In previous analysis, most tokens have not completed their price cycles and are still hovering at key technical levels. The follow-up activity aims to provide traders and investors with the latest insights and strategic prospects based on the latest market development expansion analysis.

Read more: Price Forecast 5/28: BTC, XRP, Link, Doge, Sui, Eth and Sol

Bitcoin price forecast

Bitcoin held a strong rally, soaring from $104,900 and decisively broke the $106,920 level before testing a key resistance zone of $110,330. The area triggered a short-term callback, with initial support determined about $108,750. A rebound from this level is still reasonable. However, if the purchase pressure proves insufficient, Bitcoin may review further to retest stronger support for $106,920.

A breakout above $110,330 will mark a clear bullish signal and may pave the way for a move to previous highs – even potential new all-time highs.

Source: TradingView

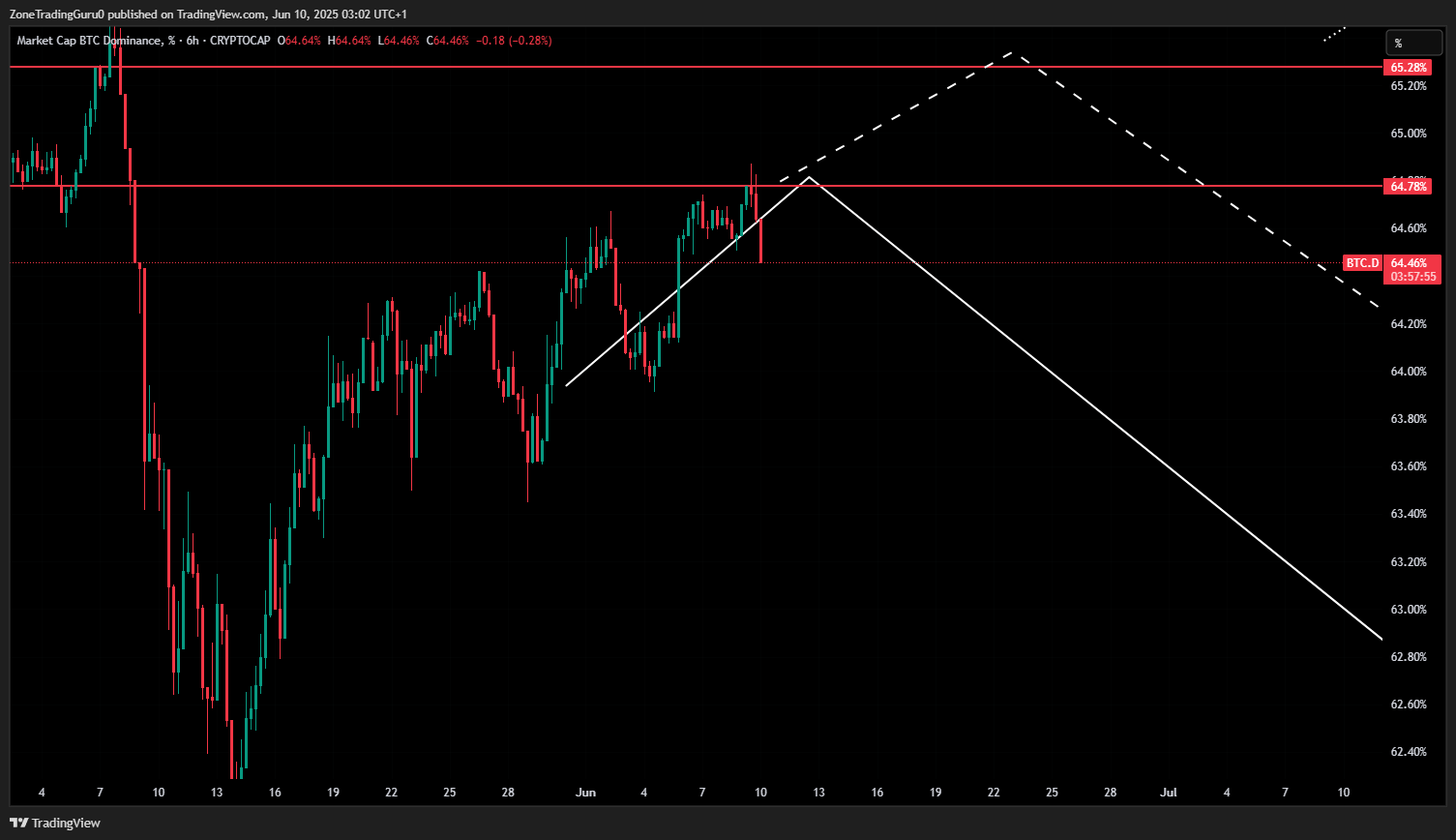

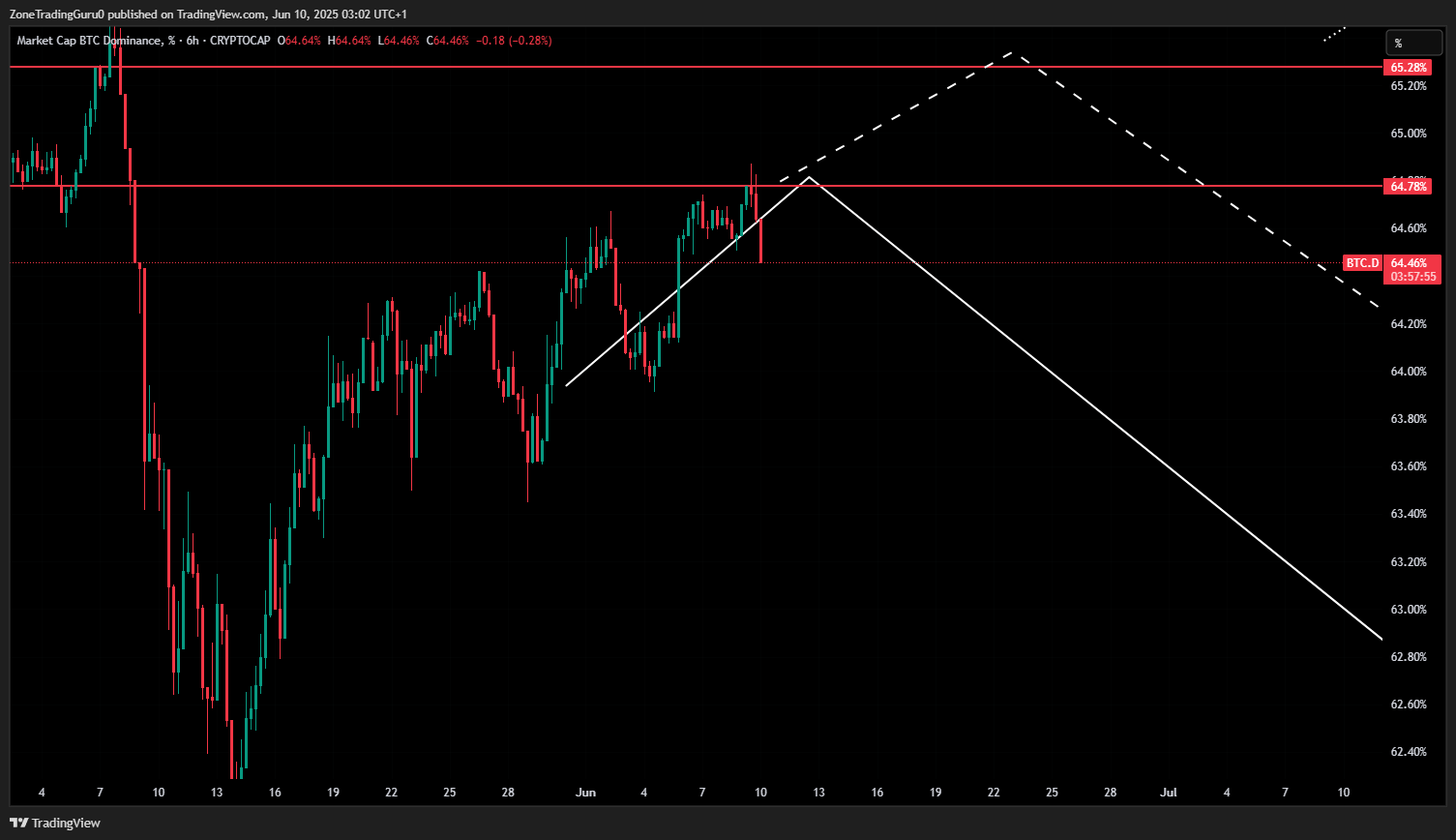

Meanwhile, Bitcoin Advantage (BTC.D) has reached a 64.78% threshold, an area previously marked as a potential reversal point.

The subsequent decline in dominance is an encouraging signal for Altcoin traders. Combined with the short-term merger of BTC, this opens the door to the tactical long position of selected altcoins, aligning with the broader price action of Bitcoin.

Read more: Trading with free encrypted signals in the Evening Trader Channel

Ethereum price forecast

Now, Ethereum has recorded six weeks of no meaningful callbacks for six months in a row – a pattern that is usually done before sharp corrections, as unsustainable gatherings tend to invite profits. On the daily chart, ETH is currently trading at about $2,670, close to the key resistance zone at $2,825.36, with one of the major bullish inflection points at $3,013.

There are two main situations now:

- Solution 1: ETH may continue to climb the $2,825.36 resistor. The liquidity sweep briefly pierced $3,013 without closing every day, which would indicate a potential bull trap. This failure to close critical levels could mark the local top, with a sharp reversal that could push ETH into the $2,000 area.

- Scheme 2: If ETH successfully closes the daily candle above $3,013, the breakout will confirm the continued uptrend. In this case, traders may want to buy a $3,013 renewal as new support, while the mid-term target approaches the height of the previous cycle is about $4,000.

As of now, Ethereum is still in a key decision-making zone. The price structure indicates that bullish momentum is getting bigger, but if there is no confirmation of more than $3,013, please proceed with caution.

The coming days will be crucial in determining ETH entry into price discovery or facing a correction rejection.

