Ethereum entered in a re-rally in June 2025 after months of underperforming. At the beginning of the year, ETH soared about 45% in late May, surpassing Bitcoin and the broader Defi market.

This article will analyze all factors to predict the price trajectory of Ethereum through June 2025.

Basics: Upgrade, Stillness and Tokenology

The most important upcoming milestone is the “pectra” hard fork – bringing Prague and Electrolux together. Pectra plans to double the double-layer blob space in mid-March 2025, introduce account abstraction (let users pay gas in stable shares such as USDC) and increase the fixed limit of the validator from 32 ETH to 2,048 ETH.

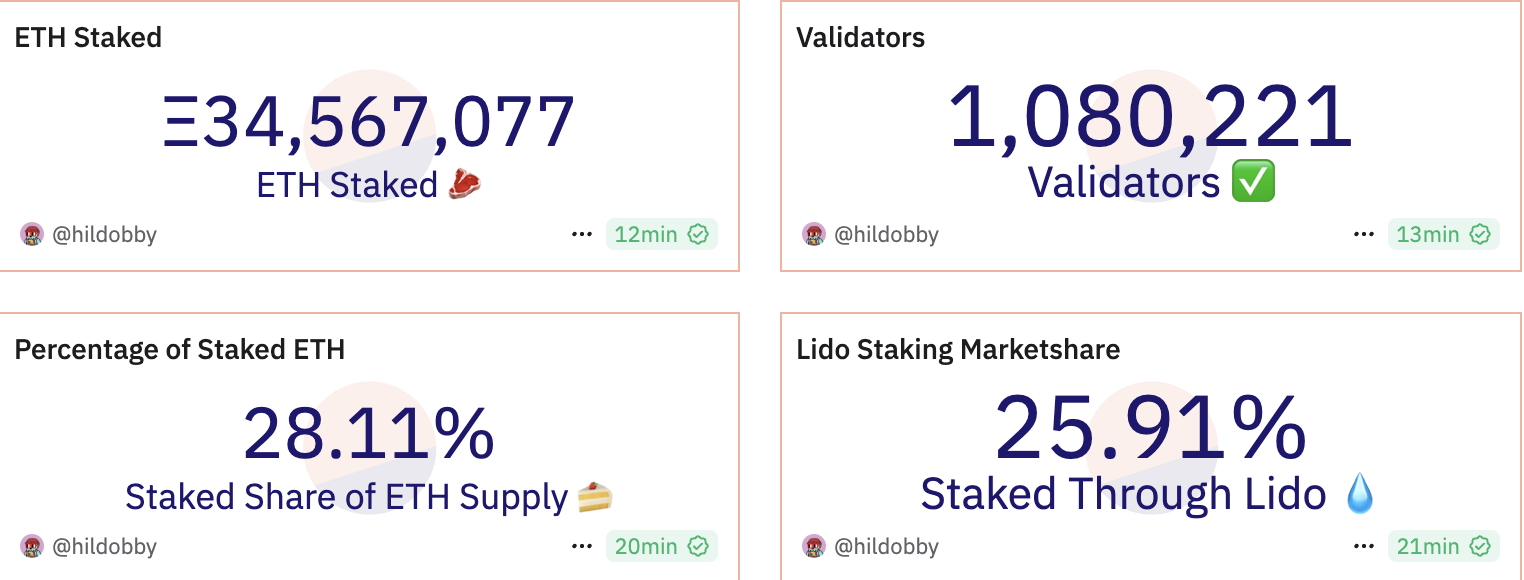

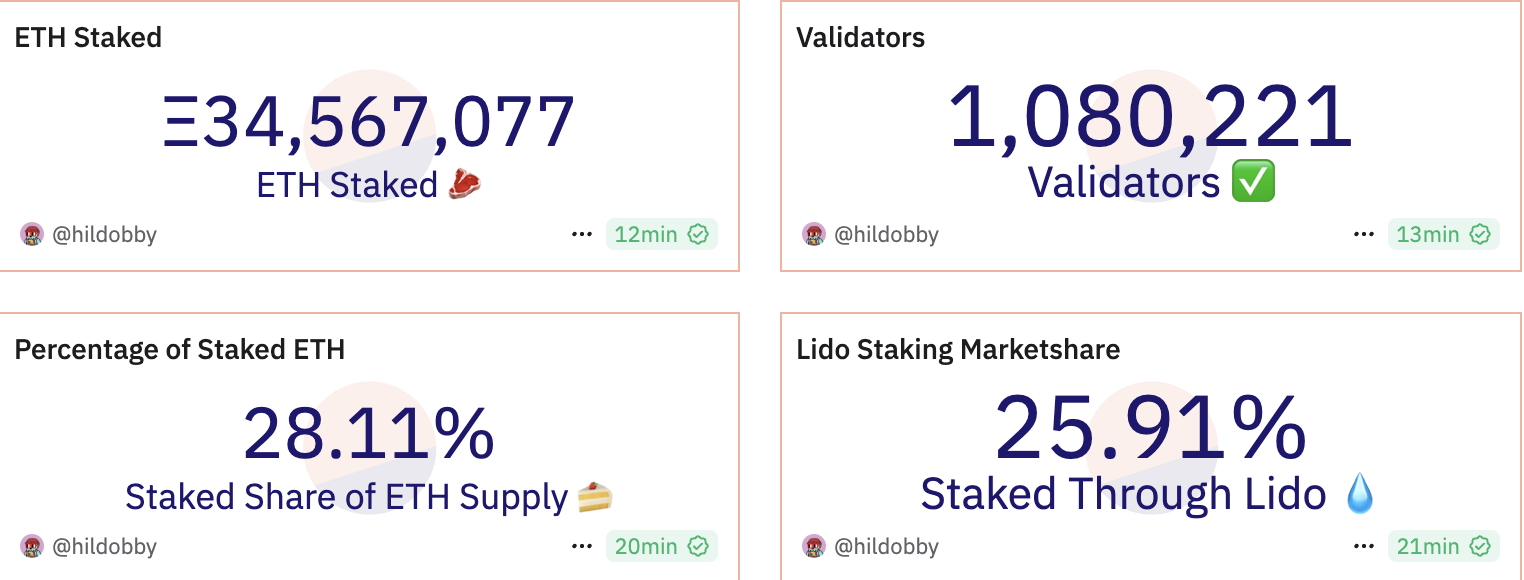

Ethereum’s stacking ecosystem is very powerful. More than 27% of qualified ETH are placed on POS (~2% of BTC) and the average annually is about 3–4%. Now, major liquids such as Lido have deals with TV stations are about $22.6 billion (although it has dropped by about 20% in recent weeks).

Source: Sand Dunes

More inclusion means less ETH supply in AC, thus increasing ether scarcity.

In fact, these changes mean that Ethereum can handle more L2 transactions per block, helping to significantly reduce gas fees and make large holders more efficient. Phase 2 of Pectra will add more enhancements, such as Verkle trees, to improve data efficiency and thus further improve throughput.

Perhaps the most critical thing is the merged token learning: Since the POS issuance of EIP-1559 is greatly reduced and the transaction fees are greatly reduced, Ethereum’s net issuance is usually negative now. In fact, since the merger in 2022, approximately 170,000 ETH has been removed from the cycle, causing the annualized drop in ETH to be about 0.22%.

Source: Ultrasonic Funding

There are currently approximately 120 million ETHs, with approximately 18.9 million (≈15.7%) locked in the ETH2 deposit contract.

With more ETH than ever before and new supplies are constantly offset by Burns, Ethereum effectively converts release when network usage is high. This supply compression – coupled with growing demand from Defi users – is based on a positive outlook: A decline in net issuance rates may drive prices over time in the case of rising usage.

Read more: Trading with free encrypted signals in the Evening Trader Channel

Ethereum ecosystem: defi, nfts and dapps

As of June 2025, it has more than 1,300 Defi protocols, with a total TV of approximately $46.3 billion. This makes it closest competitor (Solana $7.2B, BNB chain $5.5B). Even when the activity is transferred to L2S, the Defi stack is robust: L2s such as intionum also constitute many new defi applications for Ether elements, and the cross-chain bridges all indicate that the values locked on L2S still reflect the Ethereum ecosystem.

