The cryptocurrency market faced a turbulent start to the week, with Bitcoin (BTC) leading a wide sell-off, selling a $700 million long position and sending major altcoins such as Dogecoin (Doge) (Doge) and Cardano (Ada) (Ada) and fell by up to 7%.

The recession reported by Coindesk on May 13, 2025 reflects a cooling of risky appetite among traders, driven by macroeconomic uncertainty and transfer capital flows. This provides an in-depth look at today’s market dynamics, price movements, and the power to shape the cryptocurrency landscape.

Selling News Action hit Bitcoin today, which is under $102K before challenging $106,000. Further performance may appear in the card when tariff concerns disappear.

– Coindesk (@coindesk) May 12, 2025

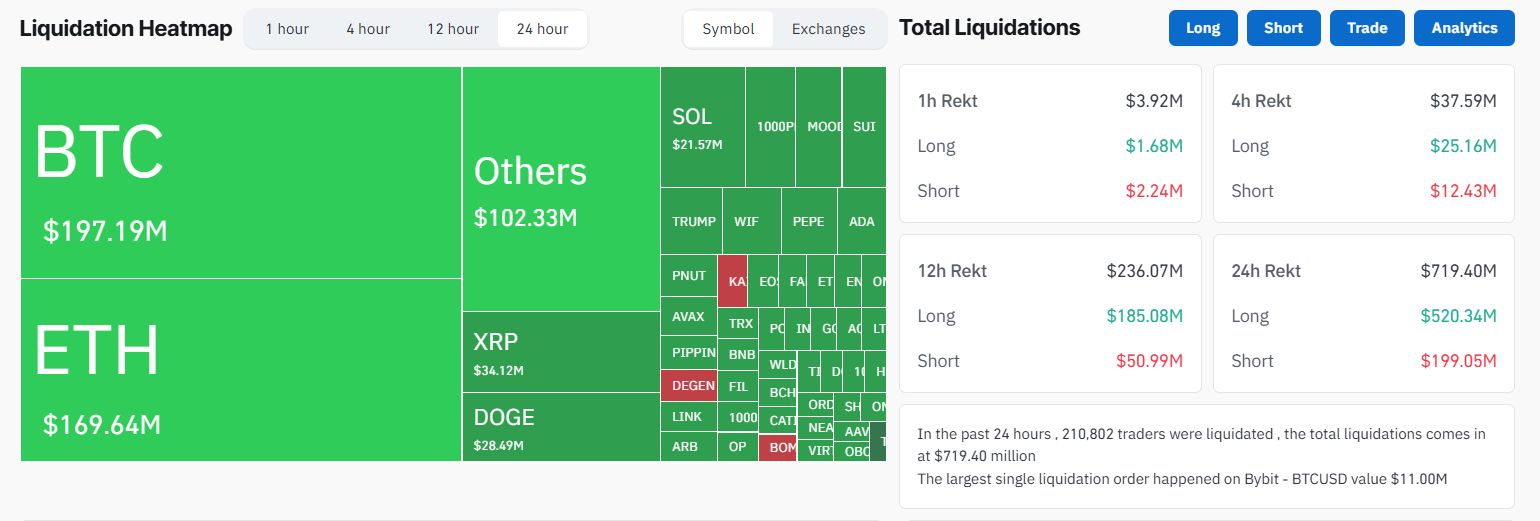

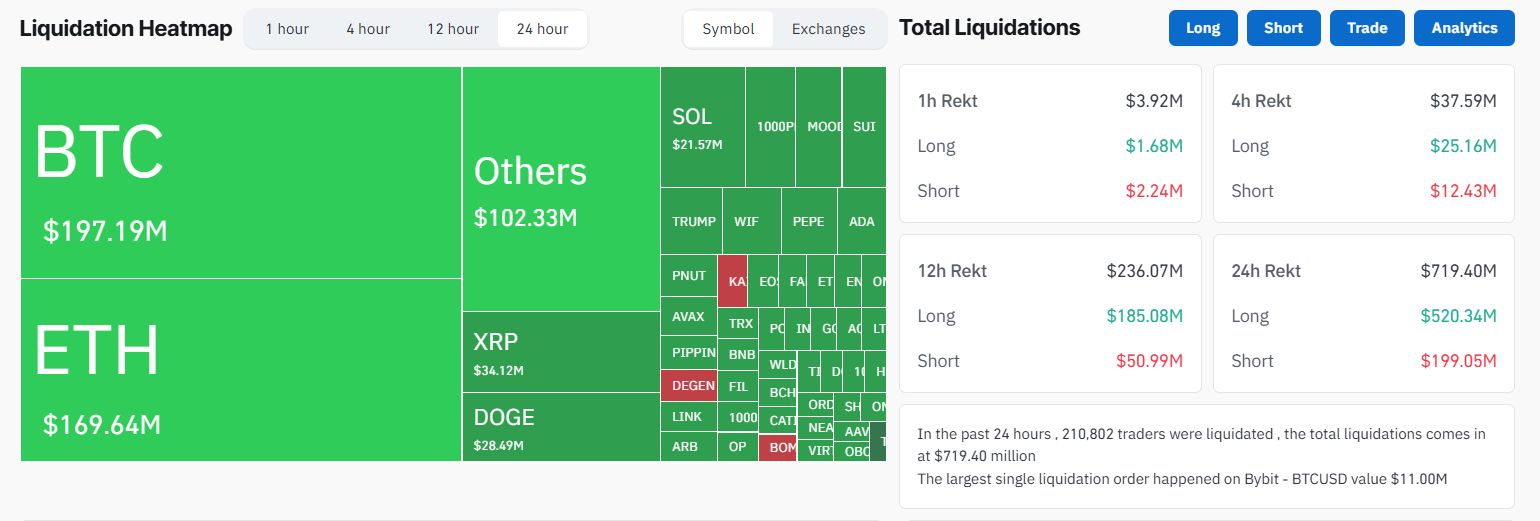

Bitcoin drops to $10,000, liquidation cascade

Bitcoin BTCthe market’s waist down 2%, hovering around $101,000, removing earnings that briefly exceeded $105,000 earlier this week. The pullback triggered a long-term liquidation of $700 million as leveraged traders increasingly caught off guard.

Source: TradingView

When exchanges are forcibly exchanged due to insufficient profit margins, liquidation occurs, which usually increases price fluctuations in volatile markets such as cryptocurrencies. The largest single liquidation is BTCUSDT futures trading by BYBIT, worth $11 million.

Source: Xiaodian

The sell-off was partly attributed to profit after the recent rally of Bitcoin and the wider market caution. The post on X highlights a “soft” Asian Fair with a total market cap reduced by $15.5 billion and capital flows into Stablecoins as investors seek security requirements. Other indicators include the crypto fear and greed index (a kind of emotion meter) that are still in the realm of “fear”, suggesting the potential is the near-term bottom, but also reflecting ongoing uneasiness.

