President Donald Trump’s return to the White House is rekindling debate in financial markets, especially in the cryptocurrency world. As Trump’s Bitcoin narrative gains appeal, investors are paying close attention to how his policies, public statements and political styles affect the future of digital assets.

He has a well-documented influence on traditional markets, but his recent statements and actions have made the cryptocurrency community wonder: How does the Trump revival affect Bitcoin (BTC)? This article explores Trump’s current impact on Bitcoin’s presidency, drawing on Bitcoin from recent events, market sentiment and expert analysis.

Trump’s growing relationship with Bitcoin

President Donald Trump has taken a complex and evolving stance on Bitcoin. In his first semester (2017-2021), he publicly suspected cryptocurrencies, famously in 2019 that Bitcoin was “based on thin air” and “not real money”.

Still, the cryptocurrency market flourished under his leadership, with Bitcoin rising from about $1,000 in early 2017 to over $33,000 in January 2021, driven by wider macroeconomic shifts and growth in institutional interests.

Now, during his second term, Trump’s tone has changed. Although he has not yet confirmed that Bitcoin can be used as a financial instrument, he has accepted blockchain-related businesses. His NFT series, “Trump Digital Transaction Card”, sold out quickly and generated more than 13,000 ETH in Opensea’s transaction volume, reflecting his willingness to participate in crypto.

Additionally, Trump has made fewer negative comments about Bitcoin during his current tenure. Some analysts interpret it as a strategic move to avoid alienating American crypto investors and blockchain entrepreneurs.

Although he still stresses the importance of dollar domination, Trump’s ever-evolving blockchain interactions mark Bitcoin’s more pragmatic and less aggressive stance than Bitcoin.

