When Babylon prepares for the eagerly anticipated token generation activity (TGE), the focus is on its pricing strategy and performance after issuance. Babylon has a unique model for non-BTC-suppressing Statiking and TVL’s $3.8B, so it goes into the modular infrastructure space with Eigenlayer, Solayer and Pendle – expected to unlock new value, but also face pressure to deliver immediately.

Highlights of Babylon

The most unique feature of Babylon is its fixed mechanism for non-habitual Bitcoin: BTC holders can place their Bitcoin directly on the Bitcoin network without browsing third parties or centralized bridges.

Learn more: What is Babylon?

Essentially, Babylon transformed Bitcoin into a “security layer” of the POS ecosystem, while also establishing a liquidity center that directs BTC to DEFI. During the Genesis phase, the Babylonian Chain was designed to integrate with multiple blockchains such as Penetration, Cosmic Hubs, and SEI.

Currently, Babylon’s total value lock (TVL) is over $3.8 billion, accounting for about 80% of the total TVL of the Bitcoin ecosystem.

Before the rise of Babylon, Yzi Labs had actively supported liquid accumulation programs such as kernel Dao. Even CZ repeatedly emphasizes this narrative. These factors helped Babylon become a leading player in this emerging field.

TVL of Babylon – Source: Defillama

Babylonian symbolism

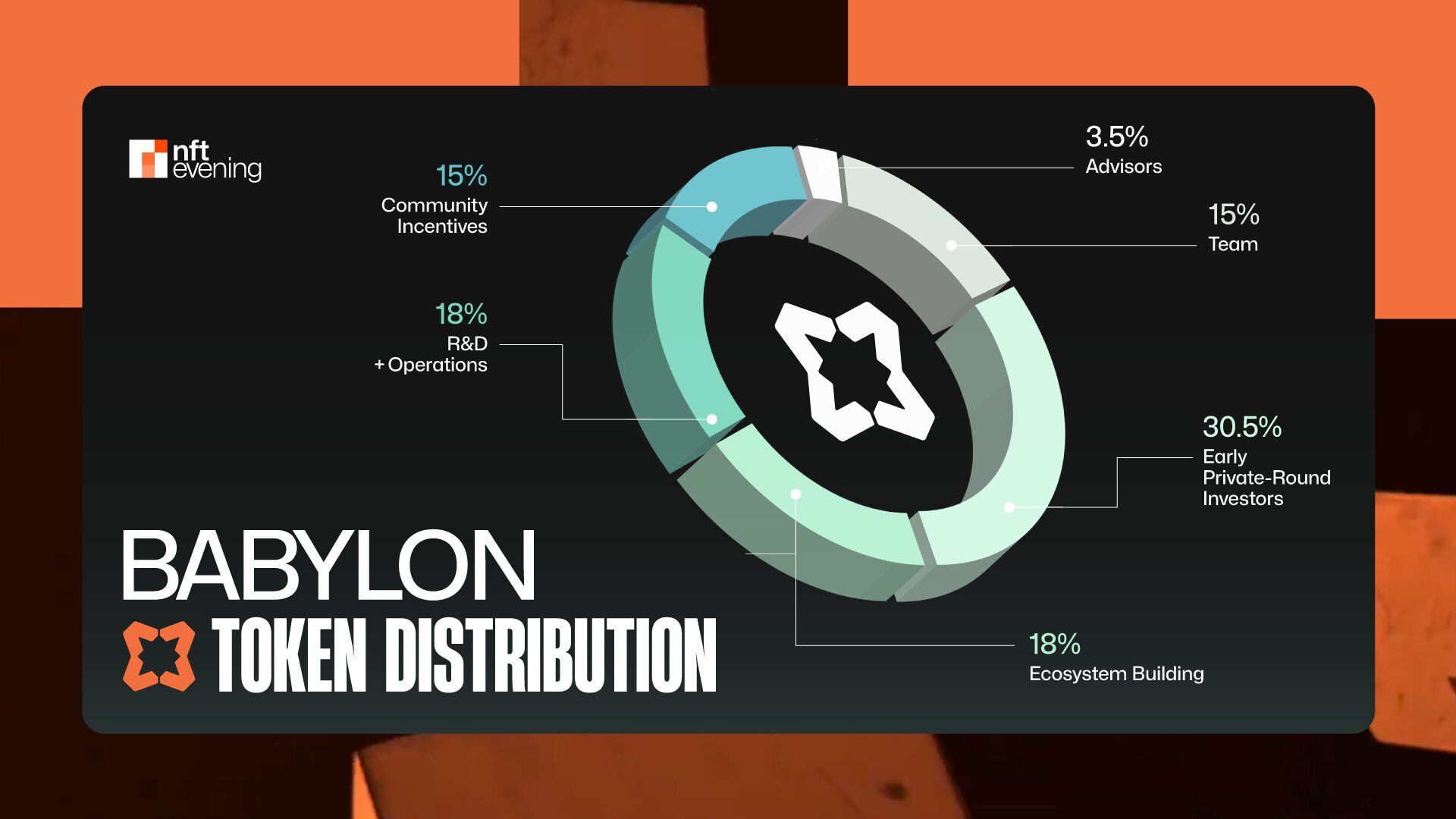

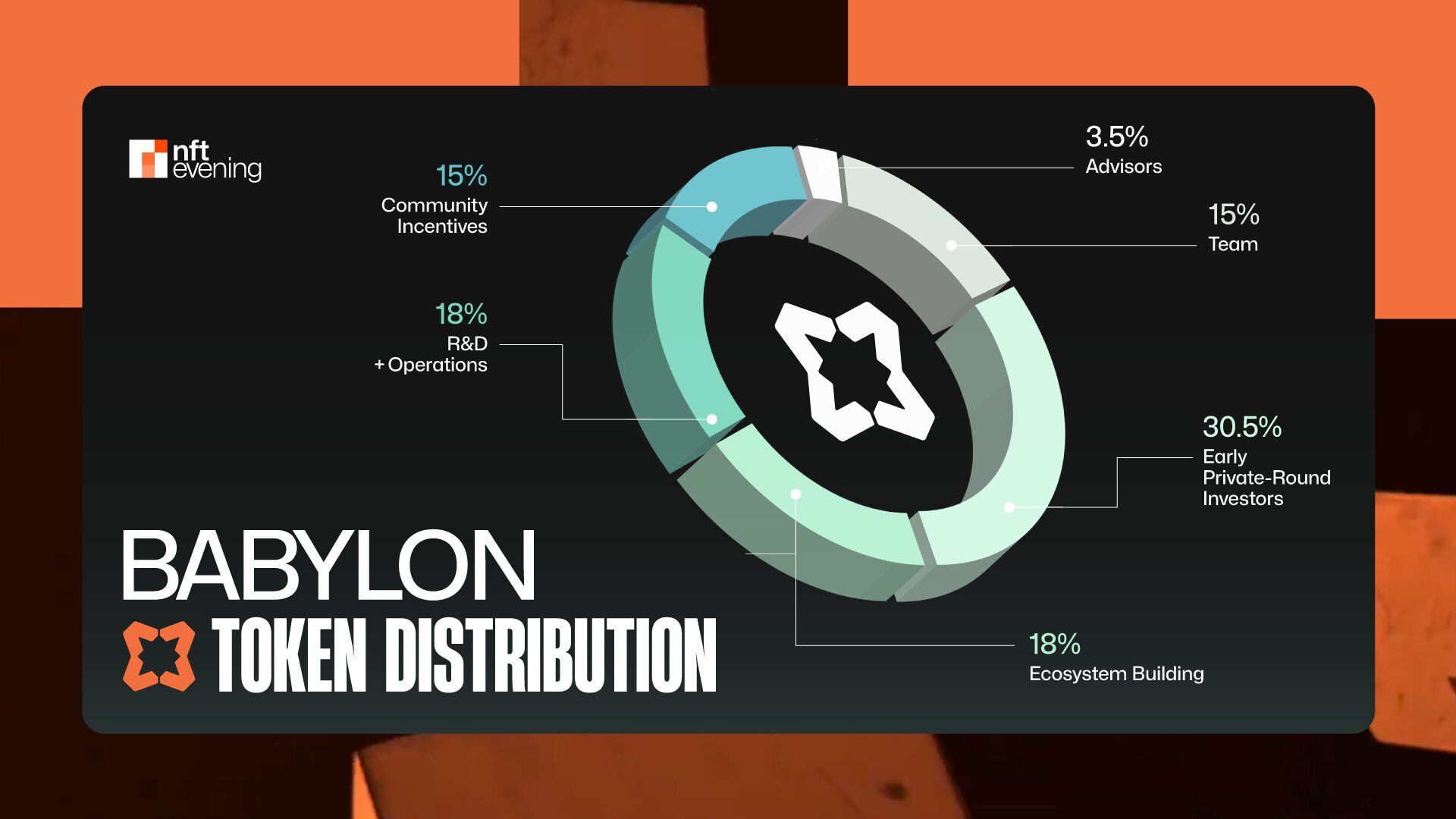

Token allocation

- Early private investors: 30.5%

- Ecosystem Building: 18%

- R&D operations: 18%

- Team: 15%

- Community Incentives: 15%

- Consultant: 3.5%

Babylonian symbolism

The initial recycled supply was 2,294,036,491 tokens (22.9% of the total supply), which is a relatively high percentage that could create sales pressure.

