Specifically, a large percentage of users on Polymarket are betting by the end of March this year, with Bitcoin going to drop to $75,000. This reflects a prevalent pessimism.

Growing anxiety in the community

Relatively understandable, many people are concerned that Bitcoin and the broader market this year’s view is less pleasant.

The market is currently showing extreme unpredictability, with major cryptocurrencies showing poor momentum, while mid- and lower-cap coins are increasingly vulnerable due to the diversified and diversified market liquidity.

The Fear and Greed Index, an indicator used to measure market sentiment, is currently being registered in the “Fear” area, indicating widespread concerns that cryptocurrency markets may be vulnerable to further massive downturns.

Source: CoinMarketCap

On Polymarket, by the end of March, a large percentage of participants bet on Bitcoin below $75,000. In addition, only 9% of bettors expect positive growth in BTC in the first quarter of 2025.

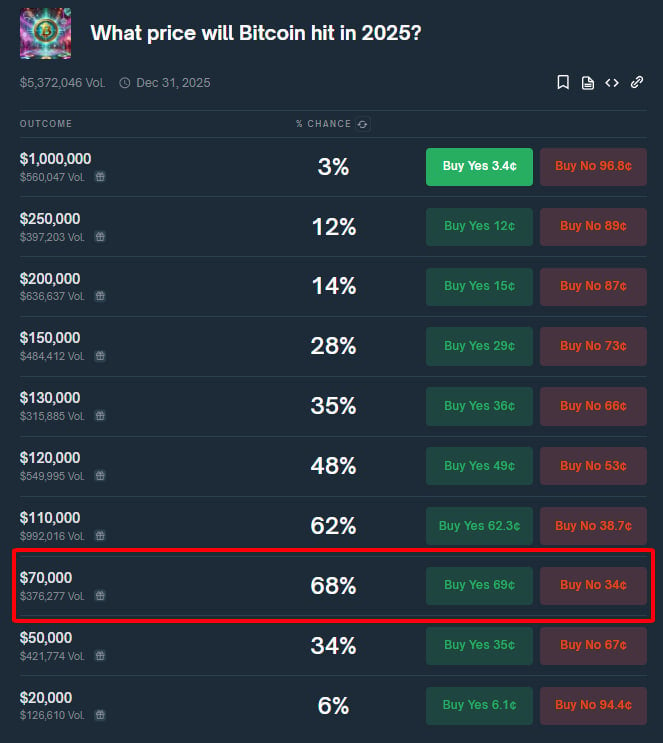

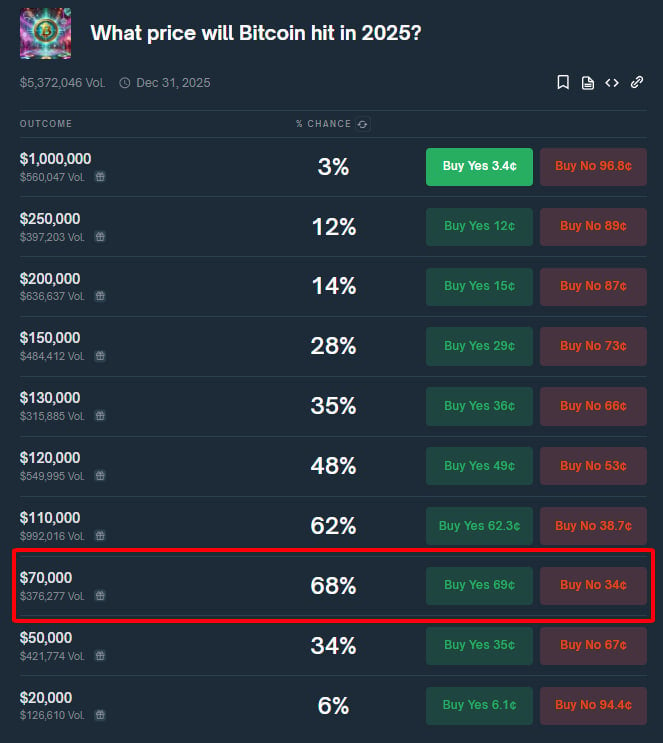

It is worth noting that 67% of Polmoarket Bettors believe that by the end of 2025, Bitcoin will only reach $70,000.

Source: Polymarket

It is important to note that the market is a reflection of the general speculative sentiment in the community, rather than a reliable indicator of investment decisions.

About Duoju Market

Polymarket is a decentralized prediction market platform that allows users to bet on the results of real-life events using cryptocurrency. It runs on a polygonal blockchain, a layer 2 scaling solution for Ethereum that ensures fast, low-cost and transparent transactions.

Learn more: Research: 88% of businesses report higher revenue after accepting cryptocurrencies

These stocks are priced between $0.01 and $1.00 (fixed on the dollar exchange rate), and if the forecast occurs, the stocks are paid at $1; otherwise, they will become worthless.

The platform aims to aggregate collective knowledge, often claiming to provide more accurate predictions by reflecting the funds people are willing to use than traditional polls. Users can buy, sell or hold stocks based on their confidence in the results, and market prices are dynamically adjusted to reflect the crowd’s perception of probability.

Instead of directly holding user funds (not monitored), Polymarket relies on smart contracts to automatically trade and spend, thereby enhancing security and trust.