Today, March 19 at 5 p.m. ET is the deadline for bidding for Diamond Comics assets. The auction will be held on March 24 in New York’s office, Raymond James, which oversees the sale of assets and approves the sale on March 27 in the Maryland bankruptcy court.

Who is the bidder? Court documents say there is 30 potential buyers under NDA The person who is investigating the assets. Since the bidding process must be private by law, we will not know until March 24, and may not even be.

We do know Universal distribution Has bid for League Games, Diamond’s most profitable division, and Diamond UK’s track horse (test balloon). Universal Studios has been describing as “the diamond of Canada” and they have been trying to expand into the United States, and everyone seems to think they are a motivated bidder. But they may surpass it.

So who are the other 29 people? It must be remembered that diamonds are selling all their various parts, even office equipment. There are 11 separate business units auctioned:

Diamond Comics Distributor

Diamond Book Distributor

Alliance game publisher

Collectable scoring permissions

Fandomworld

freecomicbookday.com

Diamond selection

Gentle Giant Co., Ltd.

Ironguard supplies

Comic Exporter Company

Comic Holdings, Inc.

The last two companies are those that own 50% of Diamond UK. In theory, someone could bid for the toy assets (Diamond Select and Gentle Giant) and others in the book distribution business. Toy companies may get toy businesses, etc. Any company that wants to enter the comics distribution business also wants to make licensed toys under DC Comics and Dragon House of Dragon, which seems impossible.

I don’t have an internal track about potential suitors for diamond assets. However Milton Griepp wrote this in a review of the Toy Fair:

I stopped at the booth to choose toys for Diamond, Diamond Comics distributors and Alliance Game Distributors spoke with Ramy Aly, senior director of Getzler Henrich & Associates, a restructuring consultant who helped guide Diamond’s Chapter 11 process. He told me that the incidents since the filing of the application and better than expected include good supplier support and other parties interested in acquiring diamond assets. Bidding can be complicated because there are a lot of moving parts, but he says things usually go well.

This interaction is combined with direct and indirect information from other sources that suggest that well-funded buyers are strategically connected, but diamond assets outside of comics and gaming businesses hover and tell me directly that they intend to bid.

Since Griepp is the last sentence of all distributions, I take it as an optimistic report, and Griepp even came out and said, “I now have higher hopes for Diamond’s viable future as a distributor of comics and merchandise, and its support and transformative management can produce better companies.”

Anyone who wants to know that all this will shake should also read a two-part interview with Christina Merkler and Cameron Merkler, co-owners of Lunar Distribution. ((Part One,,,,, Part 2), here is a candid discussion about how the moon can expand its business, and the Diamond’s question from Christina Merkler:

Christina: That’s the thing. Any distributor that comes into contact with 10 publishers of 10 million units is more efficient than a publisher with 50 publishers with 1 million units, because then you have to deal with 50 people and data. This is a data problem, a resource problem, and capacity at some point.

I can say our experience as a retailer is that some smaller publishers (not all) lack consistency in their products, lack of shipping consistency. It is difficult for distributors to deal with those multiples that keep moving, constantly pushing things.

When it comes to it, it is much easier to distribute a cover that sells 5,000 than a cover that sells 500. Due to the actual square feet in the warehouse, capacity is not necessarily capacity-driven. Yes, how many SKUs do we have to choose in a week? I think this is the downfall of Diamond (whatever you want to call it): it is not as profitable as possible because it is a failed game. [laughs]

Gripp responded:

They havee They lost the hardest part of the rest of the rest of the biggest publisher.

This is as simple as possible to summarize. The number of SKUs generated by a large number of variant covers generated by several publishers may affect any potential bidding infrastructure, and Lunar has taken great care. At ComicsPro, I was told that Lunar even limits the number of variant covers that publishers can launch. Change is coming.