Trump, inflation and Bitcoin safe haven status

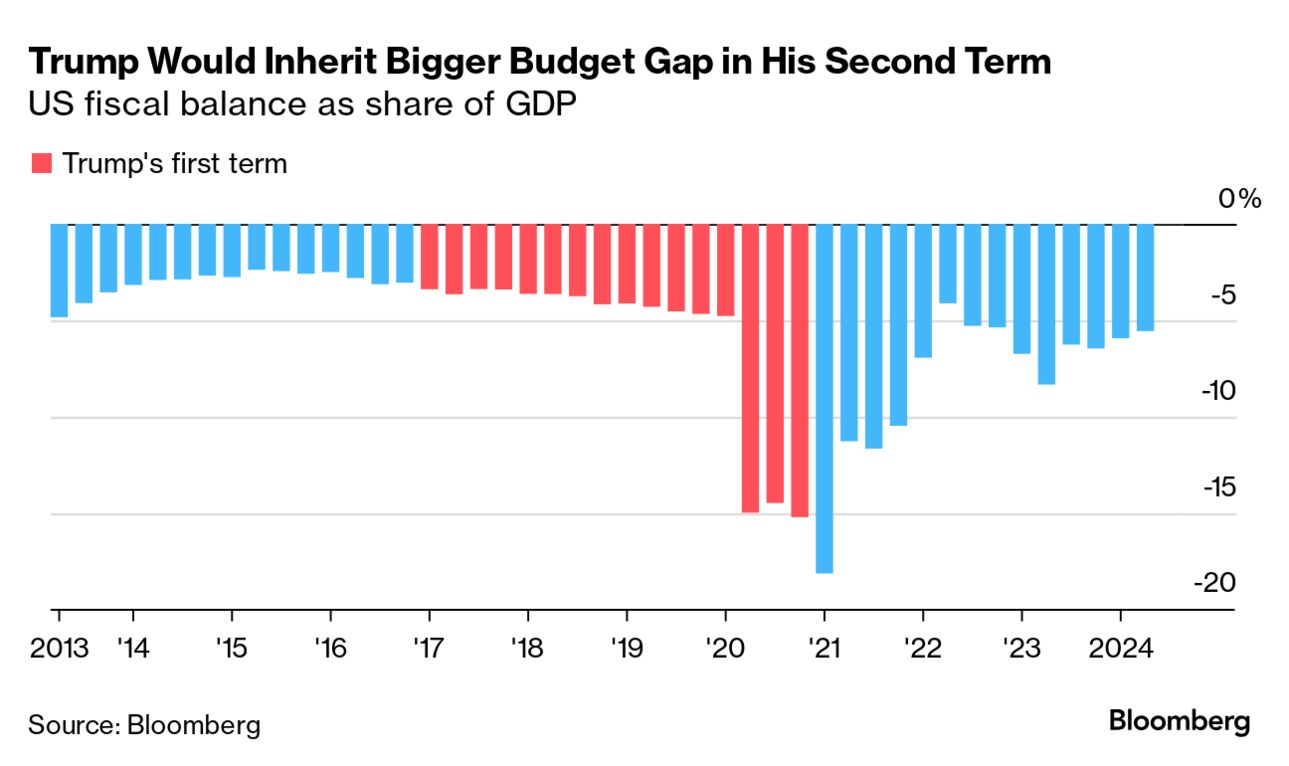

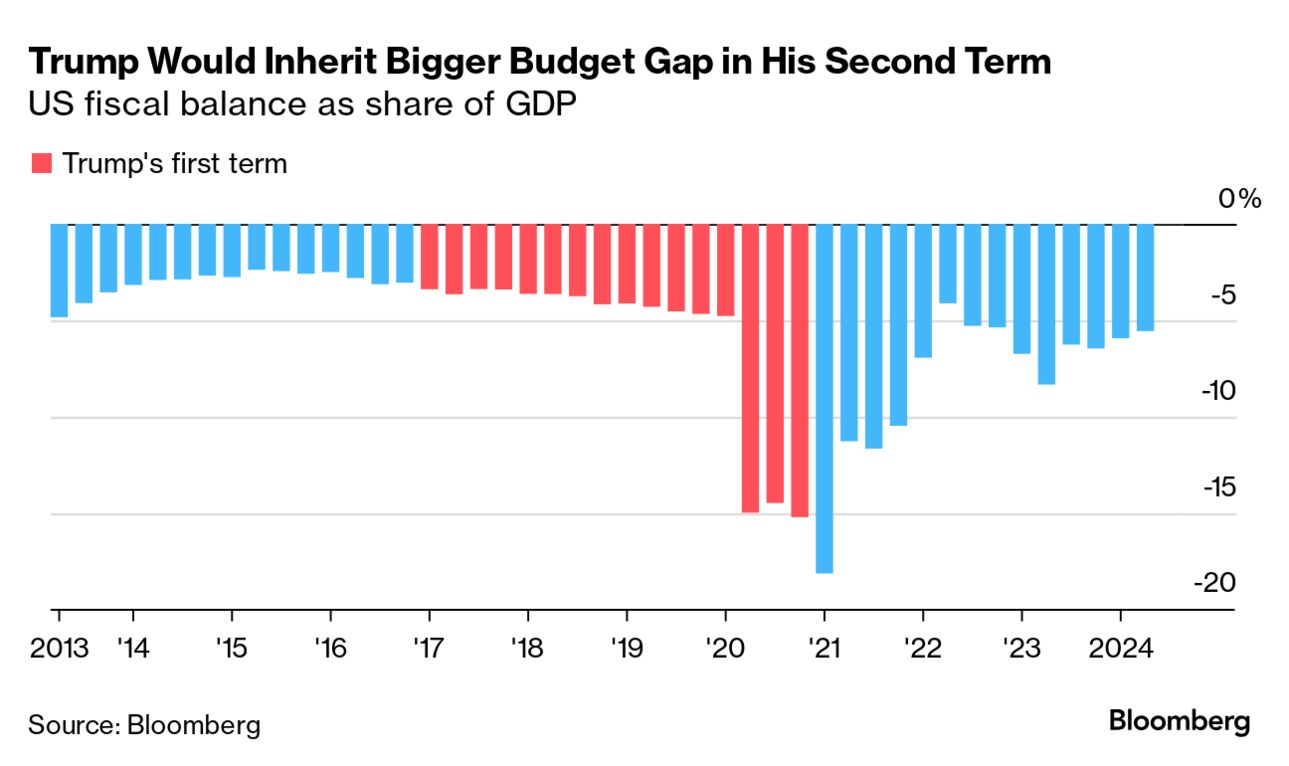

One of the most important economic themes under President Trump is his commitment to growth-driven fiscal policy, even with the risk of inflation. His administration continues to advocate for low interest rates, tax cuts and stimulus spending, which raises concerns about long-term debt levels and the potential erosion of the purchasing power of the dollar.

Recent inflation has been rising in early 2025, with April’s Consumer Price Index (CPI) rising 4.1% year-on-year, higher than the Fed’s 2% target. These macroeconomic pressures strengthen the attractiveness of Bitcoin as a value among institutional and retail investors.

Source: Haver Analytics

Bitcoin is often described as its fixed supply and decentralized “digital gold.” In an environment where traditional fiat currencies may lose value due to expansion of monetary policy, Bitcoin tends to see more inflows.

The combination of fiscal stimulus and geopolitical uncertainty under Trump leadership strengthens BTC’s narrative to hedge inflation.

As Trump raises infrastructure investment and tax benefits in his second term, some analysts believe that the winds of inflation can further accelerate Bitcoin adoption, especially if the Fed still slowly lowers monetary conditions.

Source: Bloomberg

Trump’s second term regulatory approach

One of the most critical aspects of investors is Trump’s potential approach to cryptocurrency regulation. Trump’s previous administration had different regulatory stances.

