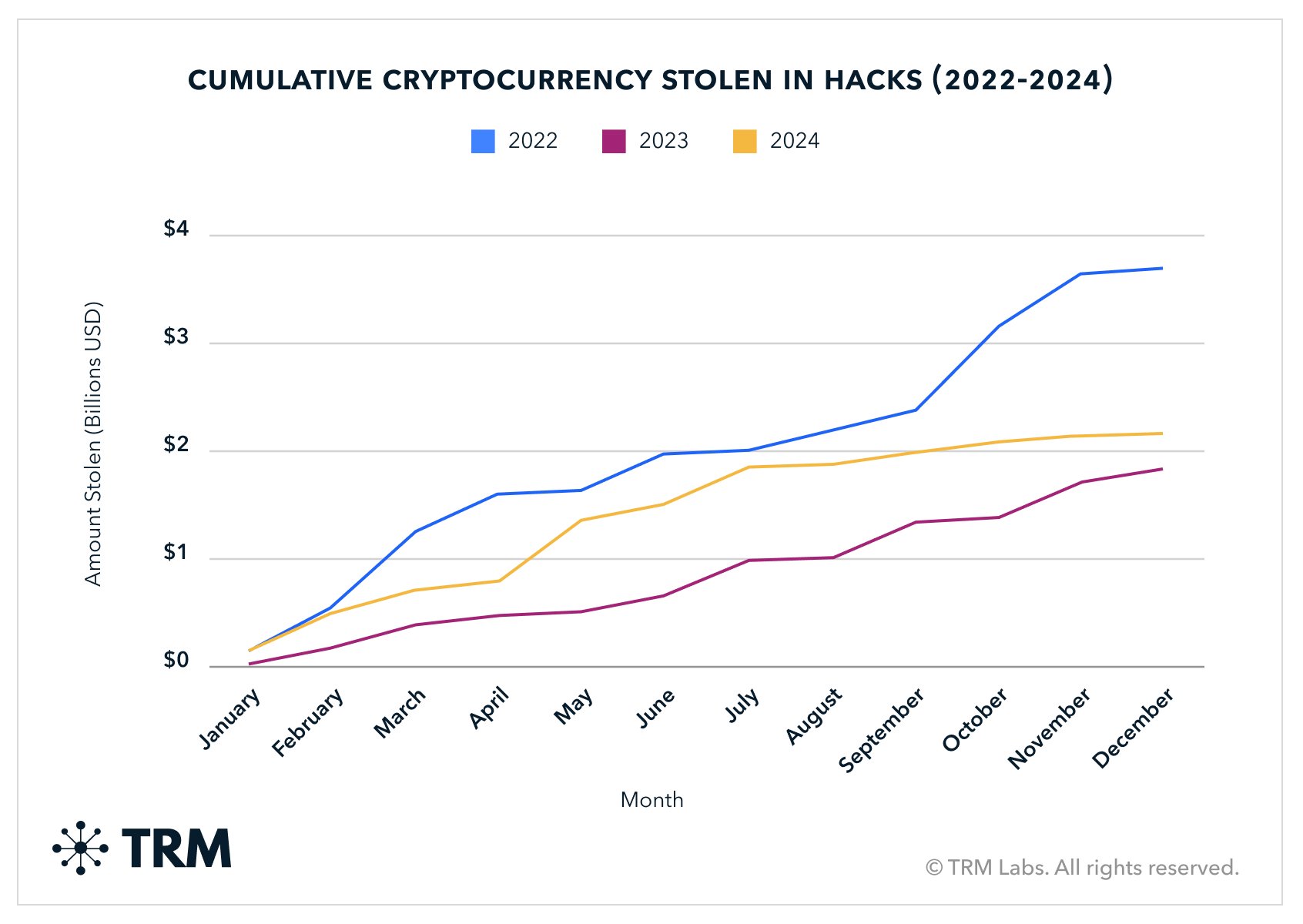

Higher inherent risks: Compared with traditional bonds, Defi investment faces greater fundamental risks even with fixed interest rates. These include smart contract vulnerabilities that resulted in more than $2.2 billion in 2024 crypto-related hackers’ theft.

The impermanent losses of liquidity pools and inherent volatility of crypto assets also have potential; for example, the volatility of Bitcoin and Ethereum is significantly higher than that of traditional assets, thus affecting the value of the principle.

