The cryptocurrency market continues to attract global investors, with a total market value of approximately US$3.51 trillion as of May 12, 2025. Bitcoin (BTC), Ethereum (ETH) and XRP are still at the forefront of investor concerns, as well as other large cryptocurrencies.

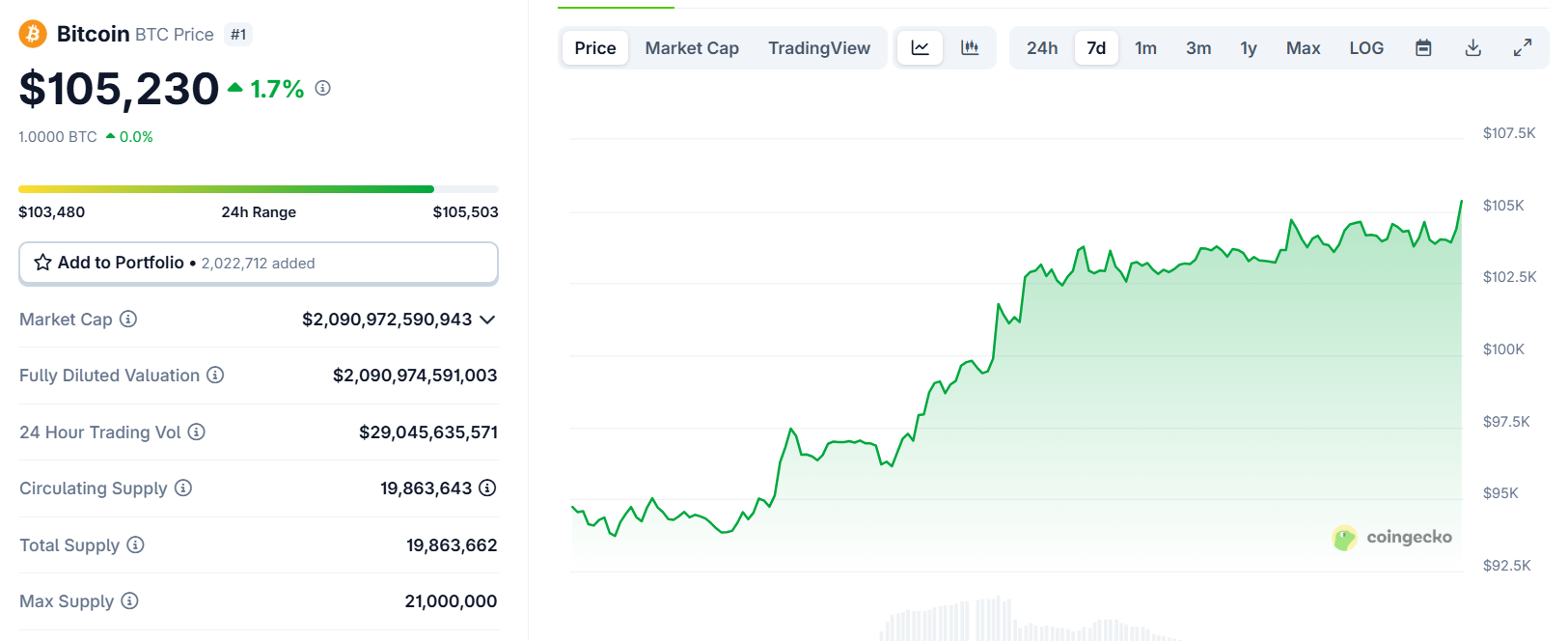

Bitcoin remains stable around $105K

The flagship cryptocurrency Bitcoin, which traded at about $106,000, increased 2% on the day. Its market advantage is 59.6%, highlighting its key role in determining market sentiment. This momentum is driven by optimism about macroeconomic development and U.S. policy shifts, including discussions on strategic bitcoin reserves.

Source: Coingecko

However, since then, Bitcoin has backed down, with analysts pointing to low volatility (563-day low), a potential cooling phase. Direct resistance is $97,000, and psychological $100,000 obstacle is imminent. If the bullish momentum recovers, analysts will invest a promotion in $107,000, while support will be $85,645.

Read more: CryptoQuant CEO: “A new era of Bitcoin has begun”

Market sentiment remains cautiously optimistic, supported by institutional adoption and ETF inflows, although concerns over macroeconomic uncertainty, such as U.S. trade policy, may introduce volatility.

Ethereum’s market value exceeds Coca-Cola

Ethereum is the second largest cryptocurrency in market capitalization, with a price of around $2,500, reflecting a 40% increase per week and a 4% increase per day. ETH has a market value of US$311 billion, surpassing Coca-Cola’s market value and ranks 40th in global asset market value.

Source: Coingecko

The recent rally was partly attributed to expectations of Pectra’s upgrade and positive market sentiment after Bitcoin moved upward.

$ethThe market cap has exceeded Novo Nordisk and is looking for Coca-Cola, Alibaba and BOA.$eth It is currently the 36th largest asset in the world. pic.twitter.com/bcydwzaija

– CW (@CW8900) May 12, 2025

Technical indicators show that Ethereum is testing resistance around $2,500, and if Bullish Momentum persists, it is possible to recover its multiple month high of $2,600. However, if liquidity issues arise, analysts warn that it may withdraw to $1,500.

