Ethereum (ETH) recently recovered $1,800 between $1,500 and $1,700. This price increase, coupled with strong chain activity and growing whale interest, raises the question: Is this movement a real bullish signal for ETH, or is it just a temporary spike? Let’s study the details.

ETH shows signs of bullish comeback

After a challenging two-week period eth The cryptocurrency’s continued rate between $1,500 and $1,700 has recovered significantly, reaching $1,800 on April 23. This price change coincides with several positive indicators of Ethereum’s ecosystem. The total value lock-in (TVL) of Ethereum’s ecosystem has reached $467.19 billion, reflecting growing confidence in its decentralized applications (DAPP) and overall network activity.

Read more: In: Ethereum falls sharply to its lowest point in 2024-2025

Source: Defillama

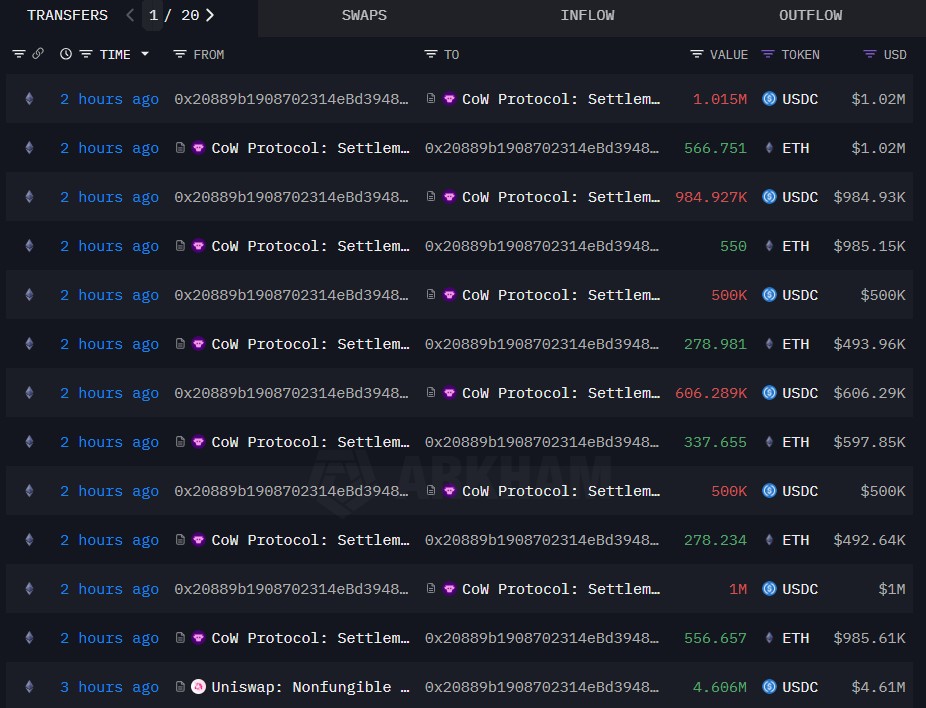

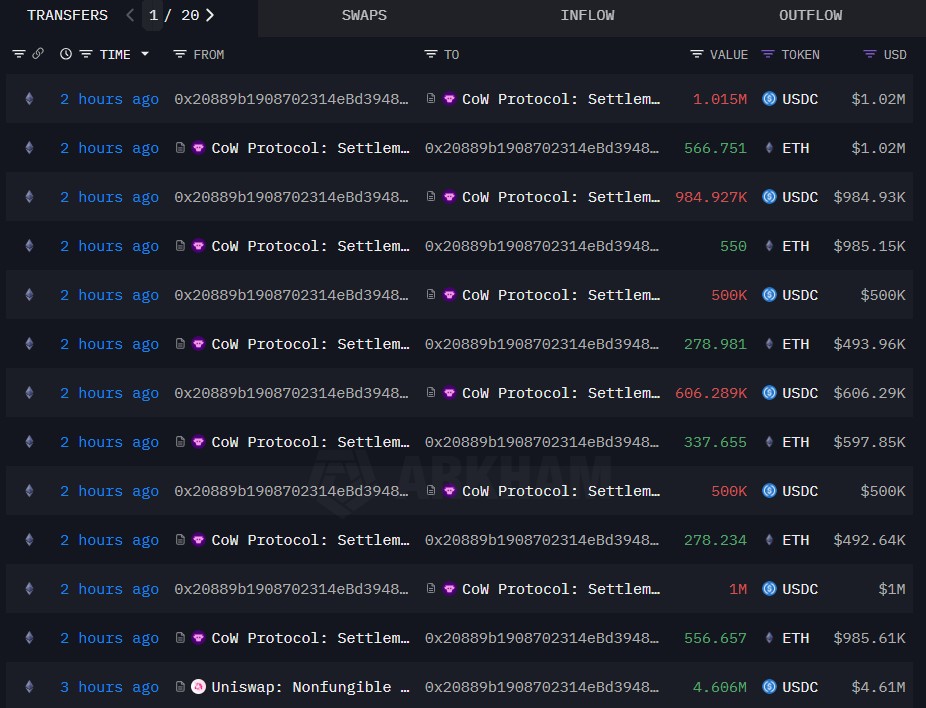

On-chain data further supports this optimism. According to Lookonchain, two outstanding whales showed a strong buying interest in ETH. Whale 0xD20E withdraws 5,531 ETH (worth $9.8 million) from Binance, while Whale 0x2088 spent $4.61 million to buy 2,568 ETH, and today bought 2,568 ETH for $1,794. In addition, another whale previously suffered a $40 million loss from ETH, borrowing $34.75 million from AAVE for $1,740 after its recent price increase, suggesting a bold move to take advantage of the rise.

