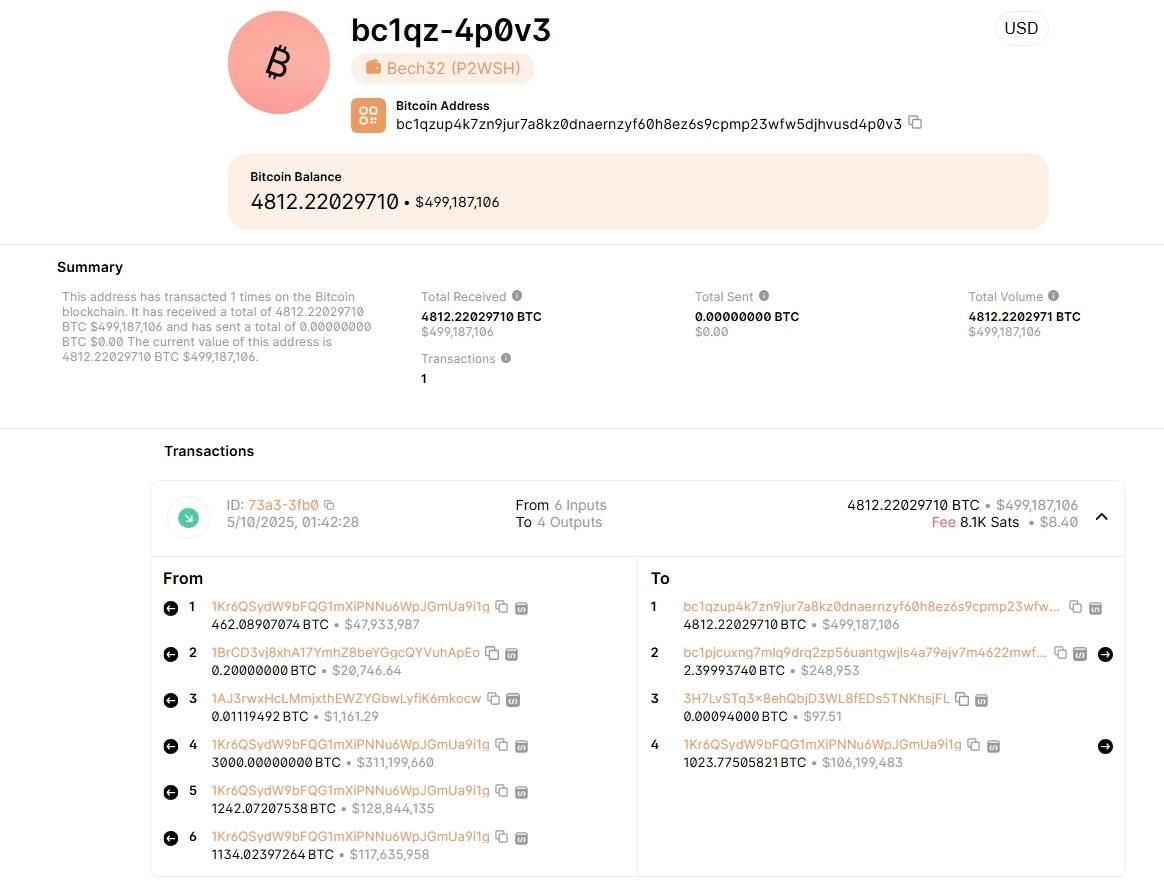

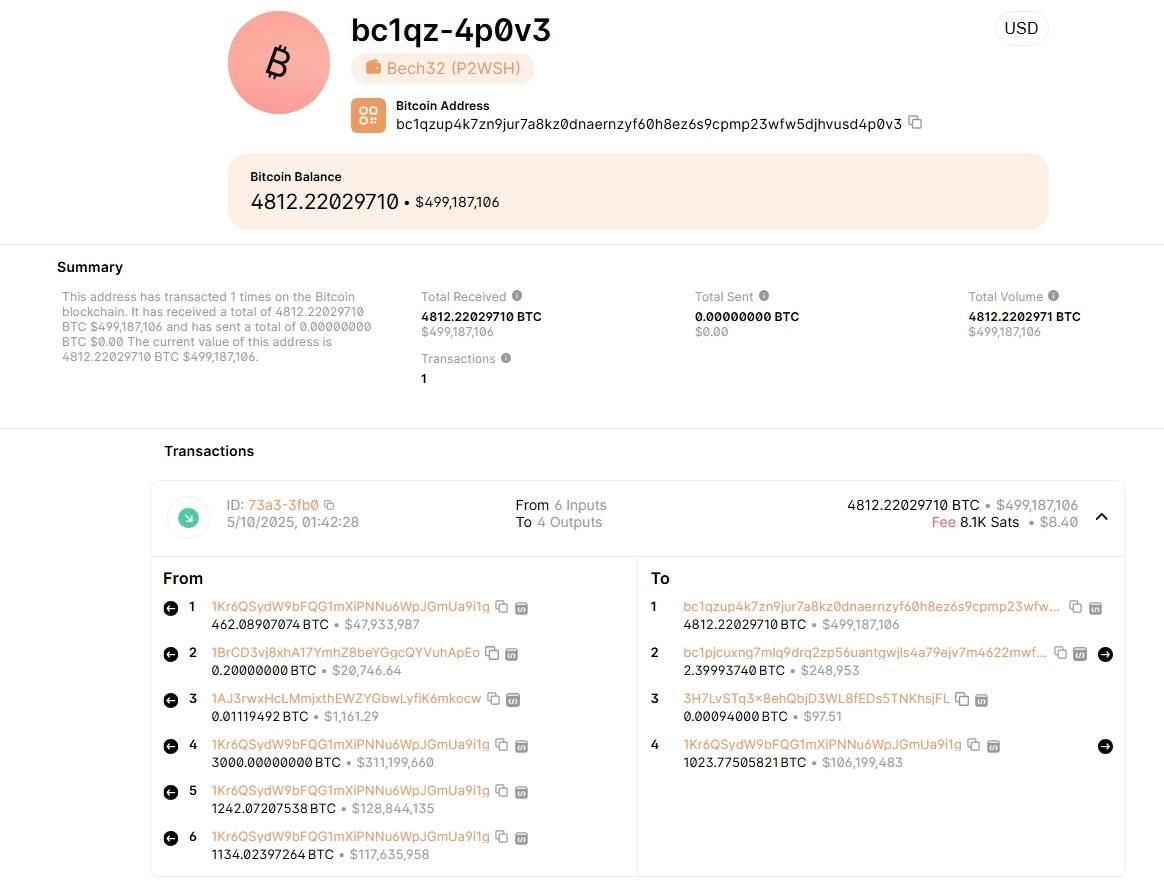

On May 14, 2025, Twenty-one Capital, a Bitcoin local financial company, backed by heavyweights such as Tether, Softbank and Bitfinex, made headlines, at an average of $95,300 per Bitcoin at $458.7 million at $4,812 BTC.

Just in: Jack Mallers #bitcoin $458,700,000 pic.twitter.com/szfmzcdbaa

– Bitcoin Magazine (@bitcoinmagazine) May 13, 2025

Strategy ambitions for buying signals from large quantities of Bitcoin

Bitcoin BTC The purchases executed through Tether have pushed the company to become the third largest public Bitcoin holder, with its Treasury Department having over 42,000 BTC.

Source: X

Led by CEO Jack Mallers, Twenty-one Capital aims to maximize Bitcoin per share and position itself as a pure Bitcoin opportunity in the capital market. This move is not only a financial flexibility, but also a strategic statement, challenging established players such as strategy (formerly micro-strategy) in the competition to accumulate Bitcoin as a core asset.

