AAVE TVL hit a record $40.3 billion, indicating that the strength of Ethereum’s Defi ecosystem is institutional and retail interest, driving unprecedented growth in 2025.

A new week, a new all-time highest.

$40.3 billion net deposit 👻

The highest TVL ever was achieved through the DEFI protocol. pic.twitter.com/xbrnruemqz

-Aave(@aave) May 12, 2025

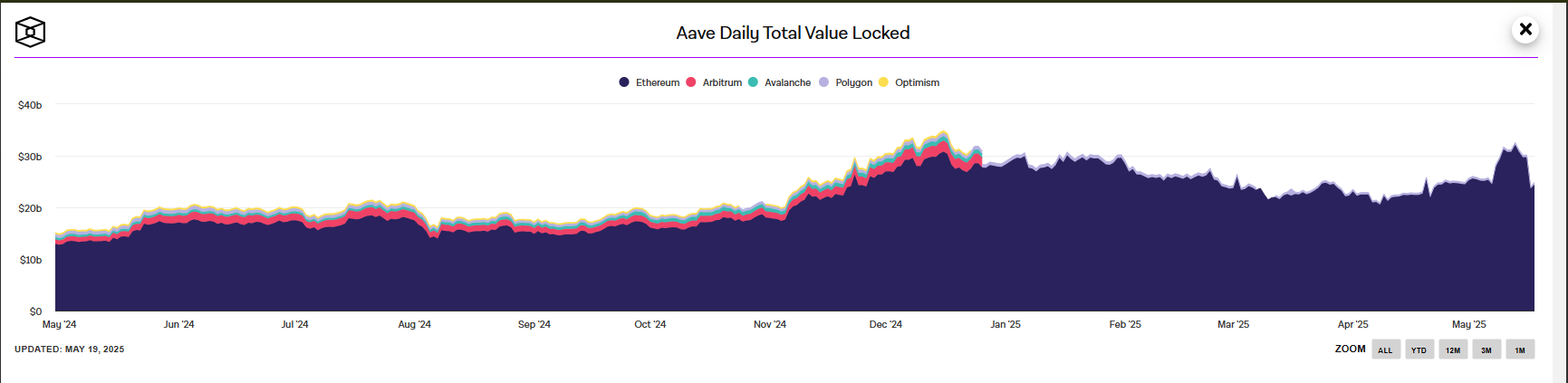

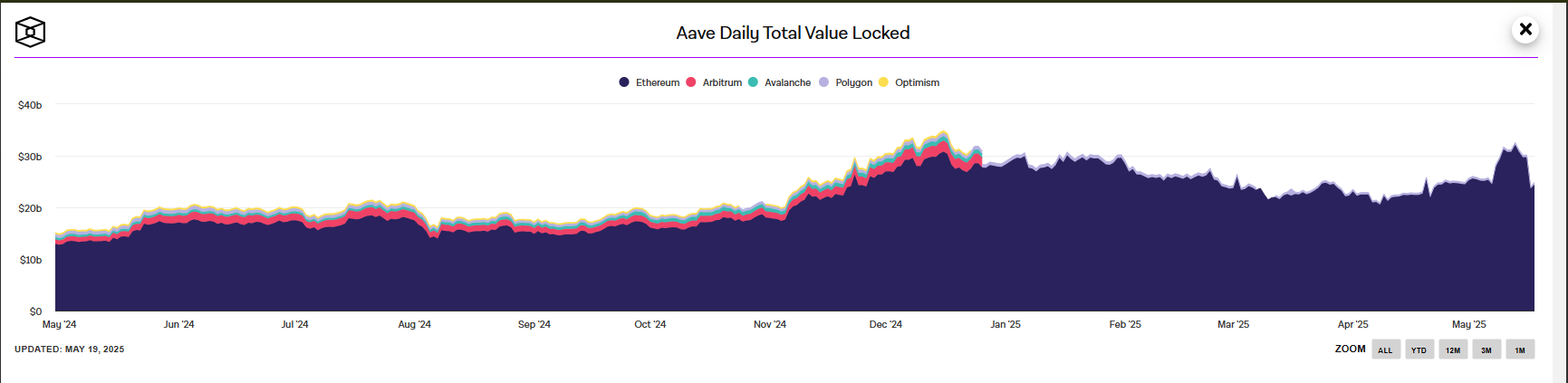

AAVE TVL doubles in 2025

ghostAs of May 12, 2025, Ethereum’s leading decentralized financing (DEFI) loan agreement has reached a historic total value lock-in (TVL) of $40.3 billion, a 50% increase from its $20 billion annual total 50%.

Source: Block

This milestone positioned it as TVL’s top protocol, surpassing competitors such as Lido Dao, which holds $33.8 billion. This surge reflects growing confidence in the Ethereum ecosystem, which is due to improved market conditions, with Ethereum prices ranging from $1,500 to $2,500 in the past month. Aave’s outstanding debt has risen to $10 billion, maintaining a healthy 33% debt-to-TVL ratio, indicating strong utilization and liquidity.

