On May 19, 2025, Bitcoin soared to $107,000 before falling to $103,000 in a $620 million market liquidation, while CryptoWhale opened a high leverage position indicating that Bitcoin would undermine Bitcoin despite volatility.

BTC, ETH, XRP experiences sharp volatility, and the market sees $620 million in liquidation

Multiple catalysts have driven Bitcoin’s climb to $107,000. Optimism about the prospects of the U.S.-China trade deal and former President Trump’s pro-Cretto position, including potential Bitcoin reserves. BTC’s Relative Strength Index (RSI) hit 73.51, and the signal exceeded the conditions, but it was strongly bullish.

However, with the attention of the macro economy, the rally stagnated. Moody’s downgrades U.S. credit rating to AA1The invocation of $36 trillion in Treasury bonds has triggered risk-taking sentiment throughout the market.

The profit that follows, after Bitcoin BTC Prices soared to $107,000, and prices fell to $103K, finding support from $102,000 to $104K.

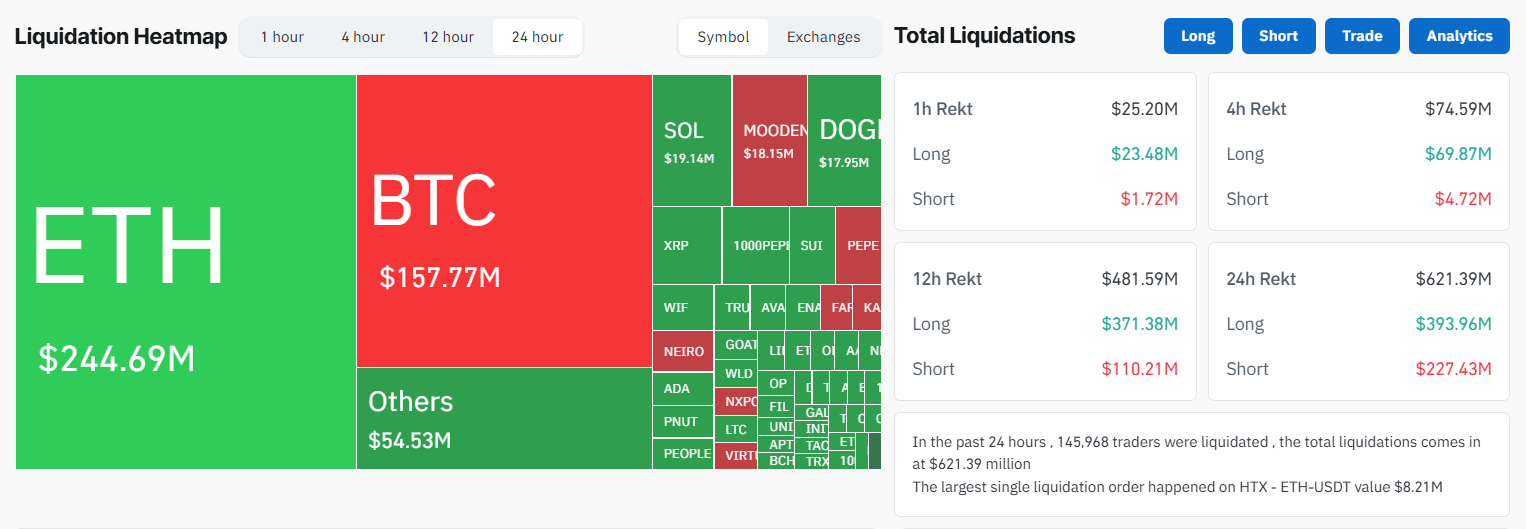

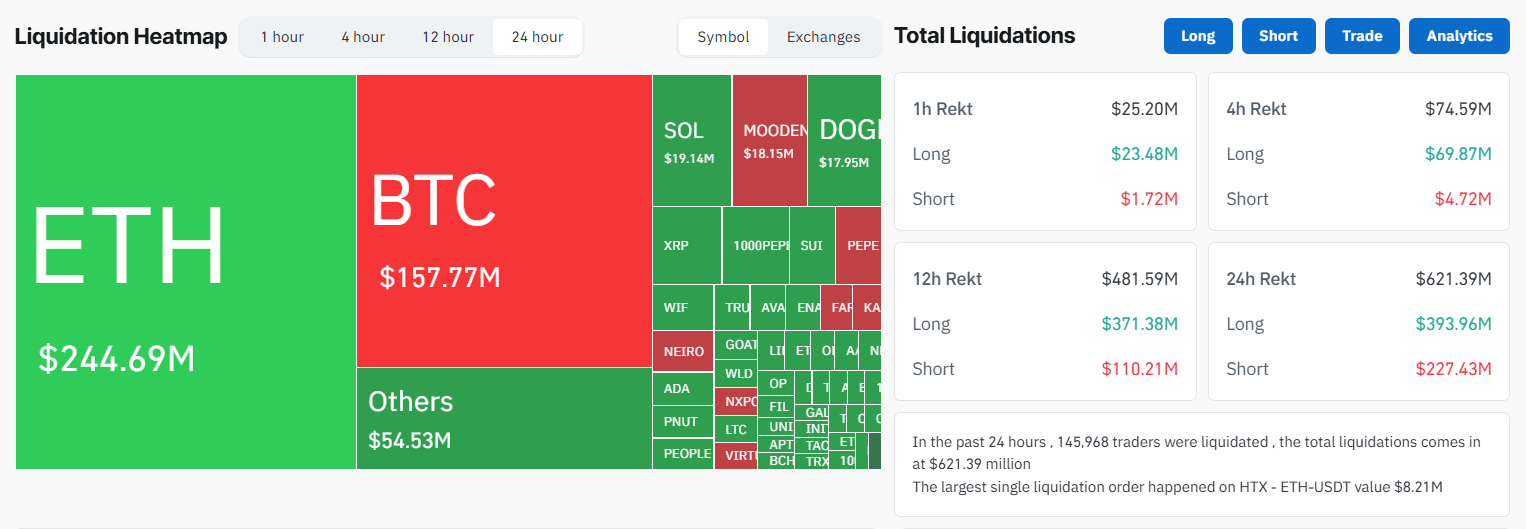

Clearing data from Coinglass shows that the total liquidation amount in the entire market is US$620 million, and in the market, the longer positions reach US$390 million. The pullback described by analysts as “correction in a broader uptrend” reflects the market’s sensitivity to global economic signals.

Source: Xiaodian

Altcoins follows Bitcoin’s lead, demonstrating high volatility. Ethereum eth It rose to $2,600 before it fell to $2,390, down 4% in 24 hours, driven by whales’ accumulation but corrected in a liquidation of $245 million.