Twenty-one Capital’s strategy demonstrates confidence in the long-term value of Bitcoin, using its institutional support to capitalize on market volatility. Unlike the strategy, which faces the challenge of inefficiency in stock issuance (for example, Bitcoin purchased on March 17, 2025 was only $10.7 million), the liquidity signal through Tether is a flexible and powerful strategy, a simplified approach to twenty-one capital. Mallers highlighted this distinction in a recent interview, noting that his company offers a purer tool for Bitcoin investment than strategically broader financial manipulation. This purchase emphasizes the Twenty-One Capital’s ambition to redefine corporate Bitcoin, integrating financial technology innovation with traditional finance.

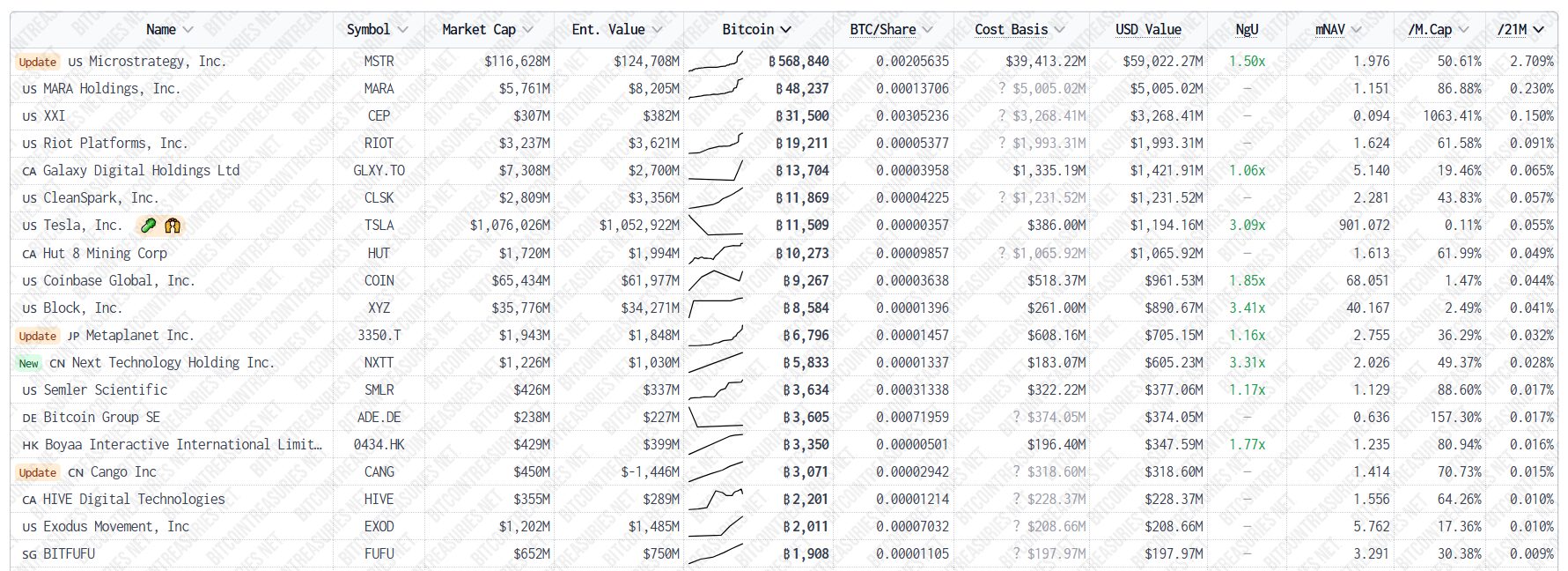

Source: Bitcoin Treasury

Other institutions that ride Bitcoin waves

Twenty-one capital is not alone.

