The highly anticipated moment has come to the circle. The fintech power behind the ubiquitous USDC Stablecoin officially set its IPO at $31 per share on the New York Stock Exchange, marking a critical step for a major crypto-local company entering the traditional public market. Although Circle initially aimed to raise $624 million at a target valuation of $6.7 billion with 24 million shares, the final $31 price reflects strong demand from investors, which reshapes its public offering. Arguably, this is the highest IPO associated with cryptocurrencies since Coinbase ($COIN) in 2021.

Circle (CRCL) IPO key statistics (as of June 5, 2025):

- Final Circle IPO listing price: $31.00 per share

- Initial market valuation (at IPO price): approximately US$6.9 billion

- Fully diluted valuation (at IPO price): approximately US$8.1 billion

- Total shares provided by IPO: 34 million Class A common shares

- Stocks provided by the circle: 14.8 million

- Shares offered by shareholders: 19.2 million

- IPO excess inspection rate: reportedly more than 25 times

- Notable institutional interests: Ark Investment and BlackRock are reportedly interested in acquiring about 10% of the shares.

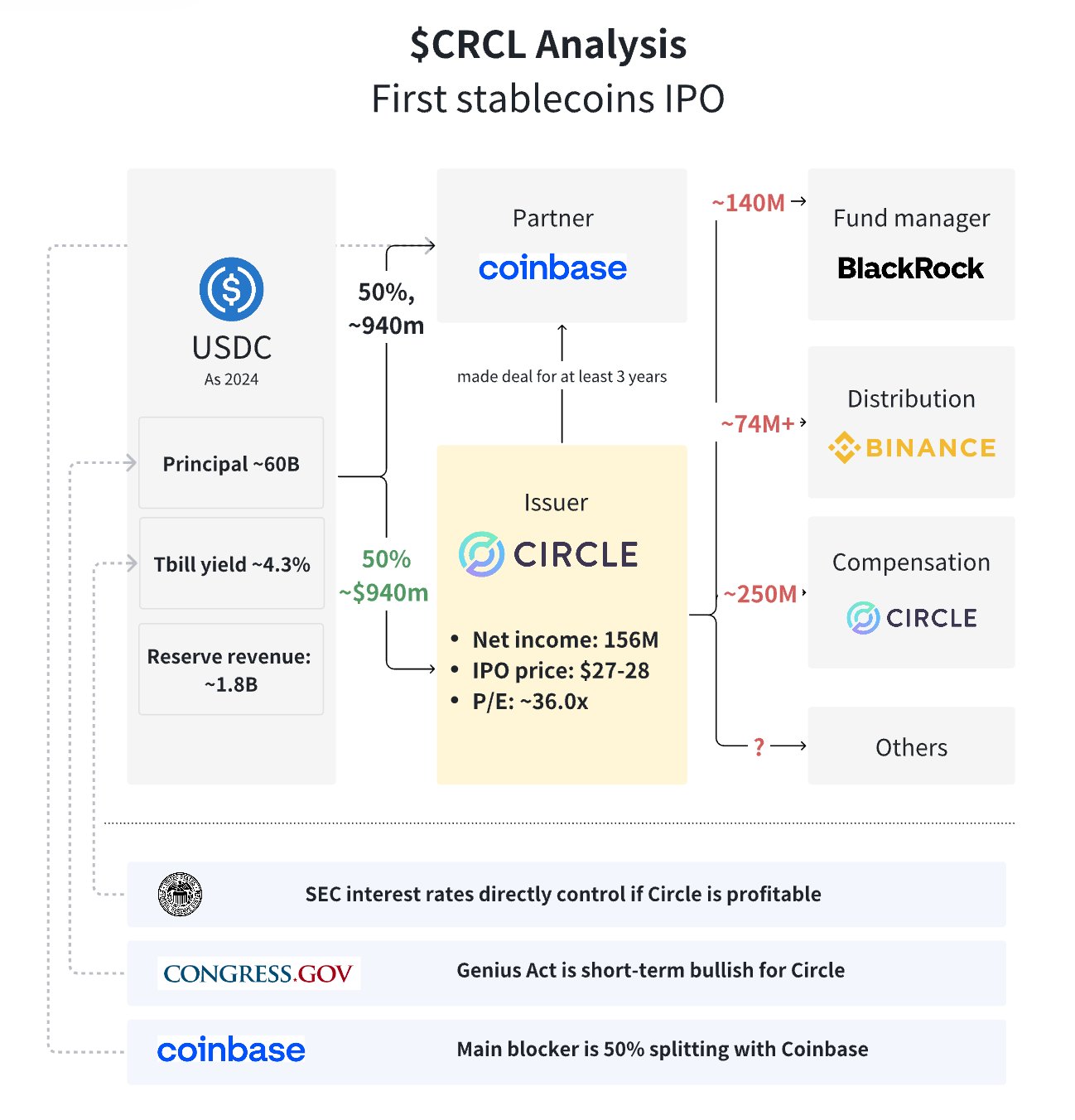

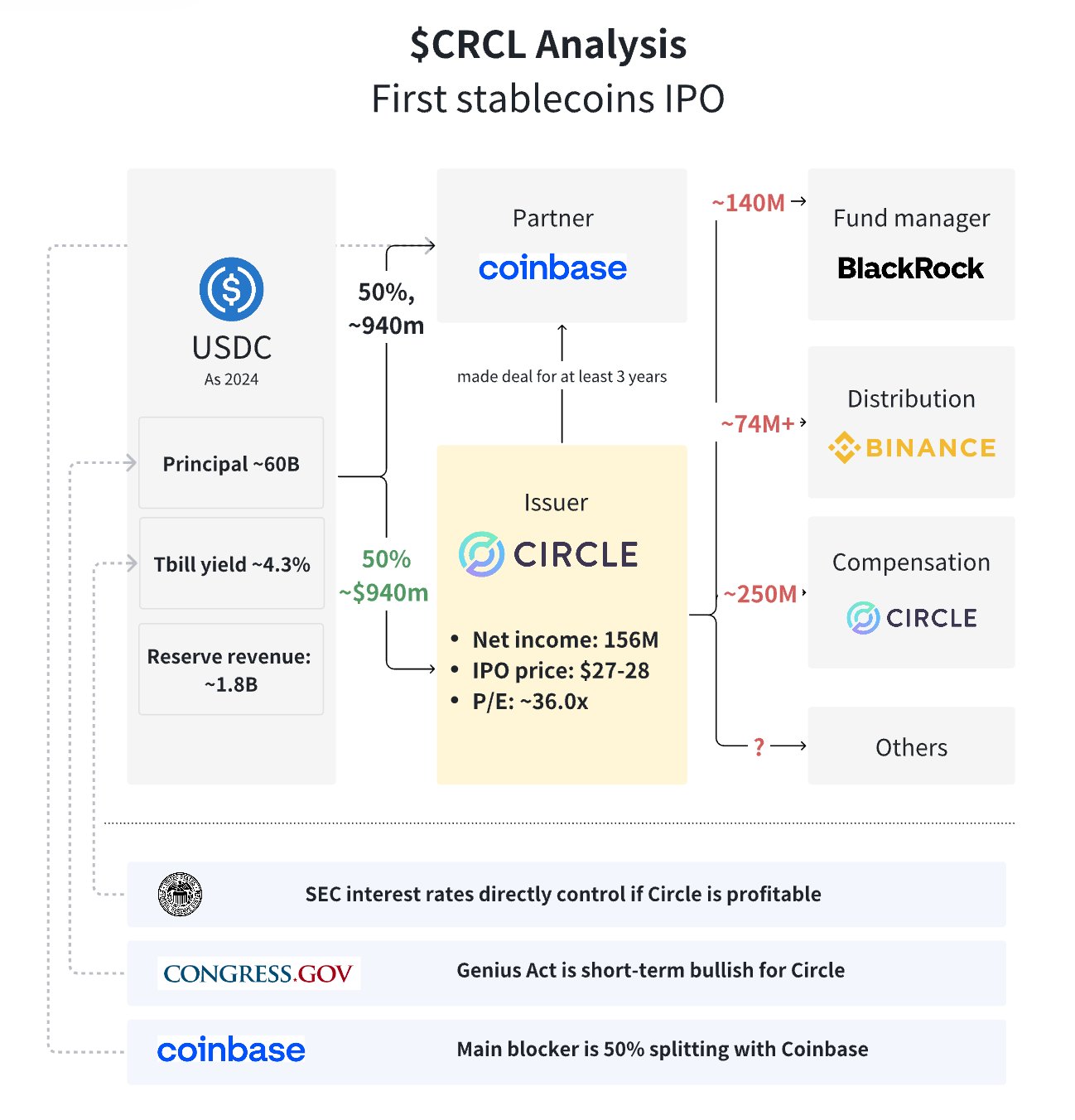

Basic business indicators (based on recent analysis, mainly 2024 data):

- USDC issuance (main reserve): approximately US$60 billion

- Treasury bill reserve yields about 4.3%

- Estimated reserve revenue: approximately US$1.8 billion

- Net income (according to analysis related to the initial IPO scope): approximately $156 million