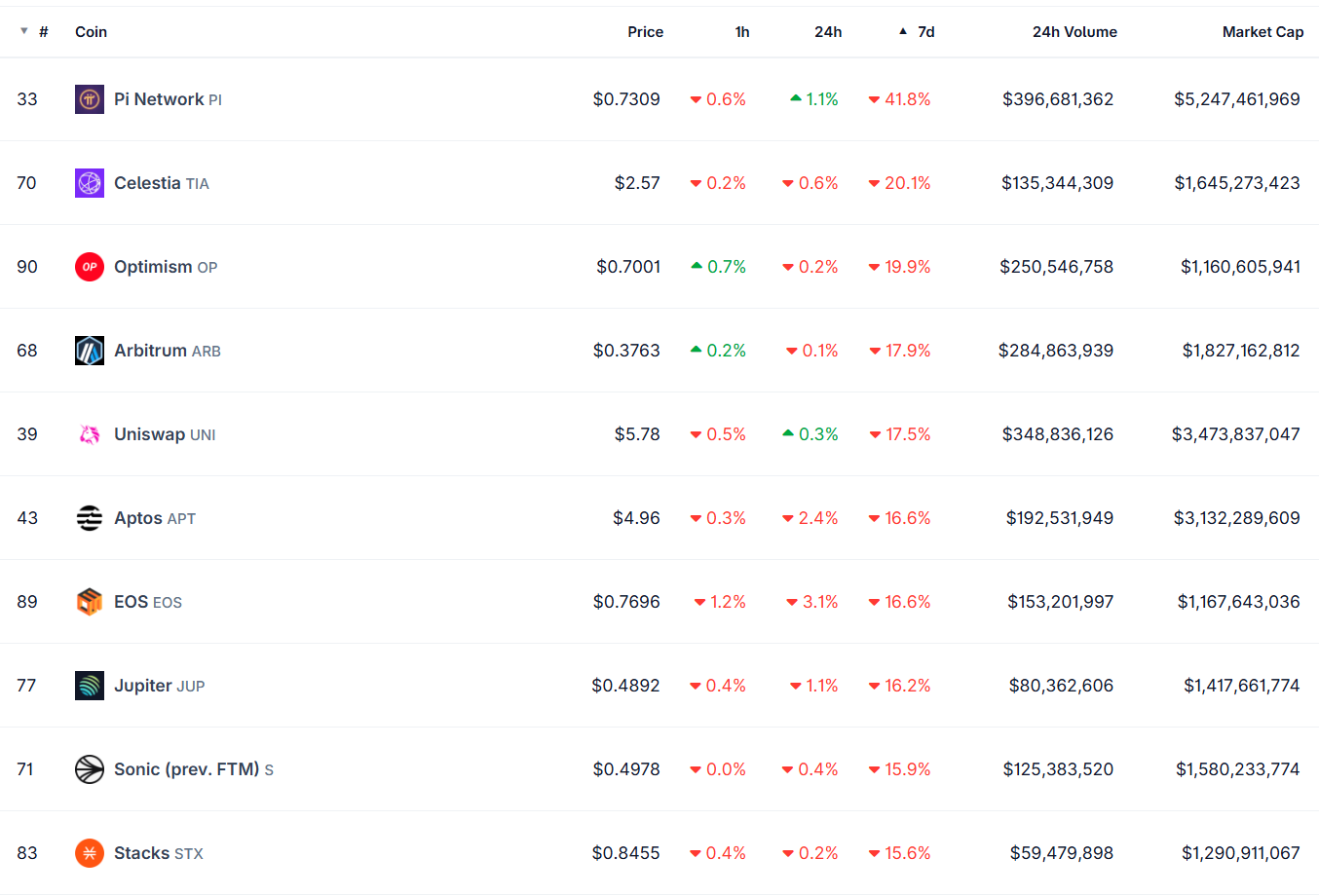

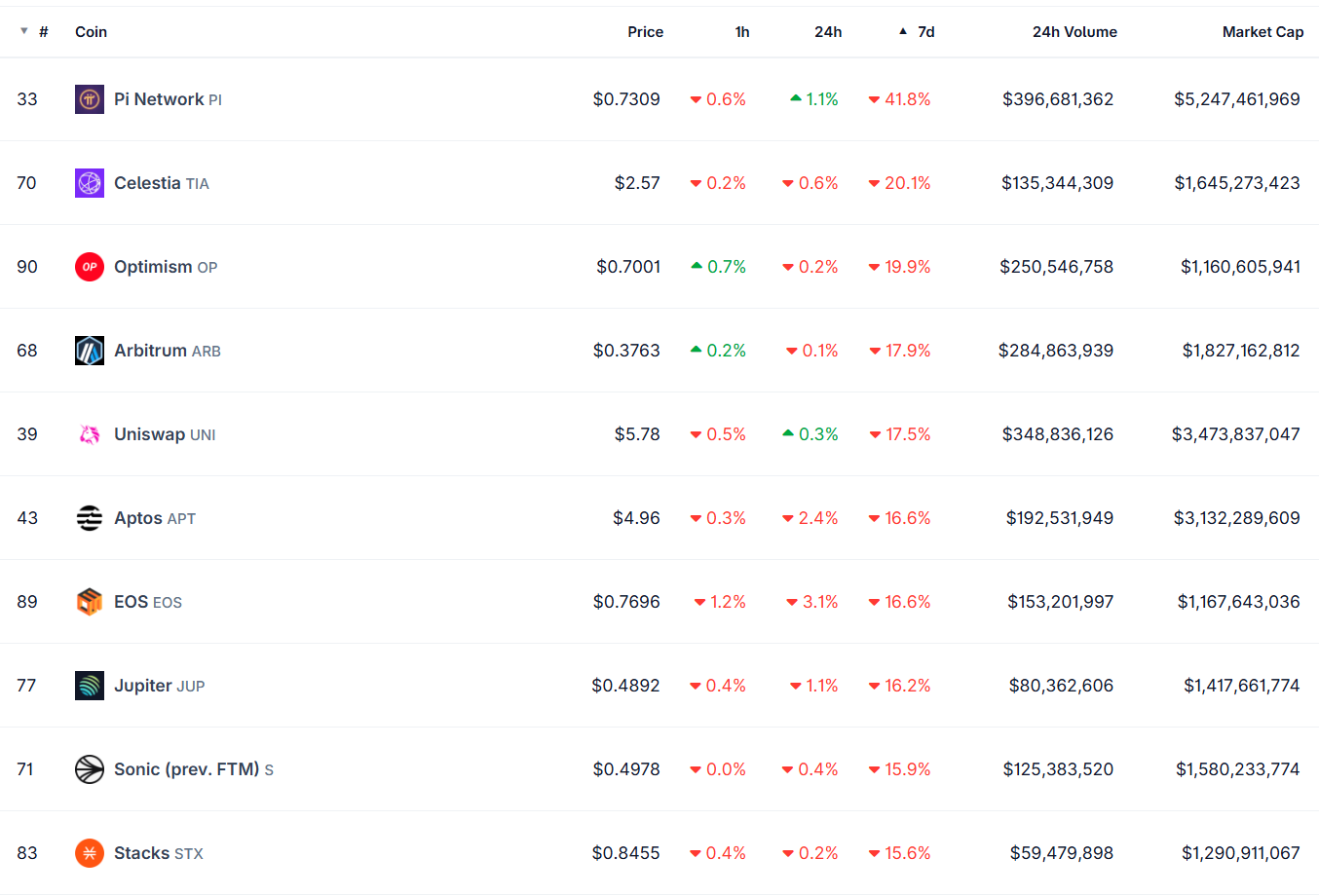

Solana sol XRP faces a steep decline, with Sol down 1% to around $165 XRP In profit-taking situation, it fell 2%. Meme coins (such as Dogecoin (Doge)) remained stable at $0.22, while others like PI have crashed 42% in the past 7 days.

Source: Coingecko

Analysts remain optimistic, forecast Bitcoin to hit $2 million

The cryptocurrency market experienced significant turmoil on May 19, 2025, with total capitalization falling 2.5% to $3.38 trillion, driven by low trade volumes, which expanded the economic uncertainty of large transactions and U.S.-China trade tensions.

Despite the strong volatility of the market, experts are still very optimistic about the future of Bitcoin.

