Canadian pop star Justin Bieber is eagerly exploring the non-fungible token (NFT) space in search of new opportunities. However, what started as a promising journey has now turned into a tale of caution, as the unpredictability of the NFT market has significantly dented Bieber’s once-thriving collection.

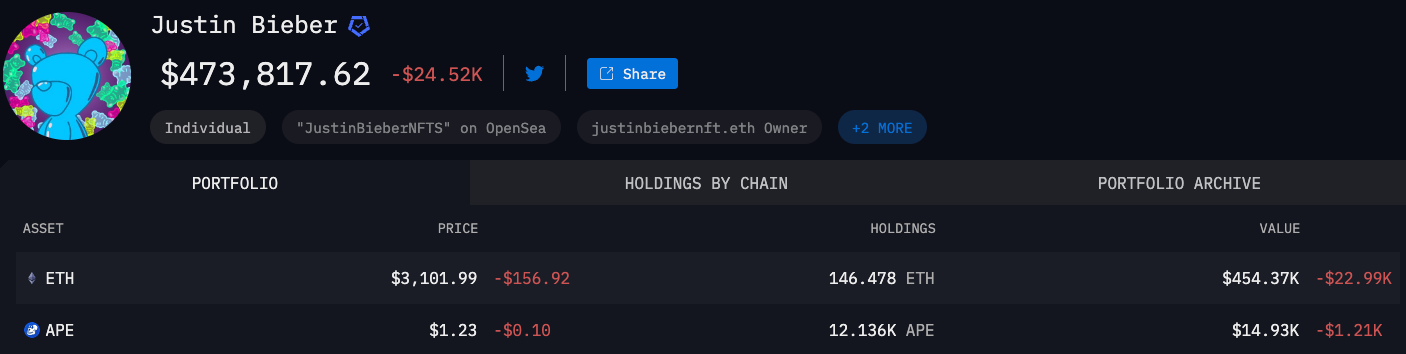

Arkham Intelligence Report

Arkham Intelligence, a well-known blockchain analysis agency, recently revealed that Justin Bieber’s NFT investments have dropped significantly. The collection was originally worth over $2 million, but by 2022, Bieber’s NFT collection dropped to just $100,000. The property has an assessed value of less than $500,000 and has lost significant value over time.

The unique characteristics of digital assets and their investment possibilities have attracted players’ attention to the NFT craze in recent years. Justin Bieber joined the NFT market back in 2022, delving into Mutant Apes (born after BAYC, World of Women, Otherdeeds, Bored Apes Yacht Club, Metacards, and Doodles despite the original NFT series). Promising potential returns, Bieber’s foray into the NFT market is not invincible to its inherent risks, causing the value of his investment to plummet.

Source: Arkham Intelligence

Source: Arkham Intelligence

Portfolio decline: The numbers speak for themselves

The valuation of JB’s NFT portfolio has dropped by nearly 95% from its peak, which is shocking. This impressive collection, which includes multiple MAYC and BAYC, has been reduced to individual Bored Ape and Mutant Ape images, both of which are now worth a fraction of last year’s purchase price. This apparent decline is a reminder of the unpredictability of the NFT market (and the web3 market in general) and the risks associated with high-profile investments.

final thoughts

The decline of Justin Bieber’s NFT portfolio highlights the importance of caution and thorough research when navigating the volatile landscape of digital assets. While the lure of potential profits may be tempting, retailers/investors should approach the NFT market with a more concerned attitude and a deeper understanding of its risks. His experience provides valuable lessons for celebrities and FOMO investors alike, highlighting the need for careful due diligence and foresight in the high risk/reward aspects of digital wealth in the Web3 space, but at the end of the day, it is still a risky asset.