Dogecoin(Doge), the original meme cryptocurrency, has regained market attention after a wave of bullish catalysts in May 2025. After navigating significant volatility, assets now show favorable technical indicators, strong chain data and signs of investors’ recovery.

Technical Analysis

In May, Dogecoin (Doge) experienced significant volatility. After the rally in early May reached the $0.25-0.26 range, the price reviewed mid-month to 0.21-$0.22. Currently, the key support zone between $0.212 and $0.214 remains intact, with notable rebounds accompanied by high trade volumes, indicating aggressive buying of interest at this level. The $0.2135 mark is considered a critical threshold; failures below this level may trigger a low of $0.20 or even $0.19.

On the plus side, the Governor needs to break through resistance levels at $0.222 and $0.2307 to re-establish the bullish trend. Continuous movements exceeding $0.23 may invalidate the current weak signal and strengthen recovery. According to technical data, the next key support level is about $0.211 and $0.204, while the area of $0.235-$0.24 is an important resistance zone to be watched.

The daily chart also shows the formation of the “Cow Flag” pattern, which usually indicates the continuation of the previous uptrend. If confirmed with strong buying momentum, this setting could push the target of about $0.35.

As for momentum indicators, both RSI and MACD showed neutral to mild signals. The 14-day RSI hovers around 55 near neutral territory without indicating any obvious negligence or overselling conditions.

Source: TradingView

Meanwhile, the MACD line on the daily chart formed a bullish crossover in mid-May, which was seen before the previous roughly outbreak. Trading volumes remained high, especially during the retest of the $0.21-0.22 support area, which suggests that investors’ sales activity remains strong.

Dogs’ chain activities

Dogecoin’s chain data further strengthens technical analysis and provides strong support for the bullish outlook. Whale Wallet – Those with a large number of thresholds have shown significant accumulation behavior in recent weeks.

In April 2025 and May 2025 alone, the whales had a total of more than 1 billion addresses, bringing their total holdings to approximately 25.97 billion. This continued accumulation of signal signals is increasing, and major investors are looking for Dogecoin’s upward potential.

Meanwhile, there is a significant increase in large chain transactions (valued over $100,000). In early May, data from Intotheblock showed that in one 24-hour period, more than 60.9 billion whales were addressed, marking a 41% increase in large transactions compared to the average. Such surges are often associated with portfolio rebalancing of institutional or high net worth holders, before expected market volatility.