Baby price forecast

Market comparison

Babylon is not alone in releasing the underlying asset value of other blockchain networks. Several other notable infrastructure projects, such as Eigenlayer My ownSolayer layer and Pendle Pendle Also efforts are being made towards similar goals of shared/reusing security and chain linkages.

Babylon is not alone in unlocking the value of underlying assets across the network. Other notable infrastructure projects designed to achieve shared or reusable security and cross-chain connectivity include Eigenlayer, Solayer and Pendle.

Market comparison

Babylon vs. eigenlayer

Eigenlayer uses Ethereum’s massive fixed capital (currently over 7 billion in TVL) as a “shared security layer” for multiple applications, eliminating the need for each application to issue its own staking stricking tokens. Both featurers and Babylon are considered pioneers of “reproduction” and share security movements in their blockchain space.

However, there is a key difference: the feature layer targets Ethereum’s possessive community, while Babylon attracts Bitcoin holders into the Defi ecosystem. Ethereum already has a rich landscape of bias and application that can be naturally integrated and restored. By contrast, Babylon opened up a new market for Bitcoin, but independent POS chains must be convinced to join its network.

Babylon currently tows Eigenlayer in TVL, with BTC of $4.4 billion on Eigenlayer, while ETH is equivalent to $4.4 billion. Nevertheless, Babylon still has significant growth potential due to the huge unexplored liquidity of Bitcoin.

Babylon vs Solayer

Solayer represents a new direction in modular security spaces, providing Appchains with a “modular security layer”. The project launched its layer token through Binance Launchpool in March 2025, and shortly after it went public, the token peaked at around $1.15, and was then corrected to the current range of 0.42 to 0.45 USD.

Solayer currently has 1 billion tokens and initially revolving supply of more than 220 million tokens, currently holding a revolving market capitalization of about $370 million, while its FDV hovers around $150-1.7 billion. Although this valuation is not very high compared to other infrastructure projects, it reflects market caution with modular security narratives through possession.

Babylon vs pendle

On the other hand, Pendle does not focus on security, but gains prominence in the yield optimization segment. This is the direction Babylon has the potential to expand in the long run – once a large amount of BTC is placed through Babylon, derivatives based on BTC production can see meaningful growth.

As for tokens, Pendle has seen huge growth, rising from $0.10 in 2023 to a peak of more than $7.50 in April 2025, with the current limit on the cycle market exceeding $1.1 billion. Pendle is considered a major example of a new generation of DEFI protocols, where capital efficiency is the core value proposition.

Babylon has raised $70 million from the paradigm, and investors from Polychain, Binance Labs, Galaxy, Galaxy, Framework and Hashkey have raised a total of $88 million in multiple seed and strategic rounds. If 30.5% of the token is allocated to investors, the implicit fundraising valuation shows that the private turn price per baby is about $0.028.

Babylon has over $4 billion in TVL (57,000 BTC), which has actually surpassed Solayer and Pendle.

Babylonian price forecast

Therefore, when included in the binary, users are expected to have multiples of 3-5 times on private circular pricing, converting to FDV between $840 million and $1.4 billion. At public prices $0.084 and $0.14Compared to top infrastructure projects such as Eigenlayer, Lido and Solayer, Babylon’s circular market capitalization is still within reasonable limits.

Babylon may also follow the same path as many highly anticipated infrastructure projects that have dropped sharply after they go public. Even the flagship store that is considered a remake of the narrative has fallen by 85% from its all-time high.

Featured Price – Source: Coingecko

However, another result is still completely reasonable: babies can get strong momentum immediately after TGE, especially if Babylon chooses to list it with a FDV similar to Solayer and price exploration.

Price of the tier – Source: Coingecko

in conclusion

Babylon has implemented non-habitual BTC piles, positioning Bitcoin as modular security for POS chains. With over 57,000 BTC (TVL $4.2B), it has surpassed its peers like Solayer and Pendle.

Baby’s $0.084 – $0.14 USD The range shows strong upside potential, but short-term risks remain. Babylon must quickly prove its utilities to avoid selling off and secure the long-term value of this cycle.

Read more: Binance introduces Babylon (Baby) in Hodler Airdrops Program