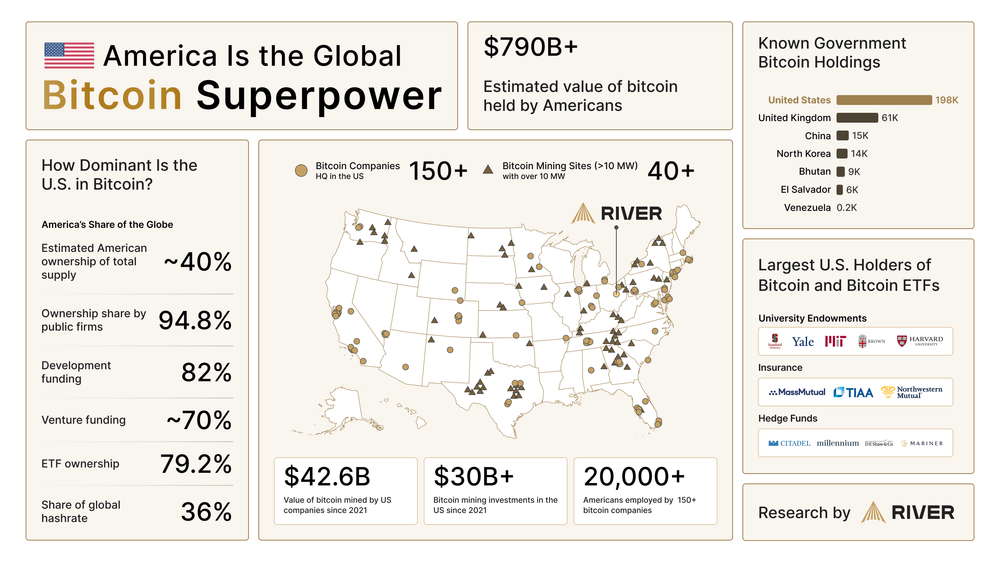

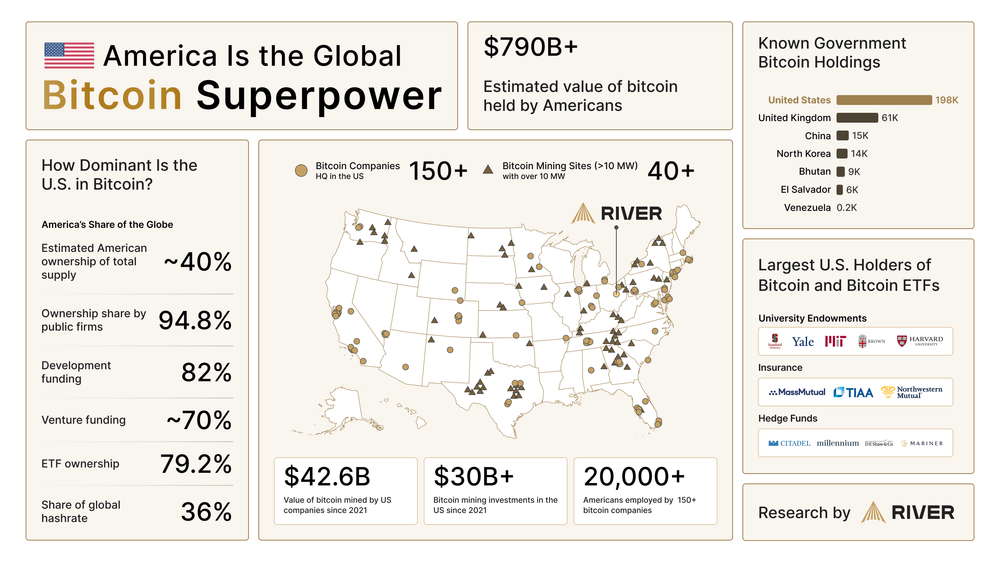

A recent report by River shows that Americans dominate Bitcoin in total supply, mining and investment, highlighting its position as a global leader in the cryptocurrency ecosystem in May 2025.

According to a comprehensive report by River, the United States has consolidated its position as a global leader in the Bitcoin ecosystem. These data highlight the significant U.S. impact in every aspect of Bitcoin, from ownership, mining to venture capital and ETF investment.

Americans dominate Bitcoin ownership, mining and investment

The river’s report It clearly depicts the US’s command role in the Bitcoin ecosystem. About 40% Total supply of Bitcoin, estimated $790 billionowned by Americans, this figure emphasizes a large number of U.S. ownership shares.

