The crypto market is in trouble again.

The project is widely praised by the current wave of “Meme 2.0” that has sparked excitement and suspicion ahead of its Token Generation Event (TGE). Although it is undeniable that the marketing firepower and cultural influence of the pumps are, this problem is imminent.

To answer this, we turn to history. A careful examination of the main TGE performances in the last euphoric market cycle, especially in the late stages of the 2021 Bull Run, can create valuable insights into the pump’s pumps in the coming weeks and months.

Pump: The Narrative Engine of 2025

What separates the pump from many of the 2021 era’s projects is its meme itself’s identity and cultural virus. Instead of promising to “innovate finance” through complex architecture, Pump.Fun offers an easy way for creators and communities to launch meme tokens directly on Solana.

Its success is undeniable: More than 100,000 meme tokens were minted using the platform, and transaction volumes are often competing with top decentralized exchanges.

Now, the platform aims to capitalize on this momentum with ambitious token sales. Surprising details:

- Target salary increase: $1 billion

- Implicit FDV: $4 billion

- Allocation: 25% of the supply sold by TGE, the rest will enter teams, ecosystems and community incentives.

Read more: pump.fun launches tokens and gas disks, targeting $1B to increase valuation at $4B

Source: Kaito

This is a bold move that emphasizes the platform’s confidence and the speculative nature of the market cycle in which it operates.

2021 Case Study: Soaring High, Then Fast Down

The second half of 2021 saw the launch of highly anticipated crypto tokens. While many of these projects have strong fundamentals and impressive user metrics, their TGE timing (at the peak of the market) ultimately laid the foundation for a dramatic post-issuance decline.

Several key metrics support this view: Bitcoin Advantage (BTC.D) climbed above 56% for the first time since early 2021, indicating a spin back to BTC from AltCoins.

Ethereum gathered nearly 45% in May alone, partly driven by ETF speculation. Meanwhile, meme coins soar like Pepe and Wif, reflecting the peaks of past cycles, which are driven by speculation.

In 2017 and 2021, the rise in BTC’s dominance suggests Altcoin exits before major market corrections. Instead of marking a new bullishness, it indicates caution, indicating that the broader market has exhausted its risk appetite.

Today’s indicators indicate the pump. FUN may face a similar hype-driven decline in the coming weeks.

Take traffic (stream) as an example. The CVX launched at $9.90, reaching $43.35 by 2025 before falling to $0.40 with just 3.8% ROI.

Or consider Casper (CSPR) launched in May 2021 for a price of $1.29. Despite reaching a $5 peak briefly, CSPR is now trading at close to $0.012, down more than 99% from its issue price. Similar trajectories plagued both Permeation (OSMO) and DYDX (DYDX), both losing over 95% of their highs.

Once a bear market is established, even top platforms like Tujin Finance will struggle. Despite reaching $60.33 in early 2022, CVX is still below its startup price of $3.01.

| project | TGE date | TGE price | Ath Price | Current Price |

| flow | 27/1/2021 | 9.9 | 43.5 (4/5/2021) | 0.375 |

| CSPR | 11/5/2021 | 1.29 | 5.12 (11/5/2021) | 0.0122 |

| Osmo | 19/6/2021 | 5 | 26.8 (3/12/2021) | 0.214 |

| CVX | 15/5/2021 | 3.01 | 60.33 (1/1/2022) | 2.7 |

| dydx | 8/9/2021 | 14.3 | 27.66 (30/9/2021) | 0.574 |

Projects initiated in late bull markets often collapse as hype fades and moods weaken.

Echoes of the Past: Is pump.fun overrated at release?

In TGE’s $4 billion valuation, Pump.Fun will immediately become one of the most important meme tokens to cap the market – with the possibility of putting it in the same category as Pepe, Doge and Bonk.

Unlike Doge, however, Doge has more than a decade of brand awareness or PEPE (evolving into a cultural symbol).

This raises similar concerns to the 2021 token: high TGE valuations, relatively short records and heavy internal allocations.

Historically, this setup often leads to strong volatility in early trading, and then there is constant selling pressure as early buyers seek to realize gains and unlock them.