Source: TRM

Lack of regulatory clarity and consumer protection: Defi operates largely in an unregulated environment, lacking extensive supervision of traditional finance. This means that in the event of a platform failure or scam, there is less legal resources. As of early 2025, Europe admitted that there were large regulatory gaps that put users at significant risks.

Scalability Challenges and High Gasoline Fees: Famous Defi networks such as Ethereum may face scalability issues and high transaction (“gasoline”) fees during congestion. Although Ethereum’s average fee is about $0.537 in June 2025, the spike will affect less investments, which is a non-issue in the traditional bond market.

Relying on cryptocurrency market fluctuations: Fixed-production products are related to the performance of basic crypto assets. Although interest rates are fixed, the value of the principal may fluctuate greatly and may result in overall losses. Unlike FIAT’s traditional fixed income, Defi Assets can experience 5-10% or more daily price fluctuations.

Current status of fixed income market

The Defi market, including its fixed yield components, showed significant growth and maturity. By early 2025, the total value lock-in (TVL) in all DEFI protocols reached approximately $60 billion, reaching a peak of more than $100 billion in October 2023, and confidence has boosted confidence despite market volatility.

Ethereum still dominates, holding more than half of the locked value, but Layer 2 (L2) solutions (such as arbitration and optimism) are the main forces, collectively known as more than $15 billion. This shift reflects lower fees and faster transactions for users to move to L2S, thus addressing barriers to adoption.

Stablecoin production has fallen from its 16% peak at the end of 2021 to its most recent average of 3.1%, consistent with the global interest rate drop. Nevertheless, capital inflows into stable deposits on platforms such as AAVE and COMPOUND has grown from $4 billion in 12 months to more than $15 billion. This shows that more elastic capital is driven by Defi’s transparency and decentralization.

Crucially, the development of institutional participation has grown significantly, up 65% year-on-year, with more than 350 financial institutions now actively participating. They are involved in liquidity delivery, yield farming and treasury management, signaling DEFI to transform from experimental technology to an established financial system component. Cross-chain bridges further improve interoperability and facilitated more than $250 billion in asset transfers in 2023.

Emerging trends and future prospects

The fixed rate of return Defi market is characterized by several key emerging trends that will affect its future trajectory:

