UNISWAP (UNI) entered in June 2025 with renewed momentum and was driven by strong whale accumulation, protocol upgrades through V4 and growing developer activities in its expanded ecosystem.

Basic development

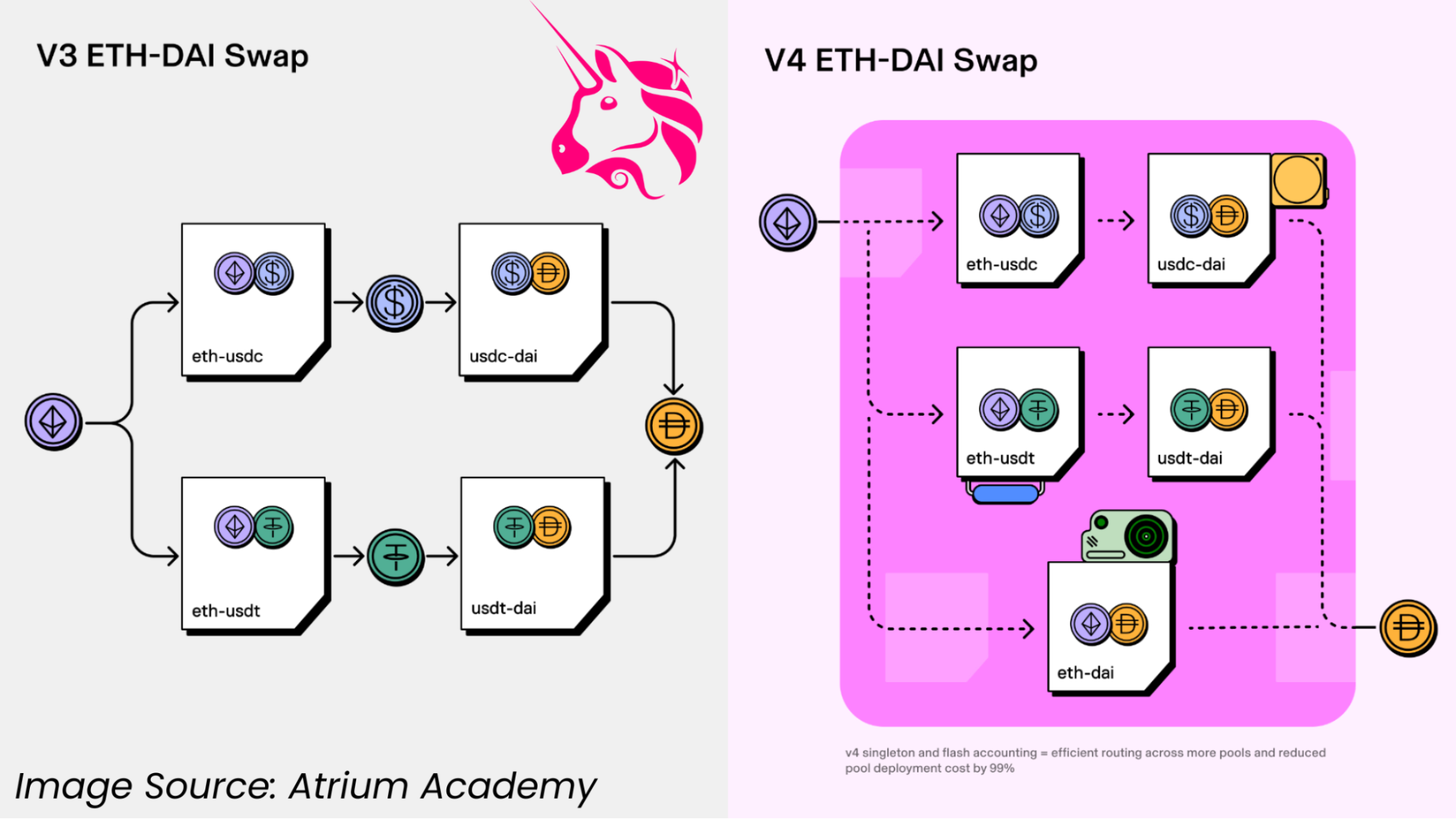

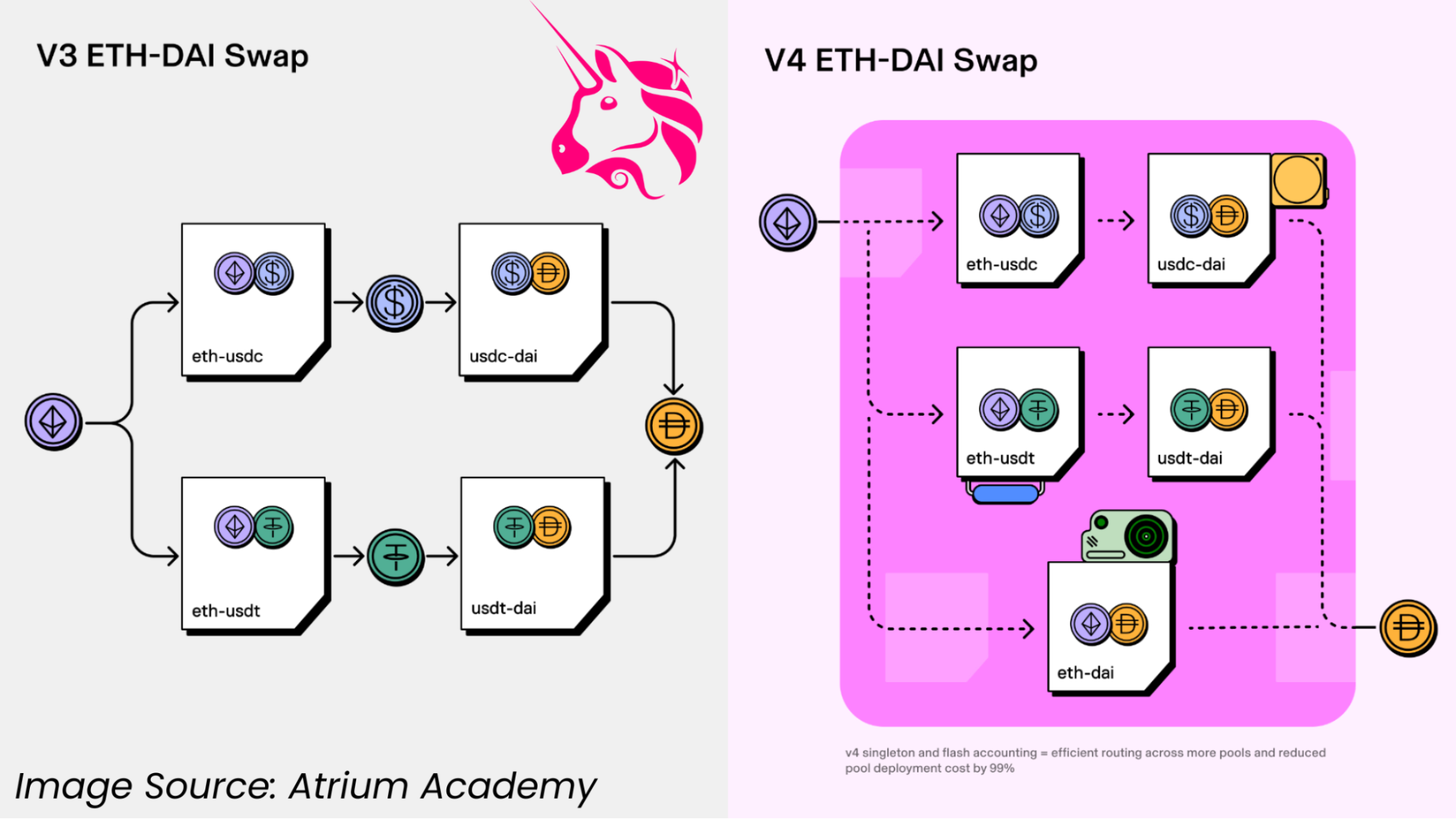

The core protocol of UNISWAP continues to evolve. Recently, UNISWAP V4 was launched through a major building overhaul. The key to its functionality is a new “hook” mechanism that allows developers to run custom code before/after the exchange.

