The landscape of digital assets is constantly developing, and stable bacteria are the basic pillar of the Web3 economy. The Stablecoin ecosystem is not a holistic entity, but is becoming more focused, resulting in two distinct but interconnected categories: payment stable stocks and load-bearing stable stablecoins.

This comprehensive analysis will delve into the complexity of each analysis, exploring its mechanisms, market impacts, advantages, risks and its collective role in shaping the future of global finance.

Pay Stablecoins: Digital Cash for the Internet

Payment stablecoins are designed mainly as stable medium of exchange. Their core utility is to promote seamless, low-cost and near-inherent transactions across various blockchain networks. They aim to replicate the stability of fiat currencies (most commonly the US dollar) in a decentralized digital format to avoid the inherent volatility of traditional cryptocurrencies such as Bitcoin or Ethereum.

For more information: The Rise of Stablecoins: Market Updates and Key Statistics for 2025

How payment stablecoins work:

The vast majority of payment stablecoins are supported by Fiat. This means that for each digital token issued, the issuer holds the same amount of fiat currency (or high-risk cash equivalents and short-term government bonds, such as cash equivalents and short-term government bonds) in the reserve. This 1:1 support is crucial to maintaining its fixed underlying fiat currency. Regular proof and auditing is essential to ensure the transparency and integrity of these reserves, building trust among users.

Market advantages and influence

The two giants of the world of Stablecoin are Tether (USDT) and Circle (USDC). Together, they account for more than 86% of the total stable market value, and as of early June 2025, their trading strength is undeniable.

- USDT remains the largest market cap division, hovering between $15.3-15.4 billion in June 2025, driven by its widespread liquidity and widespread acceptance in exchanges and emerging markets.

- As of June 5, 2025, USDC’s market value climbed to US$6.105-61.5 billion, and its market value climbed to US$6.105-61.5 billion. Its emphasis on regulatory compliance and transparency has driven its adoption, especially in jurisdictions with a clearer legal framework.

- Unprecedented trading volume: A major milestone occurred in 2024, when the total stable transfer volume reached an astonishing $27.6 trillion. This number exceeds the combined transaction volume of visa and Mastercard. This trend continued until 2025, and the report showed that in the first quarter of 2025, Stablecoin transaction volume narrowly exceeded visa payments. This emphasizes their importance in global commerce and remittances.

- Network Offset: Although Ethereum and TRON are still stable hosts, networks such as other networks (such as Basic, Solana, Arbitration and APTO) are gaining traction due to lower fees and higher throughput.

Source: Payment Association

Advantages of stable payments

- Price stability: Their direct PEG minimizes price volatility, making it suitable for trading, savings and accounting.

- Speed and efficiency: Transactions settle on a blockchain network for minutes (sometimes seconds), in stark contrast to the traditional banking system, which can take several days, especially for cross-border payments.

- Lower cost: Transaction fees are significantly lower than traditional credit card processing fees or international wire transfers.

- Global accessibility: They enable seamless cross-border payments and financial inclusion to transcend traditional banking time and geographical constraints.

- Programmability: As a digital asset, they can be integrated into smart contracts for automated payments, hosting services and other innovative Defi applications.

Risk of stable payments

- Centralized risks: Many are issued by centralized entities that require trust in the issuer’s reserve management and commitment to transparency. Lack of routines, comprehensive reviews can be a problem.

- Regulatory uncertainty: Despite the emergence of frameworks, unforeseen strict regulations or classifications may affect their operations and availability.

- Illegal Financial Risks: The speed of certain stable transactions and pseudo-anonymity pose a challenge to anti-money laundering (AML) and oppose financing of terrorist (CFT) efforts, thus increasing scrutiny.

Stability of load-bearing stability: Productive digital dollar

Load-bearing stabilizers represent the next frontier in the Stablecoin utility. Their purpose is not only to maintain stable value, but also to generate passive income for their holders. They transform static digital assets into dynamic, interest-based tools that bridge the gap between traditional interest-bearing accounts and blockchain efficiency.

