Hyperliquid is an emerging layer 1 blockchain that soars in standout situations after a record-breaking airdrop in November 2024, positioning itself as a strong contender in the Defi space. Its rapid rise has caused a comparison with Ethereum (the leading layer 1 blockchain).

Despite Ethereum’s huge total value lock-in (TVL), despite the smaller TVL, Hyperliquid’s ability to induce higher fees highlights the fascinating dynamics of blockchain economics due to its unique design and market focus.

Super Fluidity Starring: Digital Talk

Hyperliquid is a high-performance layer 1 blockchain tailored to decentralized permanent futures trading. As of April 2025, its TVL was about $627 million, a small part of Ethereum, but it was impressive for professional platforms. The recent hype of 94,000 users tokens, worth $7.6 billion, jumped into focus, driving user adoption and transaction volume.

Learn more: What is a hybrid?

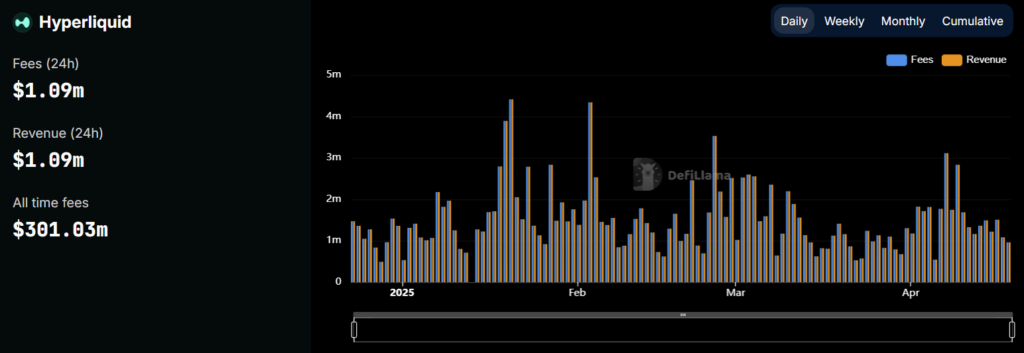

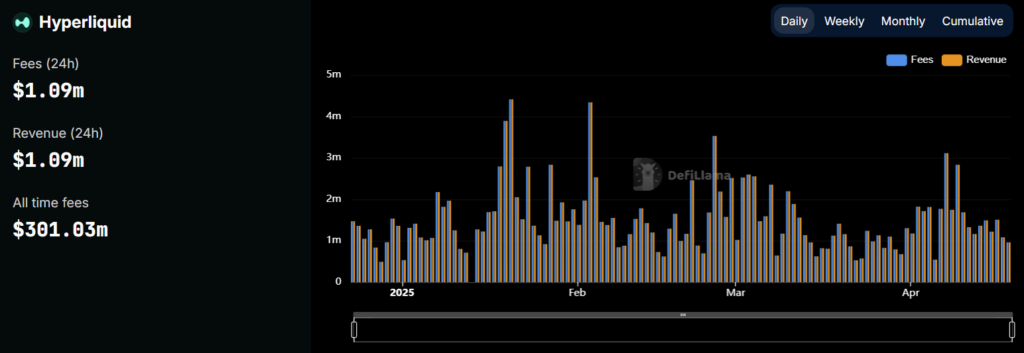

Source: Defillama

DEFI’s backbone, Ethereum, commanded more than $46 billion in television stations, with a short ultra-liquidity. It hosts over 1,216 projects and supports various ecosystems of DAPP, NFTS and DEFI protocols. Recent updates include the Dencun upgrade (March 2024), which cuts tier 2 fees by 95% and has gradually adopted re-adoption through Eigenlayer.

However, Ethereum’s chain fees have been struggling, with a charge of $300,000 in the past 24 hours compared to the $1 million of super liquidity in the past 24 hours. Throughout the first quarter of 2025, Ethereum’s performance was faltering, hitting record lows due to reduced network activity due to reduced network activity, as the market was chaotic across the market and the price of post-sales gasoline fell. Despite its unparalleled validator count (1.05 million) and decentralization, Ethereum’s revenue lags behind because its higher TVL reflects passive activity, such as staking rather than high trading.

Source: Defillama

The contrast is stark: Ethereum’s TVL is nearly 80 times the super liquidity, but the daily expense of overflow is more than three times. The gap widened in the first quarter of 2025 as Ethereum fees repeatedly hit historic lows, despite whale-induced volatility. Air conditioners further expand the appeal of hyperliquidity, increasing its user base to 230,000 and daily transaction volume to $470 million.

Source: Artemis

Why is the over-current expenses surge?

Hyperliquid’s cost advantage stems from its professional design and market fit. Its eternal futures DEX is built on the L1 of Super Liquid and has a super consensus that provides sub-second latency and 100,000 orders per second, with competitive centralized communication.

The platform’s high leverage trading (up to 50 times) and low-cost structures drive large volumes, thus expanding charges. HLP Vault is a unique feature that is collected from transactions, funds and liquidation, thus ensuring effective revenue capture.

By contrast, Ethereum’s gas fee allocated to validators depends on network congestion, and not much link to TVL, which is usually locked in low-transition protocols such as AAVE or LIDO. Dencun upgrades to improve scalability, cut costs and reduce Ethereum revenue.

Hyperliquid’s airdrop also played a key role, attracting traders and maintaining TVL growth, which is different from what the typical post-streaming disk saw in projects like Scroll. Its community-focused token learning, allocating 76.2% of hype tokens to users, further exacerbating participation.

High liquidity ecosystems improve performance

Hyperliquid has evolved from a perpetual futures DEX into a multidimensional Web3 ecosystem since launching HyperEVM, an Ethereum-compatible blockchain, in February 2025. HyperEVM’s high-performance design, with quick block times and parallel processing, supports over 100 dApps across DeFi, NFTs, GameFi, AI, and liquid staking.

Projects such as Hyperend and Times -Wap have innovated in terms of loans, while clusters and SOLV protocols can enhance liquid content. Local DEX (HypersWap, Spectra) and AI-driven tools (Beats AI, HCR robots) demonstrate their versatility.

Affluent underestimated babies and Gamefi platforms such as NFT collectibles, such as Hyperverse Drive Community, are involved. Bridges (wormholes, Hybridge) and Oracles (Pyth networks) ensure interoperability, while Meme tokens (such as Autist) increase viral appeal. Hyperliquid’s vision is likened to “Solana on EVM” with the goal of achieving a super-fast, scalable experience that positiones it as the basis for Web3 innovation. Its diverse ecosystem is built on a trader-centric core, marking the transition from a niche to a broad, competitive platform.

Read more: Hypermobility Ecosystem: From perp dex to emerging crypto ecosystems