Geoff Kendrick, head of digital assets research at Standard Chartered Bank, predicts that Bitcoin could soar to $200,000 by the end of 2025, possibly at an all-time high. He relied this bullish view with an increasing focus on Fed independence and Bitcoin’s fighting spirit as hedge against risks in traditional financial systems. With the implicit deterioration of economic uncertainty, this prediction highlights the growing appeal of Bitcoin in volatile markets.

Resist the hedging of financial risks

Kendrick stresses Bitcoin’s decentralized ledger to resist vulnerability in centralized financial systems. Unlike traditional assets, Bitcoin is independent of government or agency control, making it a safe haven during a crisis.

according to Investing.comThe collapse of Silicon Valley Bank in March 2023 illustrates this as Bitcoin rally as Tradfi assets falter. Investors increasingly see Bitcoin as a buffer to prevent systemic risks, especially when trust in traditional institutions diminishes. This unique positioning is the optimism of the standard franchise on the price trajectory of Bitcoin.

Feeding Independence and Treasury Bond Dynamics

Recent concerns about Fed autonomy have exacerbated Bitcoin’s appeal. Remarks by former President Donald Trump on boycotting Jerome Powell, who actively slowed down the pace, raised concerns about political intervention. This uncertainty expands the value of Bitcoin into a decentralized asset.

Kendrick also pointed to the premium of the U.S. fiscal maturity, which reached a 12-year high in 2025, reflecting investors’ caution with long-term fiscal bonds compared to short-term bonds. According to LSEG data, Bitcoin has historically benefited from this output difference, with a six-week high of $90,459 visible on the climb, as shown in the LSEG data.

Bold predictions of standard charter flights

Standard Chartered’s $2025 forecast for 2025 reflects confidence in Bitcoin’s long-term growth. By 2028, Kendrick’s target is $500,000, driven by ongoing macroeconomic uncertainty and trust that erodes centralized financial systems.