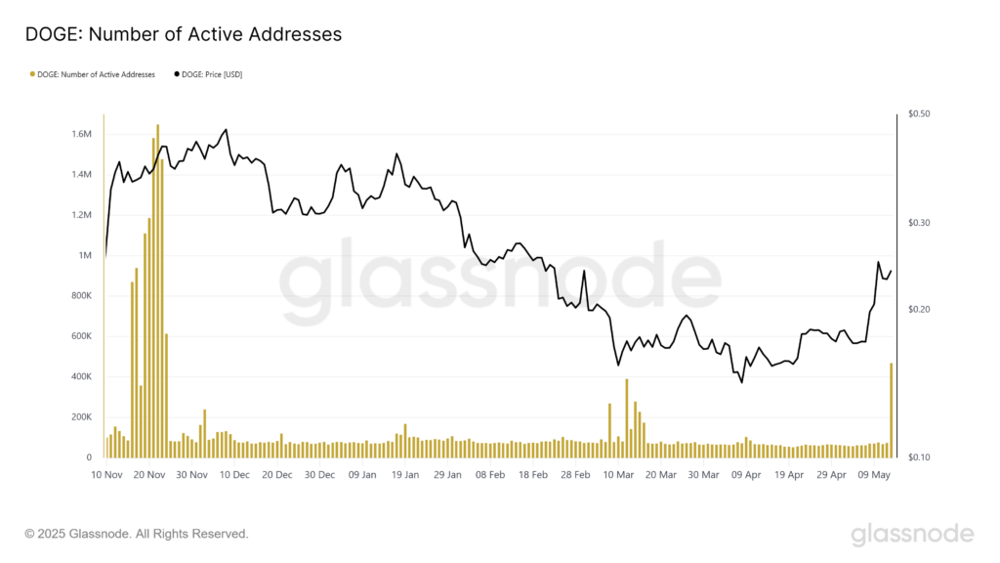

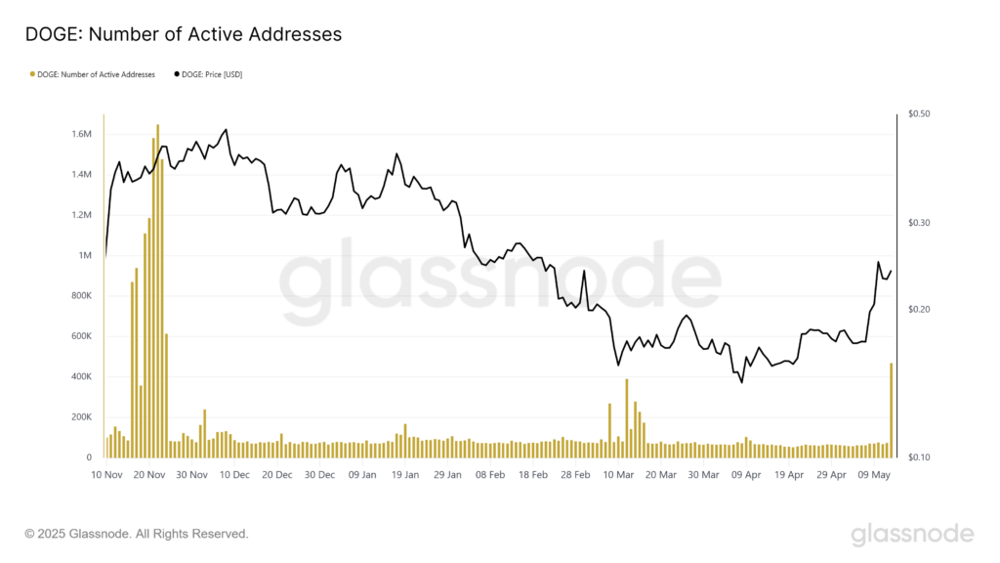

Source: Glass Festival

Additionally, the number of daily active addresses on the Dogecoin network has risen sharply, reaching a peak of 469,000 on May 13, an increase of 528% in just one day. This sudden surge shows that a new wave of retail participation coincides with positive news, such as the SEC’s endorsement of the Dogecoin ETF application.

Another key indicator, the net unrealized profit/loss (NUPL) indicator for long-term threshold holders has exceeded 0.5. This level usually marks a transition to the “faith” phase, with most long-term holders making profits and sentiment becoming increasingly bullish. In fact, this suggests that many long-term holders now have greater belief in continuing the uptrend rather than hoping to make a profit in the short term.

Fundamentals and Market News

Dogecoin ETF expectations

Dogecoin has been at the center of media and community attention in late May 2025, largely due to increasing speculation surrounding approvals of Dogecoin-based ETFs. This narrative has become the main catalyst for Doge’s recent upward momentum.

In April, the Securities and Exchange Commission (SEC) announced its delay in its decision to several on-site ETF applications, including applications from Dogecoin (made by Bitwise) and XRP, pushing the review deadline to June 2025.