This enables advanced features (built-in restricted orders, custom price Oracle, dynamic expense management, automatic liquidity strategies, etc.). Other V4 improvements include dynamic fees, gas optimization (such as “flash accounting”, native ETH support (no packaging-ETH required), and multiple pool types.

These upgrades are designed to increase capital efficiency and user flexibility and may attract more traders and liquidity to UNISWAP.

V4’s hook has built up some new projects (such as Bunni for dynamic liquidity management, frankly structured Memecoin launch), which shows that developers are growing interest in the latest tools for the platform. In short, the V4 was launched very smoothly, with advanced features that enhance the long-term value of Uniswap by increasing the competitiveness of Uniswap.

Source: Atrium College

In addition to protocol logic, Uniswap Labs expands its network scope. In February 2025, it officially launched Unichain, a local layer 2 summary based on an optimistic stack. More than 100 applications/protocols (including Uniswap itself, Coinbase, Circle, Lido, etc.) have been deployed on Unichain.

Importantly, Circle (the issuer of USDC) is actively integrating Unichain to enable local USDC usage and production capabilities (discussed below). This layer 2 extension should enhance the scalability and accessibility of UNISWAP.

UNISWAP has spanned many chains – Defilama shows that about $4.96B TVL is allocated on Ethereum L1 and many L2S: $3335B on Ethereum, $510 million for Unichain, $445 million for base, $293 million for arbitration.