Read more: 15+ Best Encrypted Signal Telegram Groups in 2025

Dogecoin price forecast

Based on the current chart, Dogecoin (Doge) does trade in the previously pointed out range of 0.26-0.21, showing a lateral movement with potential risks of instant investment. Waiting for a significant breakthrough above 0.26 or below 0.21 to confirm the trend remains a prudent strategy before planning any trade.

For the two situations outlined above:

- Case 1: If the price falls above 0.26, please consider waiting for the return to 0.26 to buy. The price may rise to a resistance level of 0.31. Please note the secondary resistors of 0.2719-0.285, where short circuits can be chosen, but strict capital management is crucial.

- Case 2: If the price is below 0.21, please wait for the backtest of 0.21 to be brief. The potential support levels monitored were 0.195, 0.185, 0.17 and 0.142. Closed candles below 0.142 per day may lower to the previous low.

Current price action conforms to the analysis and maintaining discipline with these levels of discipline will be key to effectively managing trade.

Solana price forecast

Given that the current price of $SOL is around 158, it responds near the strong support area of 165.93-153.9, indicating a potential test for these levels. Whether $SOL can return to its previous all-time high (ATH) or reach new questions depends on price action and support levels around 186 key resistance.

Reiterate these two situations:

- Case 1: If the daily candle turns off 186 resistors, it may mark a continuation of the upward trend. After returning to the 186 recycling, you can consider buying settings, while the potential target is close to the previous high, estimated at 237.3-252.5.

- Case 2: If the price continues to fall, support may be tested with support from 165.93-153.9, with a critical trend reversal level of 143.6. If this level is reached, a strong rebound may occur. However, closing the candle at 143.6 per day will disrupt the uptrend, potentially leading to lower support or a drop in previous lows.

Since the current price is 158, it hovers near the lower end of the support zone. Monitoring the next daily candle closing is essential to confirm the direction.

PEPE price forecast

With PEPE’s current price around 0.0000127, as mentioned earlier, it is approaching the support level of 0.00001214, indicating potential testing of the area. Considering the strong resistance of 0.00001604, the analysis of the ongoing uptrend remains relevant.

Reiterate the scenario:

- Case 1: If the weekly candle is turned off on the 0.00001604 resistor, it may continue to rise with potential resistance levels of 0.00001702, 0.0000204 and 0.0000216.

- Case 2: If the daily candle is closed with support of 0.00001214, it may drop by 0.00000956 under the next support. This lower support is considered strong and may cause bounce and retesting of the 0.00001604 resistor.

- Case 3: If the 8-hour candle is closed below 0.00000956, Pepe may move towards the previous low and have an 80% chance of a rise plan failing and may go deeper into the dump.

The price is 0.0000127, and the price is close to key support. The next candle closing, especially during the daily or weekly timeframe, will be key to confirming the next move.

Link price forecast

As mentioned earlier, since the current link price is 14.55, it has moved to the previous resistance of 17.4, but is still in the correction phase after the downtrend. Prices are now approaching the established support level, indicating a potential bottom phase.

Reiterate the analysis:

- The support areas at the corrected bottom are 13.81, 12.67, 10.78 and 10.17, which can be used as a long position or on-site purchase and hold.

- If the 3-day candle is closed below 10.15, this uptrend may fail, potentially causing a deeper decline to previous lows.

- If the rise recovers, the resistance levels to be viewed are 17.4, 19.35 and 20.3, and 19.35 are the key levels of expected strong reactions. Candles that approach 19.35 per day may push the link to higher resistance at 24.91, possibly reaching its previous peak.

Price is 14.55, and the price is close to 13.81 support. The next few candles are closed, especially over the 3-day time frame, and it is crucial to confirm whether the correction continues or resumes the uptrend.

trum price forecast

Currently, Trump’s tokens are experiencing higher volatility due to a strong news flow surrounding the relationship between Donald Trump and Elon Musk. Price action can become unstable due to this media-driven narrative.

Trump’s current trading range is 10.977 and support is 10.311.

The tokens may continue to move sideways inside the band and may move in either direction as the development between Trump and Musk.

If a weekly candle (W1) closes the 10.3 support level, the price may drop to around 9.654, or even deeper, the bottom between 8.626 and 7.12. Descent to these levels will greatly reduce the likelihood of Trump’s rally back to the 2x $ resistance zone.

Conversely, if the token breaks above the key resistance levels of 11.62, 12.5, 14.975 and 15.65, a strong upward movement toward the 2x$ range can be achieved.

in conclusion

Bitcoin’s recent rally rekindled bullish sentiment, but faced a decisive test of $110,330, and its advantage retreat offers new opportunities for Altcoins. Ethereum is now standing at a critical corner after the extended rally – set to a new high, or be ready for sharp corrections for momentum.

Solana, dogecoin and Pepe are currently with a clear scope combined with settings where discipline and patience will be essential, with daily and weekly candle closings providing the most powerful signals for trend confirmation.

Meanwhile, Chainlink and Trump tokens are hovering near major support that can define their next major action, but given the distance from the crash level and in Trump’s case, both require careful monitoring and external narrative-driven risks.