Blackrock, the world’s largest asset manager, has proposed to the U.S. Securities and Exchange Commission (SEC) that allows accumulation in Ethereum Exchange-traded funds (ETFS), a revolutionary step in the cryptocurrency market.

🇺🇸 @blackrock Meet @secgov Crypto Working Group Discussion:

🔹Owned in encrypted ETP

🔹Securities tokenization📊BlackRock promotes EthET ETF Staking and Eyes tokenized funds, such as $2.9B buidl#BlackRock #sec #Ethereum #etf #crypto pic.twitter.com/tpg9tdxv4p

– Encrypted News (Coingape) (@coingapemedia) May 10, 2025

Everyone’s eyes are staring at ETF

The proposal has the potential to change the crypto investment landscape by turning Ethereum ETFs into bond-like generation assets.

To allow ETF share creation and redemption using ETH instead of USD, BlackRock proposed to modify its S-1 archive. Using BlackRock’s $2.9 billion Buidl fund, launched in March 2024 and focuses on traditional assets such as Treasury bills (T-Bills) on the Ethereum network, the change is designed to combine established and tagging strategies.

The Buidl Fund is a classic example of BlackRock’s master plan that integrates decentralized systems with traditional finance, and Ethereum is a key component of this development.

If allowed, according to market research, it accounts for about 3.2% of the Ethereum ETF. This potential return is expected to attract a large amount of institutional investment in Ethereum, which gives investors the opportunity to benefit from capital growth and passive income.