While the president himself expressed his doubts, his appointed SEC chairman Jay Clayton took cautious and loose action on the crypto market, especially in approving products such as Bitcoin futures contracts.

In Trump’s current administration, regulatory uncertainty may persist given Trump’s widespread contradictions over cryptocurrencies. However, market participants speculate that the broader Republican platform emphasizes innovation and economic freedom may mitigate excessive regulatory restrictions.

Additionally, some Republican lawmakers are aligned with Trump, such as Senator Cynthia Lummis, who has been a vocal supporter of Bitcoin. Their impact may lead to more favorable legislative development.

But Trump’s restoration of power has revisited agencies such as the Treasury Department’s Financial Crime Enforcement Network (FINCEN), especially if the use of illegal cryptocurrencies becomes a headline political issue.

Trump’s communication style and Bitcoin fluctuations

Trump is known for his marketing statements and tweets, which has made a significant contribution to short-term volatility in traditional markets. Cryptocurrencies are already highly sensitive to emotion-driven transactions and may create increased volatility in Trump’s public opinion and policy announcements.

For example, any direct criticism or support for Trump’s support for Bitcoin could trigger immediate, sharp moves from BTC. Traders may increase volatility if Trump’s campaign continues.

During his presidency, Trump’s tweets affected Bitcoin’s lack of immunity, from Fed policy to oil prices.

Reelection could bring back this unpredictable communication style, forcing crypto investors to consider not only economic data, but also political noise.