Source: Arkham Intelligence

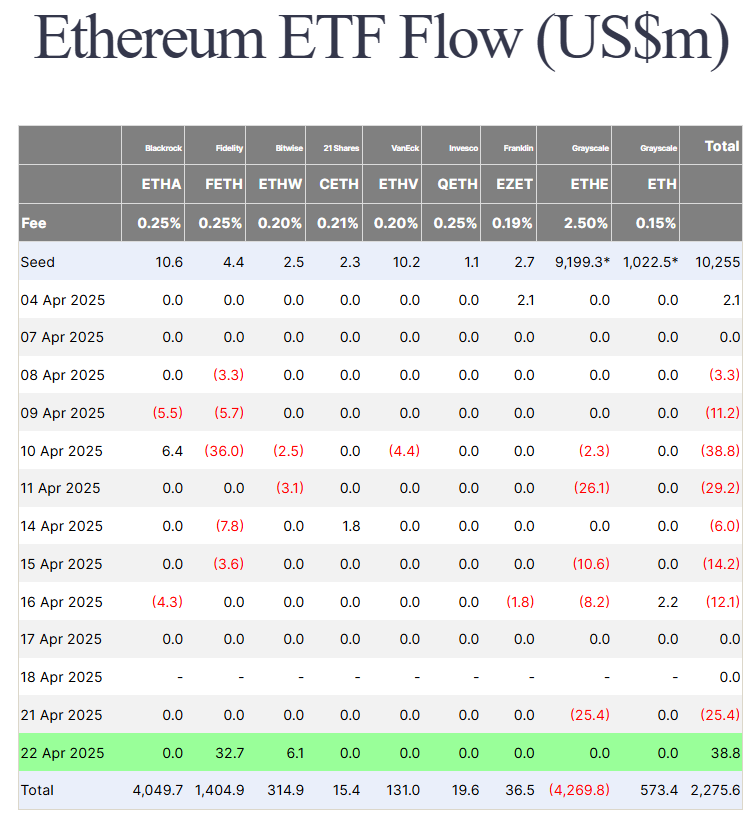

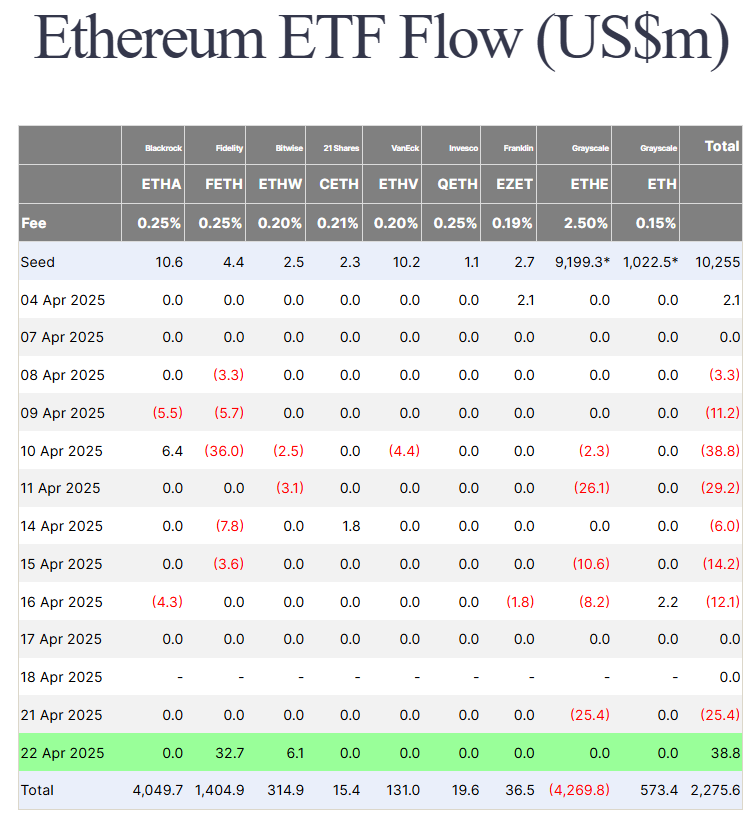

The ETH ETF market also paints promising pictures. On April 22, the net inflow of the ETH ETF was $38.8 million, driven by buying activities from major players such as Fidelity and Bitwise. It is worth noting that this marks the first positive net current in three weeks, and this shift may mark a better future for ETH.

