The cryptocurrency market is experiencing strong rally today, with Bitcoin (BTC) and Ethereum (ETH) leading the charge. Since early February, Bitcoin has soared $100,000 for the first time as of May 9, 2025, while Ethereum has shown great strength, climbing to around $2,200.

Total crypto capitalization lost $3,3 trillion, reflecting a 3.4% increase in the past 24 hours. This bullish momentum is driven by a combination of macroeconomic development, institutional adoption and technological breakthroughs.

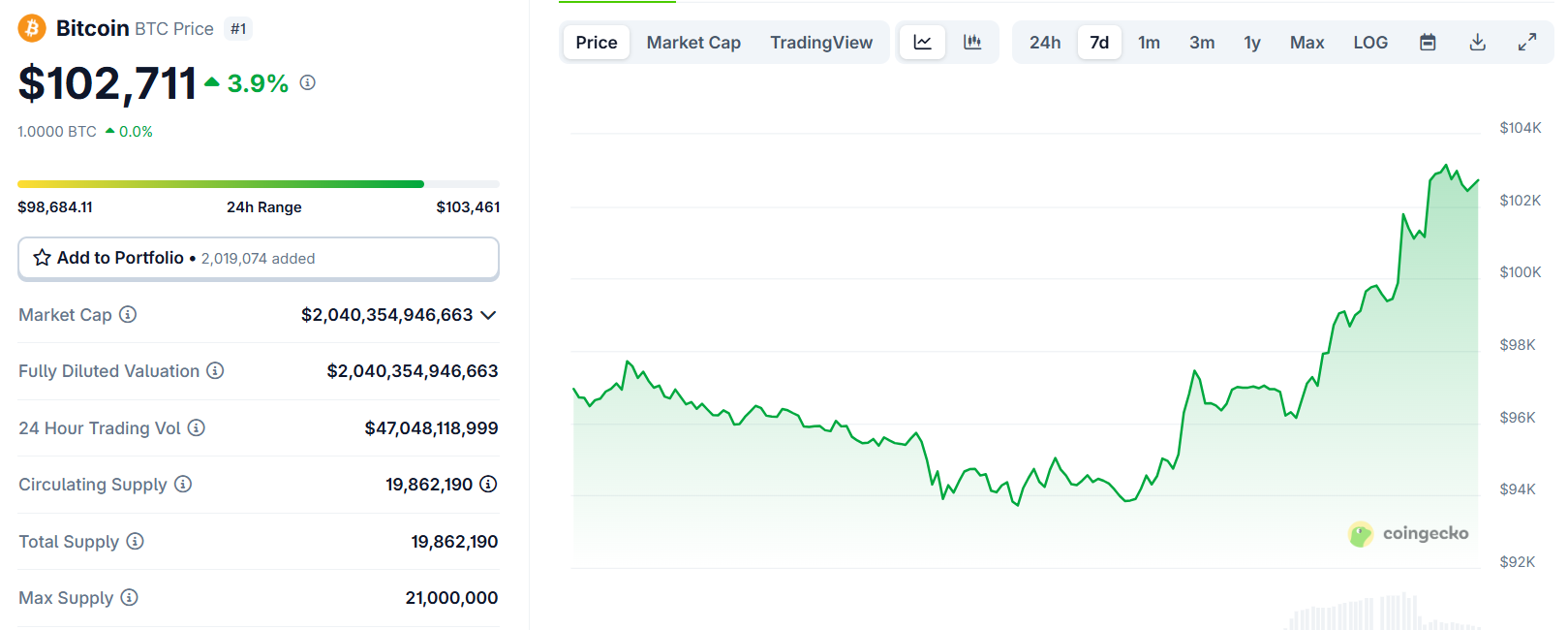

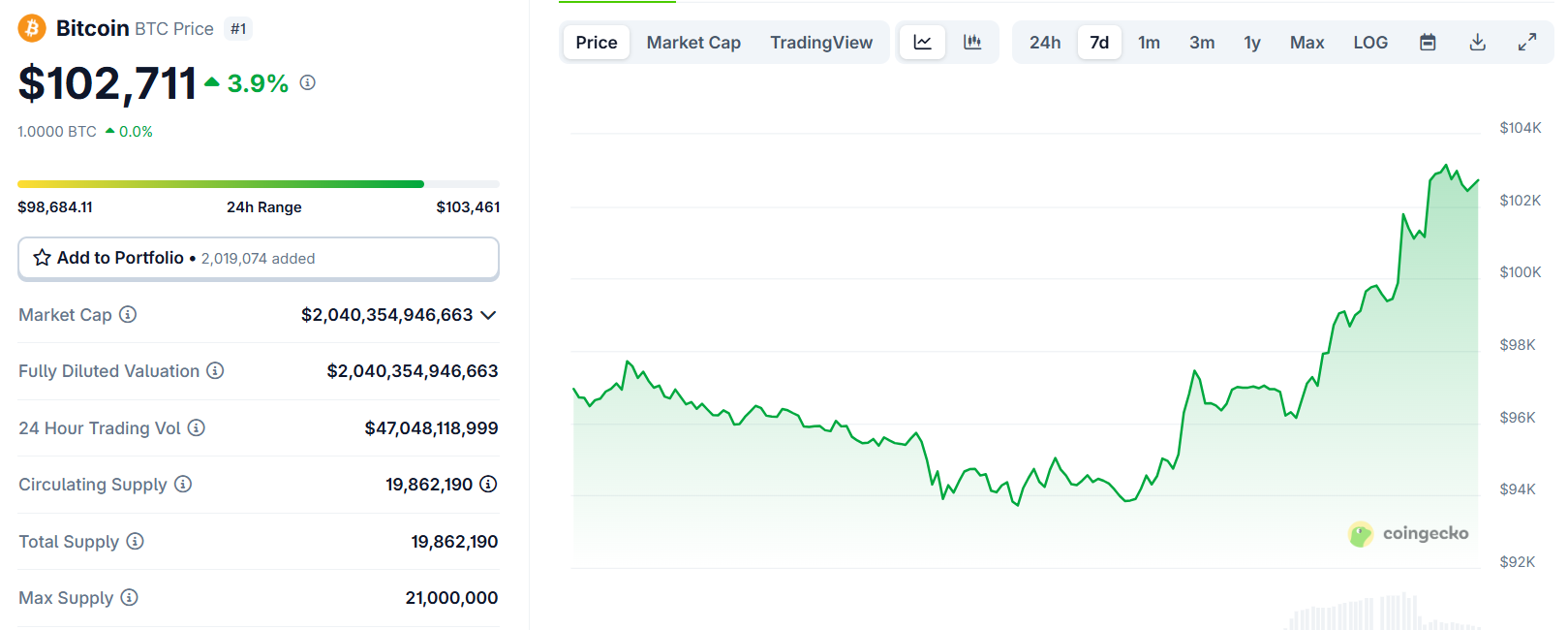

Bitcoin breaks the barrier to $100,000

Bitcoin trading was around $102,700, up nearly 4% over the past 24 hours, with daily trading volume increasing to $47 billion. This marks an important milestone as BTC has recovered its $100K level after falling to $75,000 in early April after trade tariff concerns.

Source: Coingecko

There are several momentum behind this rally:

- Easing U.S.-China trade tensions: Optimism about potential advances in U.S.-China trade negotiations promote risk sentiment in global markets, including cryptocurrencies. China’s Ministry of Commerce recently marked the openness of negotiations, alleviating doubts about tariffs that previously weighed risky assets. This drives the price of Bitcoin as investors see it as a hedge against economic uncertainty.

- Large short clearing: The derivatives market activity is huge, with US$341 million in short currency positions liquidated in the past 24 hours. This imbalance reflects a strong bullish momentum as bearish traders are forced to cover up their positions, pushing prices further upward.

Source: Xiaodian

- Institutional and regulatory stymology: Recent developments, such as the U.S. Office of the U.S. Monetary Audit Agency (OCC) relaxes its rules, allow banks to buy and sell customers’ crypto assets and boost institutional confidence. Additionally, Arizona passed the passage of Bitcoin reserve bills and recorded inflow signals input into Bitcoin ETFs, which is the growth of mainstream adoption.