Read More: 2025 Crypto Ownership Report: 70% of U.S. adults own cryptocurrency

Source: River

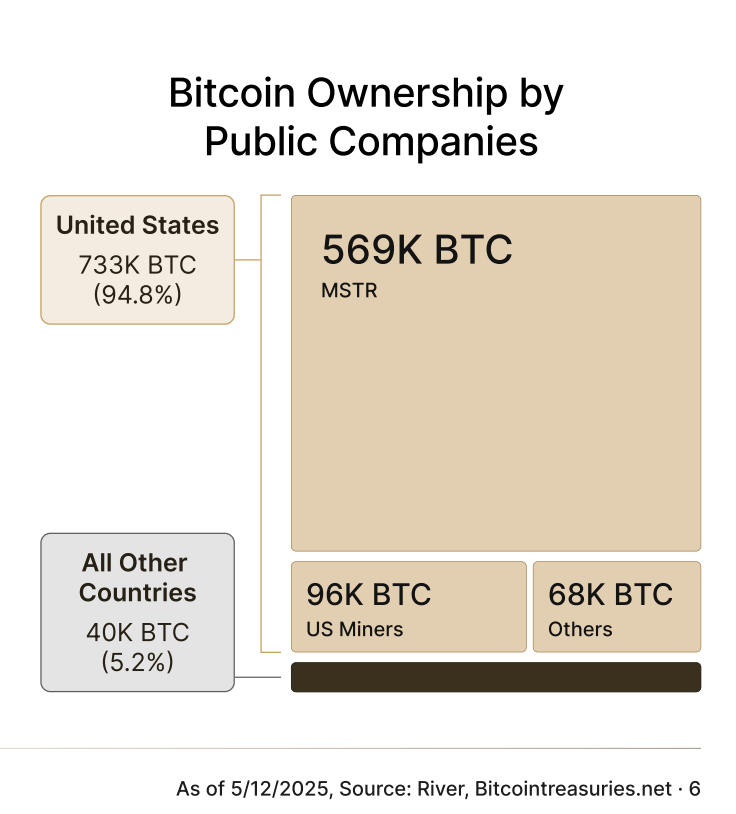

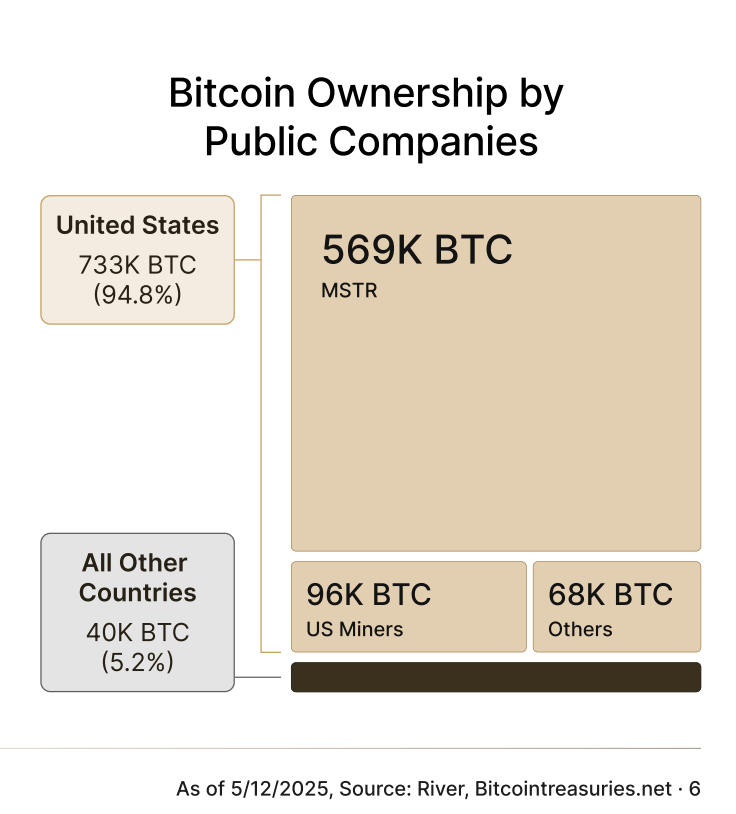

This dominance extends to company holdings, and 94.8% Bitcoin BTC Owned by listed companies worldwide that belong to American companies.

Since 2021, U.S. companies have added $42.6 billion worth of Bitcoin to the treasury, reflecting the growing trend of company adoption. MicroStrategy, for example, has been a pioneer in the field, with over 576,230 BTC.

The United States also leads Bitcoin mining, controls 36% The capacity in the global hash base of more than 40 mining sites exceeds 10 MW. This is a major shift from Hashrate, which is 50% above the dominant position in China in 2021. The rise of U.S. mining capacity coincides with China’s crackdown on crypto mining in 2021, which brings miners to North America.

In addition, the report highlights that more than 150 U.S.-based Bitcoin companies employ more than 20,000 Americans, further cementing the country’s role as a hub for crypto innovation.

and, 79.2% The ownership of the Bitcoin ETF is held by U.S. investors, and major financial institutions such as Blackrock and Fidelity led the allegation. As of May 14, 2025, Bitcoin ETF has reached ATH with inflows of more than $41 billion.

Concerns about the risk of centralization

The overwhelming impact of the U.S. on Bitcoin is a signal of an institution and corporate participation in a mature market that is driving growth. Americans own 40% of ownership suggests that the U.S. has a vested interest in Bitcoin’s success, which could impact regulatory decisions. For example, the Securities and Exchange Commission (SEC) has taken a more favorable stance on Bitcoin ETFs since 2024, a shift that coincides with the growing economic interests of U.S. investors.

However, this concentration of ownership has also raised concerns about the centralization of decentralized ecosystems, as a small number of U.S. entities can have a significant impact on Bitcoin’s market dynamics.

The dominance of mining and corporate adoption highlights the United States’ strategic positioning in the Bitcoin economy. 36% of the global hashing base in the United States plays a key role in securing the Bitcoin network, but this also links Bitcoin’s energy consumption to U.S. infrastructure, causing environmental problems.

In terms of investment, 70% of venture capital and 82% of development funds indicate that the United States is shaping the technological development of Bitcoin and may prioritize innovations that are aligned with U.S. financial interests such as ETF products and custodial solutions.