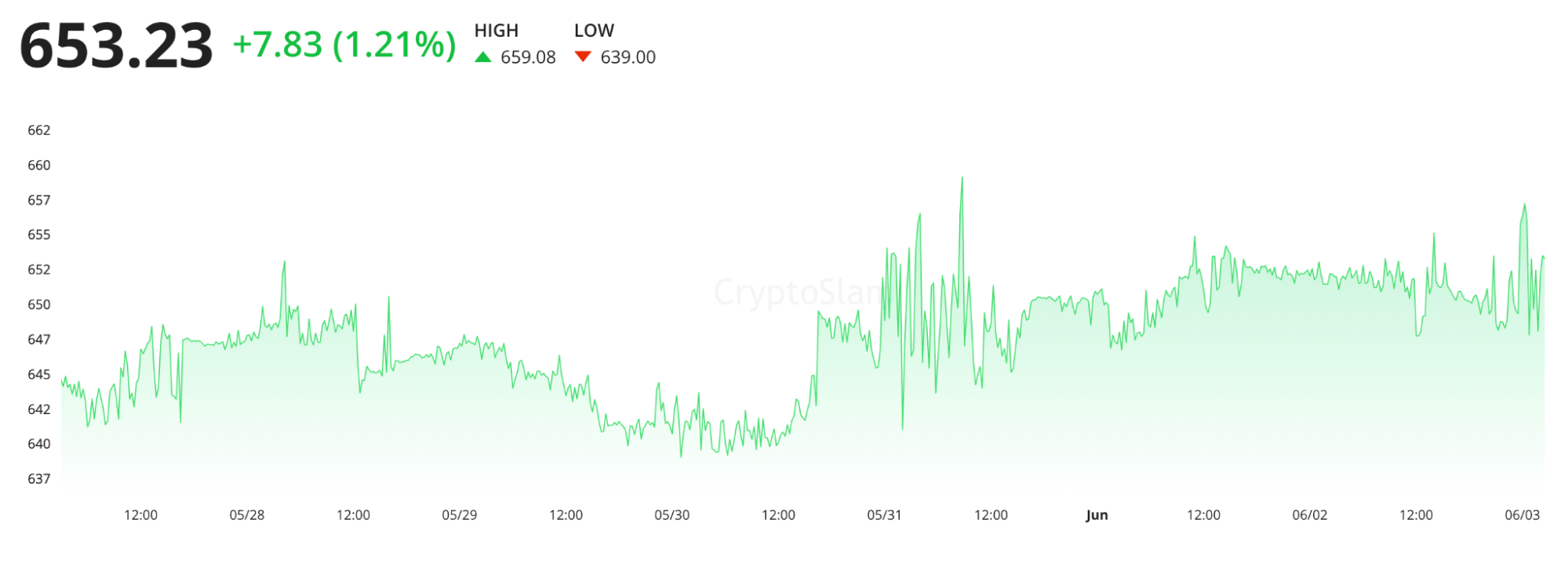

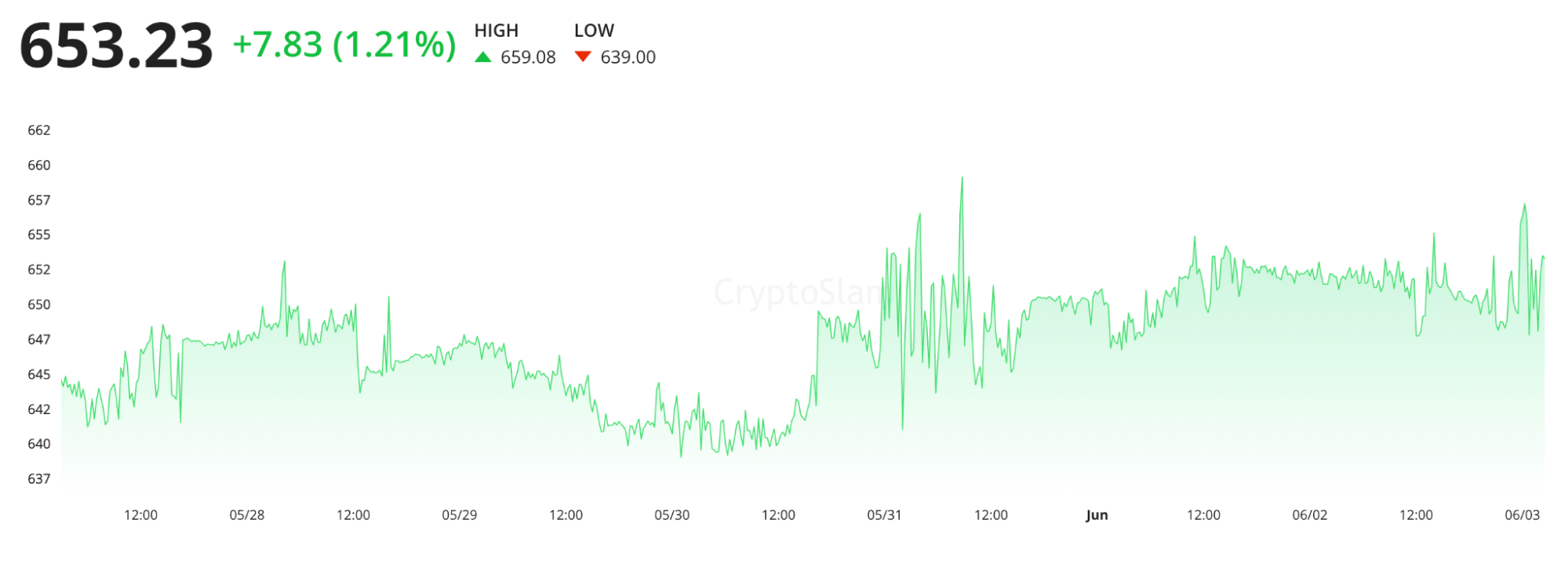

NFT remains a key part of the Ethereum ecosystem. After 2021-22 hype and subsequent cooling, the NFT market stabilizes with new utility priorities. Ethereum retains the lion share of NFT volume: In late May 2025, Ethereum NFTS’ weekly sales were about $36.5 million, about 28% per week, much higher than other chains, according to data from CryptoSlam.

Source: Cryptoslam

However, NFT trade remains relatively static, which means that the segment is still reappearing rather than thriving. However, since most projects in these fields rely on ETH, any broader revival in NFTS or Web3 games may benefit significantly from Ethereum.

In short, Ethereum’s fundamentals and ecosystem are still strong. It has the vast majority of Defi values and NFTs, is using upgrades such as Pectra and EIP-4844 to advance its core protocols, and is supported by a larger fixed ETH, thus reducing inflation.

These positive drivers must be weighed against competition (other blockchains) and technology risks, but as we enter mid-2025, the growth story of Ethereum looks intact.

Market trends and macro factors

Spot ETFs are at the forefront. After U.S. regulators approved multiple ETH ETFs in mid-2024. In May 2025, a record $564 million cumulative ETF inflows were set, and they continued until June. As of June 3, the overall ETH ETF assets were approximately US$9.37 billion (about 3.06% of ETH market capitalization).

Market sentiment still has risks. In June 2025, tech stocks and cryptocurrencies were widely transferred in tandem: for example, the slight growth of Nasdaq, and the rise of Bitcoin to $66,000 was positively correlated with ETH’s rebound.

As inflation cools, the Fed has stabilized interest rates at its recent meeting (4.25-4.50%), suggesting a pivot that could lower interest rates late in 2025. Lower interest rates may raise cryptocurrencies again because “usually, “usually, lower interest rates” means higher cryptocurrencies are priced higher”.

Source: CME Group

Historically, Ethereum often sees re-activity in the second half of the year. The indicators on the chain are already optimistic: the number of active network addresses and transactions is related to the market rebound. Overall, the market will tend toward June, but traders will be cautious about macro events that may trigger volatility.