- Price-to-earnings ratio (P/E) ratio (based on initial $27-$28 IPO range analysis): ~36.0x

Source: Rui

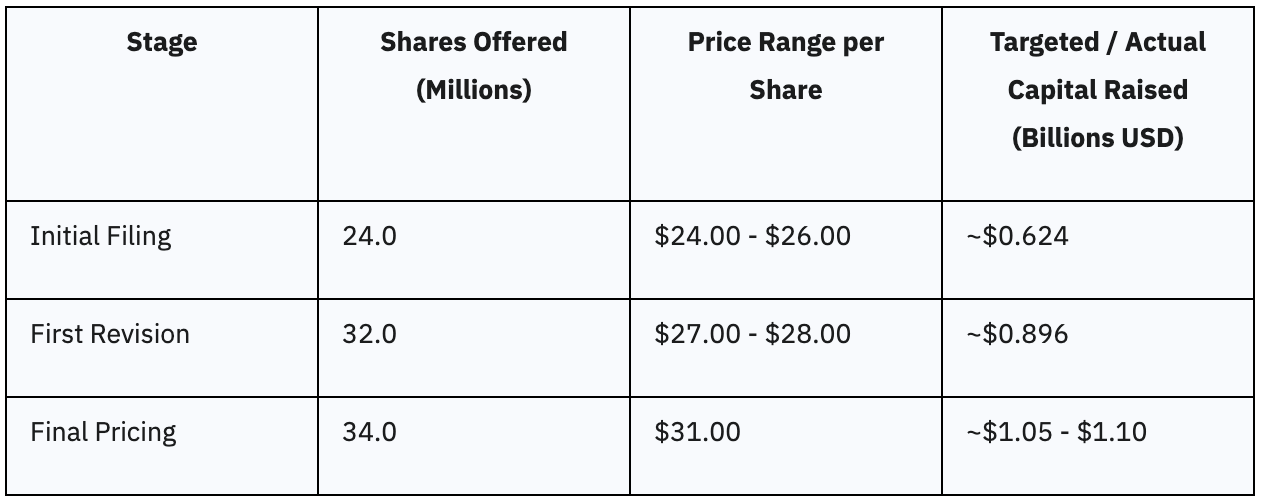

Circle’s IPO Journey: From initial expectations to rising reality

Circle Internet Group’s path to its public debut is characterized by a series of upward revisions that demonstrate that market validation at each stage has strong market validation. The company’s strategy appears to be a measure of re-entry of the public market, especially given its previously unsuccessful attempt to publicly pass the SPAC merger in 2021. This cautious approach allows Circle and its underwriters to accurately calculate investor appetites, allowing prices to be driven by real market demand rather than positive initial valuations.