Bitcoin in global dynamics dynamics

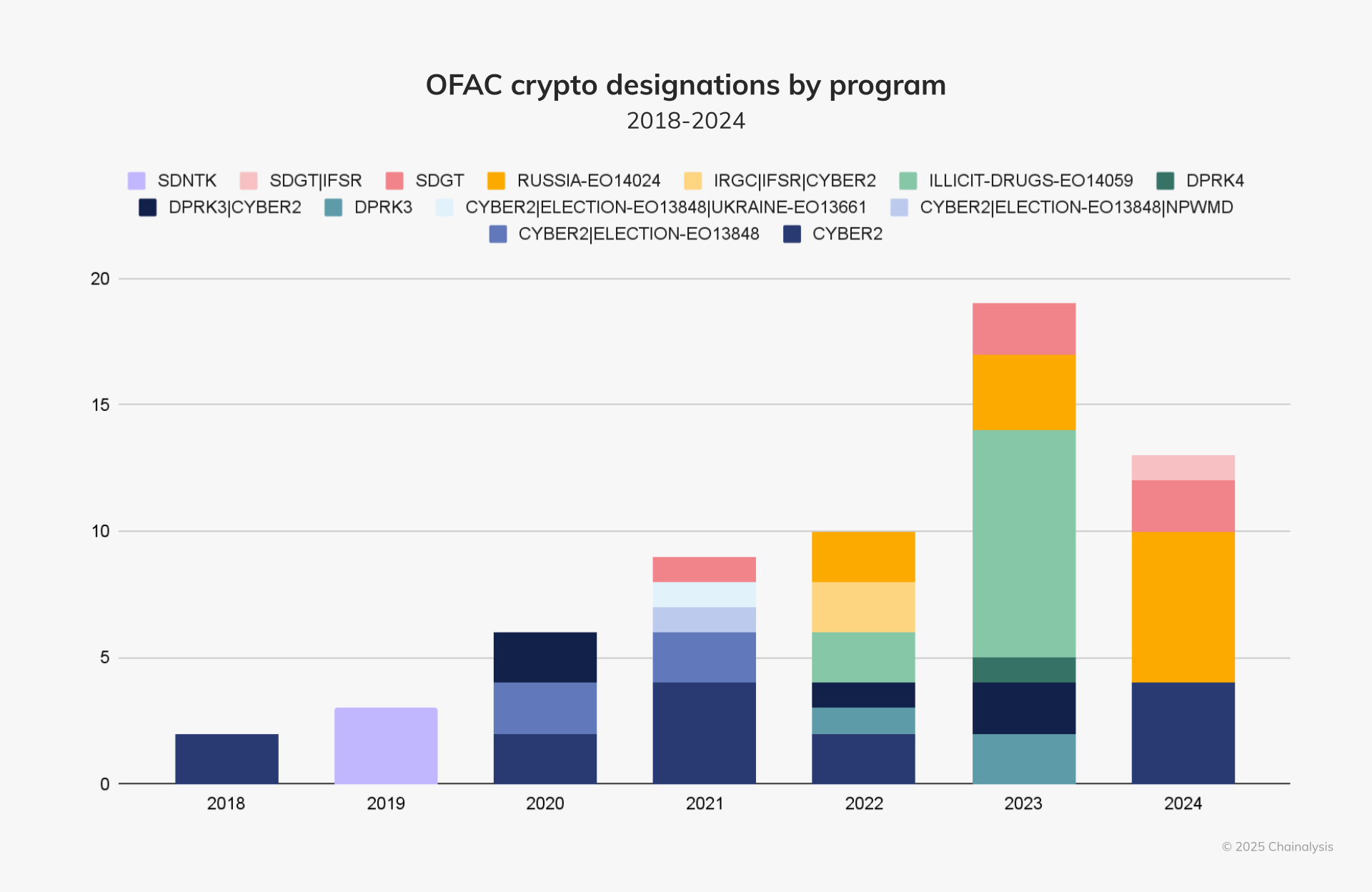

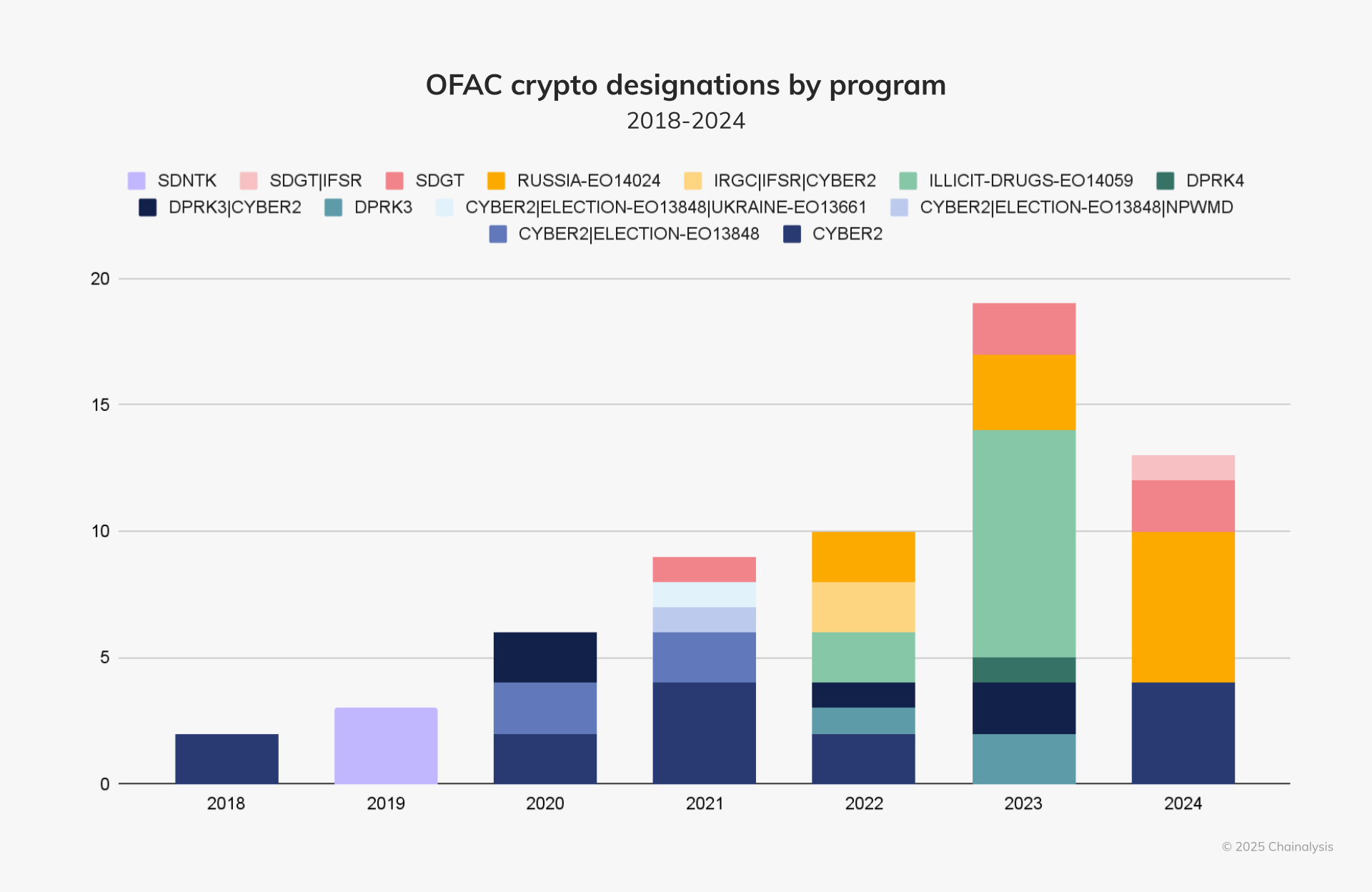

In addition to domestic economic policies, Trump’s approach to international relations and sanctions may also indirectly affect Bitcoin. Trump’s administration has previously imposed strict sanctions on countries such as Iran and Venezuela, which then turned to cryptocurrencies to avoid restrictions, which subsequently increased Bitcoin adoption.

According to a 2021 chain analysis report, Venezuela and Iran have become the highest number of countries in the period of increased US sanctions.

