Bitcoin’s Turbulence Week has produced one of the most compelling stories of the year: a huge liquidation that liquidated the famous whale James Wynn – and chain data suggests that other large holders are quietly doubling.

James Wynn’s liquidation becomes a market fable

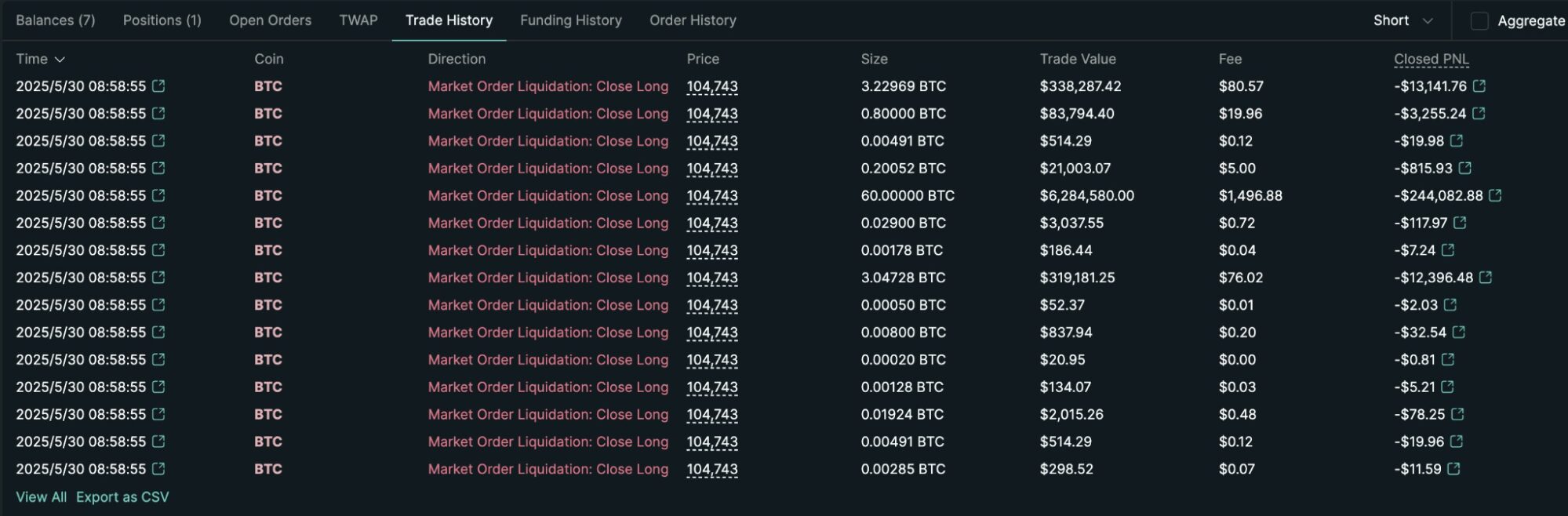

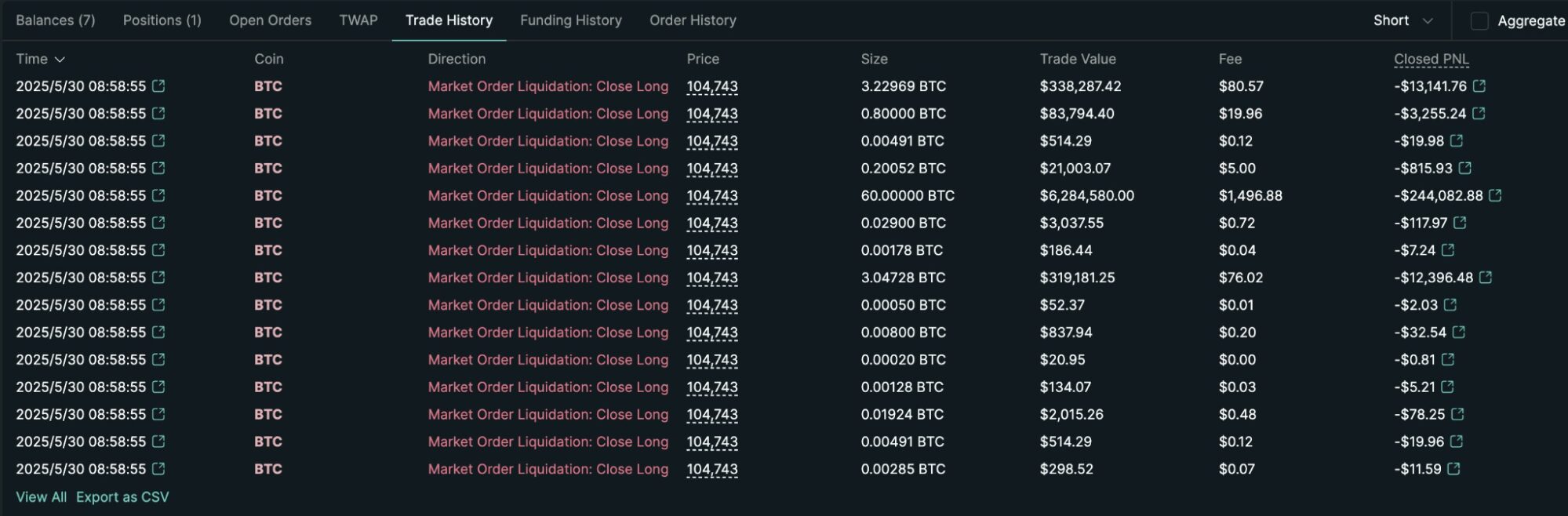

Trends are in sharp contrast to the fate of individual traders. James Wynn is one of the most notable examples, who recently suffered one of the biggest liquidations recorded this year.

Source: Super Mobile

Wynn has liquidated at 949 BTC, about $99.3 million after a brief decline earlier this week, after Bitcoin’s brief decline below $105,000. The position is part of a larger set of long deals that disappeared in just a few days and is worth over $99 million.

Wynn’s dramatic reversal highlights how fast it can happen in a highly leveraged market, even for previously successful traders.

The incident quickly became a cautionary tale for the entire cryptocurrency community. A pseudonym’s wallet address is reportedly 0x2258, which has been against Wynn for the past few weeks, executing short positions at Wynn for a long time and vice versa.

result? During the same period, the estimated profit of 0x2258 was $17 million, and his huge loss was $43 million on May 13.

While some market participants speculate that these anti-trades are algorithmically driven or simply opportunistic, the broader gain is obvious: the market is rewarding patience and punishing excessive leverage.

Whale accumulation signals increase confidence

Bitcoin’s recent price action is by no means easy. While the broader market witnessed a healthy recovery following last month’s callback, a closer look at the data on the chain suggests a deeper story unfolding below the surface.

Large Bitcoin holders – those with 1,000 to 10,000 BTC, excluding exchanges and miner wallets, have resumed positive accumulation, a move that is related to bullish price action.