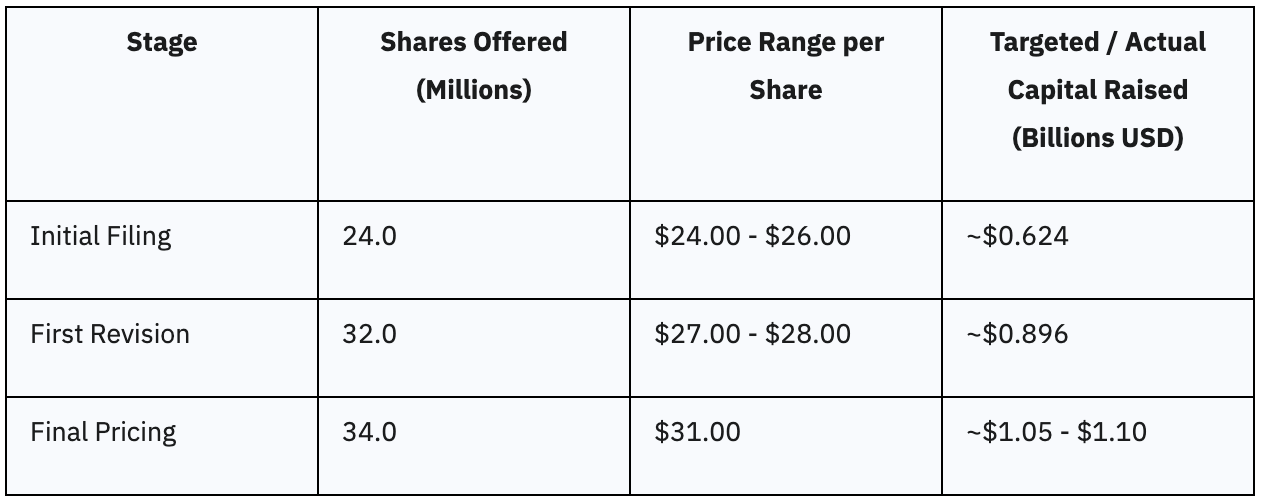

Initial Circle IPO price range and stocks offered

Circle initially launched an IPO and plans to offer 24 million shares of its Class A common stock, with an expected price range of $24.00 to $26.00 per share. The initial product is expected to raise about $624 million. At the midpoint of this range, $25.00 per share, the company’s market capitalization is estimated at $6 billion, and when stock options and restricted stock units are considered, the fully diluted valuation could reach $6.7 billion. Even in this initial, more conservative valuation, the billion-dollar figure highlights the established location and perceived value of Circle in the emerging digital asset ecosystem.

Revised price range and sales

After a very strong reception, Circle quickly revised its issuance terms. The company raised the stock volume to 32 million and adjusted the price range to $24.00 to $26.00 per share. The revised plan aims to raise up to $896 million.

The report shows that the stock has more than 25 times orders, indicating that there is a high interest and confidence in issuance. This rapid upward revision is clearly associated with such an important over-certification and is a strong market validation of Circle’s business model and future prospects.

This overwhelming demand provides leverage for companies and their underwriters to drive higher valuations, which demonstrates a strong attraction for the investor community rather than just pushing from issuers. This dynamic shows that a wide range of investors are eager to participate, except for a few anchor institutions.

Final pricing and total capital increase

On June 4, 2025, Circle announced that the fixed price of its large-scale IPO was $31.00 per share. The final product includes 34 million Class A common shares, allowing Circle to successfully raise $1.05 billion to $1.1 billion. Of these stocks, Circle itself provides 14.8 million, while the seller provides 19.2 million.

Additionally, Circle granted underwriters a 30-day option to purchase up to 5.1 million shares to cover overdistribution. The final price is $31, even beyond the scope of the revised marking a very successful IPO execution. This result reflects strong market acceptance of Circle’s business model and its strategic positioning in an evolving digital financing environment.

The ability to add multiple volumes and still priced products demonstrates successful investor confidence and successful book building by leading underwriters including JP Morgan, Citigroup and Goldman Sachs.