Bitcoin has the characteristics of patience and is often the preferred medium of exchange under geopolitical pressure.

If Trump resumes his previous positive stance on global trade and sanctions, then Bitcoin could be re-interested, a geopolitical tool, whether targeting sanctioned countries or those seeking neutral financial avenues.

Organizational positioning in the Trump era

Institutional investors, long considered the main driver of crypto market maturity, continue to adapt their strategies based on Trump’s second-term economic policy. His government’s emphasis on fiscal expansion, deregulation and national competitiveness has restored the interest and caution of large capital allocators.

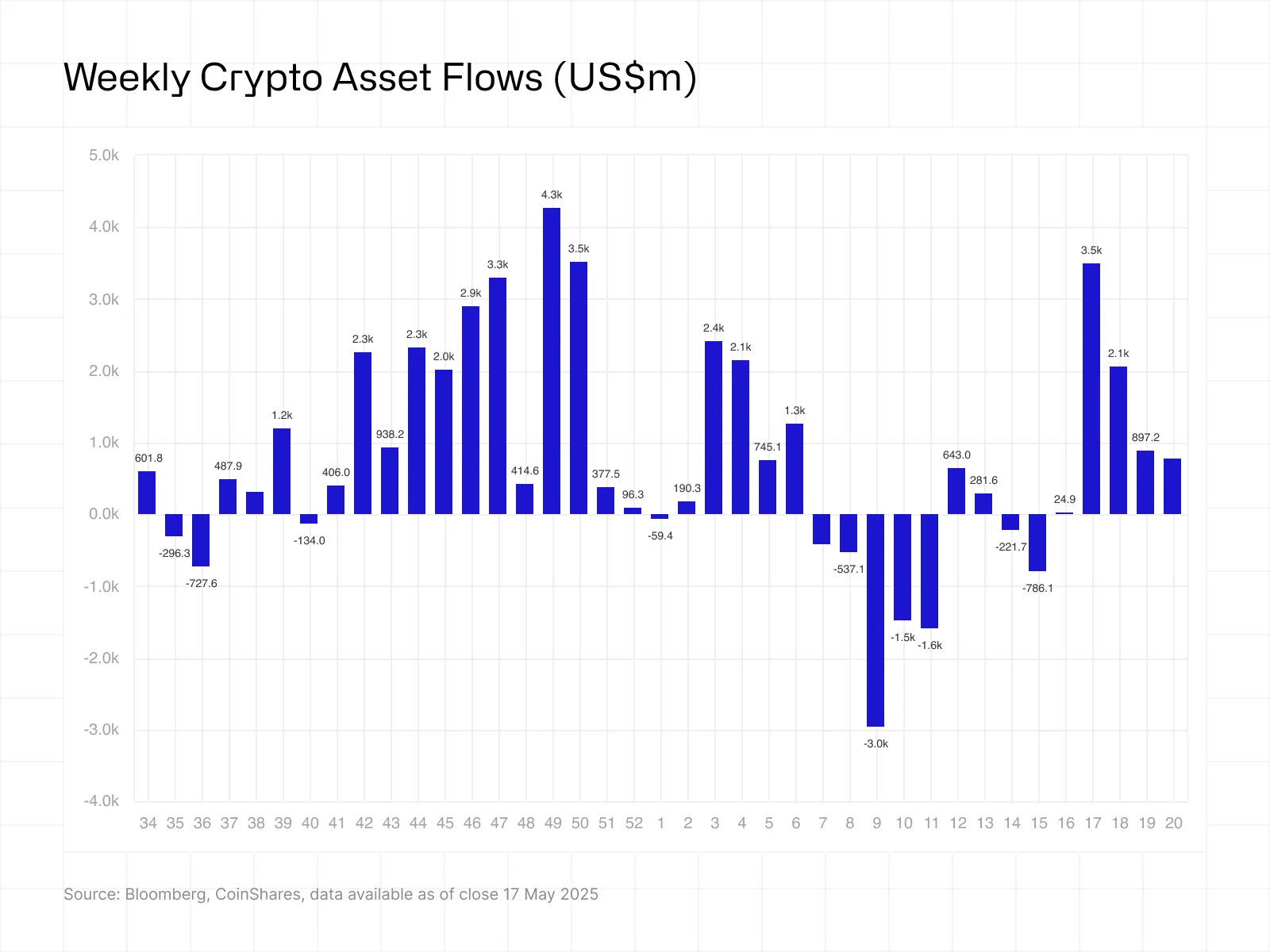

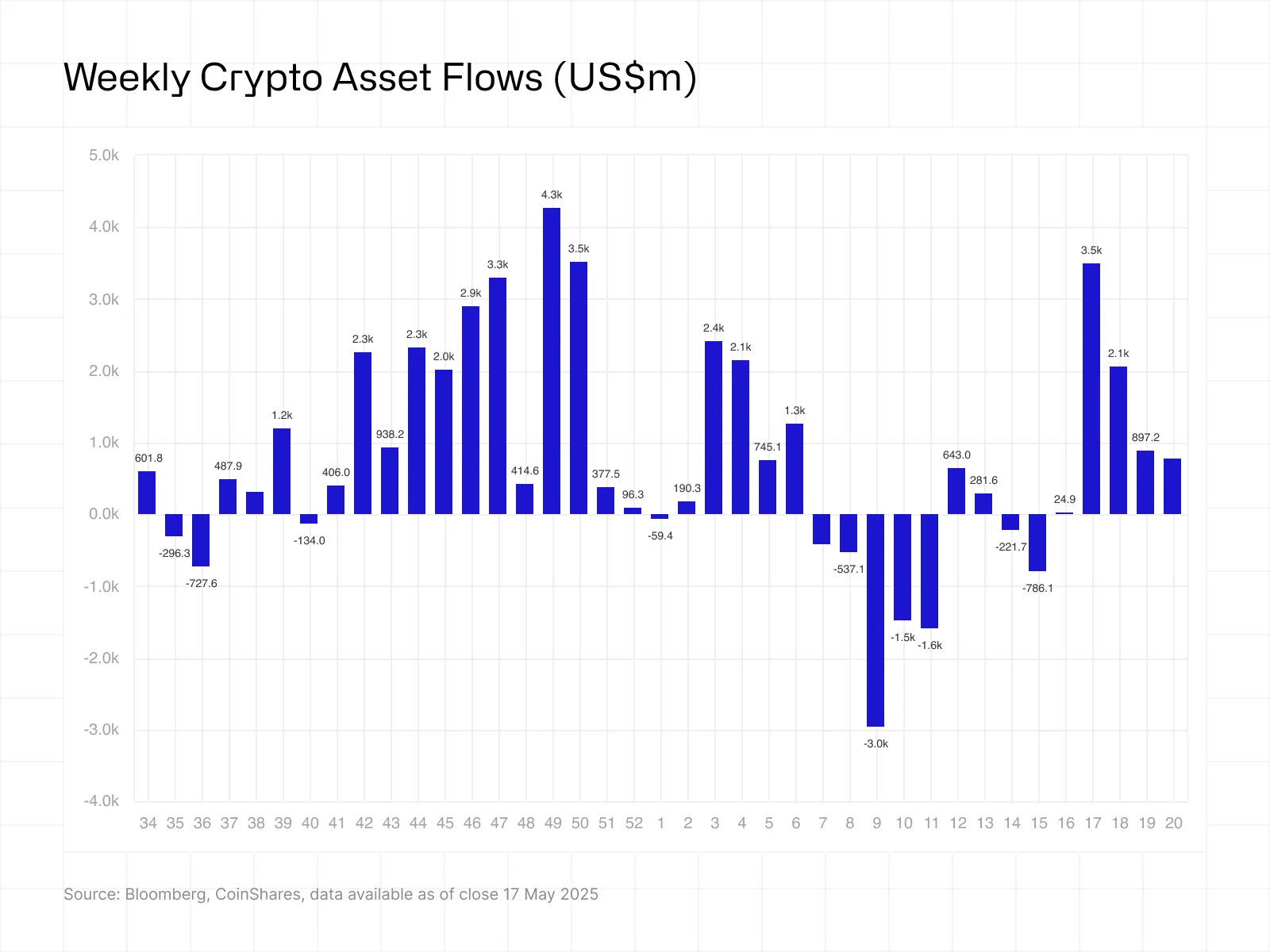

According to a May 2025 report by Coinshares, digital asset investment products recorded more than $2 billion in net inflows in just four weeks, with 72% of which went directly to Bitcoin. This trend suggests that institutions are not only resilient in cryptocurrency exposure, but may also see Bitcoin as a macro hedge against potential volatility triggered by Trump’s positive fiscal stance.

A 2024 Fidelity Digital Assets survey echoes this sentiment, indicating that 74% of institutional investors worldwide believe that digital assets should be part of a diversified portfolio.

Trump’s second policy, especially on trade, debt issuance and interest rate pressures, is seen as a catalyst for increasing exposure to Bitcoin, especially hedge funds and asset managers seeking to move forward with inflation or the depreciation of the dollar.