Institutional Perspectives and Regulations

In May 2025, Paul Atkins, the newly-created SEC chairman, announced clearer guidance on which crypto tokens are considered securities, and even suggested that registered brokers be allowed to trade “non-security, such as Bitcoin or Ether” on alternative trading systems.

This marks a very different position from the previous SEC.

SEC Chairman Paul Atkins

Such developments reduce policy uncertainty: if Ethereum (Ether) is explicitly considered to be a commodity rather than a security, it can further legitimize the ETH market. Furthermore, global regulations (mica in Europe, the ever-evolving rules in Asia) remain a hybrid package, but institutional interests for ETH seem to be largely ignored.

For example, Circle is preparing for an overrated U.S. IPO, which reflects confidence in the crypto infrastructure.

Some countries (China, India) maintain strict crypto bans, which limits demand, but others are exploring blockchain technology (CBDCS, tagged assets). Ethereum’s strong support for private and permission variants (e.g. legal persons, polygon edges) means it often plays a role in experiments with enterprises and central banks, even outside of pure crypto guesses.

In short, although regulations may introduce short-term volatility, the current news traffic for ETH around ETH in the mid-2025 is primarily neutral, especially compared to 2022-23.

On the institutional side, research by banks and asset managers highlights the strong fundamentals of ETH and the math of inflation, which is beneficial to higher prices if demand is met. For example, Bloomberg analysts have pointed out that the potential of ETH staking and revenue models will soon support price.

Technical Analysis – Ether Price Structure

Now, Ethereum has recorded six weekly green candles in a row without any noticeable callbacks, a pattern that is usually preceded by explicit corrections in the cryptocurrency market. This uninterrupted upward momentum may be structurally unsustainable, especially if not supported by large mergers or volume expansions. This suggests that investors should be prepared for potential downward volatility in the short term.

