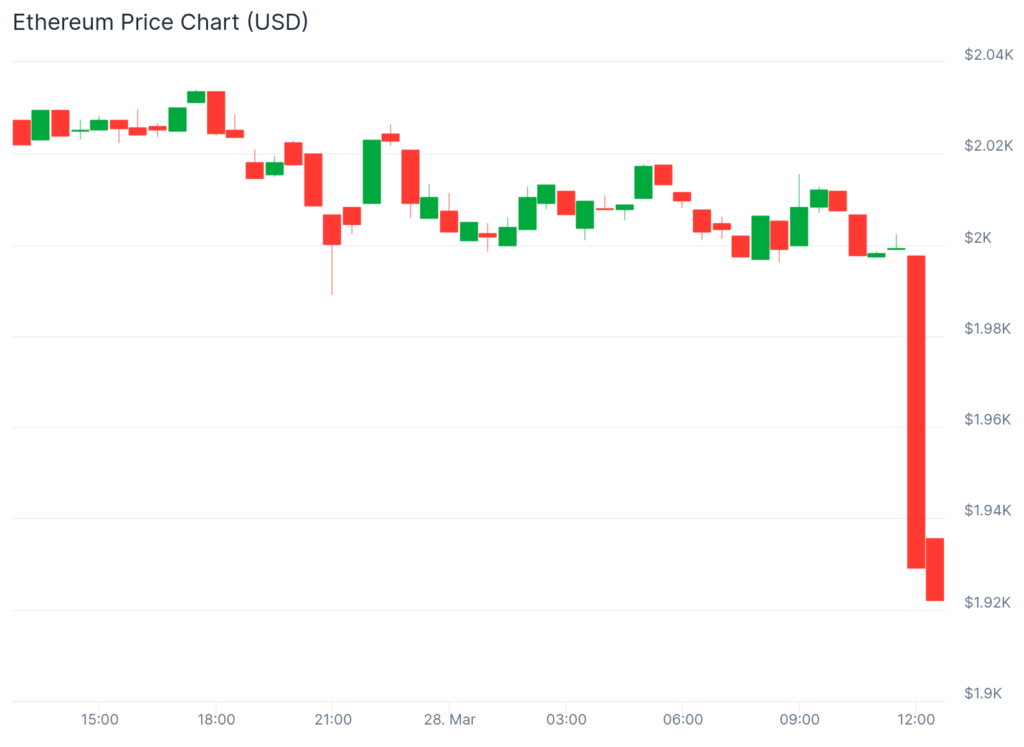

Recently, ETH supporters witnessed a sudden plunge of $1,900, sparking market panic, while speculation and doubt about the recent performance of the world’s second-largest cryptocurrency.

ETH unexpectedly dropped to $1,900, dragging to the cryptocurrency market

Today, Ethereum eth Suddenly, a sharp drop occurred, falling to $1,900. This level has caused shock waves through the cryptocurrency market. This move has caused widespread buzz among ETH holders and the cryptocurrency market as a whole.

Source: Coingecko

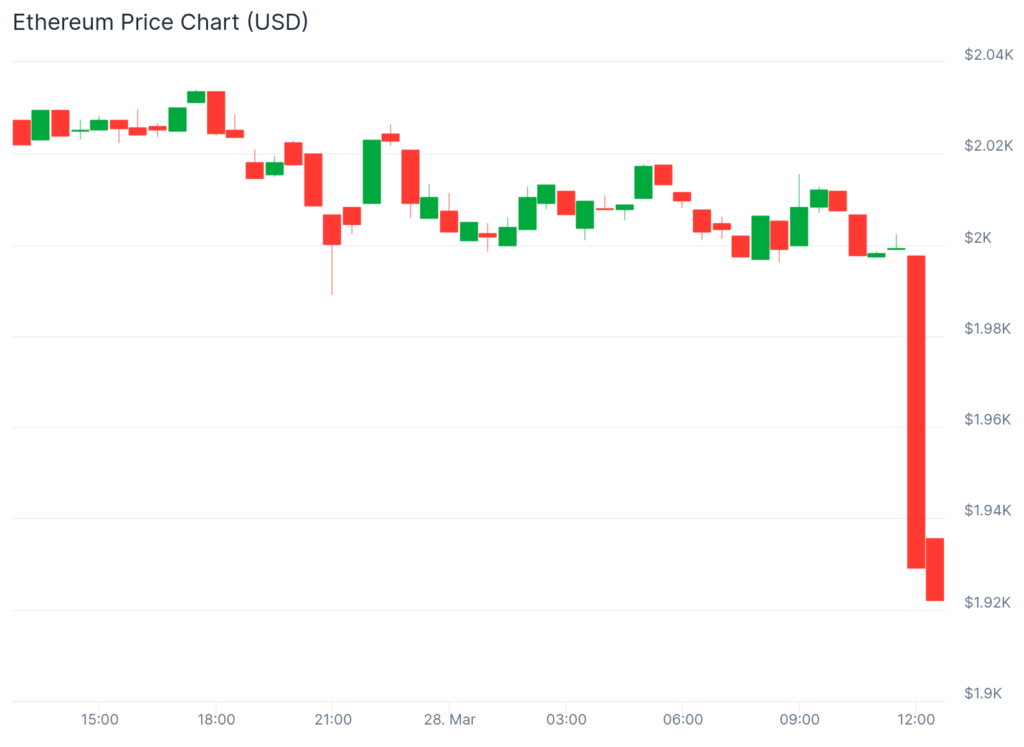

This sudden plunge does not happen in isolation. It triggers the domino effect, reducing the price of major Altcoins, including Ripple XRPSolana soland Cardano Aida. Even Bitcoin BTCMarket leaders, not immune to this downward pressure, recorded a significant decline in their value. The price drop in ETH has caused investors and traders to scramble to evaluate the situation, raising questions that could trigger such a huge sell-off.

Source: Coingecko

Analysts point to a combination of factors that could lead to a sharp decline in ETH. Market sentiment has been shaking in recent weeks due to macroeconomic uncertainty, regulatory issues and relative stability profits.

The cascading role of cascading on AltCoins highlights the critical role of Ethereum in the crypto ecosystem, as its movement usually determines the trend of smaller tokens. Although Bitcoin is more resilient, it also feels pressure and emphasizes the interconnectedness of the market. Currently, the crypto community is on the edge, keeping a close eye on signs of stability or further decline.

Market forecasts and liquidity issues

Looking ahead, the immediate future of ETH and the broader cryptocurrency market remains uncertain, especially over the weekend. In fact, ETF funds and institutional players that cannot operate on weekends often inject large amounts of liquidity into the market. Lack of activity often leads to lower trading volumes and reduced liquidity, which means that the market may stagnate or volatile without new capital inflows.

As a result, experts believe that no major price recovery or transfer (either up or down) will be possible until next week’s trading activity is fully restored to next week.

For Eth holders and crypto enthusiasts, this may mean a cautious observation. The $1,900 level can act as a psychological support zone, but may drop further if it cannot be maintained. Instead, a revival of buying interest earlier next week could bring a rebound. Prior to this, the next major move in the market depends on the return of external catalysts and institutional participation, lifting traders up for several days.

Read more: What is Ethereum?