Ethereum’s DEX ecosystem flourished, with trader activity growing 73%, AAVE’s TVL doubled to $12 billion, and increased user engagement, which marked a strong Defi comeback as of May 2025.

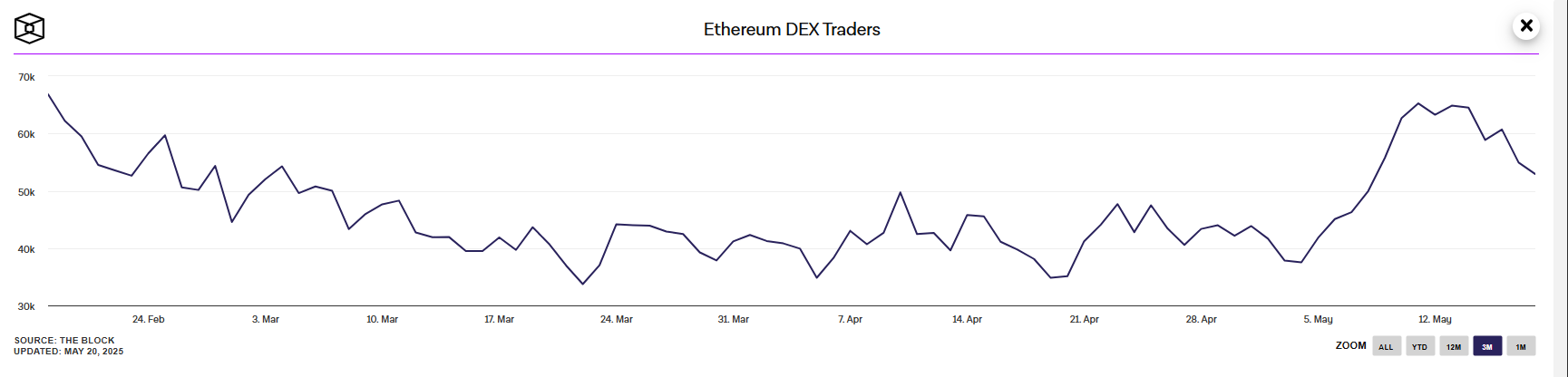

Ethereum DEX activity hits 3 months high with 64,000 users

On May 20, 2025, Ethereum’s DEX trader activity soared 73%, with daily active users reaching 64,000, three months above the May 4 low of 37,000.

Source: Block

Despite this, monthly DEX trading volume is still $15 billion, uniswap Uni Capturing 97% of traders ($13 billion in quantity), highlighting their dominance and the prevalence of smaller retail industries, driving the upward pace.

Historically, this retail-driven activity has hinted at potential growth in the coming weeks ahead of wider market participation.

also, Aave’s TVL makes $40 billion As of May 2025, it rose from US$20 billion at the end of 2024 due to interest in income breeding and loans.

Learn more: AAVE TVL will double fold after signal Ethereum Defi’s comeback?

This growth reflects growing confidence in Ethereum’s Defi infrastructure, supported by its dominance in real-world asset tokenized and decentralized financial applications.

Beyond Uniswap and ghostother metrics and protocols illustrate the upward momentum of Ethereum Defi.