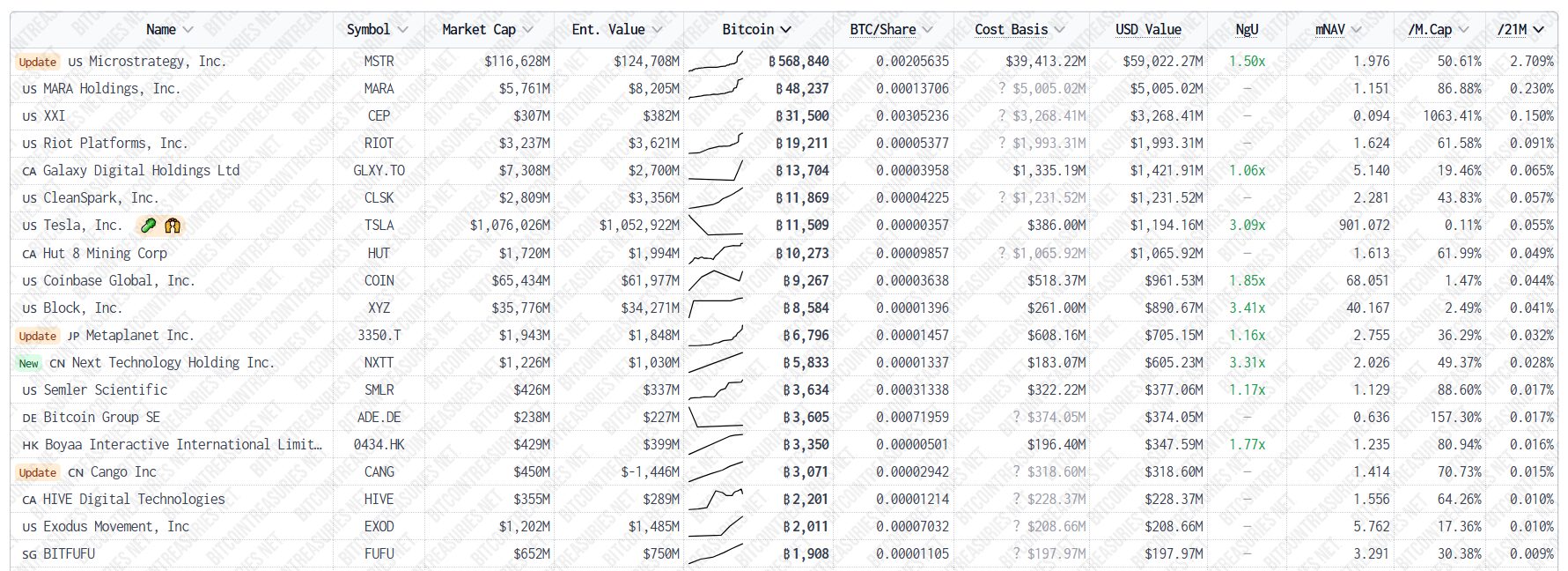

Under Michael Saylor, the strategy remains to adopt poster kids with corporate Bitcoin, holding 568,840 BTC, and as of May 11, 2025, the cost of the strategy was $39.41 billion. The strategy’s “21/21” plan is designed to raise $42 billion to further strengthen its Bitcoin reserves, although recent stock sales have slowed down its stock.

Read more: Strategy Bolsters Bitcoin Holtings Buy for $1.34 billion

Metaplanet, known as the “Asian Strategy”, also accepted Bitcoin, with 6,796 BTC, which has surpassed El Salvador’s holdings.

Read more: Metaplanet adds 1,241 BTC, over El Salvador’s Holdings

Medical device company Semler Scientific joins Fray, which will total 3,634 BTC by May 2025, worth $342 million.

These institutions regard Bitcoin as “digital gold” as a hedge against inflation and store of value in an uncertain economic environment. Their strategy usually involves issuing bonds or stocks to fund Bitcoin purchases, which is the strategy of $21 billion in stock and Microstrategy’s early $561 million in bond sales.

It is worth noting that this trend reflects the increasing acceptance of Bitcoin among listed companies, while companies such as Mara, Tesla and Tether have maintained regular Bitcoin acquisitions. However, the risk remains, as evidenced by the loss of the strategy’s $670.8 million loss in 2024, driven by its heavy Bitcoin bets. Twes Ane Capital’s entry exacerbates the high-risk game, potentially setting a new benchmark for companies to invest in crypto.