Symbolism and chain indicators

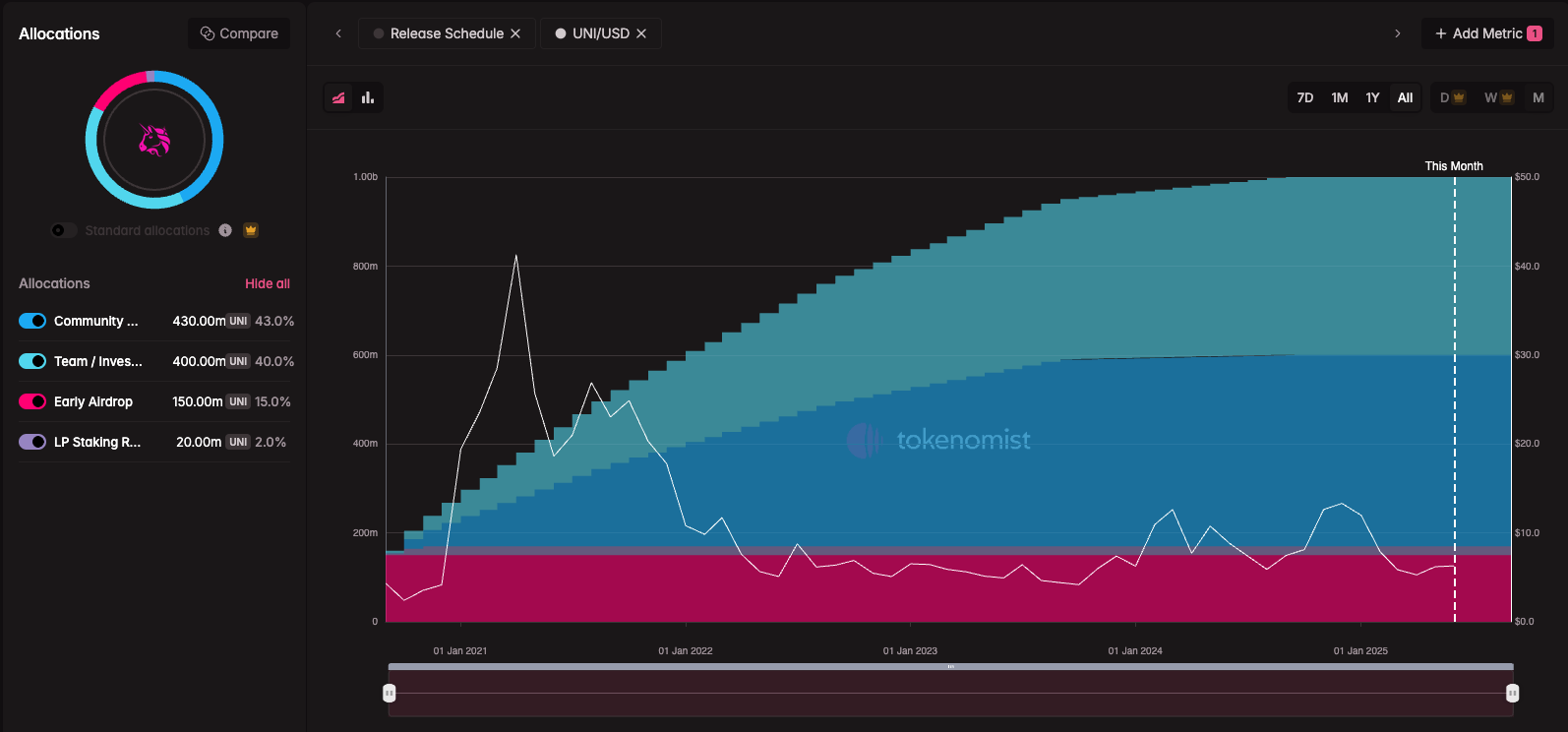

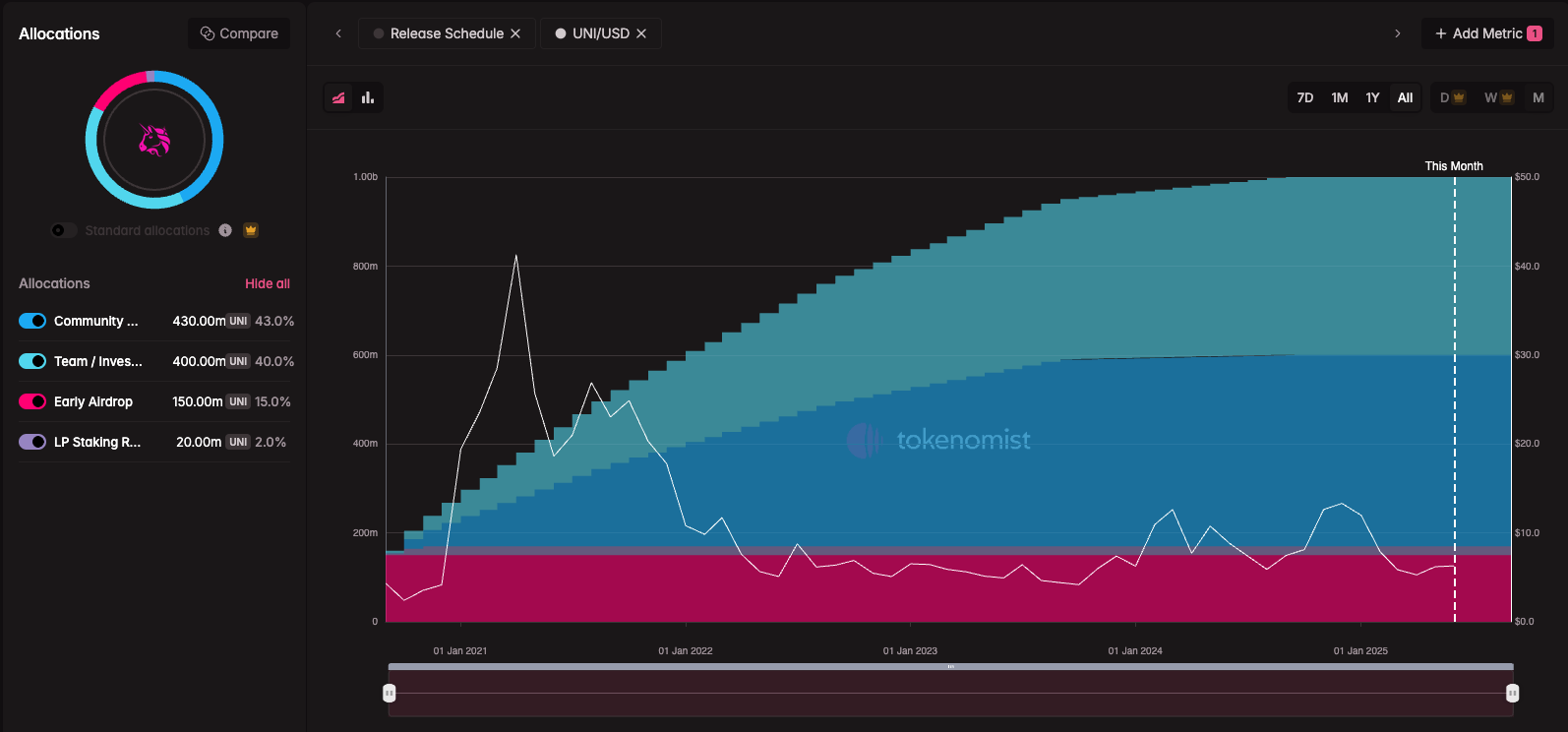

The supply of Uni token itself is about 10 billion. According to Tokenomist data, Uni’s “total unlocking progress” is 100%, which means there is no significant attribution. Therefore, Uni has no sooner to unlock inflation to exert pressure. The market capitalization of the token is approximately 3.9–4.0B (price is approximately 6.4–6.8).

Source: Token Unlock

The on-chain Treasury ministry (Defilama lists only about $167,000 Uni), so counter-cyclical sales pressure in protocol reserves is rarely distributed to liquidity providers rather than directly to token holders, so UNI itself has no planned token burn or direct gains.

Overall, token science is neutral: there is no new inflation, but there is no inherent token sinking besides platform growth.