According to CryptoQuant, the total balance of these “whale” addresses has steadily increased over the past 30 days and is now over 3.4 million BTC. More convincing is the 30-day change, which is not only positive, but is significantly higher than the 30-day simple moving average (SMA), triggering long-term buying signals for investors’ dashboards.

“This accumulated signal is constantly increasing,” said CQ Julio, an experienced chain analyst. “Historically, as the cohort increases its holdings, we see continued price increases over the next few weeks or months.”

Classic bullish settings in production?

At the macro level, the recalculation of whales accumulation is a time when macroeconomic uncertainty remains rising, but the demand for Bitcoin as a store of value seems to be flexible.

Bitcoin is currently trading at around $106,000, reflecting the rebound early this week and adding momentum to bullish narratives for long-term holders. In the past month alone, over 108,000 unique BTCs are now back in the Whale Wallet, and long-term investor sentiment is improving.

Source: Coingecko

“We are watching the classic setup,” Giulio added. “The rise in whale holdings, high leverage desire and enhanced prices support all bull markets pointing to mature.”

BTC saw sharp fluctuations at the end of this month, but these moves are still in the expected technology model. After bounced back from support to a high price of nearly $108,850, the price quickly reversed and closed below $106,900 – a short-term failure confirmed.

Although BTC has rebounded slightly from the $104,752 support level, the correction may not be over yet. The next key supports between $103,150 and $101,700. The confirmed H8 candle closure is below $101,700, which may mark the end of the current bullish trend.

Read more: Trump adopts Saylor’s script to buy $2.5B of Bitcoin