- Fed’s stable interest rate: The Fed’s decision to keep interest rates between 4.25% and 4.50% on May 7 makes Bitcoin’s attractiveness a store of value, especially among stagnant concerns. Investors increasingly refer to BTC as “digital gold” to prevent fiat currencies from eroding.

Ethereum rides goat waves

Ethereum is trading at about $2,200, reflecting 16.8% over the past 24 hours, up 20.2% over the past week. ETH has a market capitalization of $267.45 billion, cementing its position as the second largest cryptocurrency.

Source: Coingecko

On May 7, the recent pectra upgrade to activate Ethereum further exacerbated optimism. Pectra introduces smart accounts, higher points limits and increased scalability through key Ethereum Improvement Recommendations (EIPS). Features such as EIP-7702 (enable external accounts can act as smart contracts) and EIP-7691 (data blobs with 2 layers of scalability) enhance Ethereum’s usefulness to DAPPs and smart contracts, attracting developers and investors.

Learn more: Ethereum price forecast after Pectra upgrade in May

Like Bitcoin, Ethereum has seen a lot of short liquidations, with $283 million in ETH positions in the past 24 hours.

cautious

Crypto markets are waving a wave of optimism, driven by eased trade tensions, pro-Claputo policies and strong technological breakthroughs. Bitcoin surged over $100,000, and Ethereum rally to $2,200, reflecting an effective combination of institutional inflows, short-volume clearing and the tailwind of the macro economy.

While potential Fed policy shifts and technical pullbacks such as imminent risks are imminent, the current momentum emphasizes the growing role of cryptocurrencies as mainstream asset classes. As market volatility remains a double-edged sword, investors should remain informed and cautious.