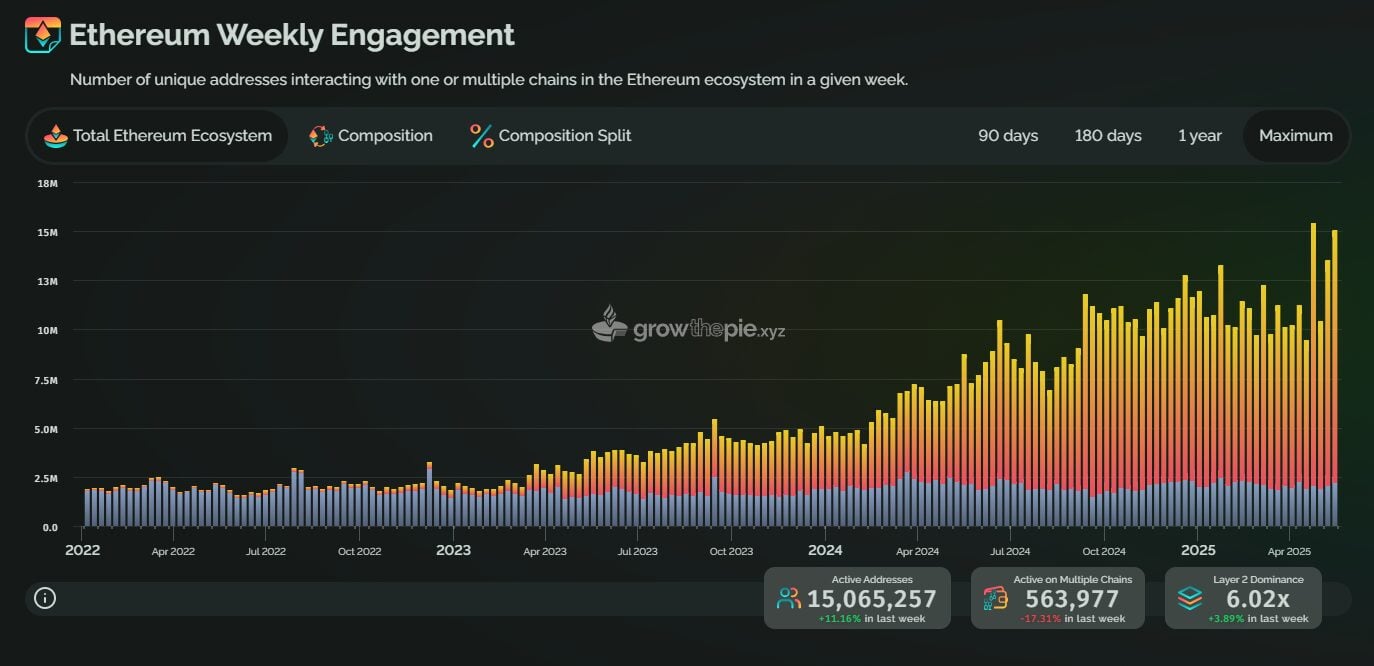

According to Grow The Pie, the number of unique addresses interacting with the Ethereum Defi protocol reached an all-time high of 15 million. This surge in user activity indicates an increase in adoption and engagement.

Source: Pie

Additionally, curve financing is the main decentralized exchange for stablecoins, with its Ethereum-based TVL growing by 30%, and as of May 20, 2025, each Defilama climbed to $2.4 billion.

Source: Defillama

Pectra upgrades and market recycled fuels Ethereum Defi growth

Several factors drive the comeback of Ethereum Defi. this Pectra Upgrade Ethereum’s scalability and user experience have been significantly enhanced.

11 11 Ethereum improvement recommendations implemented in Pectra help improve storage efficiency, wallet availability and gas efficiency. A key feature is EIP-3074, which simplifies Defi interaction by enabling account abstraction, reducing transaction steps and reducing costs for users using protocols such as UNISWAP and AAVE. This makes Ethereum eth Defi is easier to access, resulting in a surge in activity in 73% of traders.

The wider market recycling also plays a role. After the experience in late 2024, Crypto market reboundsEthereum’s price rose nearly 50% to $2,700.

Additionally, Ethereum’s ecosystem extends through layer 2 solutions such as arbitration arbAs shown by 3 million daily transactions, its Defi TVL hit $2.5 billion, has reduced gas fees and attracted more users.

undoubtedly @arbitrum It’s the top L2

– Stablecoin MCAP: $2.6B

-TVL: $2.5B

– 3M TXN every day

– Weekly DEX volume: $6B+

– Weekly application revenue: $1 million+

– @l2beat Stage 1$ arb The ecosystem is seeing a lot of growth beating all other L2s. pic.twitter.com/go58frkdkk– Immortal 💥 (@bitimmortal) May 18, 2025