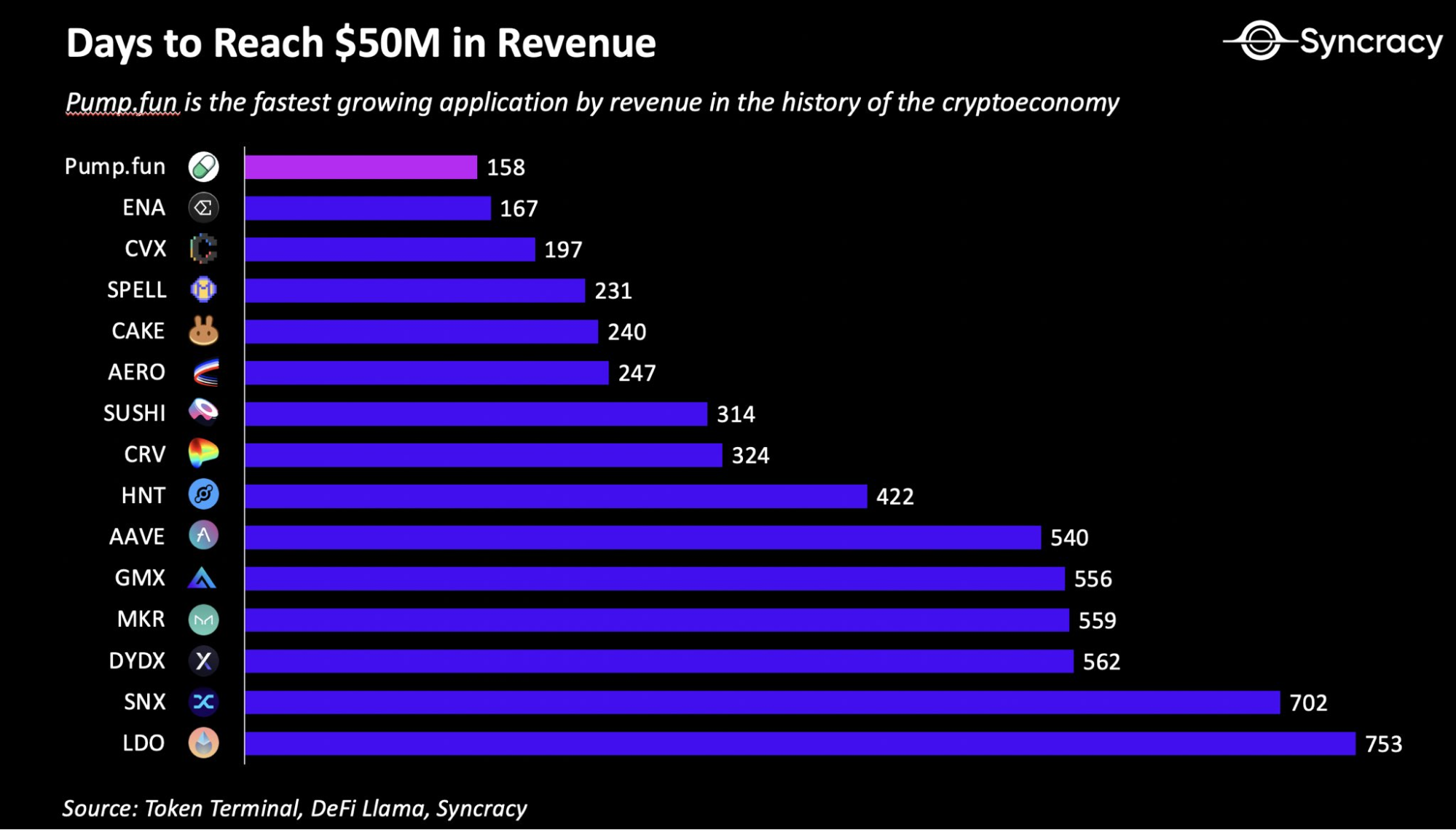

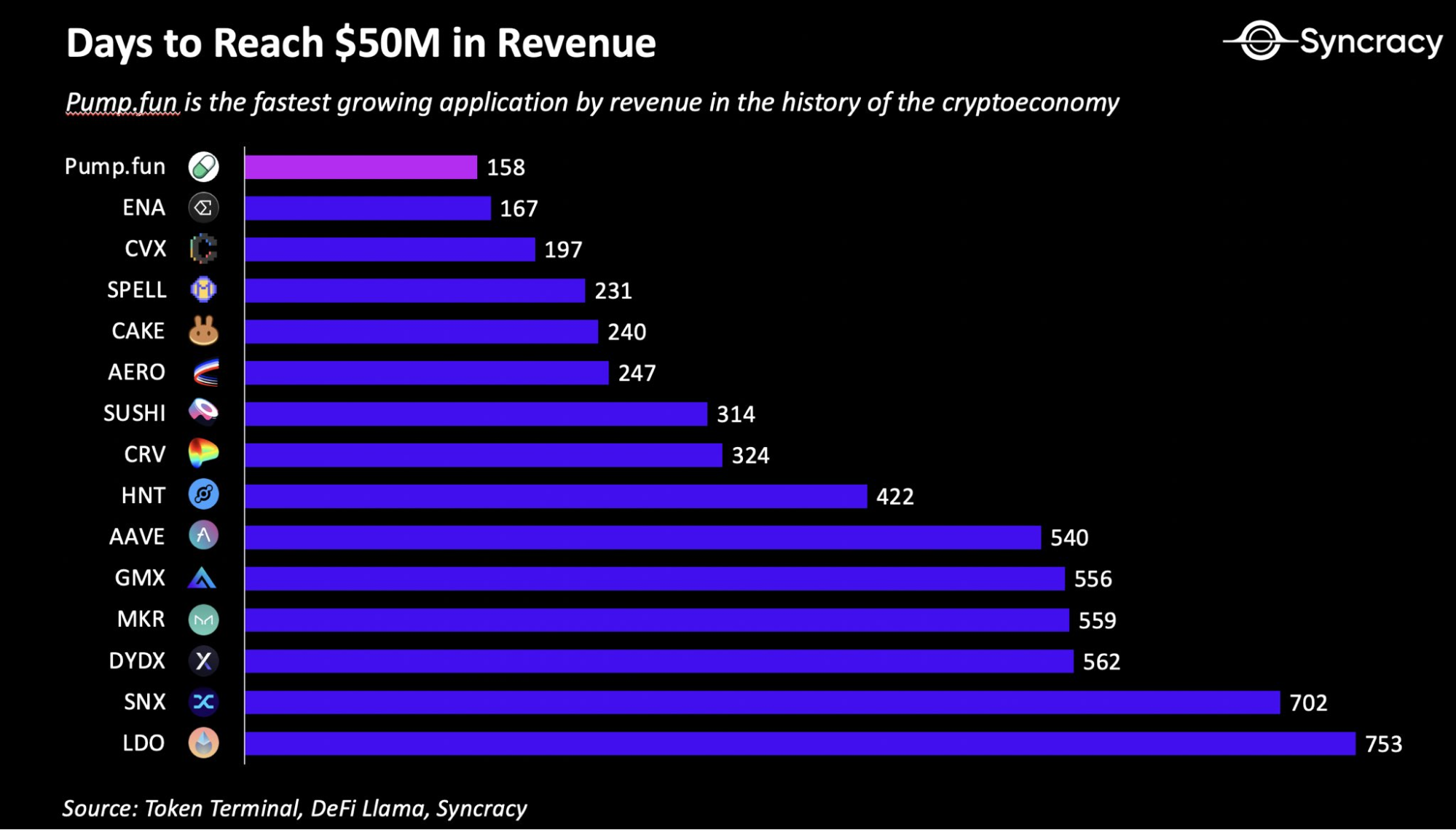

That said, pump.fun’s latest platform metrics depict a compelling picture of user activity and growth:

- Transaction fee revenue in 2025: $296.1 million, surpassing Ethereum’s $249.1 million, and leads all programs with weekly revenue for nine consecutive weeks.

- Monthly minted tokens: More than 10 million in April 2025, with an average of about 30,000 new tokens per day.

- Daily Active Users (DAU): As of May 2025, more than 156,000.

Source: Comprehensive

Nevertheless, these impressive indicators raise questions about long-term sustainability. Many of the tokens about the pump exist for only a few days, catering to short-term speculation rather than community building.

The explosive growth in token creation could quickly lead to oversaturation, echoing the fate of previously hype-driven ecosystems.

Potential price path: After the scene

Assuming that Fum.Fun’s initial market capitalization based on circular supply is about $1 billion, the token can follow one of several pathways based on market sentiment and investors’ behavior.

In bullish cases, reminiscent of the launch of DyDX, the token may see a sharp price increase driven by hype and FOMO, possibly reaching 2-3 times its TGE price in a few days.

Subsequently, as early investors lock profits, the attribution schedule begins to release more token circulation, which may gradually decline.

More neutral results may reflect penetration, in a short period of time, side trading or experience moderate growth in token trading. Retail interest may make it float, but consistent selling pressure from seed investors could push prices toward TGE levels within two to three months.

Bearish cases similar to Casper’s trajectory will involve markets that are completely rejecting overvalued. This can trigger a rapid sales wave, especially if the initial liquidity is thin.

The token could then drop 80-90% from the issuance price in a few months, reflecting widespread concerns about sustainability and overvalued.

in conclusion

The token release of Pump.Fun will be one of the most watched events in the cycle. It combines meme culture, Solana’s revival and engagement fueled by gas-light, combining it with a highly speculative package. While short-term volatility can create opportunities for savvy traders, long-term holders should maintain peak valuations.

History shows that tokens usually face cruel corrections in the euphoric phase, especially those with high FDV and aggressive private allocation.

Unless Pump.Fun can provide sustained platform growth for novel use cases for tokens and disciplinary timelines, it has the potential to be another cautionary tale of a bull boom.

Read more: Trading with free encrypted signals in the Evening Trader Channel