With the increase in political and monetary uncertainty, many institutions view not only Bitcoin as a speculative asset, but also as a fundamental component in portfolio risk management in the Trump era.

Expert opinion on Trump’s influence on Bitcoin

Famous analysts still have differences on how President Trump’s current tenure affects Bitcoin. Some highlight the potential for short-term volatility associated with his unpredictable communication style and market intervention, while others focus on the long-term economic shifts caused by his inflation policy posture.

“Trump’s economic agenda – based on growth and fiscal stimulus, could lead more investors to move towards hard-finance assets like Bitcoin. In the past, we have seen BTC thriving under similar macro pressures.”

Instead, economist Nouriel Roubini continues to warn against underestimating Trump’s suspicion of digital assets.

But even Roubini admits that a broader Republican environment may be more friendly than regulatory crackdowns under the Biden administration. Some believe that such political re-alignment may create a more fertile foundation for adopting digital assets in the United States

Trump’s embrace of NFTS and crypto innovation

Although Trump has criticized digital currencies, it has increasingly shown a selective openness to blockchain technology. A key example is the release of the NFT series “Trump Digital Transaction Card” in December 2022.

The series sold out in hours, and according to Opensea data, the series has since produced over 13,000 ETH in transaction volumes, highlighting its commercial success and cultural impact.

Now, Trump has not only avoided direct criticism of cryptocurrencies during his second term, but also expressed interest in exploring blockchains for government transparency and campaign fundraising mechanisms.

Sources close to his administration have hinted at using tokenized pilot programs to modernize financial infrastructure and digital identity systems.

Although Trump is cautious about decentralized currencies, such as those in which Bitcoin replaces the dollar, his evolving involvement with tagged assets shows a more pragmatic and opportunistic view of the crypto ecosystem.

Many analysts believe that this shift is a strategic attempt to align with the growing population of Web3 voters and entrepreneurs.

in conclusion

President Trump’s second term reshapes the Bitcoin landscape, combining fiscal expansion, regulatory ambiguity and selective interaction with crypto innovation. Despite the persistence of uncertainty, Bitcoin seems to be increasingly positioned in the evolving global power dynamics, both as a hedge against inflation and a strategic asset.

From Trump’s communication style-driven enhanced volatility to a soft stance on blockchain innovation, the incumbent administration’s approach continues to influence institutional positioning and public sentiment around Bitcoin.

Read more: Trump Crypto: Everything You Need to Know About Donald Trump’s Engagement