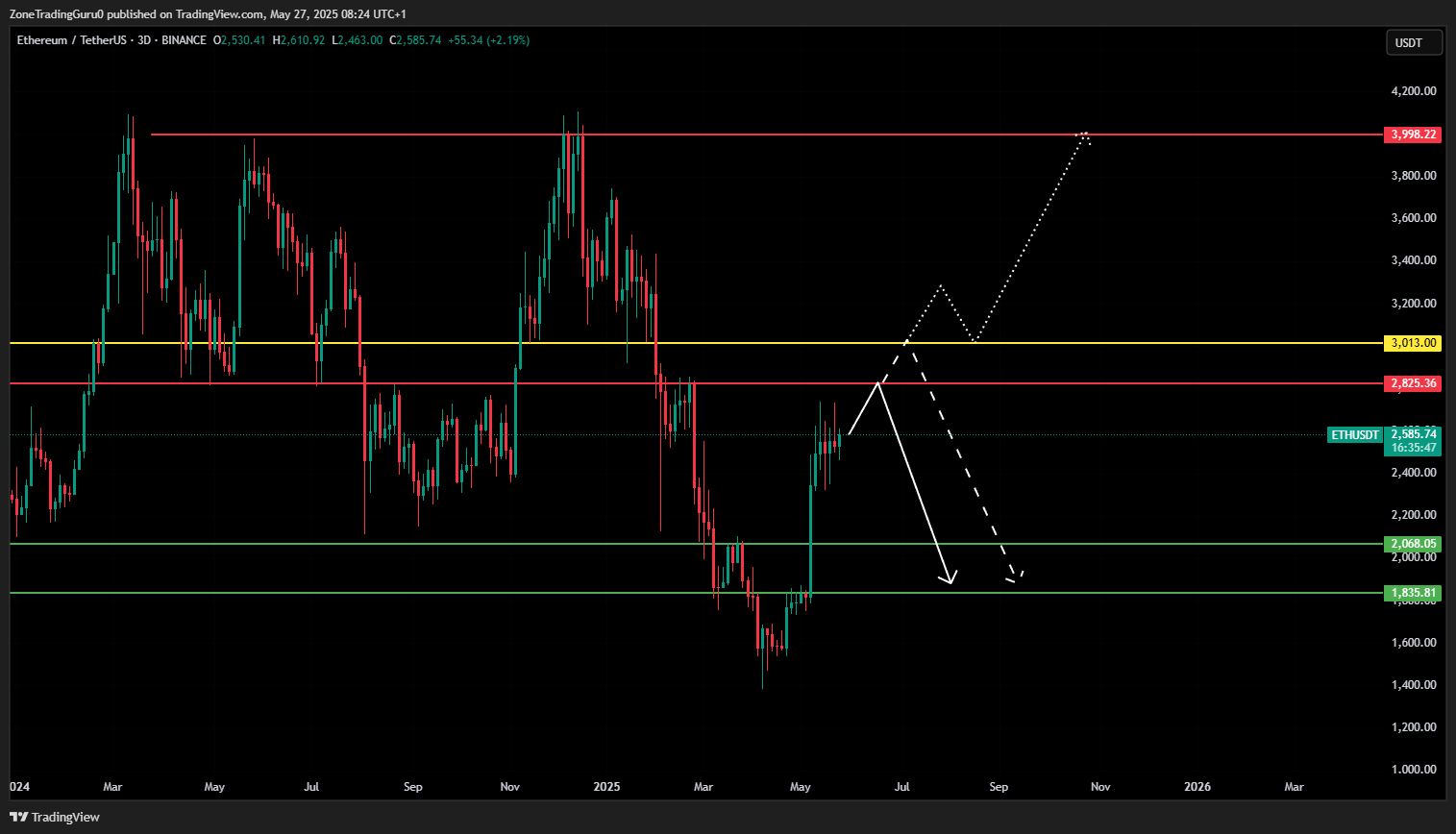

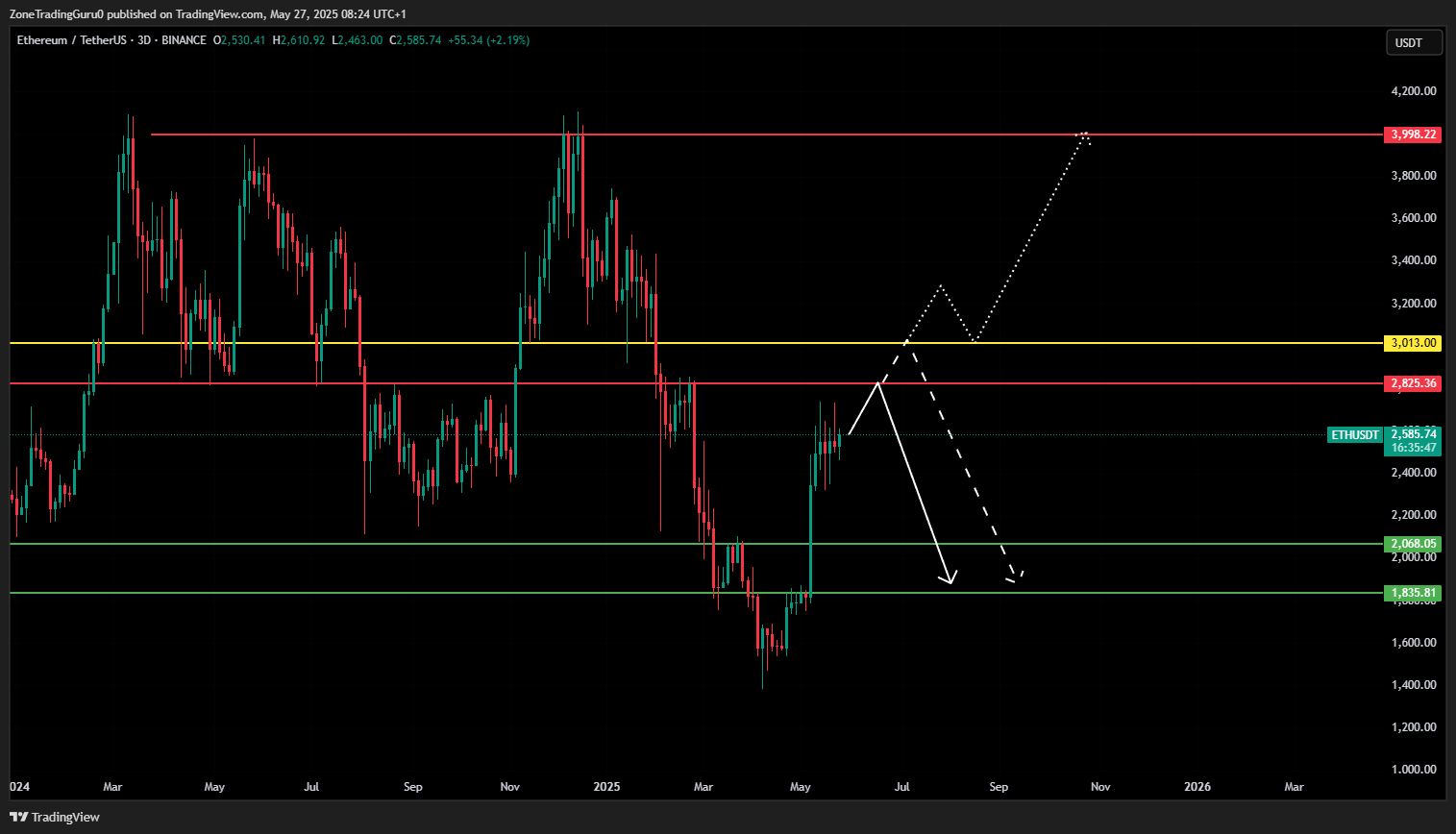

Currently, ETH faces two main levels of resistance: the first one is about $2,825.36 and the second (more critical threshold) is $3,013. This $3,013 region was identified as a key breakthrough level that could define Ethereum’s bullish momentum or fade out.

Analysts are currently watching two main situations:

- Solution 1: Cow Trap Closes $3,013

Ethereum may initially push towards the $2,825.36 resistance zone, with potential liquidity likely causing huge liquidity up to $3,013. However, if no Daily Candles successfully close above $3,013, this would indicate a breakthrough attempt failed. In this case, the price may reverse direction sharply, potentially triggering a wider correction that brings ETH backwards towards the $2,000 area.

- Plan 2: Bullish continues to exceed $3,013

If Ethereum manages to exceed $3,013 resistance convincingly, then the daily candle will indicate a confirmed bullish breakthrough. In this case, traders can retest the $3,013 support as support, providing potential long-term entry zones. If proven, the next technical goal will be the previous cycle that was close to $4,000, which marks a continuation of the uptrend.

These levels and options provide key guidance for short-term traders and investors and improve ETH’s price action on ETF-driven optimism. As always, risk management remains crucial, especially in a market known for sudden reversals and liquidity hunting.

Ethereum price forecast for the short term: June 2025

In the short term, Ethereum’s price trajectory in June 2025 appears cautiously optimistic, mainly supported by continued ETF inflows and a relatively stable macroeconomic background. If these favorable conditions persist, ETH can retest the mid-to-high $2,800 range, with a potential breakthrough pushing it briefly higher by $3,000 psychological $3,000.

The most influential driver remains the capital flow into Ethereum ETFs. Since its approval earlier this year, these financial instruments have aroused a consistent institutional interest, providing a strong fundamental bid for ETH. As long as these inflows remain positive and stable, they provide a reliable source of demand that offsets the balance of sales pressure from profitable or broader market risk sentiment.

In addition to ETF liquidity, the market is also maintaining positive sentiment towards Ethereum, mainly because investors expect upcoming network upgrades to be made, aimed at improving scalability and verification efficiency. Even without explosive news, this forward-looking optimism helps maintain price momentum.

All in all, Ethereum may trade on moderate bias throughout June as long as ETF demand remains strong, macro conditions (such as interest rates or regulations).

While sustained transfers of more than $3,000 may require catalysts (such as a massive inflow week or a surprising upgrade launch), the baseline projection remains modestly bullish.