Read more: Super liquidity claim advantage, will surpass 1 Bellaya

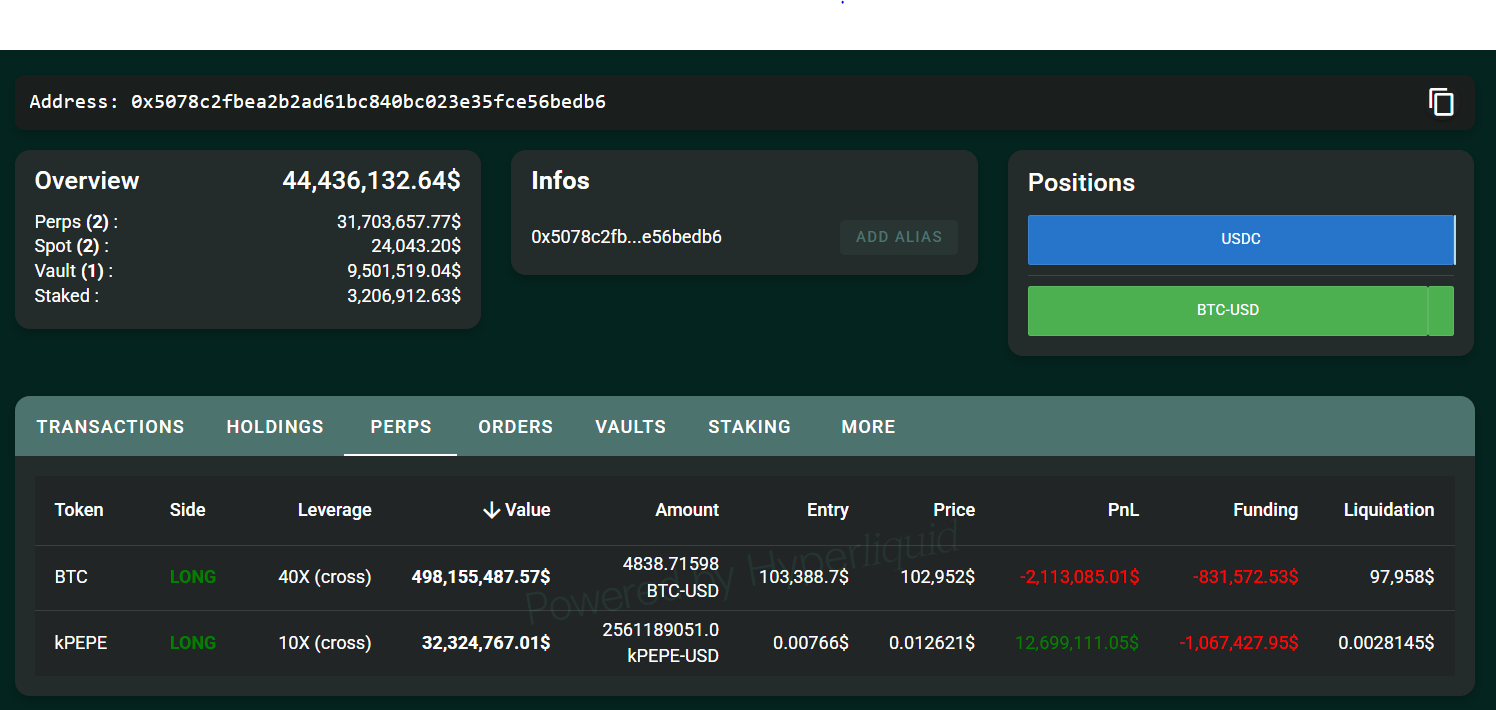

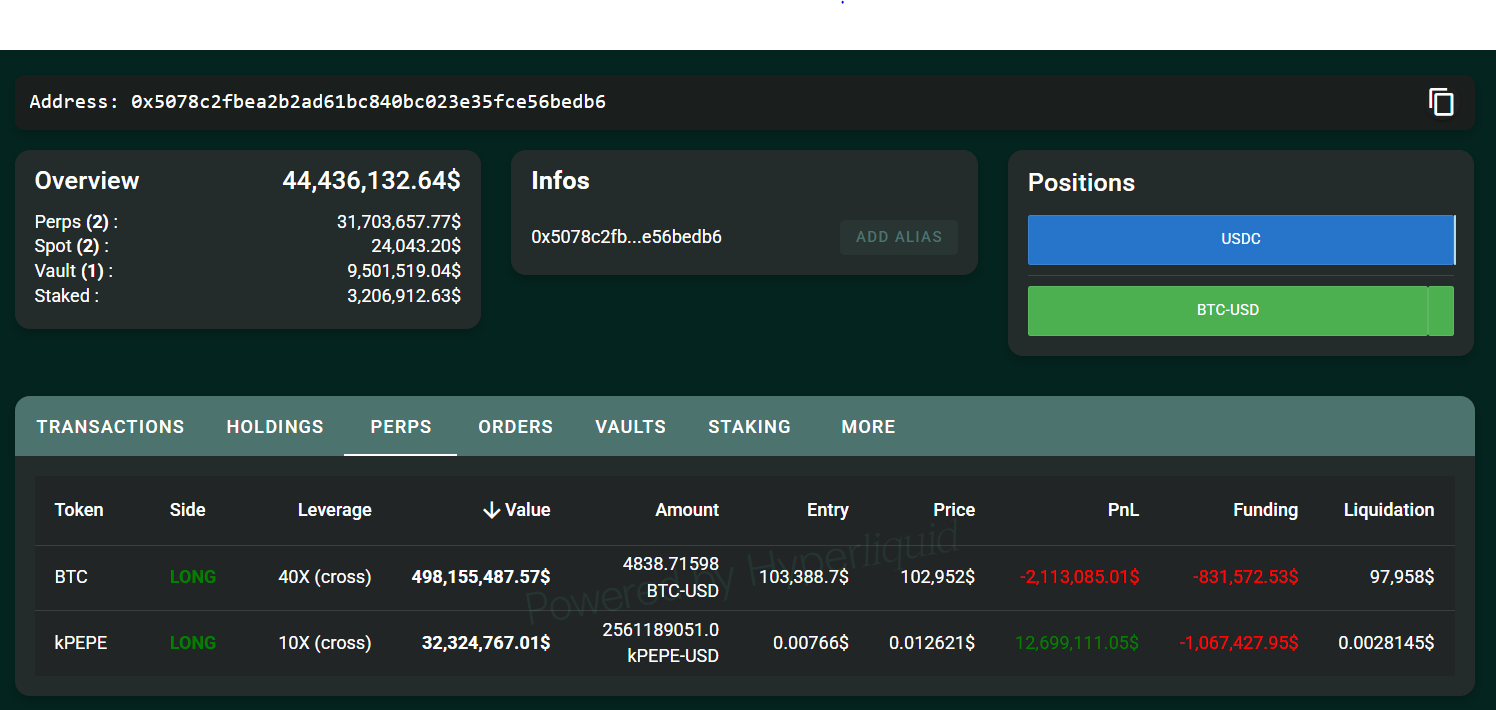

On May 19, 2025, the analysis highlighted the huge leverage position that whales take on Bitcoin. A whale opened 40X lever Long position BTC-USD is worth $488 million, with $103,389 input. The entry close to $104,000 is “very high”, which shows that Bitcoin’s bold bets break its all-time high.

The move suggests that whales may be finding market signals such as potential institutional inflows or regulatory shifts, which give them confidence in taking this high leverage risk. Their positive positioning can foreshadow excellent price changes as whales often play an insight that retailers cannot get.

Source: Super Mobile

Additionally, Bitmex founder Arthur Hayes offers bullish outlook in the latest Fortune Cryptocurrency interview, predicting Bitcoin will reach $200,000, boosted by U.S. Treasury spending, while also using gold as a hedge.

Read more: Bitcoin to $150,000: Mike Novogratz’s bold predictions

He also stressed the undervaluation of Ethereum, believing that its current “hapless” position in the market has brought buying opportunities, especially as ETH’s institutional interests grow.

Hayes’s view fits with his broader strategy of holding gold as a strategy to hedge inflation, while advocating a “Degen” approach to investing in strong fundamentals such as Desci tokens to capitalize on the next wave of growth in the market.