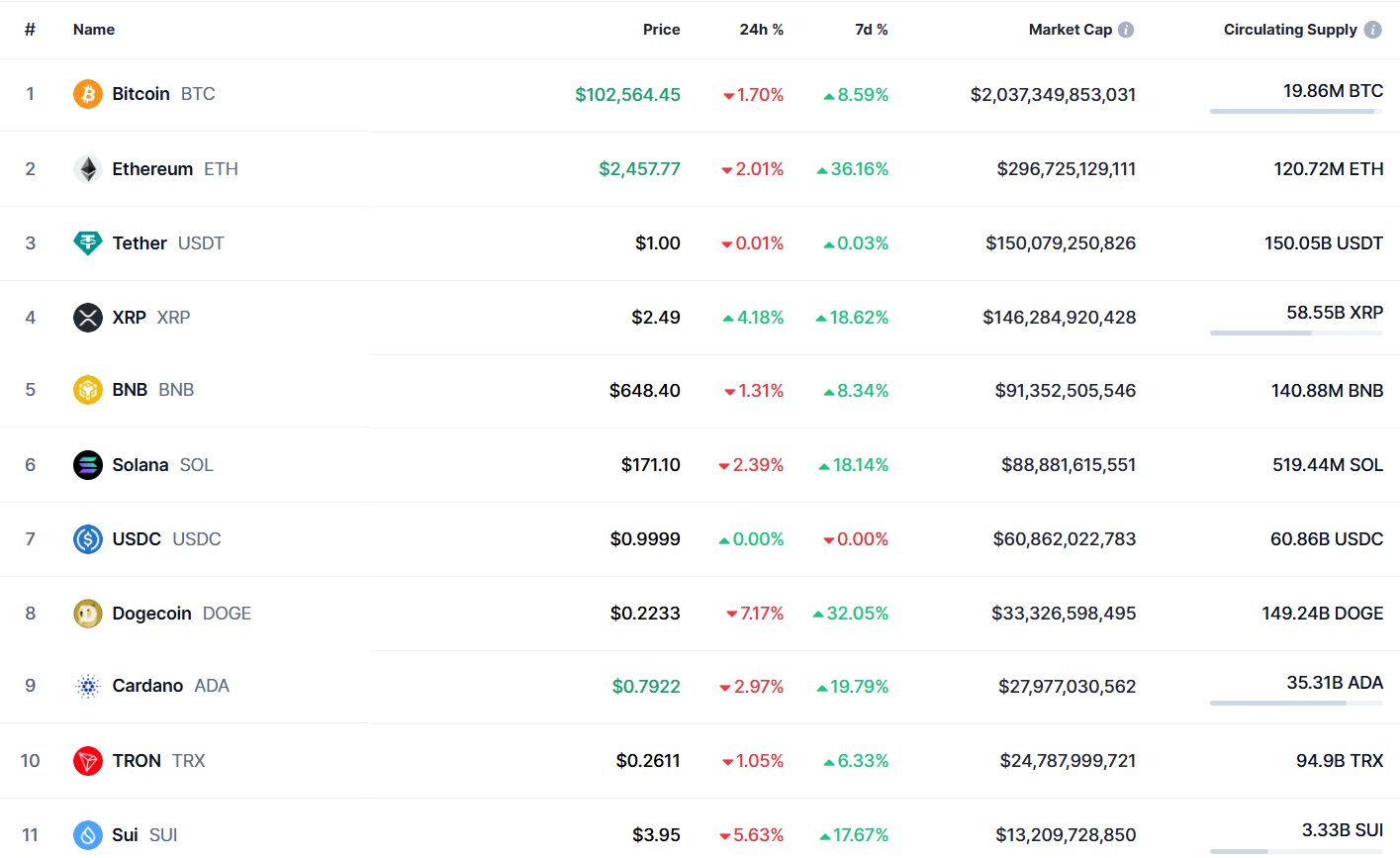

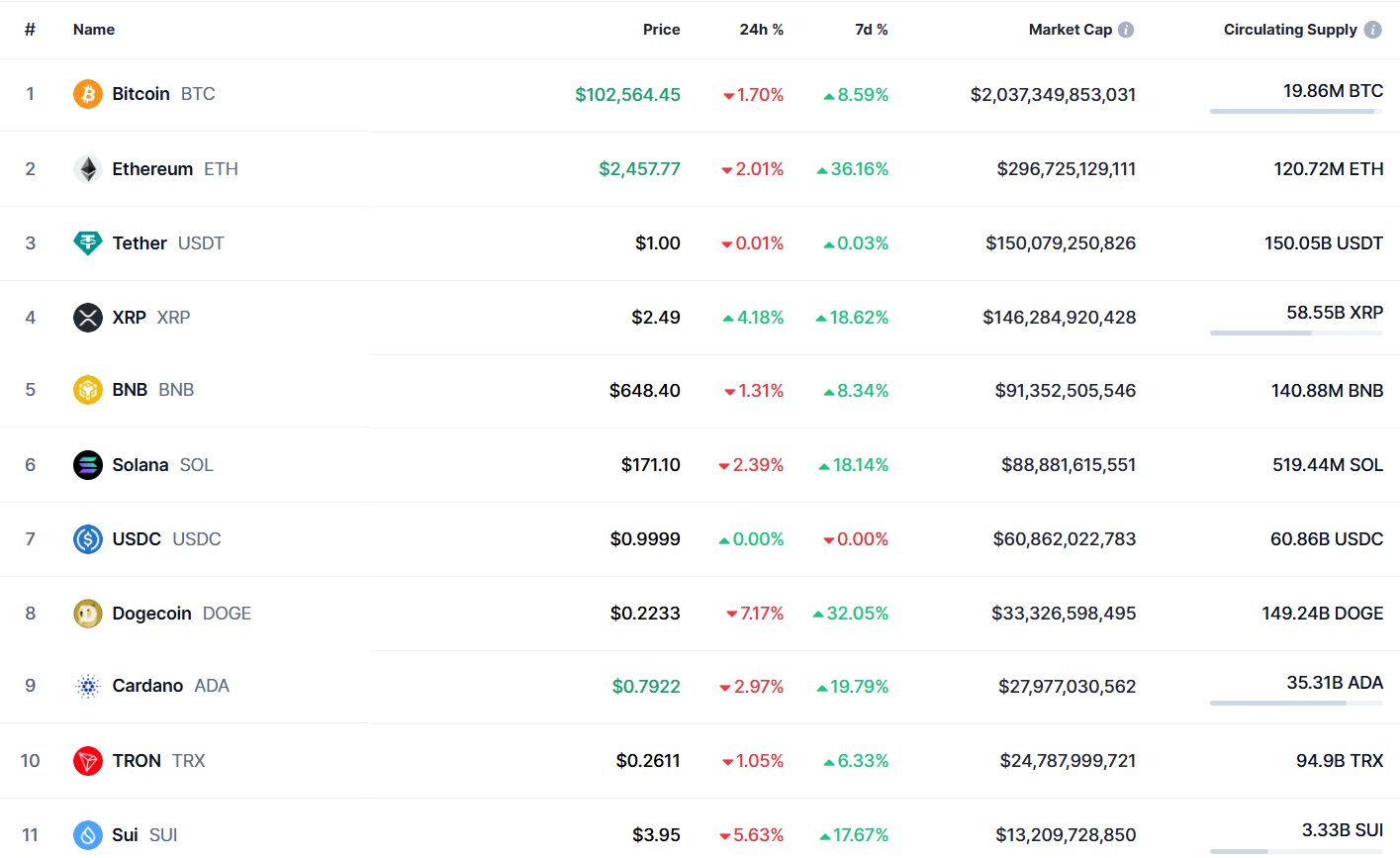

Ethereum, XRP and Solana under pressure

Ethereum eth It fell 2.2%, trading close to $2,450. The trend fell by 36% last week, fueled by optimism over Ethereum’s pectra upgrade and the US-UK trade deal. However, today’s risk-taking sentiment reverses these gains, and ETH futures contribute a lot to clearing statistics.

Read more: ETH price forecast after Pectra upgrade in May

Source: TradingView

XRPusually the darling of retailers, earning 4% and trading at $2.50.

Read more: Wellgistics adopts $50 million XRP: a catalyst for price growth?

Source: TradingView