How does the stability of load-bearing stability work

The benefits generated by these stablecoins come from a variety of sources, beyond simple Fiat support:

- Defi loans and yield farming: Users deposit stable shares into diversified loan programs (e.g., AAVE, compounds) or participate in yield farming strategies. The interest gained from these activities is then handed over to Stablecoin holders.

- Real-world Assets (RWA) Tokenization: A rapidly expanding model involves backing up a stable model with tagged traditional assets (such as US Treasury bills). The interest generated by these highly liquid, secure financial instruments is then distributed to Stablecoin holders. This provides a convergence of blockchain efficiency and traditional financial yields.

- Derivative-based strategies: Certain protocols, such as Ethena, employ complex strategies involving permanent futures and other derivatives to generate capital rates and market inefficient returns.

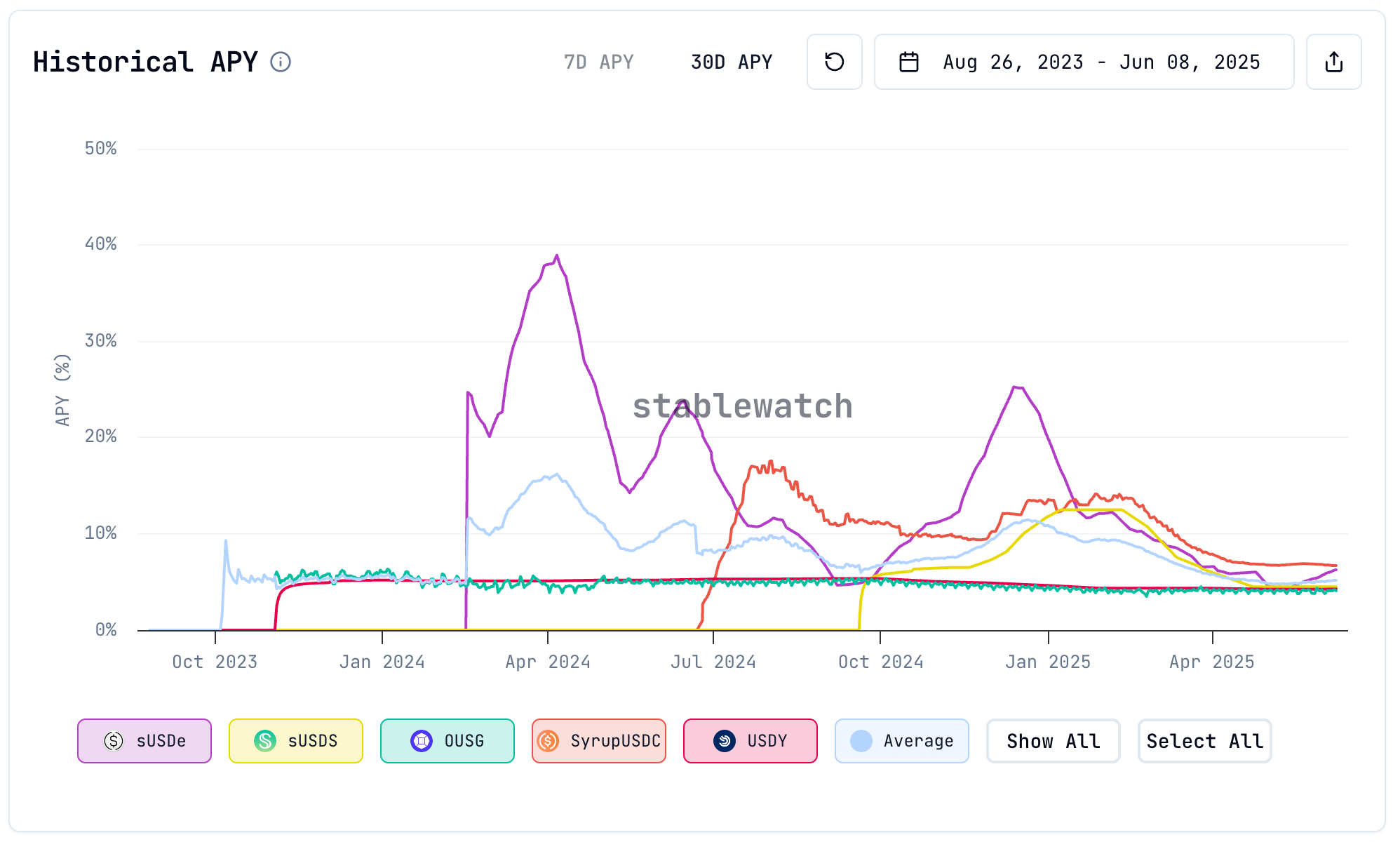

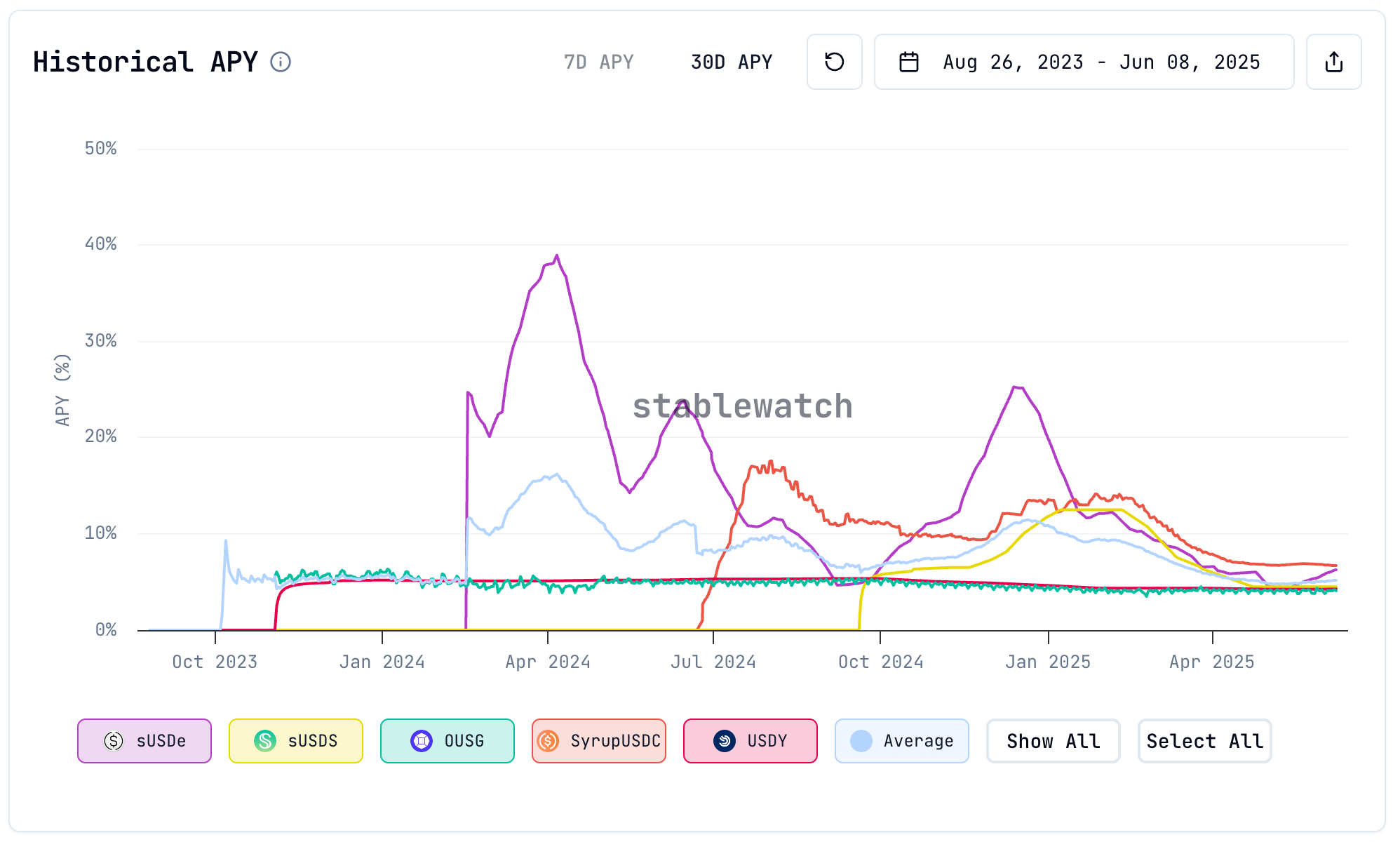

Source: Stability Observation

Explosive growth and market impact

The growth of load-bearing stabilizers is excellent:

- Market cap surges: By May 2025, the market value of stable stocks with stable load-bearing stocks soared to more than $11 billion. This marks a significant increase of $1.5 billion in early 2024.