Real-world Assets (RWA) Tokenization

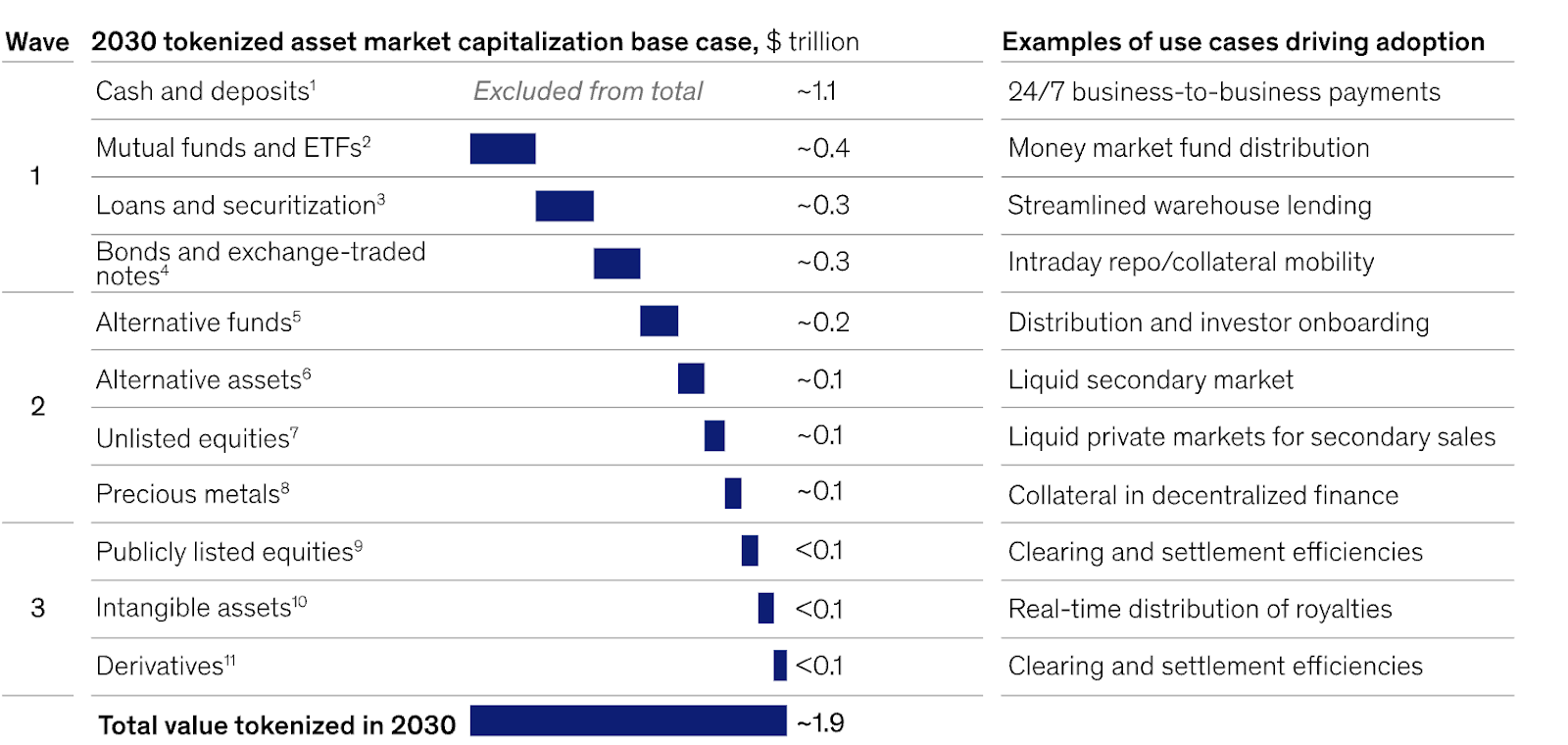

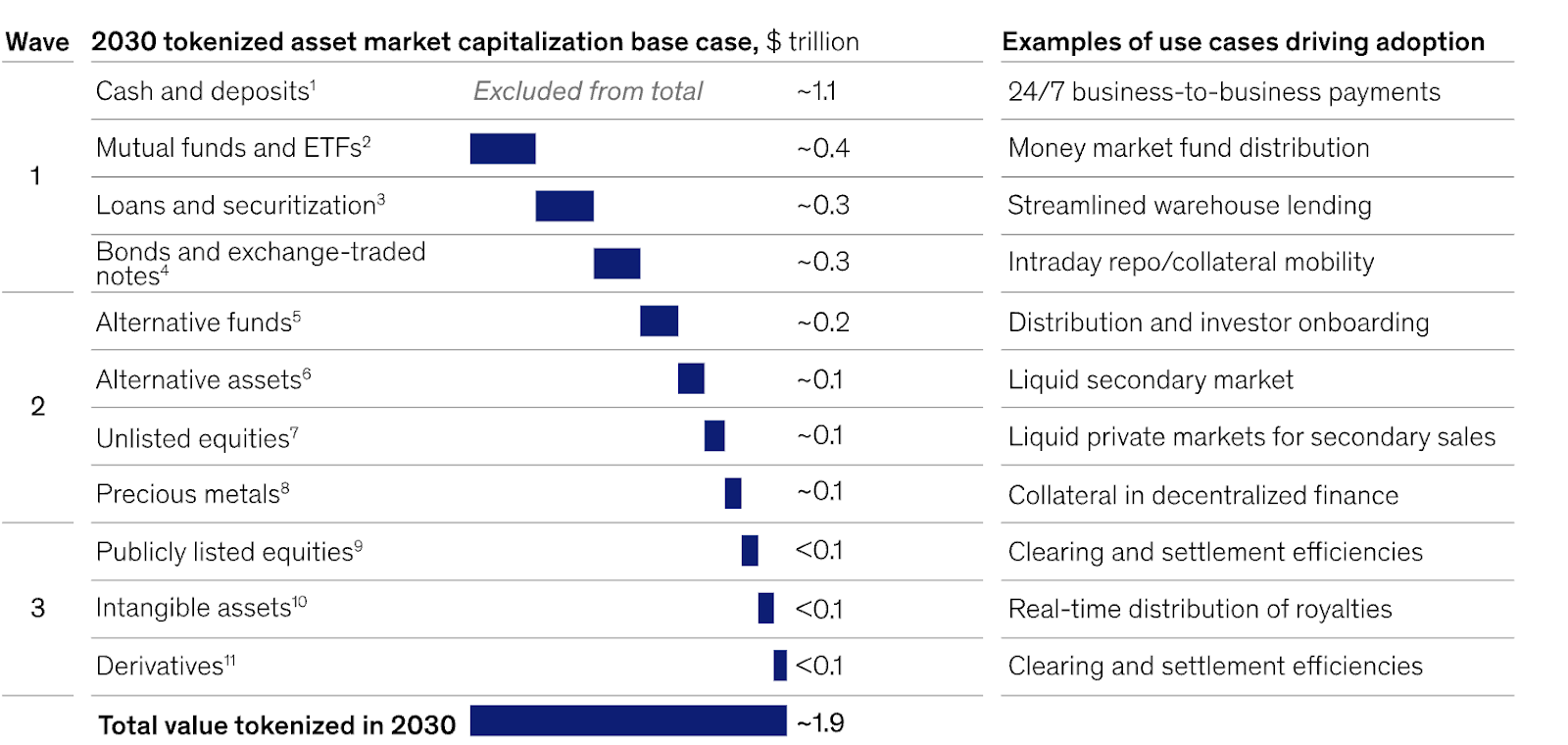

Real-world Assets (RWA) tokenization is a crucial trend. Indeed, the asset class on the Defi platform has reached $12 billion. In addition, it grows 150% per year. It is worth noting that RWA includes tokenized securities, real estate and commodities. Credit products also belong to this group.

Therefore, more capital is allocated to RWAs of different blockchains. This reflects a wider shift. It points to the move towards diversified yields. It also helps preserve the value of traditional capital markets. Ultimately, this trend is crucial to Defi. It expands defi beyond typical crypto assets. As a result, assets with insufficient liquidity gain new liquidity. Fraction ownership becomes possible. In addition, RWA integration enhances the link between traditional finance and violations. This provides greater legitimacy for defi. As a result, investors can now gain defense against risks while still earning traditional yields.

Symbol waves through asset capitalization

Generate aggregators and policy protocols

The Defi landscape is seeing the spread of yield aggregators and strategic solutions such as financial aspirations. These platforms are designed to provide users with automatic optimization, efficient and sustainable returns profiles for a variety of protocols. They are DEFI ramps, simplifying investments for users who may not fully understand the underlying portfolio components. This trend shows a move towards greater user-friendliness and output optimization.

Liquidity owned by the agreement (POL)

The protocol is adopting the liquidity (POL) model owned by the protocol. This solves the problem in inflation token emissions. It also deals with “hiring fees,” which capital chases temporary yields. Instead of renting liquidity through incentives, the agreement establishes a permanent capital base.

These foundations produce sustainable returns. This comes from actual economic activity, not just token inflation. POL makes the protocol more resistant to capital flight. This is especially true during market downturns. It also generates consistent expense income flowing to the agreement. This promotes long-term development and security.

Innovation in yield generation model