The following table summarizes the evolution of Circle IPO pricing and issuance:

Table 1: Circle IPO pricing and issuance evolution

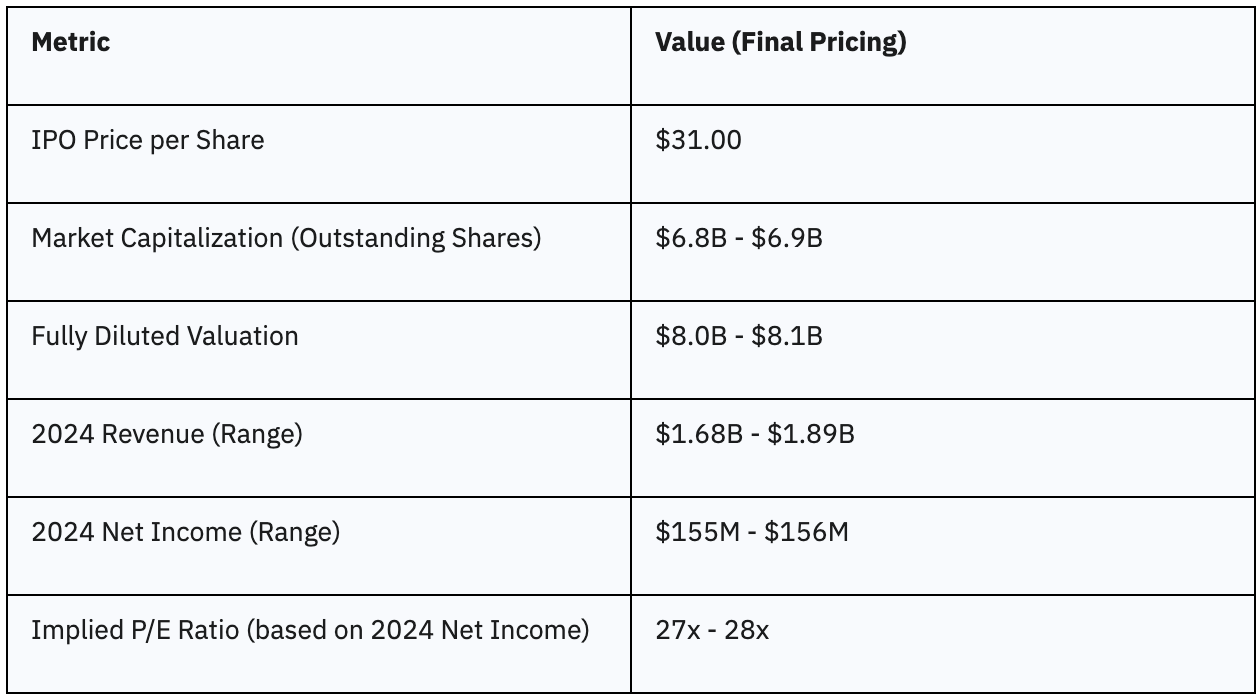

Circle IPO evaluation analysis: Understand the price point of $31

The final pricing of the Circle IPO ($31.00 per share) provides a clear benchmark for its market valuation, giving insight into how the market sees its current position and future potential.

Market capitalization and fully diluted valuation is $31

Based on the final IPO price of $31.00 per share, Circle’s market capitalization is estimated at about $6.8 billion to $6.9 billion based on its outstanding shares (reported to exceed $220 million or $222 million).

However, on a fully diluted basis, including employee stock options, restricted stock units and warrants, the company’s valuation is significantly higher, estimated at about $8 billion to $8.1 billion.

For investors, it is crucial to understand market capitalization (based on current outstanding shares) and fully diluted valuations. Higher fully diluted figures provide a more comprehensive view of the company’s potential future share count and the potential impact of dilution on per capita metrics, thus providing a more realistic assessment of the total value paid by investors.

Circle Financial Analysis (Revenue, Net Income, Profitability)

Circle reported revenues ranging from $1.68 billion to $1.89 billion in 2024. Its net income in 2024 was reported to be between $155 million and $156 million. For comparison, in 2023, the company generated $1.45 billion in revenue, with a higher net income of $268 million.

