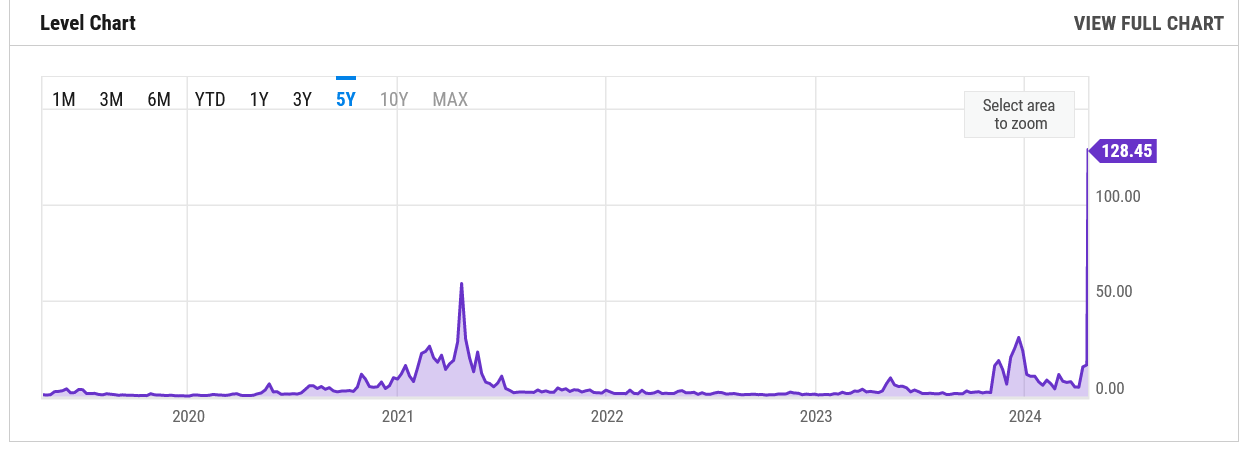

On April 20, Bitcoin’s block fees experienced an unprecedented spike, reaching an astounding average of $128. This surge coincides with the fourth Bitcoin halving event, compensating for the reduction in block subsidies faced by miners. Just one day later, on April 21, the average fee for medium-priority Bitcoin transactions dropped significantly to $8-10, a significant decrease from the previous day’s all-time high.

Average daily transaction fees for Bitcoin over the past 5 years. Source: Y Chart

Average daily transaction fees for Bitcoin over the past 5 years. Source: Y Chart

Record-breaking fee income

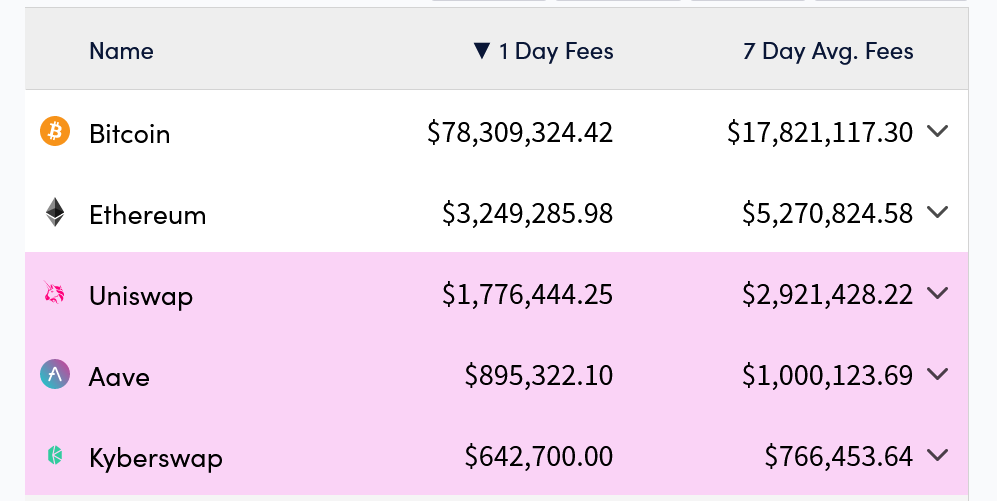

According to the Crypto Fees report, on the day of the halving, Bitcoin’s total fees reached $78.3 million, more than 24 times more than Ethereum. Notably, a single block with a height of 840,000 rewarded miners a staggering 37.7 Bitcoins, equivalent to $2.4 million, making it a historic moment for the network.

Block 840,000 witnessed huge demand, driven by memecoin and non-fungible token (NFT) enthusiasts who raced to acquire rare satoshis using the Runes protocol. This resulted in 3,050 transactions being included in the block, with users paying an average of nearly $800 per transaction.

April 20 The largest fees incurred by blockchain and decentralized finance initiatives.

as in memory pool space.