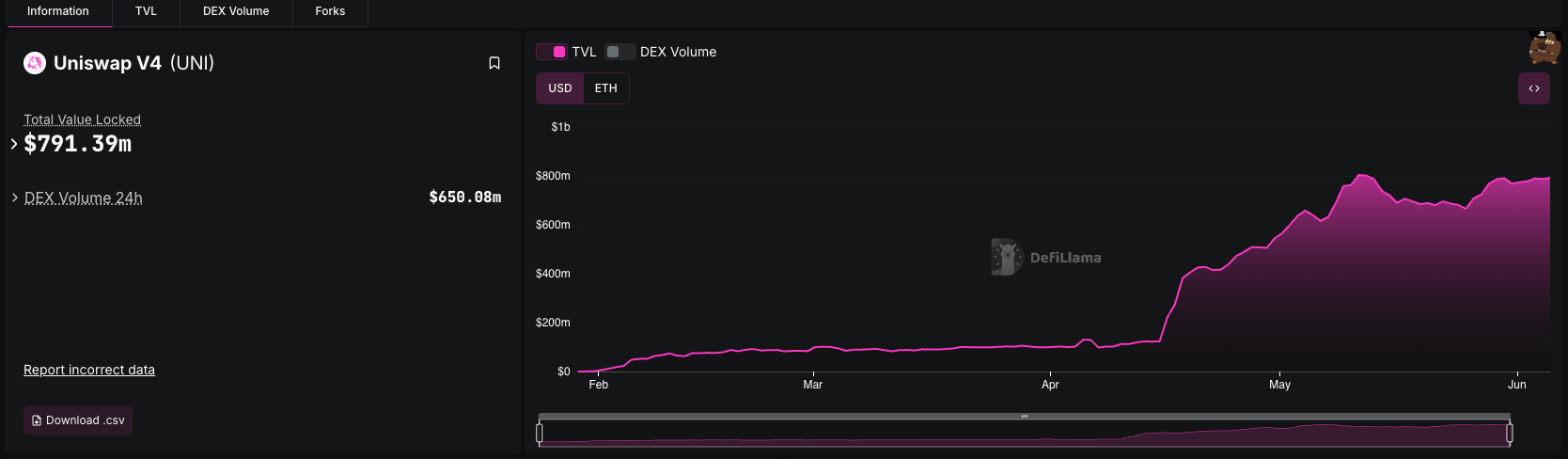

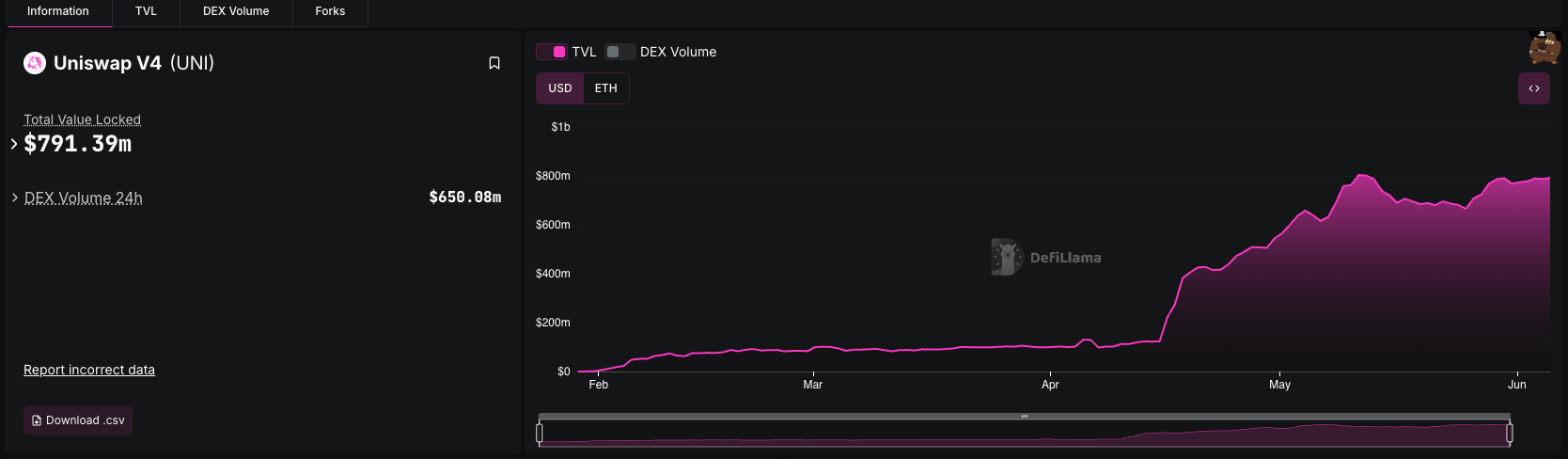

The total value of UNISWAP is locked at about $4.92B, distributed across multiple chains. The TVL peaked faster than its 2021 peak (shortly hit about $10–12B), but is still healthy.

Source: Defillama

Older liquidity (V2/V3 on L1) is all stable. TVL slowly declined from its peak in 2021 as some funds were withdrawn when LPS fell. That is, new liquidity is rolling out and flowing in the V4 pool. UNISWAP V4 initiates incentives; however, enthusiastic users can still expect higher returns and new pool designs.

About 7,261 unique addresses used UNISWAP within 24 hours, showing the powerful daily activities of traders and LPs.

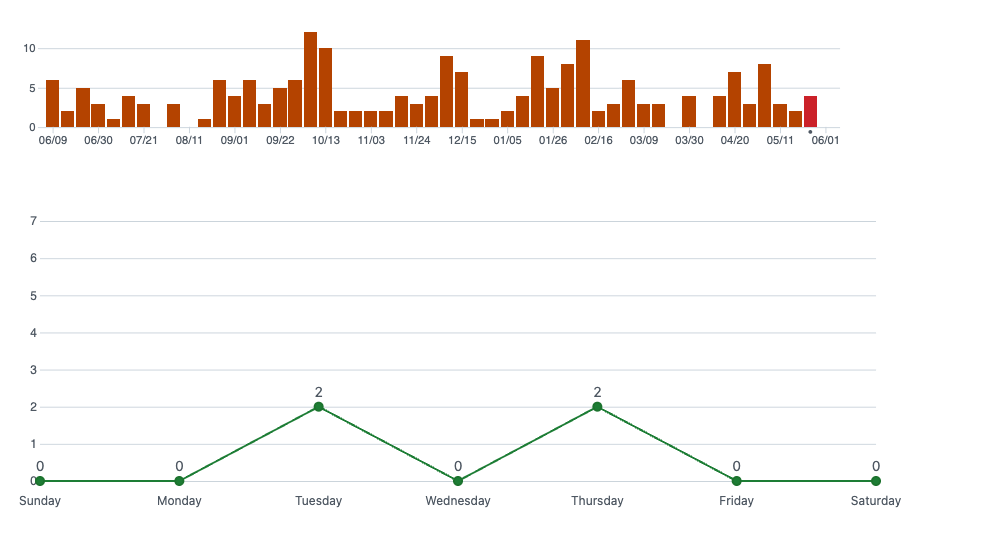

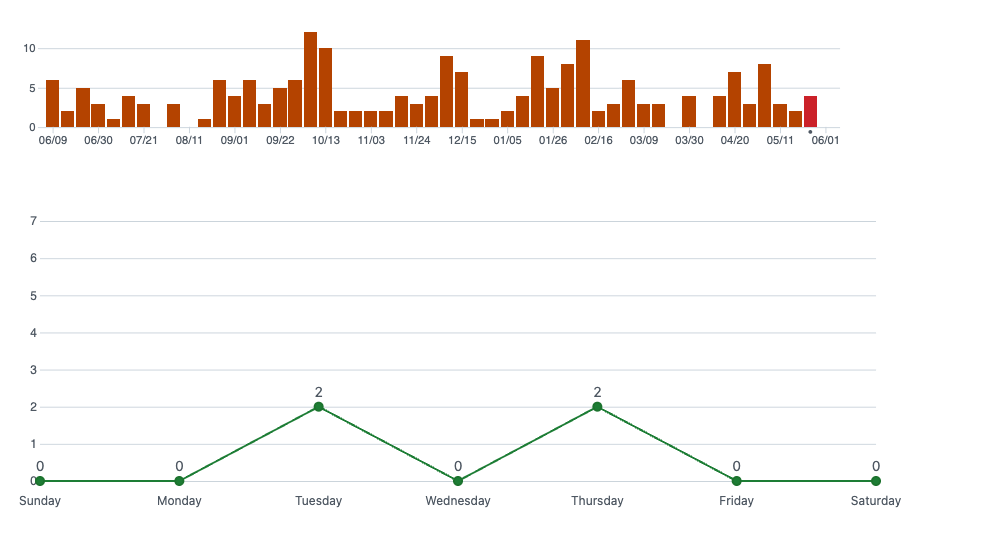

The number of new addresses may be only a small fraction of them, but the continuous high address count shows a stable usage. UNISWAP’s GitHub is active, and as of early June 2025, 3 developers made 8 submissions per week.

Source: github

This indicates ongoing maintenance and functional work. By contrast, many smaller projects see almost no commits. Active developers and frequent update signals indicate that UNISWAP Labs are constantly iterating, which supports confidence in the future of the protocol.

This highlights Uniswap’s resilience, even as crypto thrives – it captures about a quarter of all DEX transactions in 2024. This means that any growth in the Defi market will greatly benefit Unistwap from the current DEX.

Rapid competition may eliminate market share, but no major challengers have emerged. Currently, UNISWAP is still the flagship DEX on Ethereum, providing strong basic support for Uni.