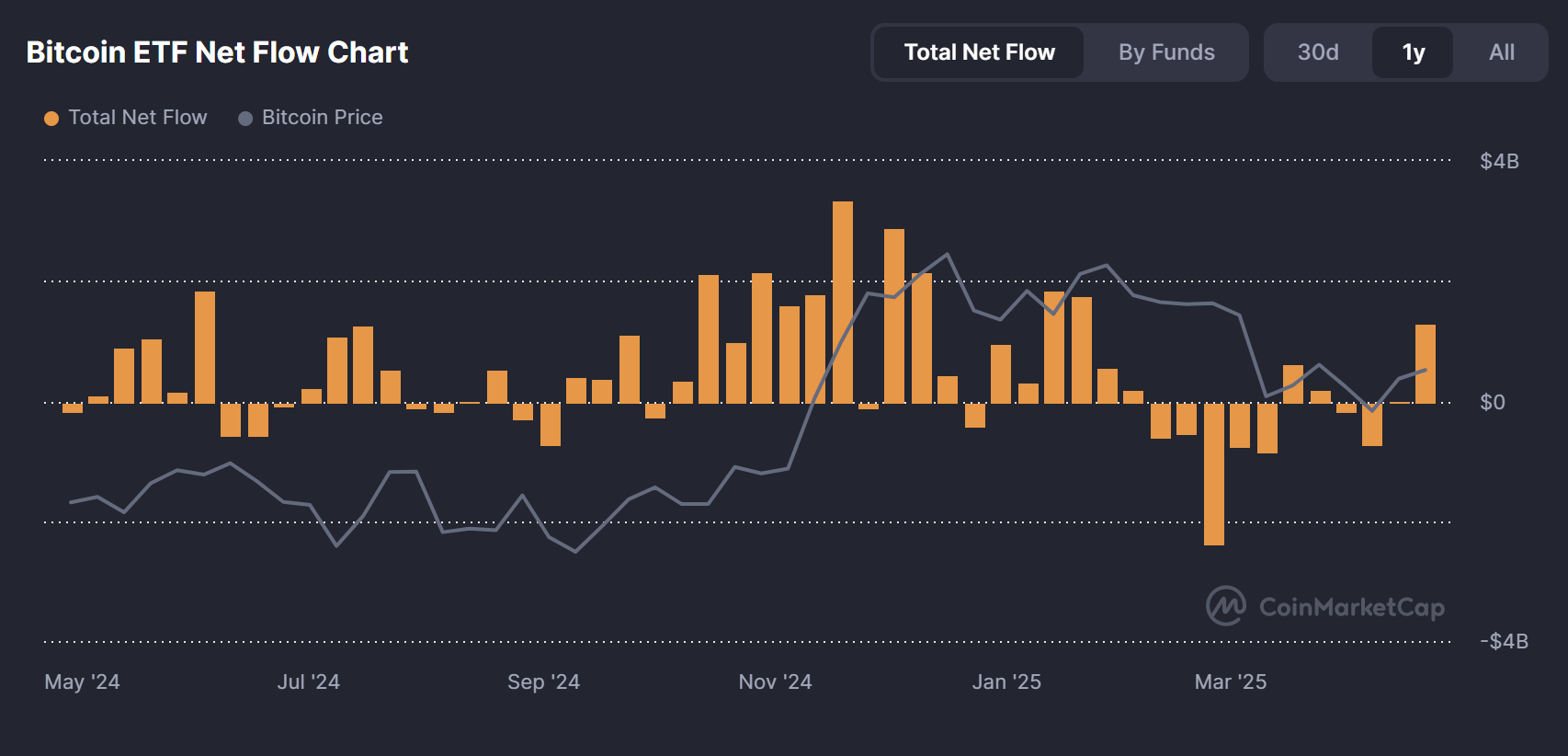

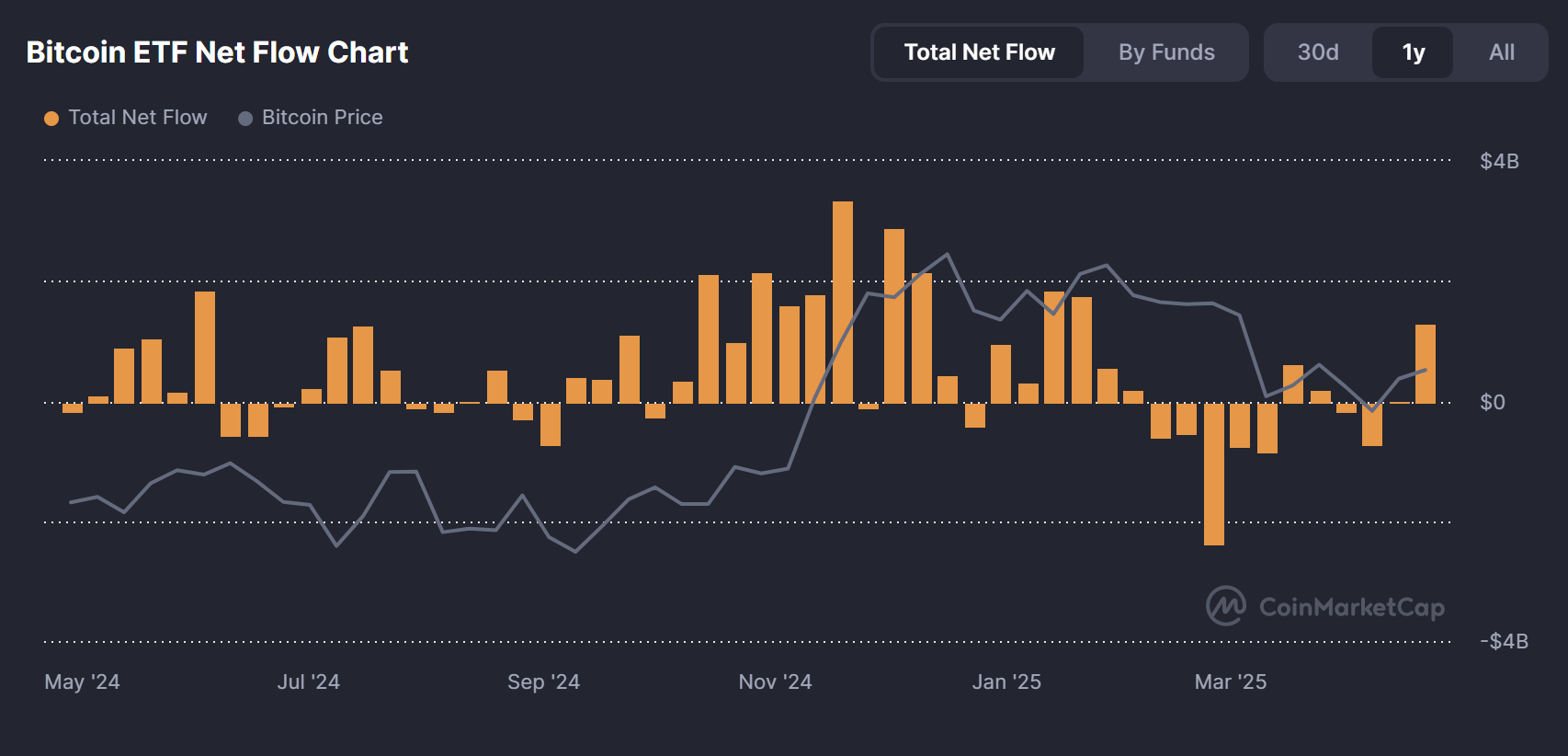

Market trends support this view with strong institutional demand and flow into Bitcoin ETFs. As of April 22, 2025, the net inflow of Bitcoin ETF net flows was $912.7 million, with historical value showing $248.7 million in the past three months. Bitcoin also soared above $93,500, followed by recovery rates across the entire cryptocurrency market.

Source: CoinMarketCap

These factors indicate an increase in adoption rate of mainstream adoption, which may drive the price of Bitcoin to rise. Nevertheless, reaching $200,000 depends on continued investor confidence and a pathway to favorable economic conditions.

Despite optimism, Bitcoin’s volatility cannot be ignored. Price forecasts are speculative in nature, with external factors such as regulatory repression, shifts in monetary policy or reduced institutional interests that may derail the standard charter predictions. Investors must make such predictions with caution and conduct detailed research before making decisions. Despite the elasticity of Bitcoin’s decentralization, its price remains sensitive to global economic and political development.