An administrator account leveraged 111 million ZK tokens, resulting in a massive $5 million hack, awakening the crypto community this week. Although ZKSYNC guarantees users that their funds are safe, the incident has rekindled concerns about the security and reliability of the platform.

How does Zksync lose $5 million?

The violations quickly became devastating. ZKSYNC’s security team revealed that administrator accounts related to three Airdrop issuance contracts were damaged. The address 0x842822C797049269A3C29464221995C56DA55587D is considered an attacker and loaned the SweepunClaimed() function to 111 million ZK Sokens -worth -$5 million – to get $5 million from the airport reserves.

Source: X

Although isolated from the airdrop contract, the incident increased the supply of tokens by 0.45%, causing a 15-20% drop in price ZK Within a few hours. While core protocols and user funds remain unaffected, the attackers still hold most of the stolen funds, prompting ZKSYNC to coordinate recovery efforts with security alliances and exchanges.

Source: TradingView

However, the community does not buy a narrative of “isolated incidents”, and many question the platform’s security practices and transparency.

“The Most Funded Tier 2” Title: Does ZKSYNC’s performance match the hype?

ZKSYNC: Theoretical Tier 2 Giant

ZKSYNC actively leads Ethereum’s Layer 2 ecosystem, leveraging zero-knowledge aggregation to deliver low-cost, high-speed transactions while adopting Ethereum’s robust security. Since its inception, Zksync has attracted a lot of money and positioned itself as the preferred solution for Defi platforms, NFT markets and more. Its commitment to scalability and interoperability has made it a darling for investors, and millions of dollars have poured into its development. But recent events cast a shadow on its reputation, raising the question: Has Zksync lived up to its “most funded tier 2” title?

Airdrop Fall: Community Bounces and Broken Trust

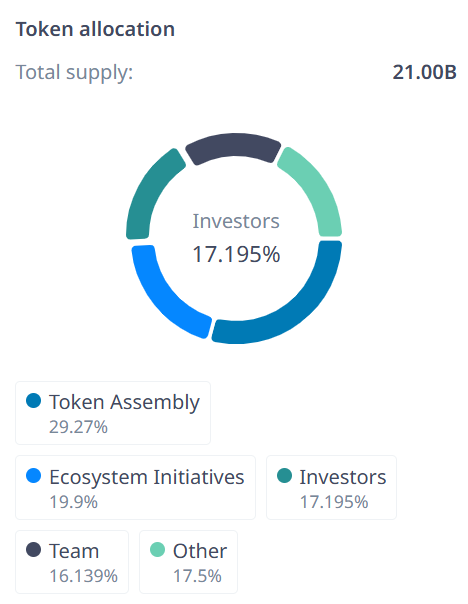

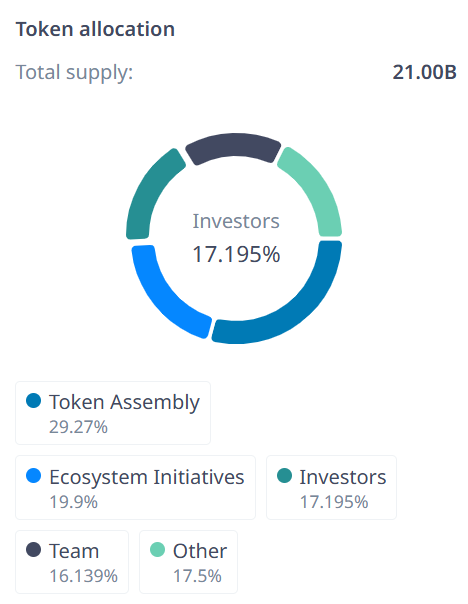

Zksync’s trouble didn’t start with this hack. The project’s token air conditioner was launched in June 2024 and faces fierce criticism for its “unfair” distribution. Of the 21 billion token supply, only 17.5% were allocated to early users, while 33.3% were donated to teams and investors.

ZKSYNC Tokenomics – Source: Cryptorank

Community members expect a fairer share, accusing Zksync of favoring insiders. In addition, others complained about Zksync’s fuzzy conditions for eligible air flow, while its quantity and transaction history meet the criteria. The lack of anti- and escort filtering methods allows “farmers” to play the system, further exacerbating anger. Projects such as Zkapes and Element NFT even formed alliances that required better token allocations, but Zksync’s inadequate responses made many users disillusioned before the latest hacks.

ZKSYNC’s performance: TVL and token price for free fall

The consequences of the hacking have worsened the performance of Zksync. According to Defilama, Zksync’s total value lock-in (TVL) fell to $128 million after the 2024 Airdrop controversy, down from its July 2023 peak of $19.655 million.

Source: Defillama

Recently, Zksync canceled its IGNITE program, which greatly reduced the potential and motivation of ZKSYNC developers. Recent hacking has exacerbated the decline, as users collect funds for fear of further vulnerability. ZK tokens didn’t perform much better – after the violation, its price fell 15-20%, down to $0.040, and then slightly recovered to $0.047. Compared to competitors like Polyhedra, which now has twice the full dilution of ZKSYNC valuation (FDV), the market advantage of ZKSYNC is weakening.

Once a prominent player in the 2nd floor space, ZKSYNC is now facing the challenging task of regaining trust and stabilizing its ecosystem.

Read more: ZKSYNC Cancel IGNITE Program

Final Thought: Can Zksync rebound?

This week begins with a series of cryptic cracks, from spell carpet pull and Kiloex Vault attacks to Zksync Hack. It’s a clear reminder that even the most popular items in the cryptocurrency world.

Zksync’s inability to secure its management keys, coupled with ongoing community dissatisfaction, brings a disturbing picture to its future. The damage to its reputation can be difficult to fix when a team is taking steps to recover stolen funds and enhance security. For now, the title of Zksync’s “Most Funded Level 2” is more like a hollow crown than a sign of honor. Will it rise from the ashes or become another warning story in the tumultuous world of the crypto world? Only time will prove it.