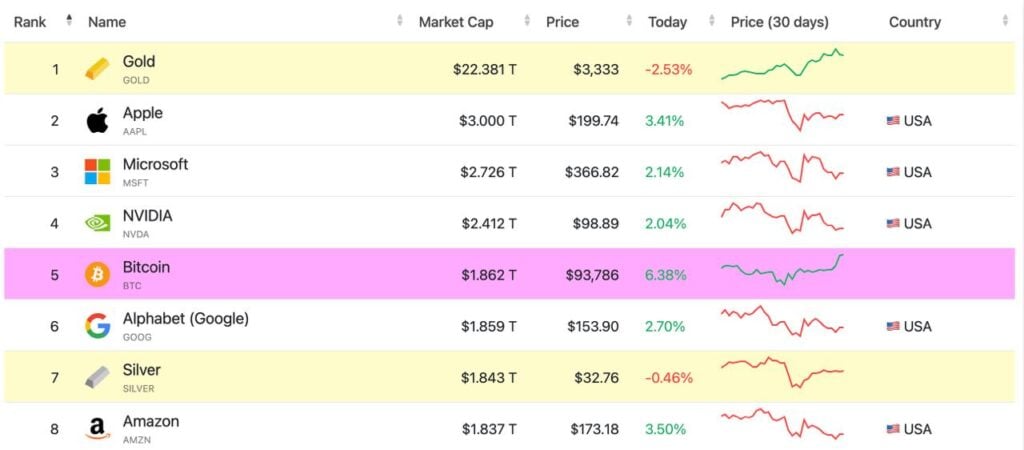

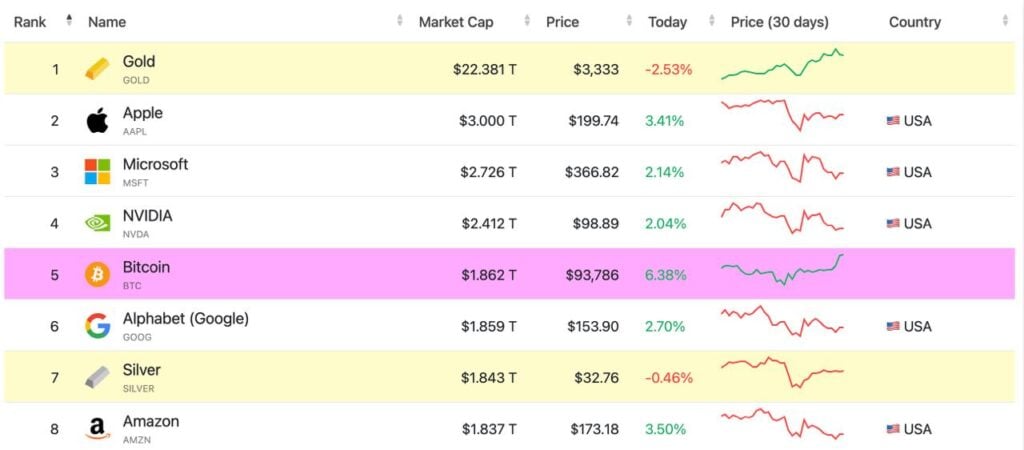

In a historic milestone, Bitcoin quickly surpassed Google, occupying a place among the top 5 most valuable assets with its market capitalization. This extraordinary achievement underscores the growing influence of Bitcoin in the global financial environment, thus raising confidence in its role as a transformative asset class.

Bitcoin enters the top 5 assets through market value

On April 24, 2025, Bitcoin achieved a groundbreaking feat, surpassing Google’s market cap to be a place among the world’s top five most valuable assets.

Source: Company Market Value

This milestone highlights the rapid rise of cryptocurrencies amid changing economic environment. According to Geoff Kendrick, head of digital assets research at Standard Chartered, Bitcoin’s upward trajectory is closely linked to the ongoing uncertainty surrounding U.S. Federal Reserve policies. Kendrick remains bullish, reiterating his bold price forecast:

“This could be the next high catalyst ever, so I reiterate my current forecast for Bitcoin – by the end of 2025, by the end of 2025, by the end of 2028, I will be $200,000.”

While Bitcoin’s top five may be temporary, its ability to compete with traditional giants like Google has strengthened confidence in its long-term potential. Both investors and analysts view this achievement as a proof of Bitcoin’s growing legitimacy, challenging the dominance of conventional assets and placing its appeal as a store of value.

Why has Bitcoin risen among traditional assets that have been around for centuries?

Several key factors have driven Bitcoin to the upper echelon of global assets.

First, it is increasingly believed to be a hedge against the risks of traditional finance (Tradfi) and U.S. fiscal bonds. According to a new report from U.S. Cryptocurrency News, the attractiveness of Bitcoin as a safe haven asset has increased amid concerns about inflation, monetary policy uncertainty and geopolitical tensions. In a broader market trend, Bitcoin, like many other hedge assets, has reached new all-time highs, reflecting the caution of investors facing global trade wars and economic instability.

Furthermore, the rise of Bitcoin reflects a broader shift to digital assets. Digital assets will now reach mass adoption as institutional investors increasingly allocate capital to cryptocurrencies. The major financial institutions that once suspected now view Bitcoin as a legal asset class. In general, the growing interest of Bitcoin ETFs and institutional banks in Bitcoin and cryptocurrencies is a significant development. So the market for Bitcoin is worthy of fueling, allowing it to surpass a long-standing company like Google.

The surge in Bitcoin’s value also underscores cultural and technological transformations. With digital assets attraction, they are reshaping how investors view wealth and value. Unlike traditional assets associated with physical or corporate structures, Bitcoin operates on decentralized blockchains that provide transparency and resilience in an era of economic uncertainty. This unique positioning makes it a focus for those seeking alternatives to traditional financial systems.