- Large market share: The segment now accounts for 4.5% of the total stable market, demonstrating its rapid adoption and demand for capital-efficient crypto assets.

- Ethena’s influence: Ethena’s synthetic dollar USDE has been the main catalyst, with its market capitalization reaching approximately $546 to $5.88 billion as of early June 2025. It reflects the potential of innovative output in the Stablecoin field.

- RWA Comes in Growth: The rise of stable load-bearing Stablecoins has directly driven the expansion of the tokenized fiscal bond market, which soared more than 260% in 2025 to more than $23 billion. This highlights the increasing integration of traditional finance and law.

Source: Stability Observation

Advantages of stable load bearing

- Passive Income: They provide a direct way to earn returns on digital assets without active transactions or complex management.

- Capital efficiency: Users can earn yield while retaining stable assets, thereby improving capital utilization.

- Inflation hedging (indirectly): By earning interest, users can offset the erosion effect of inflation on digital dollar holdings.

- Bridge Tradfi & defi: RWAS allows users to access traditional financial yields through the transparency and efficiency of the blockchain.

Risk of load-bearing stability

- Smart contract risk: Relying on the basis of DEFI protocols puts them in code vulnerabilities, which can lead to loss of funds.

- Opponent Risk: Especially for more complex or concentrated returns strategies, the solvency and integrity of the underlying entity are crucial.

- Risk of delving: Although for RWA-supported variants, some models, especially those with algorithms or derivatives, face higher risks, i.e. the risk of losing their 1:1 PEG.

- Yield fluctuations and sustainability: Yields are not always fixed and may fluctuate. High yields may indicate higher potential risks or unsustainable models.

- Regulatory Review: Many load-bearing stability may be classified as securities, leaving them under stricter regulatory oversight, which may affect their availability or operational model.

Stablecoins’ Interaction and Future

While having a unique load-bearing and payment stabilizer, it is essentially linked. Payment stablecoins are often used as underlying assets deposited in agreements to become surrender. The continued growth and specialization of both categories demonstrate a mature digital financial system.

Regulatory Environment (June 2025): The global regulatory landscape is rapidly adapting to the rise of stable proteins:

- The EU’s Mica: The EU’s market in the EU’s crypto resources (MICA) framework is fully applicable to StableCoins (asset referenced tokens and electronic currency tokens) on June 30, 2024. This gives issuers like Circle a clear clarity.

- U.S. legislation: In the United States, proposed legislation such as the Genius Act and the Stabilization Act continues to be promoted in Congress. These bills are designed to establish a comprehensive federal regulatory framework for Stablecoins, focusing on reserve requirements, oversight and consumer protection. Their passage is expected to release further institutional adoption.

- Global adoption: In addition to the EU and the United States, jurisdictions such as Hong Kong are also enforcing dedicated Stablecoin regulations (effective as of August 1, 2025), creating clear legal guidelines.

This ever-evolving regulatory landscape is crucial. It is enhancing stable legitimacy, crucial for wider institutional adoption and promoting trust between traditional financial entities and governments. Analysts predict significant growth in the future, and some even predict that overall stable issuance could double to $500 billion over the next 18-24 months, while custodial assets could capture most of the market.

The Stablecoin market is no longer a niche corner for Crypto. It is a dynamic and increasingly complex department divided into specialized functions. Payment stabilizers are transforming global transactions with speed and efficiency, challenging the traditional payment track. Meanwhile, load-bearing stables are democratizing opportunities to obtain passive income, leveraging the power of Defi and diskenized RWA to generate traditional financial returns that were unique to previously.