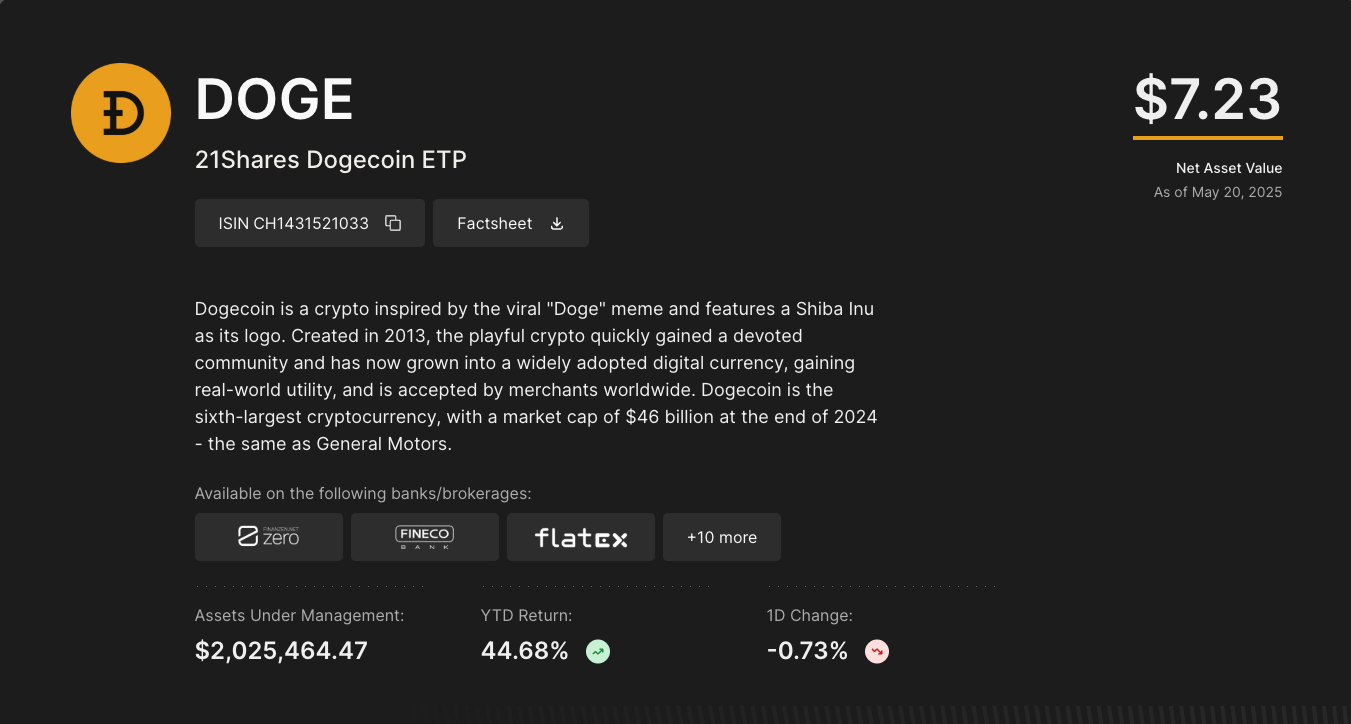

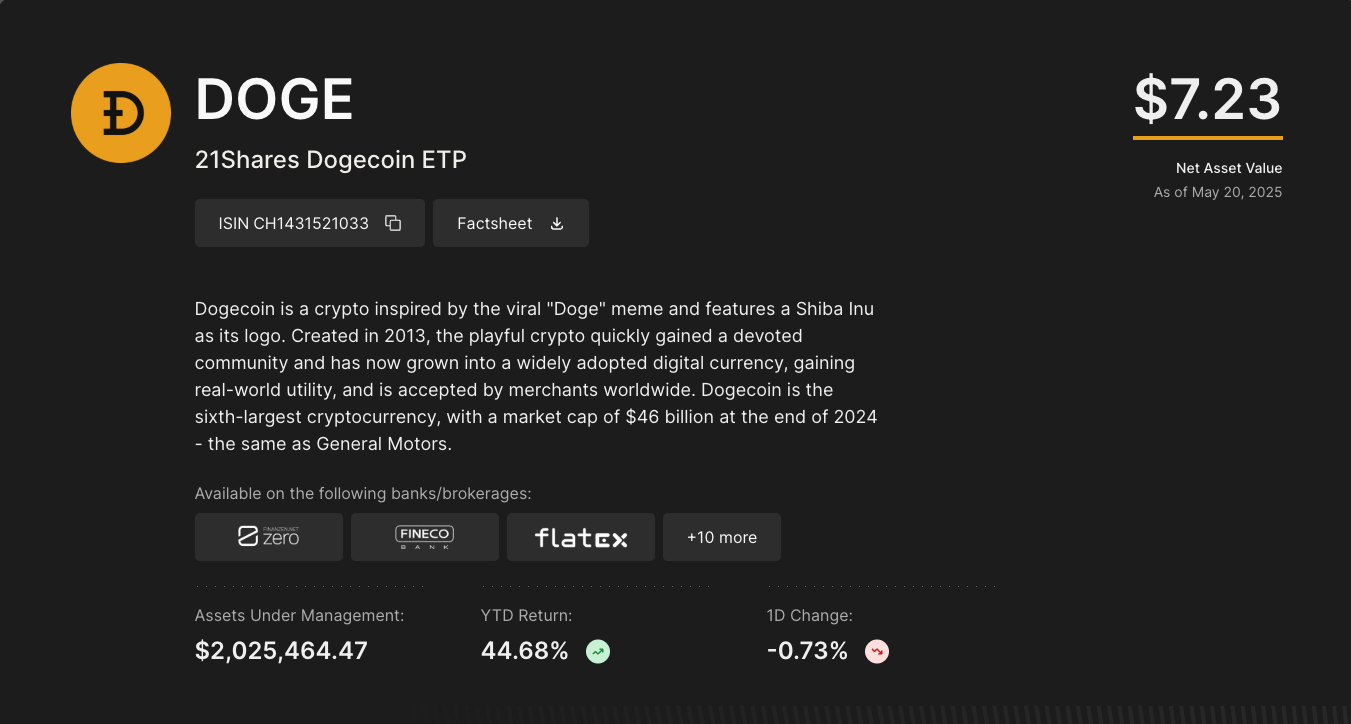

Although the delay initially weakened market enthusiasm, sentiment rebounded after mid-May when the SEC formally acknowledged the 21shares submission of Dogecoin ETF documents.

The SEC’s formal recognition of the 21shares Doge ETF application on May 14 has significantly enhanced investor confidence, which shows that Dogecoin will soon be able to integrate into traditional financial products. As of now, at least four Dogecoin-related ETF proposals in the SEC review are expected to have preliminary decisions as early as the second quarter of 2025.

Source: 21shares

On a macro level, the wider cryptocurrency market has also entered a more favorable stage than earlier this year. In early May, Bitcoin surpassed the $100,000 mark for the first time, creating a new two-month high and reigniting bullish momentum in digital assets. This breakthrough, coupled with a wave of positive macroeconomic news, intensified the market gathering.

Major AltCoins responded quickly, Dogecoin grew more than 10% daily on May 10, especially leading the allegation. ETFs are optimistic, macro headwinds and the integration of new retail and institutional interests continue to provide strong support for Doge’s continued recovery.

Read more: Trading with free encrypted signals in the Evening Trader Channel

Elon Musk Dogecoin Relationship

Another crucial fundamental factor in supporting Dogecoin is the ongoing recognition and attention of high-profile individuals and institutions – most notably Elon Musk. The billionaire entrepreneur has long been a voice supporter of Dogecoin, and his token-related rhetoric or actions often triggers sharp moves in price and market sentiment.

As of mid-2025, Musk continued to interact with the Doge community on his social media platform X, with interest and popularity in coins remaining.

Earlier this year, it was reported that X was developing a new payment service called “X Money,” which is expected to be launched sometime in 2025. According to CEO Linda Yaccarino, the service is designed to resemble China’s WeChat in functionality, although official details remain limited.

This development has sparked widespread speculation in the cryptocurrency community that funding X may include support for cryptocurrencies. Given Elon Musk’s famous support for Dogecoin, many consider this a strong candidate for future integration.