Source: Farside Investors

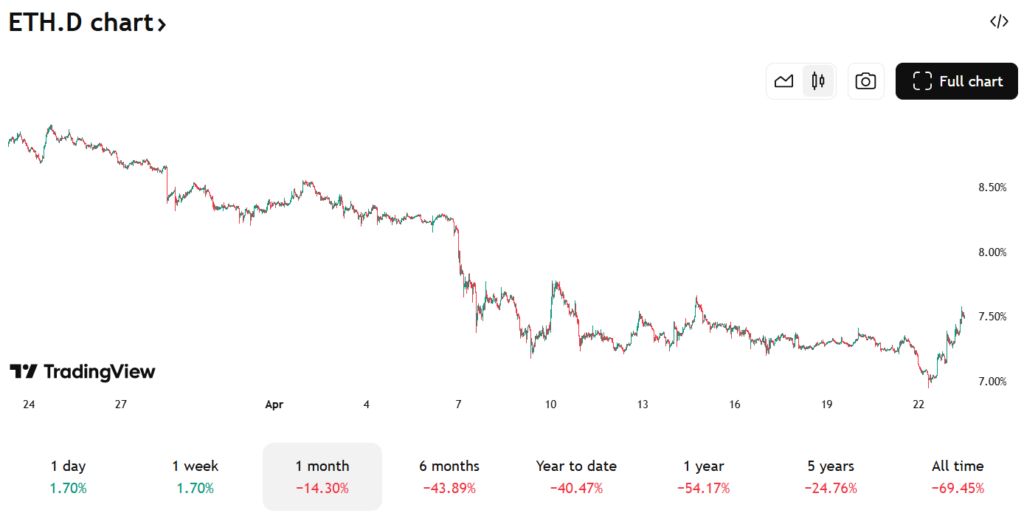

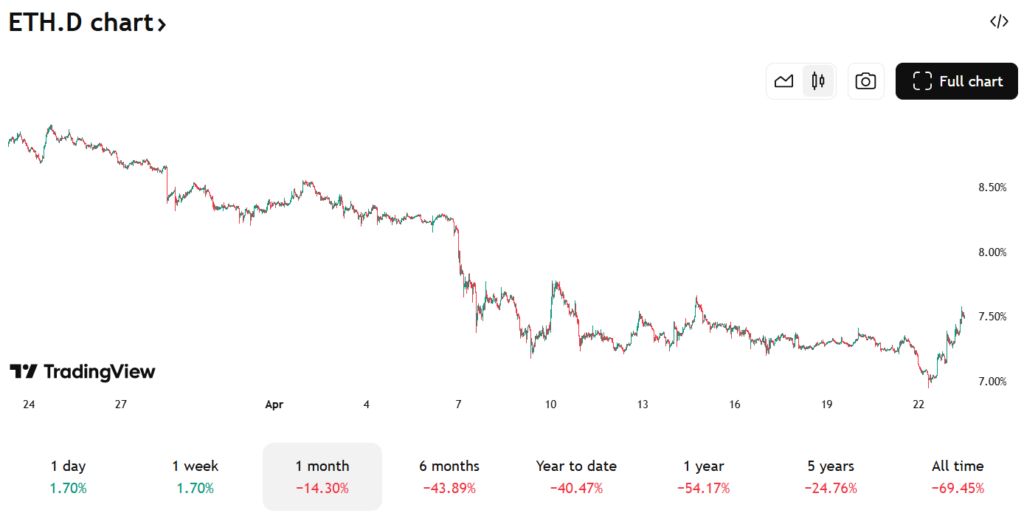

Additionally, Ethereum’s market advantage (ETH.D) has soared nearly 8% in the past 24 hours, rebounding from a long low performance.

Source: TradingView

In addition to optimism, Ethereum co-founder Vitalik Buterin recently proposed the transition from Ethereum virtual machine (EVM) to RISC-V architecture to enhance network performance. This potential upgrade has sparked speculation that pushing ETH prices to increase by addressing scalability and efficiency issues, further exacerbating bullish sentiment among long-term investors.

Is this a bullish breakthrough or a hype?