Circle also reported $779 million in operating revenue in 2024, with EBITDA operating revenue of $215.92 million over the past twelve months indicating strong operational efficiency. In the first quarter of 2025, Circle’s reserve revenue increased by 55% to nearly $558 million, although this was increased by 68% by distribution and transaction costs.

The key observation for investors is that despite the increase in revenue, net income fell from 2023 to 2024. This shows that while Circle successfully expanded its highest line, its operating costs, especially the distribution and transaction costs highlighted in Q1 2025, have grown faster, affecting overall profitability and sustainability of profit margins. This trend deserves careful monitoring of investors to assess whether a company can improve its operational efficiency and profitability.

Implicit valuation multiples and industry environment

Based on its 2024 net profit, Circle’s IPO pricing means a price-to-earnings ratio of about 27-28. However, financial analysts pointed out that this valuation is “not particularly cheap.” This is true for young, uncertain markets. In particular, if interest rates remain high or investors are enthusiastic about cryptocurrencies.

Therefore, the P/E multiple of 27-28 indicates that the market allocates a large premium. This reflects Circle’s future growth prospects. This includes its potential to gain more regulated stable markets. It is also expected to expand its financial services.

Essentially, investors bet heavily on the company. They want it to implement its growth strategy. They also expect to improve profitability. Therefore, any deviation from these high expectations may apply downward pressure. In fact, the stock is priced perfectly.

The following table provides a brief comparison of Circle’s main financial and valuation metrics in its IPO pricing.

Table 2: Circular Valuation Indicators (Initial vs. Final)

Impact on CRCL investors: Opportunities and risks

For investors considering CRCL, the success of the IPO and the company’s strategic positioning present a unique blend of opportunities and risks that can be carefully considered.

Opportunities for CRCL investors:

-

Enhanced reputation and organization adoption: Listing of the New York Stock Exchange The credibility of the circle. This comes from strict regulatory compliance and transparency. This “legality” attracts risk-averse institutions. This includes traditional banks and governments. It positioned the circle as the “financial public layer of the Internet.” This increased trust can be expanded USDC’s market scope.

-

Potential market share growth: The circle strongly emphasizes regulatory compliance. They also focus on transparent reserve management USDC. This directly challenges Tether’s opaque approach. This difference attracts institutional clients. It may grow USDC’s market share With the advent of regulatory clarity, it ranges from 27% to 40%.

-

Entering a deeper capital market: this IPO More than $1 billion was raised. This provides considerable funding for new product development. It also provides funding for global expansion and enhanced compliance infrastructure. Strategic acquisitions are also possible. This capital infusion accelerates Circle’s growth ambitions. It also enhances their competitive advantage.

Risks for CRCL investors:

-

High assessment questions and profitability prospects: Valuation of the circle It seems to stretch to some analysts. Its fully diluted valuation reached $8.1 billion. The price-to-earnings ratio is 27-28. Net income fell from US$268 million in 2023 to US$155 million-US$156 million in 2024. Despite the increase in revenue, this happened. It raises questions about profitability and cost management.

-

Business models focus on USDC: Circle’s revenue is almost entirely dependent on USDC. This focus poses significant risks. If USDC loses market share, is phased out or faces trust issues, the company will be vulnerable. Limited diversity options.

-

Continuous regulatory uncertainty: Despite positive legislative signals, U.S. stability regulations continue to evolve. Unforeseen strict rules can seriously affect Circle’s actions. This includes reclassification.

-

Volatility in the broader cryptocurrency market: Circle’s business is related to the overall health of the cryptocurrency market. This is true even for stable issuers. The downturn in volatile cryptocurrencies will affect stable demand. Therefore, Circle’s transaction volume and revenue may be affected.

Circle IPO lock-up period:

Although the specific lock-up period of Circle IPO is not explicitly detailed in publicly available materials, IPOs usually have a lock-up of 90-180 days. One noteworthy point is that of the 34 million shares offered, 19.2 million are from existing “selling shareholders”, meaning a large portion of the internal stock has been liquidated. Investors should further understand any remaining lockdown restrictions to understand future supply dynamics.