Source: X

Cardano founder Charles Hoskinson even publicly proposed to assist Musk in implementing Doge on X platform, which would further stimulate optimism among Doge supporters if there was a chance.

Additionally, the Dogecoin community remains one of the most active communities in the cryptocurrency space, often organizing online events to promote awareness and engagement. A classic example is the annual “dogeday” on April 20 (4/20), which is usually trending online and has attracted renewed attention to the project.

Overall, Elon Musk’s influence, combined with the efforts of grassroots communities and potential real-world integration through X Money, continues to play a powerful role in shaping Dogecoin’s narrative and investor expectations.

Dog price forecast in June

Dogecoin’s price trajectory enters June 2025 and appears to be cautiously bullish, based on improved technical structure, favorable chain-bound indicators and strong fundamental narratives. If the current momentum continues, Doge will maintain its recovery phase throughout the month.

Analysts and market observers have proposed a gradual and stable upward trend, with bullish price targets ranging from $0.3 to $0.35.

Several factors support this positive momentum: moderate market enthusiasm, increased participation from institutional capital and narratives around Dogecoin, including ongoing ETF developments and the ongoing influence of Elon Musk. These fundamental driving forces may catalyse investor confidence and strengthen market demand.

While numerous gatherings similar to the previous “Altcoin season” may be unlikely in an impossible time, over the course of June, a steady growth rate of 15–30% as long as current market dynamics remain supportive. The combination of technical setup, chain accumulation and favorable sentiment puts Dogecoin in a strong position to expand near-term recovery in the coming weeks.

in conclusion

Although external market risks and regulatory uncertainties remain, the current prospects suggest that Doge can achieve $0.3– $0.35 rangeif the bullish catalyst is achieved, it may break through to $0.35 or higher.

As always, investors should closely monitor macro conditions and network-specific signals, but Dogecoin appears to continue its uptrend in the coming weeks.