Market sentiment and trading behavior

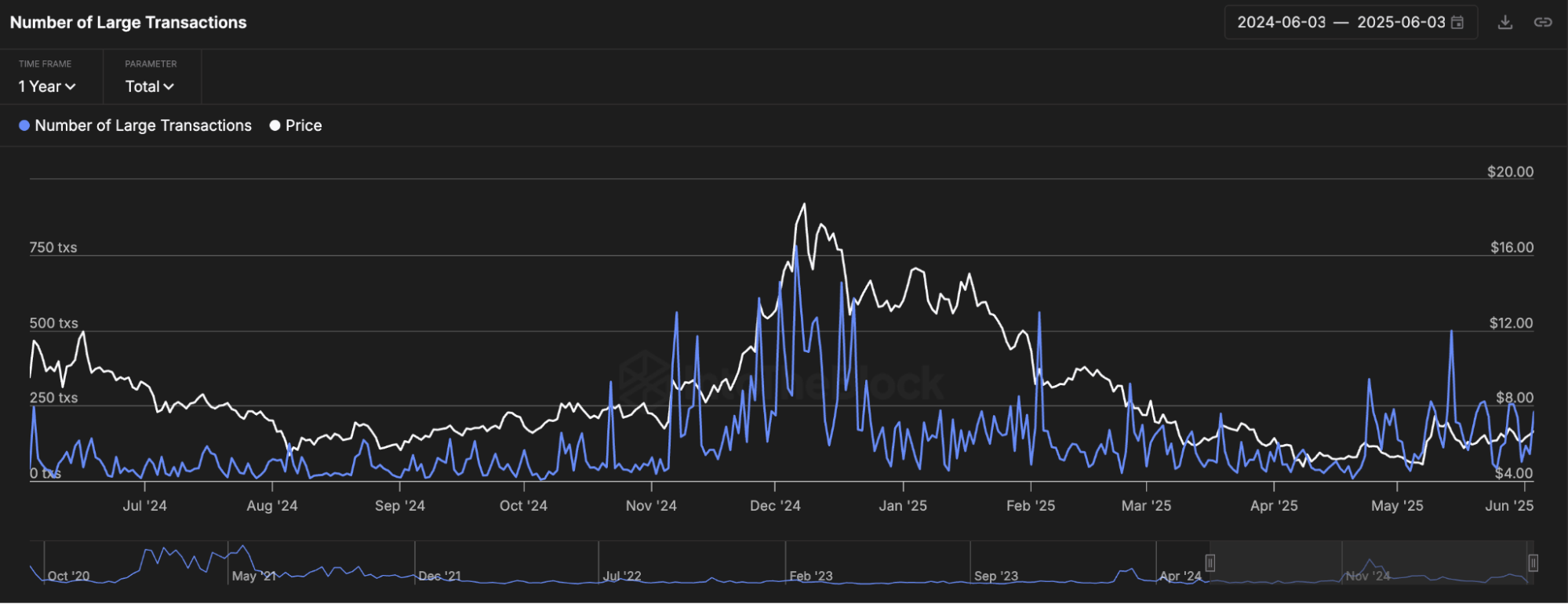

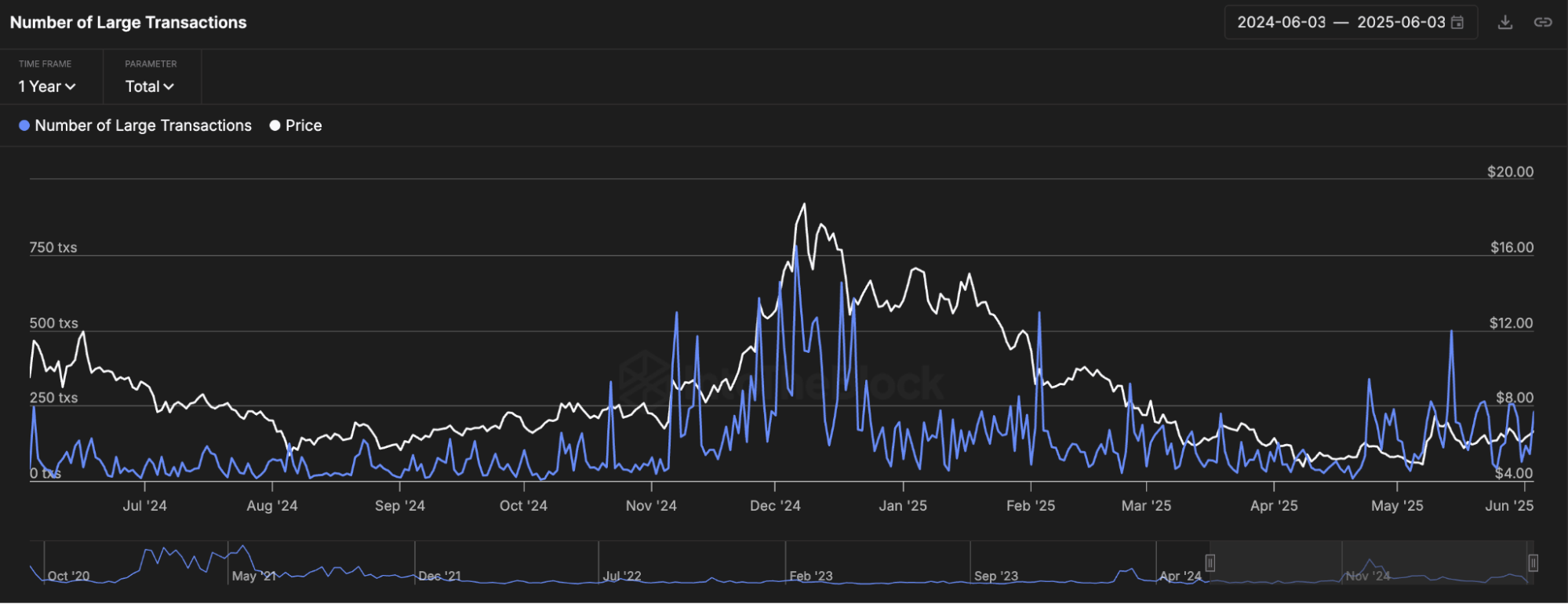

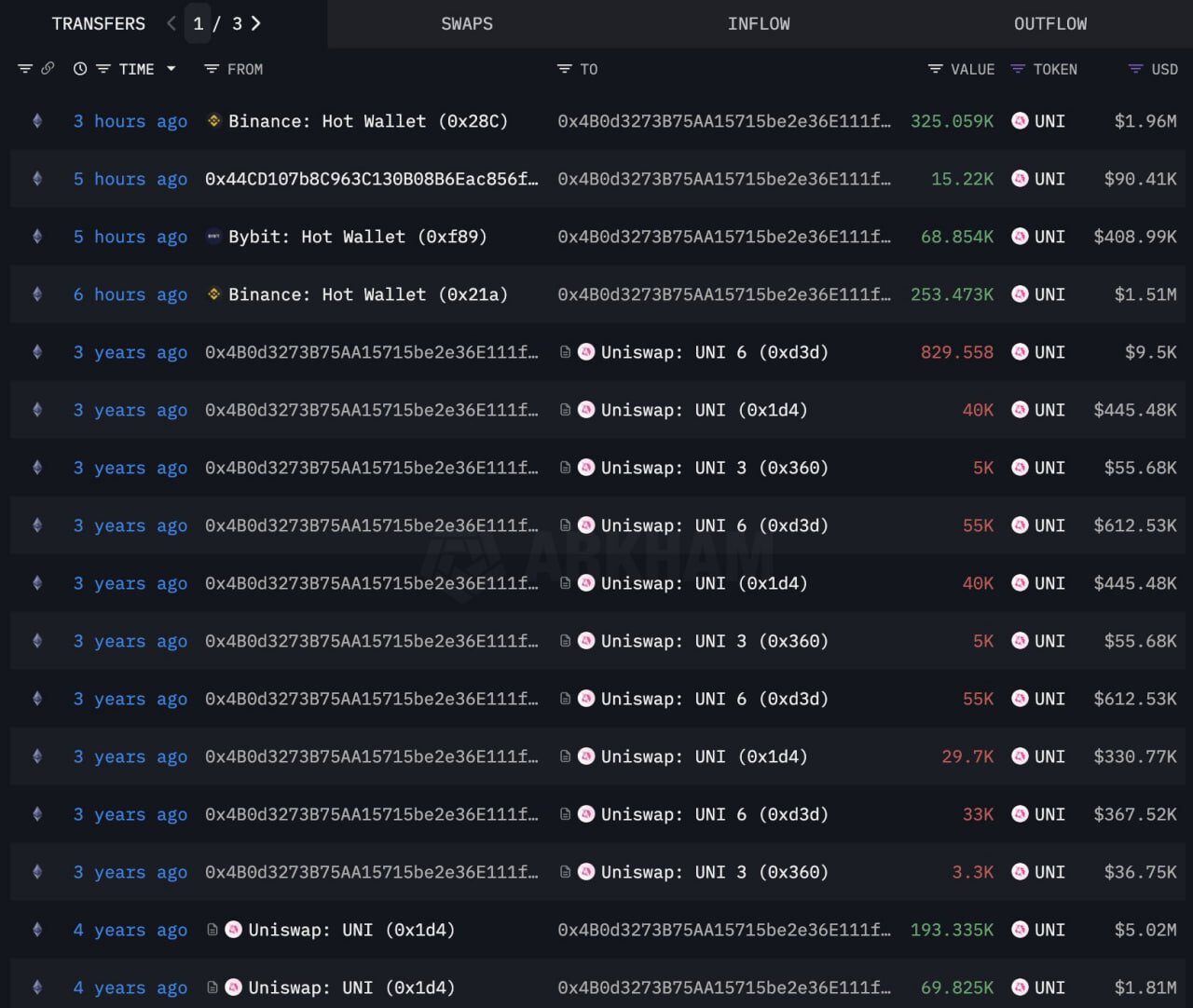

A surprising trend recently is the growing interest in whales. The crypto research report points to a sharp rise in large-scale joint transactions and accumulation. Intotheblock data shows that trading volume > $100,000 rose sharply in late May/early June.

This surge is often interpreted as an accumulation of institutional or large income. For example, on June 3, a