In addition to traditional lending fees and token incentives, the updated Defi platform also innovates by leveraging alternative sources of income. Examples include the funds charges for the permanent market (the trader in longer positions pays fees to short traders) and the market value of the share of earning transaction fees and clearing profits. These models are designed to create more market-driven and sustainable returns mechanisms that bring Defi returns closer to structured products or funds in traditional finance.

Regulatory evolution

As the defense sector continues to grow, a regulatory framework is beginning to form. Currently, the lack of uniform regulations presents challenges for DEFI projects, especially in ensuring institutional investment and expanding into new markets. However, the expected regulatory clarity will greatly affect the landscape, thereby promoting greater institutional adoption and market stability.

Scalability solutions

Continuous development and adoption of Tier 2 solutions is critical to addressing blockchain limitations such as throughput limitations and high transaction costs, especially on Ethereum. These solutions will increase the efficiency and accessibility of fixed-yield products for wider participation.

in conclusion

Fixed yields in DEFI provide predictability and passive income, attracting different investors with stable interest rates. It uses complex mechanisms such as fixed-rate loans and tokenized real-world assets (RWAS).

However, its “fixed” nature does not eliminate inherent risks of violations, including smart contract vulnerability, impermanent losses, Oracle risks and governance issues. The sustainability of yields, especially from the inflation model, is still addressed by innovations such as liquidity owned by the agreement.

Comparing Defi with traditional finance shows the trade-off: Defi provides accessibility and innovation, while TradFi provides regulatory clarity and lower inherent risks.

The market shows strong growth, and RWA tokenization is transformative. This trend, along with yield aggregators and sustainable models, suggests a more comprehensive and mature future. Investors must understand the mechanisms, conduct due diligence and assess risk tolerance in response to this evolving landscape.