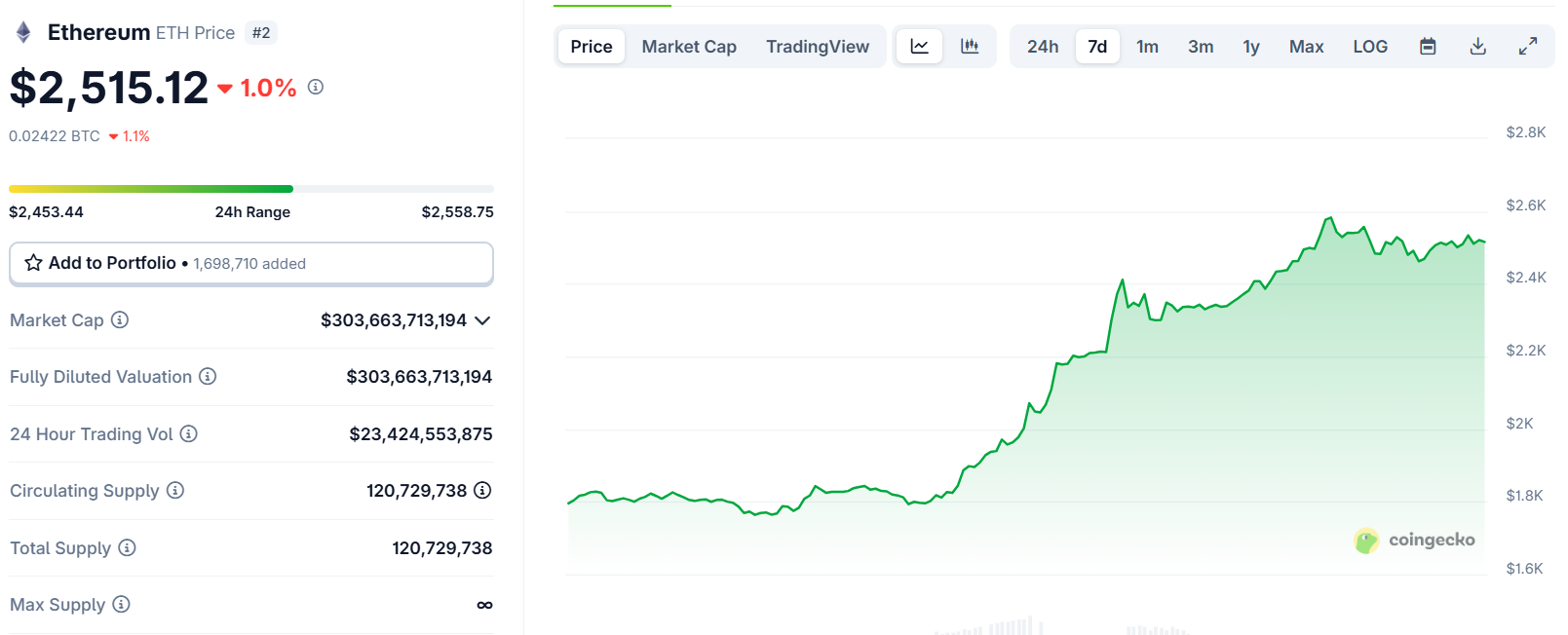

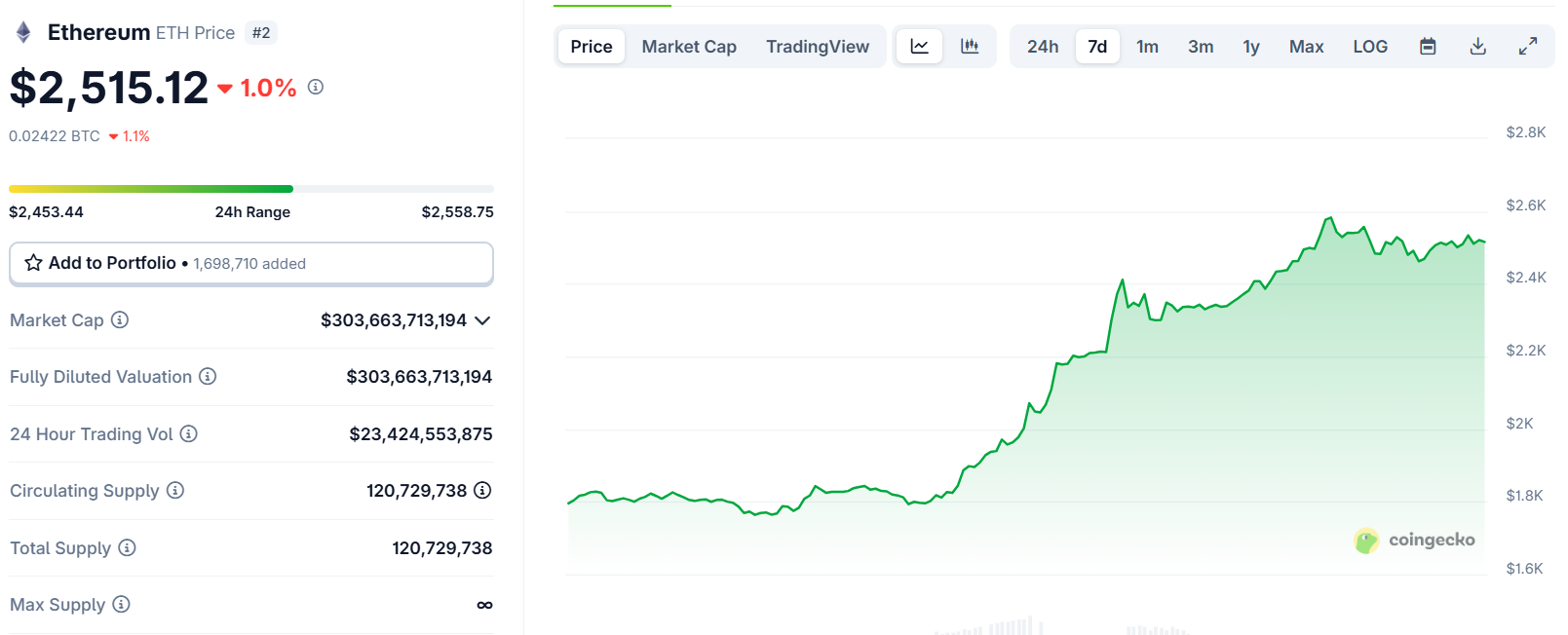

The market has already priced when investors are waiting for the SEC decision. ETH has grown nearly 40% over the past seven days, surpassing Bitcoin and other notable cryptocurrencies.

Source: Coingecko

SEC becomes active and cheering more ETF proposals

SEC has historically viewed Staking as a potentially unregistered security under the Howey test, and this legal framework is used to determine whether an asset is eligible for an investment contract. Staking was specifically banned at the launch of the Ethereum Sot ETF, which received SEC approval in May 2024. This has caused controversy in the financial community and is a major obstacle to incorporating it into ETFs.

According to an update from SEC.GOV, the more crypto-friendly SEC in 2025 appears to be looking into these restrictions and may pave the way for regulatory approvals.

In a March 2025 CNBC interview, Robert Mitchnick, head of digital assets at Blackrock, emphasized the revolutionary potential of Ether ETF equity.

“The recognition of this feature could greatly increase investor interest, and although there is insufficient demand for the Ethereum ETF since its debut in July 2024, this is largely due to a lack of points,” he said.

“ETFs are a compelling tool for holding Bitcoin, but for ETH today it’s not ideal and not put in,” Mitchnick said. He also highlighted the need for clear regulations to fully realize the potential of Ethereum in institutional portfolios.

The impact of the put-in proposal for Ether ETF exceeds the price of Ethereum. By allowing participation in ETFs, crypto assets can be reshaped as tools for income generation and capital appreciation, bringing them closer to traditional Wall Street financial products.

Read more: SEC enhances Bitcoin and ETFs with POW Compliance Altcoins

This change could introduce a new era of cryptocurrencies, bringing them closer to mainstream financial convergence and away from their decentralized roots. The cryptocurrency market is closely following the SEC’s deliberations, and Ethereum may be the first to drive the future of hybrid finance.