whale-powered breakthrough dropped the Uni from $6.45 to $7.00 (7% intraday jump).

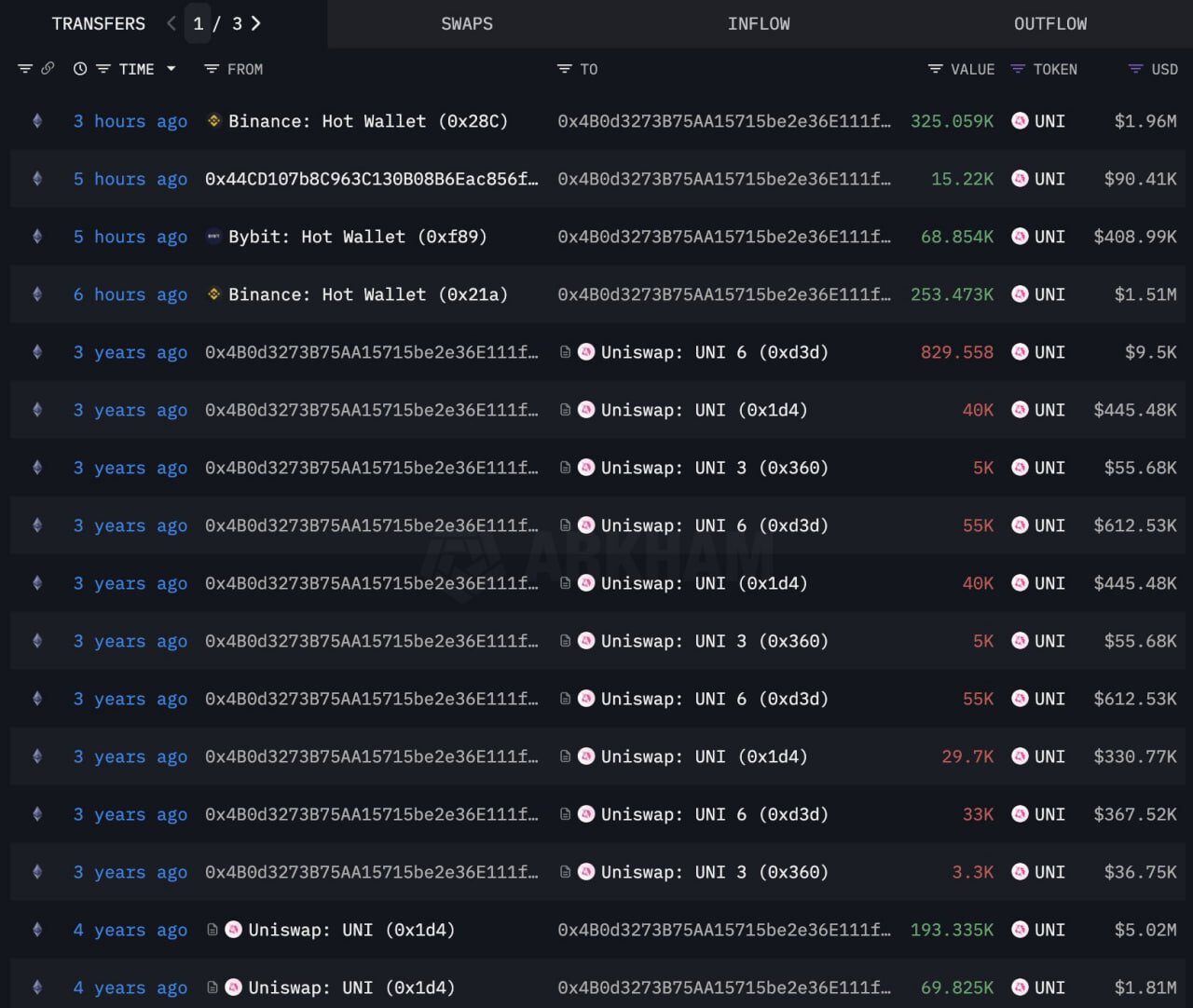

On May 21, the known “Uni Whale” purchased 662,606 Unis ($3.97 million) and withdrew another whale from Binance on June 1.

Source: Arkham

These obvious signals suggest that large investors are positioning it as Uni. Such activities tend to affect prices: exchanged withdrawals relieve immediate selling pressure (hint on holding or agreement possession), while large purchases can drive the market up.