learn more: Aave vs Jupiter: Solana War of Ethereum and Defi divisions

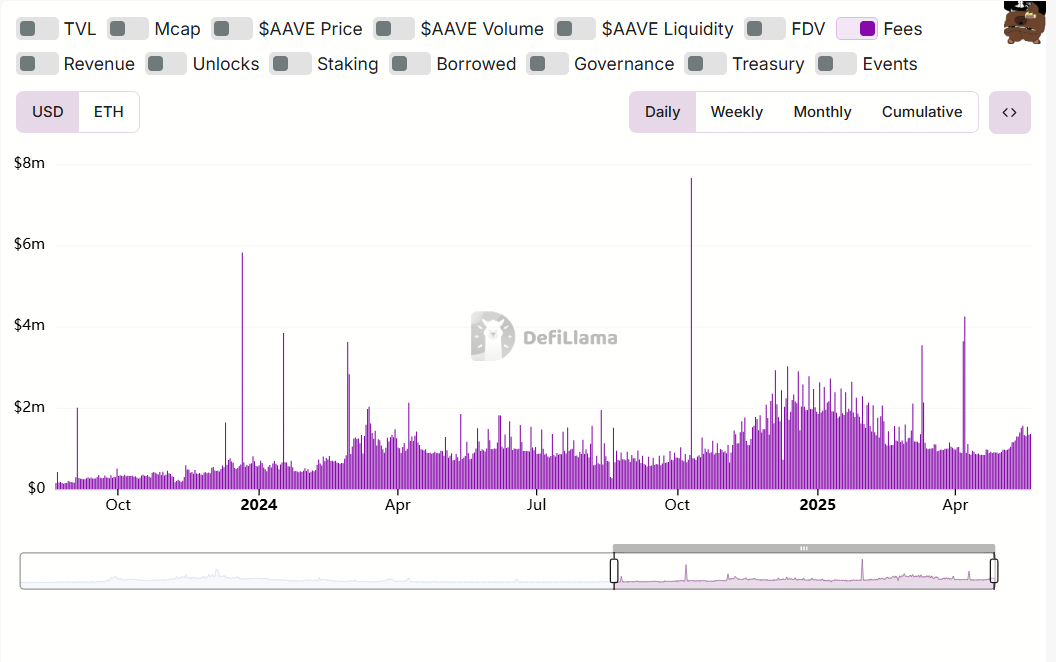

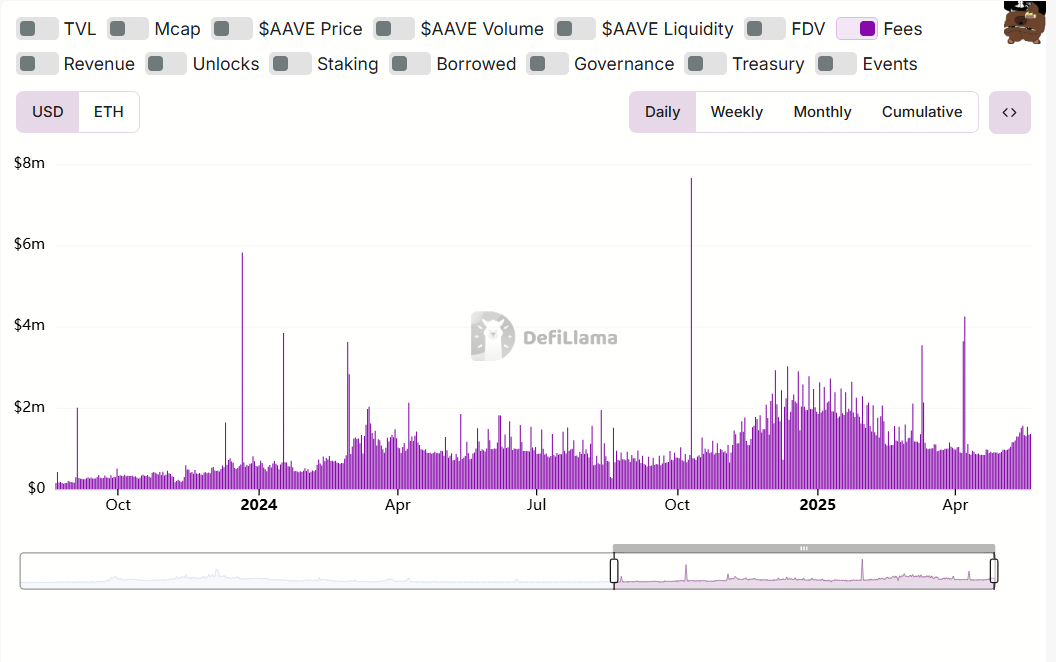

Aave’s daily expenses have reached $1 million, and its lending market across Ethereum and Tier 2 solutions such as arbitration and optimism have attracted $500 million in collateral in a week. Chainlink’s SVR integration covers 27% of AAVE’s TVL, enhancing security and scalability, further promoting investor trust.

Source: Defillama

Despite competition, Ethereum’s defense still exists

Ethereum eth Still the backbone of Defi, despite fierce competition from Solana and L2 solutions such as arbitration and optimism, the station has $77.15 billion, accounting for 51.24% of the industry’s total.

Aave’s 19.63% share of DeFi TVL is backed by its strong ecosystem, including nearly 5,000 DAPPs including Uniswap and Makerdao, as well as more than 290 million active addresses.

Solana’s Defi ecosystem features projects such as Raydium and Jupiter, which is good at high-frequency trading Membership surgein Raydium’s TVL alone, there are over 400 Defi and NFT projects as well as $1.8 billion.

Solana’s Proof of History (POH) and low-cost transactions ($0.00025 per transaction) attracts developers’ scalability DAPP, especially among games and members, but its 2,000 validators propose concentrations compared to Ethereum’s 800,000+.

L2 solutions, such as arbitration, have $8 billion in Stablecoin volume, and optimism shifts some liquidity by providing faster and cheaper transactions to challenge Ethereum’s mainnet. Nevertheless, Ethereum’s first step advantage, a mature developer community and Pectra upgrade ensures its bias, while AAVE’s cross-chain strategy refutes Solana’s speed advantage.

Despite these barriers, AAVE’s innovative features such as allowed RWA collateral and GHO Stablecoin, Bridge Traditional Finance and Defi have attracted institutional interest.