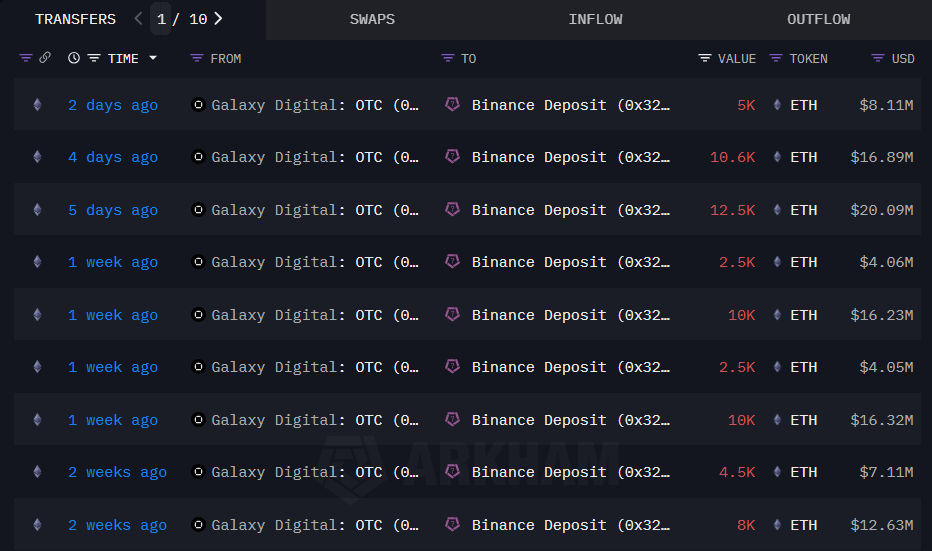

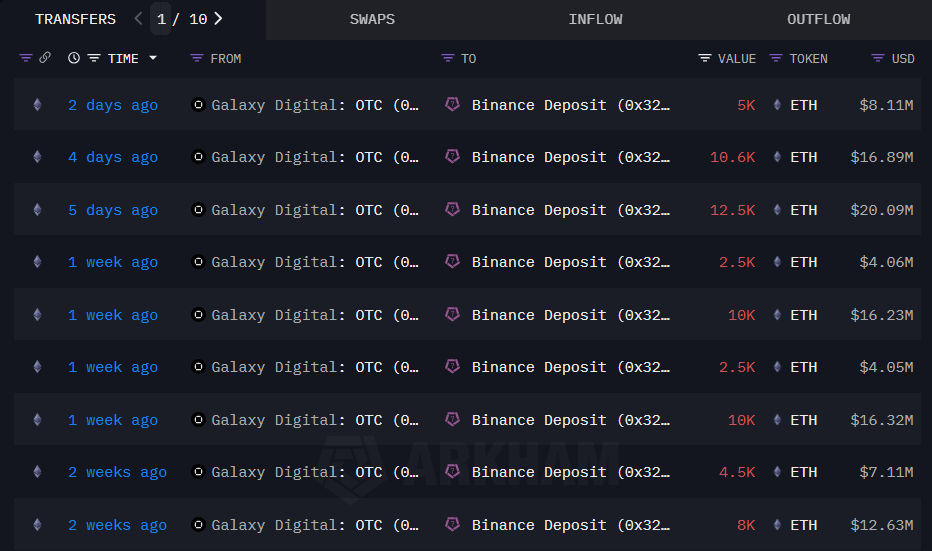

Despite these encouraging signs, the path to the ongoing bullish trend of ETH is far from certain. Galaxy Digital recently swapped $105 million worth of ETH for Solana (SOL). According to Lookonchain, Galaxy Digital transferred 65,600 ETH (about $105 million) to Binance in the past two weeks while withdrawing 752,240 SOL (worth $98.37 million) from the exchange.

Source: Arkham Intelligence

The ETH-SOL exchange suggests a possible lack of confidence in the short-term prospects of Ethereum. This move coincides with the wider bearish sentiment around ETH, with monthly declines and ongoing institutional outflows facing 20% interest. Galaxy Digital’s shift to Ethereum’s rival Solana may indicate that some institutional players are fighting ETH’s current challenges.

The rise in ETH to $1,800 is a positive signal, but investors need to wait for BTC.D to drop, which indicates capital transfer from Bitcoin to Altcoins. Meanwhile, the price of BTC must remain stable or increased; given the huge market influence of Bitcoin, it may reduce ETH and Altcoins if it drops. This interaction highlights the need for Bitcoin stability to unlock wider Altcoin rally, including potential growth in ETH.

Furthermore, the recent surge in price appears to be a 24-hour phenomenon driven by whale activity rather than a clear indicator of long-term sustainable growth. Although whales accumulation and ETF inflows are positive, they have not provided concrete evidence of a lasting upward trend. The cryptocurrency market remains highly volatile, with ETH’s age performance dropping by 46%, highlighting the risks involved.

Investors must act cautiously when making decisions, not only on ETH, but also in the wider cryptocurrency market. Solana’s competition, along with the decline in Ethereum’s burn rate and institutional sell-off, has increased the level of uncertainty in ETH.