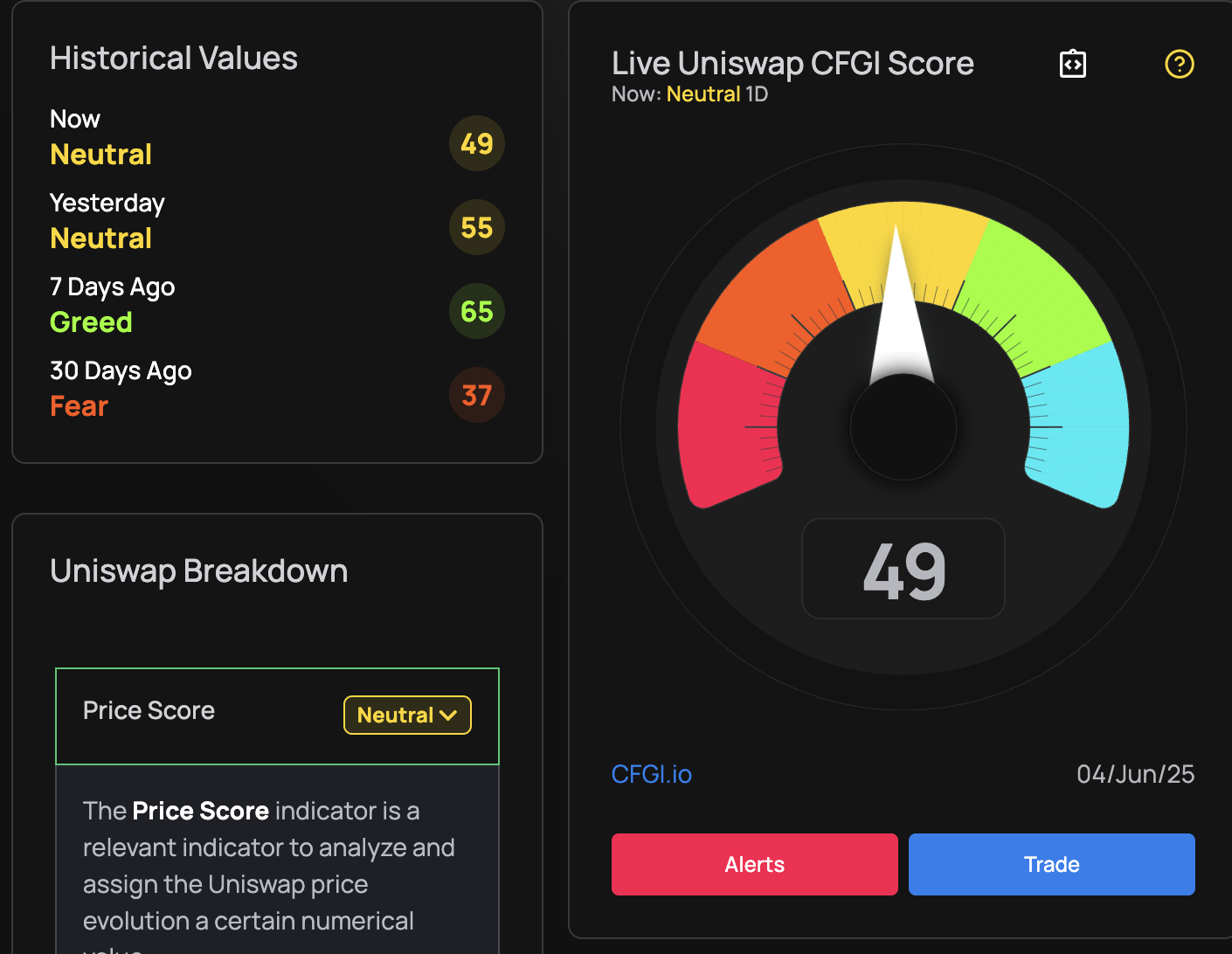

Recently, social emotions and on-chain appetite have been lifted. Crypto’s Fear and Green UNISWAP Measures (Uni Fear & Greed & Greed Index) rose from the “Fear” level (~37) about a month ago to a moderate-looking rise in “Greed” (65) a week ago, as of June 4, before about 49 (neutral).

This swing suggests that community optimism has recovered after the decline in May. On X and Telegram, Uni discussions have been positive news. The market buzz can be self-enhanced; the recent steep rally raises colleges from $5.65 (early May low) to about $6.94 (peak on June 4), which will naturally increase visibility.

Meanwhile, “Fear and Greed” shows enough room for excitement (RSI <70, Fear and Greed ~56 is not extreme). All in all, crowd sentiment seems cautiously bullish, consistent with the action of chain whale.