Vitalik Buterin’s recent comment on improving aggregate security highlights ongoing development efforts that strengthen long-term confidence in the Ethereum ecosystem. Despite occasionally underperforming compared to Bitcoin, ETH’s role as a smart contract platform continues to drive institutional interest, while ETF outflows have stabilized recently.

Read more: BlackRock proposes Ethereum ETF possession, increasing ETH price

whole-heartedly

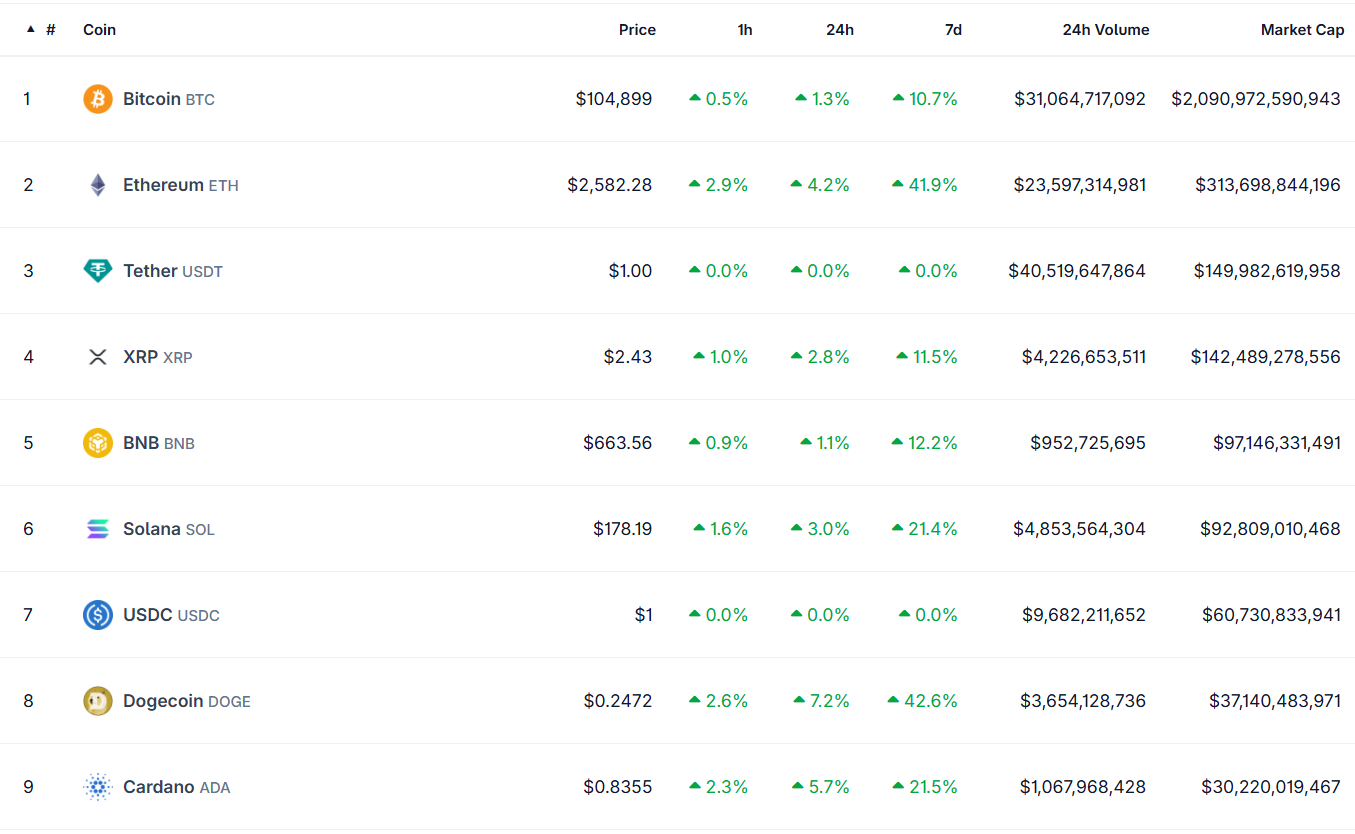

Other large cryptocurrencies such as XRP, Solana (Sol), Binance Coin (BNB), show diversified performance. Solana trades for a little $179, but strives to regain the high $200 price starting in early 2025. Analysts predict that the SOL will have a wide range in 2025, from $122 to $490, depending on the improvement in sustained scalability. BNBs remain stable, and although they lack the same upward momentum, their market cap is comparable to XRP.

Source: Coingecko

The wider Altcoin market is showing signs of life, with USDT’s depreciation lowering, indicating that investors are transferring stable funds from Stablecoins to risky assets such as ETH and XRP. However, as Bitcoin’s dominance continues to suppress smaller gatherings, “alternative seasons” remain elusive. Driven by social media buzz, meme coins like Dogecoin (Doge) and Shiba Inu (Shib) have also attracted attention, but their fluctuations have made them less reliable for sustained growth.

The crypto market is shaping a complex landscape through macroeconomic factors, regulatory developments and technological trends. The Fear and Greed Index is neutral at 51, reflecting uncertainty among investors. U.S. policies under the Trump administration, including the proposed strategic crypto reserves, are characterized by BTC, ETH, XRP and SOL, sparked optimism and debate. Meanwhile, global trade tensions and potential tariff wars may undercut bullish sentiment, such as in March 2025, when BTC fell below $83,000.