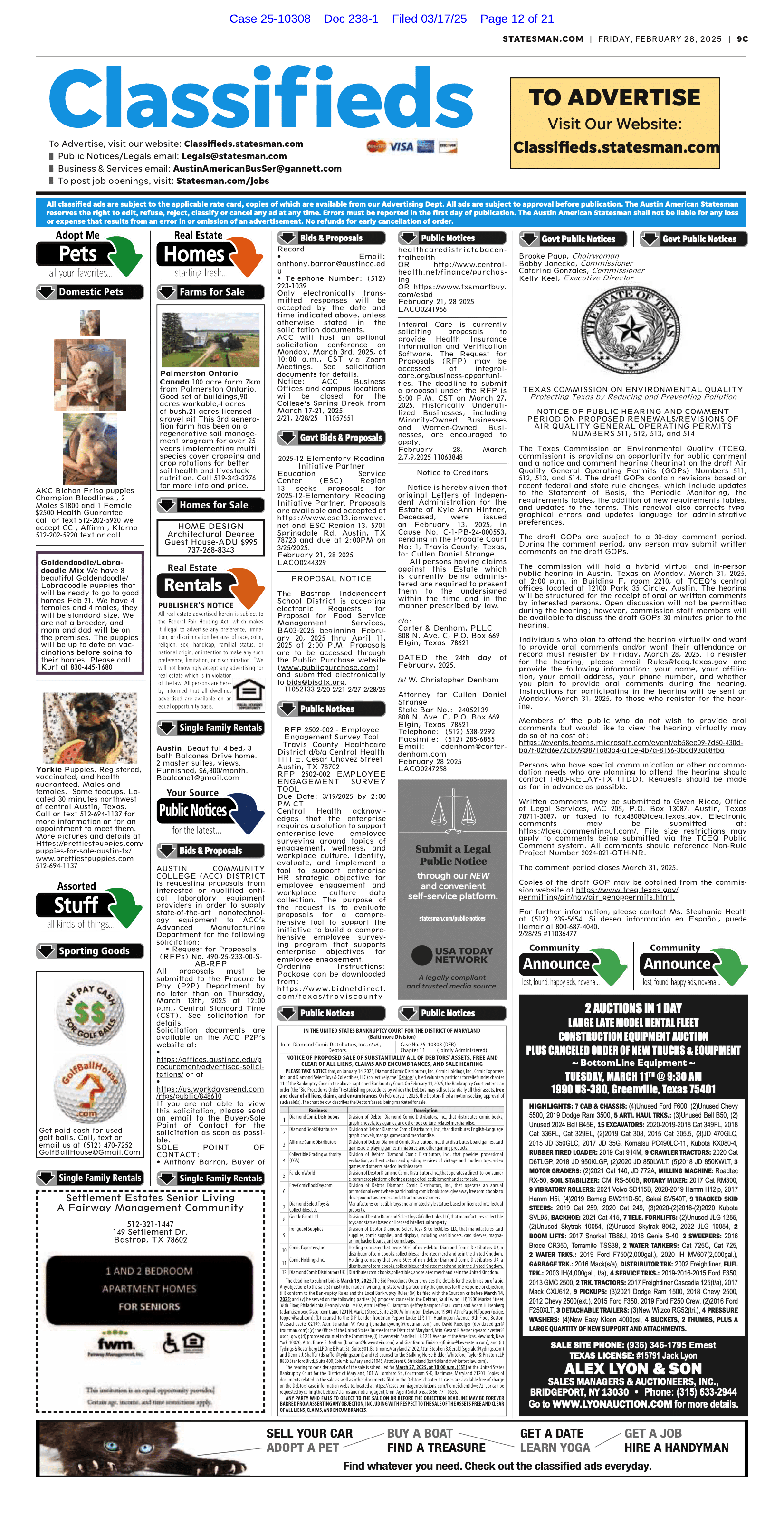

As far as I know, the 24th auction is public, so it might be a pretty day for comic history. Meanwhile, diamonds have been publishing notices of bankruptcy sales in various local newspapers as required by law. Even if everything happened, it was still a striking thing.