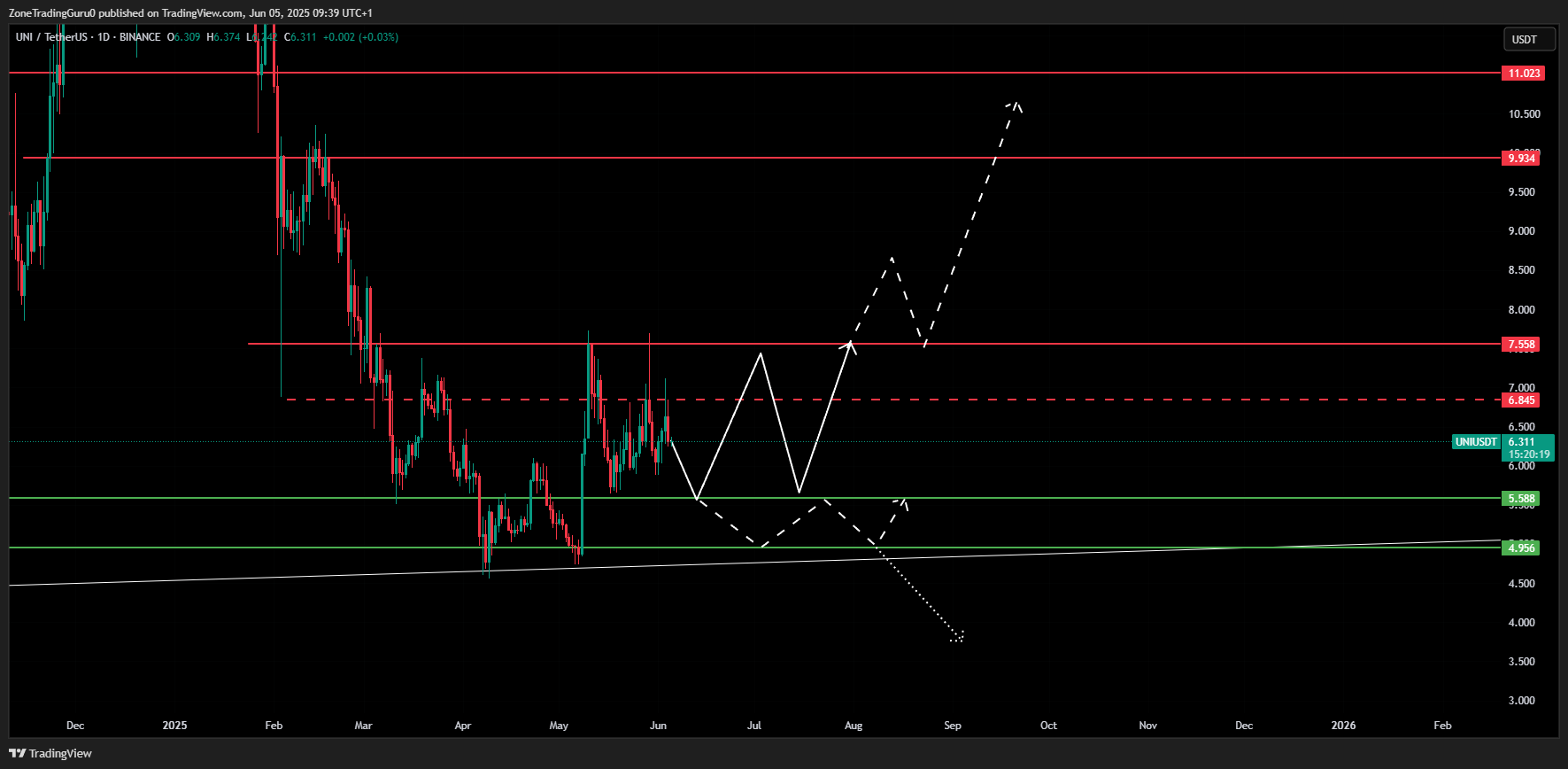

Technical Analysis: Pay attention to Uni’s key levels in June

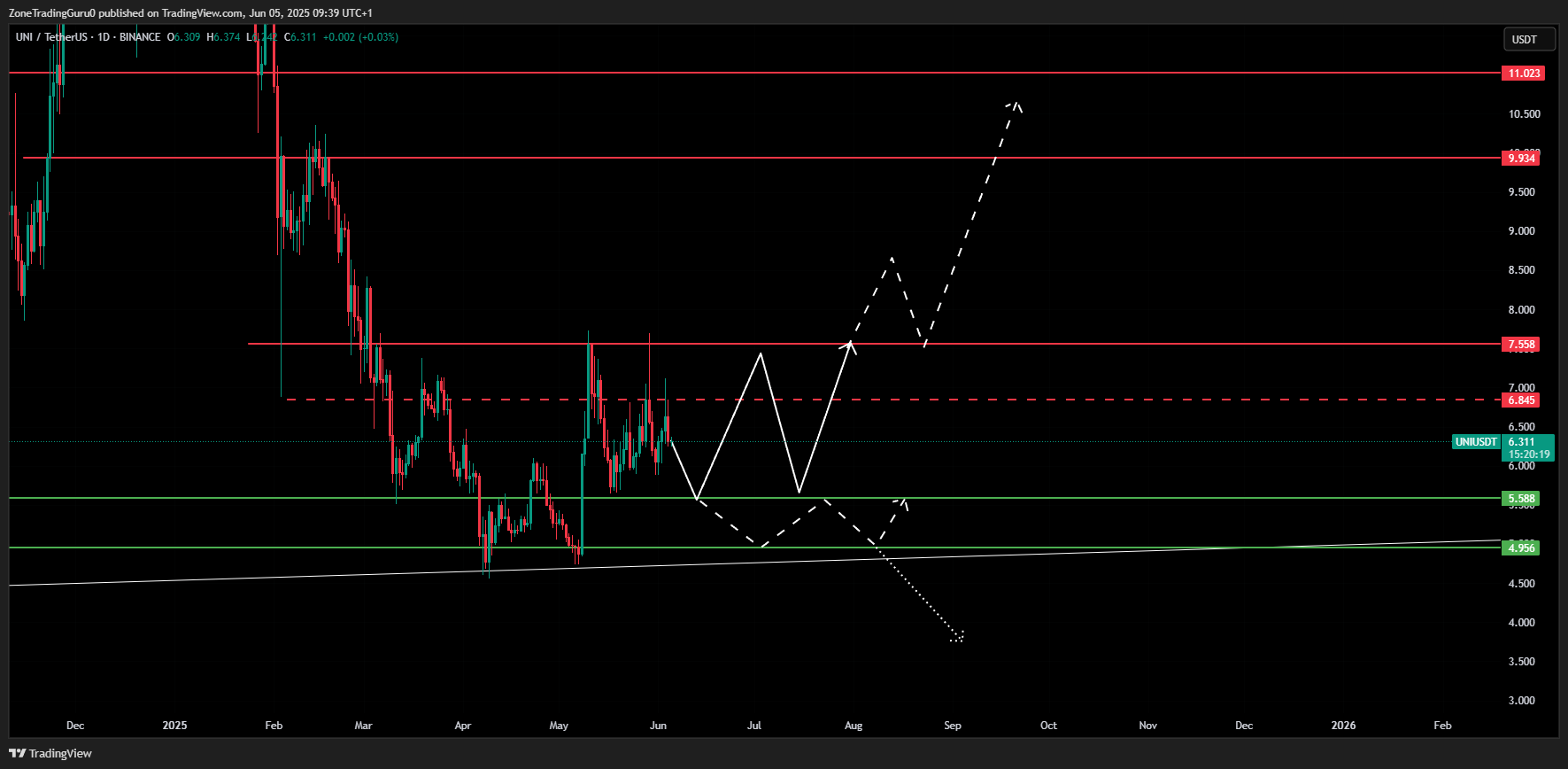

The daily (D1) closing of $7.558 will be a key technical confirmation for Uni’s transition from a correction phase to a new bullish impulse.

If this breakthrough is achieved, the upside target will expand to the next resistance zone at a price of $9.934 – $11.023, which coincides with the historic supply zone and Fibonacci expansion at previous swing highs.

Conversely, if not more than $5.588, $4.956 is opened for resupported repayment, and the intersection of the trend lines is a structure that has historically brought strong buying interest. Weekly (W1) closure of weekly (W1) below $4.956 will invalidate this support and may trigger a sharp decline as this will confirm the disruption of long-term trend support.

Traders should also monitor the Relative Strength Index (RSI) and relocation averages, especially the 50-day and 100-day EMA. Uni is currently hovering around the 100-day EMA (~$7.00), which acts as a pivot area. The continuous approach of exceeding this dynamic resistance, the continuous expansion of the volume and the continuous expansion of the market, will strengthen the bull case.

UNISWAP price forecast

If Uniswap’s momentum continues – Uni can climb steadily into June with the accumulation of whales, strong liquidity and the latest basic upgrades. In this case, we might see Uni Reclaim $7.00–7.30 By mid-June.

Importantly, this level matches the 100-day EMA, which is the pivot between bullish and bearish momentum that many short-term traders consider. Clean closing prices per day are above $7.00 (ideally, rising volumes and strong market breadth) – which may trigger follow-up purchases from trend-following algorithms, market makers, and even retail participants waiting to confirm the breakthrough.

In this case, bullish momentum may accelerate, especially if broader market sentiment, including Bitcoin stability and Defi capital flows, remains favorable.

All forecasts will still change rapidly given the volatility of cryptocurrencies. Traders should watch the $6.70–6.90 area: clearing breaks above the altitude and get support from Zhenghong tips that will confirm the bull’s breakthrough.

However, traders should be cautious about false breakthroughs, especially if moves above $6.90 lack follow-up or appear at low capacity.

In this case, Uni is vulnerable to rejection core attacks, while $6.30-$6.10 is supported. Nevertheless, developers on UNISWAP V4 are growing traction, and integrations like Spark and Unichain provide a solid foundation to help absorb downward volatility.

Read more: Trading with free encrypted signals in the Evening Trader Channel