Solana solhigh-performance blockchain tokens also fell by 2.5%, and the transaction price was $170.

Source: TradingView

Large mountain top mountain coins (such as Doge and Ada) LED losses fell by 7% respectively. Despite speculation on potential ETFs and Elon Musk’s influence, Doge has been trading at $0.2 and has been working to keep momentum.

Source: Coingecko

Macro factors and prospects

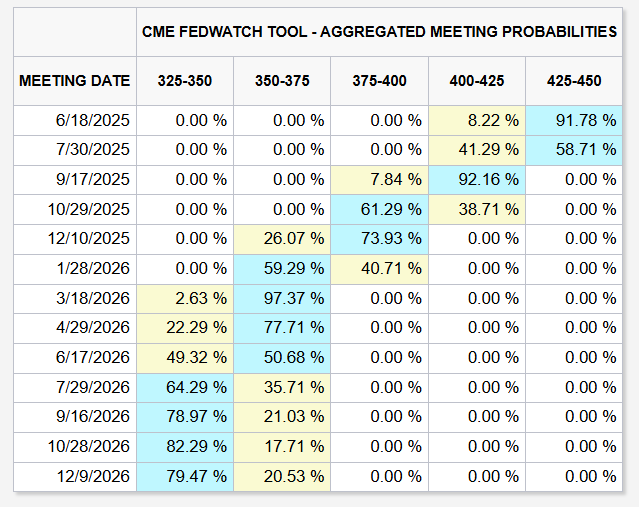

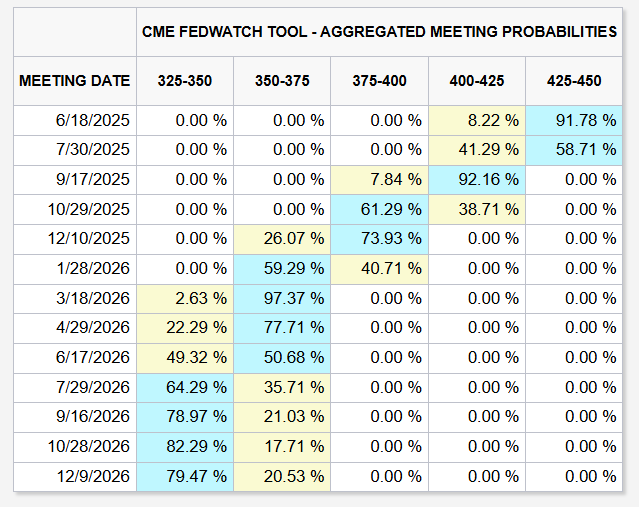

Today’s downturn coincides with macroeconomic headwinds, including a reduction in Fed’s uncertainty and fear of stagnation. The CME FedWatch tool shows that by July, there is a 41.29% chance of falling to 4.00%-4.25%, but traders remain vigilant about inflationary pressures on potential U.S. tariffs. Bitcoin’s hedge role as a hedge continues to attract inflows of BTC ETFs, with BlackRock’s IBIT flowing in $4.3 billion per month.

Source: CME Group

As Coindesk notes, although the market is still in a “holding mode”, Bitcoin has a 59% advantage, indicating that capital is being consolidated into safer assets. Currently, traders are focusing on key support levels – $96,000 for BTC, $2,300 for ETH, and $2.20 for XRP – as potential inflection points. As volatility may persist, careful positioning and robust risk management are crucial to navigating this dynamic market.