The impact of halving on miners

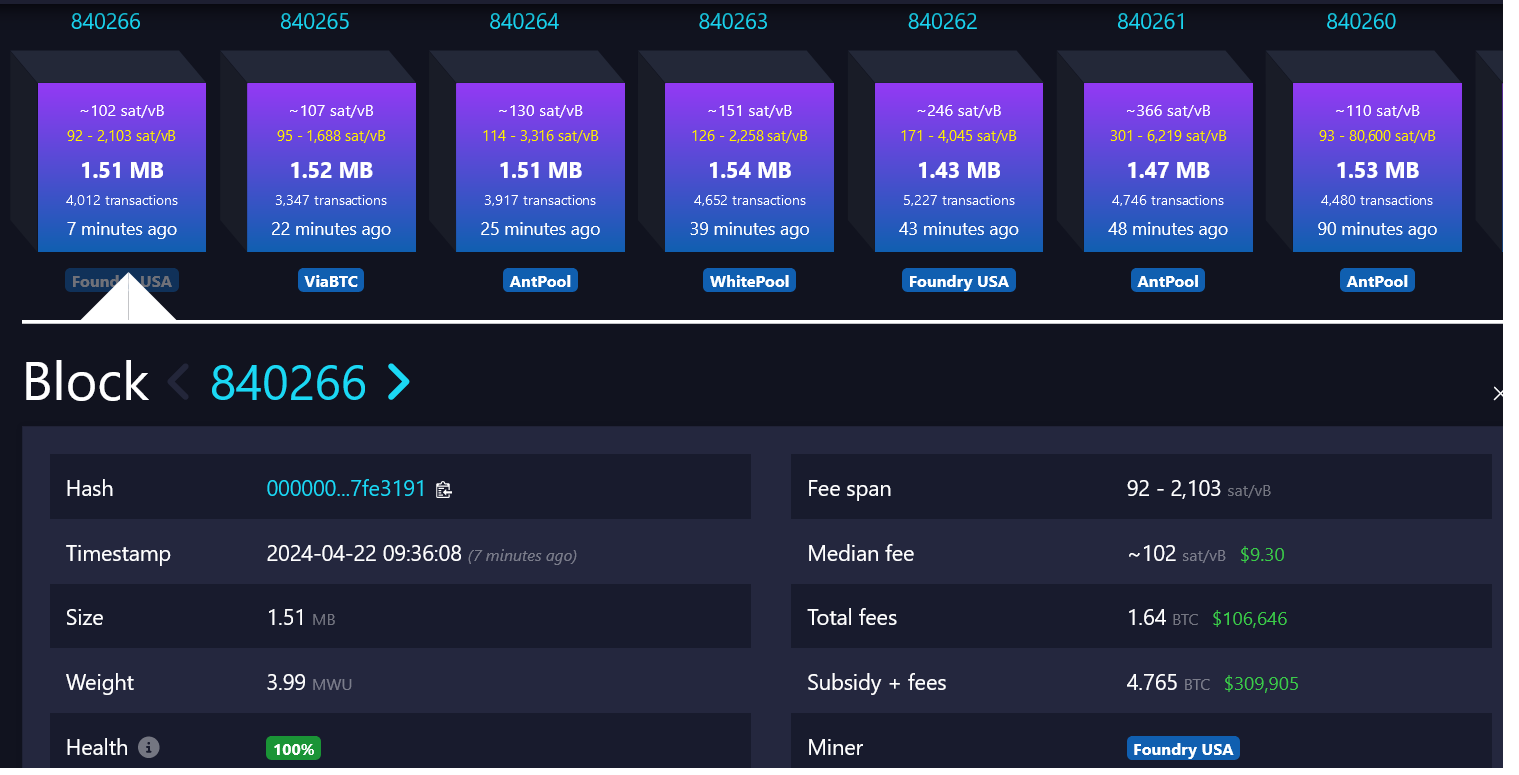

Initially protected by large block fee payments, miners were somewhat protected from the block subsidy halving from 6.25 BTC to 3.125 BTC. However, miners are feeling the impact more strongly as the average block fee is now below 3.125 BTC.

Source: Block 840,266 has a total fee of 1.64 BTC. The new block subsidy is 3.125 and the total reward is 4.76 BTC. Source: mempool.space

As of April 20, Bitcoin’s fee revenue has exceeded Ethereum for six consecutive days, with a seven-day average fee of $17.8 million, highlighting its dominance in this regard.

Despite these events, the Bitcoin halving did not result in any real movement in the price of the cryptocurrency. According to data, the value of Bitcoin has remained relatively stable, rising slightly by 1.5% since the halving to reach $64,840. Coin Gecko.

final thoughts

In short, Bitcoin network fee dynamics during the halving demonstrate the resilience and volatility inherent in its decentralization. From record highs to rapid declines, the evolving landscape of Bitcoin fees reflects the intricate interplay between network demand, miner incentives and market forces.