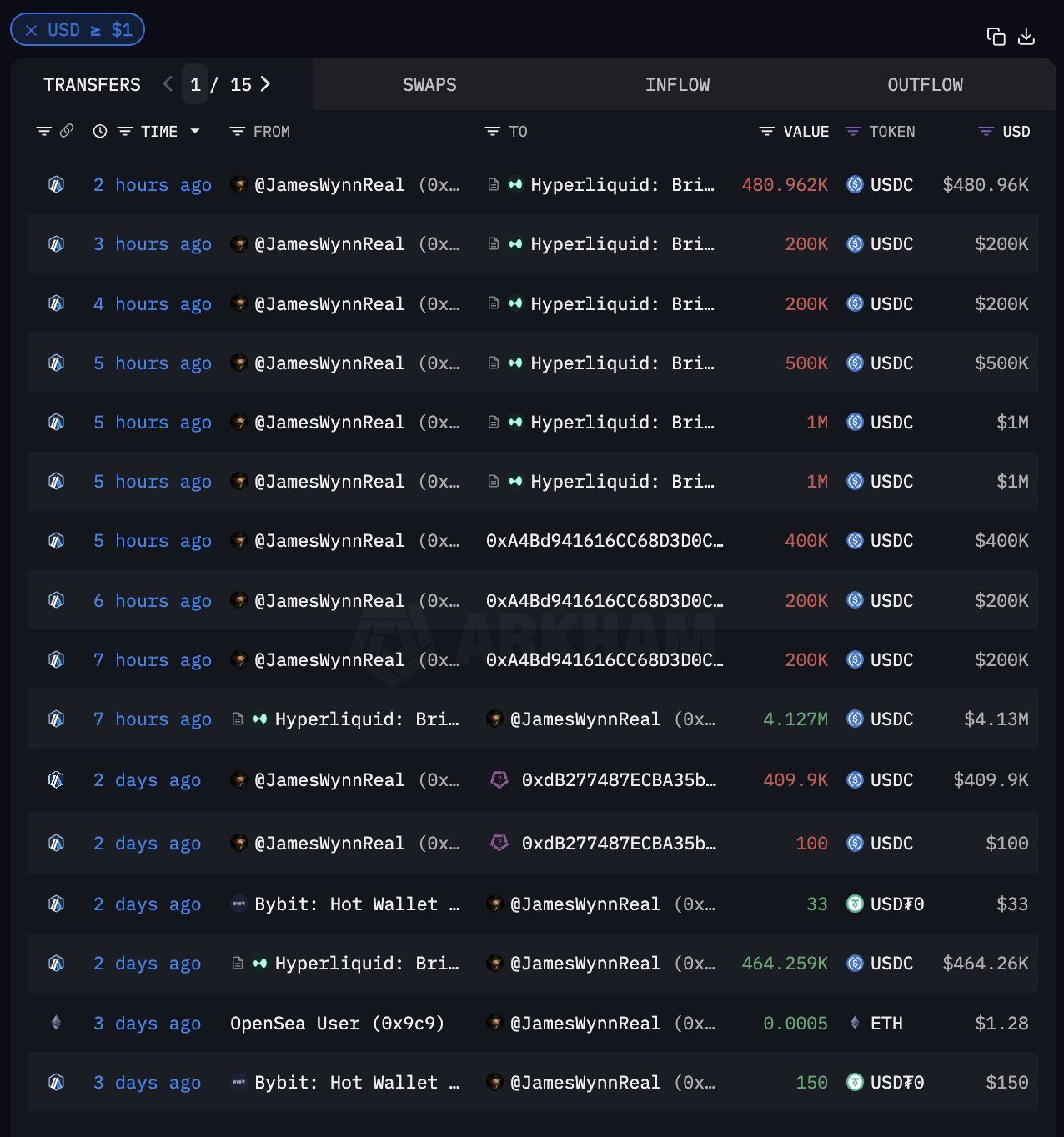

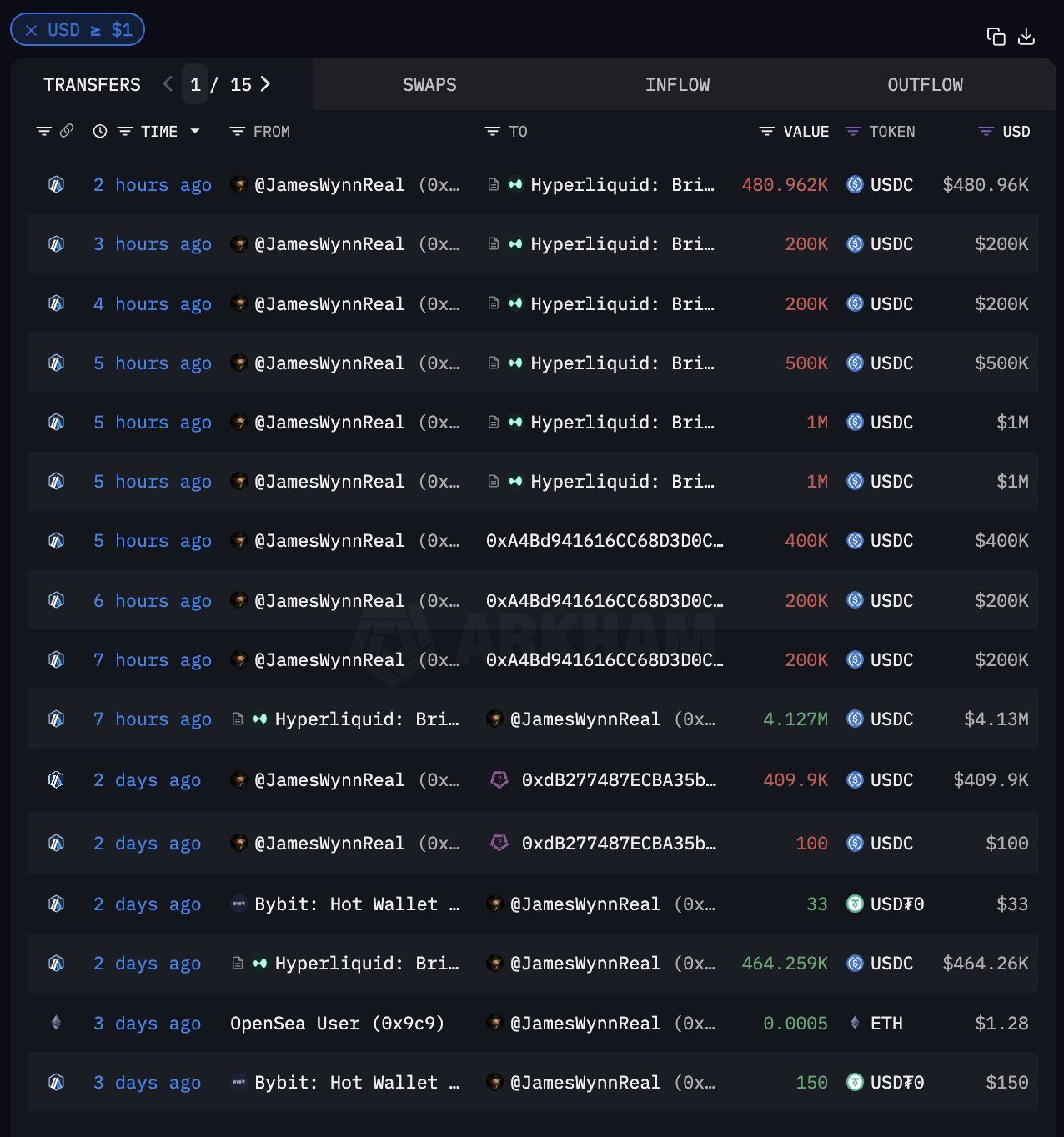

James Wynn is back in a huge return to the eternal futures world two hours after publicly announcing his retirement from practice. According to data on the chain, Wynn deposited more than $2 million into the superfluidic fluid and immediately opened a high leverage position – reported to be 40 times longer.

The move follows a recent roller coaster trading trip, which solidified Wynn as one of the most striking figures on the crypto derivatives scene.

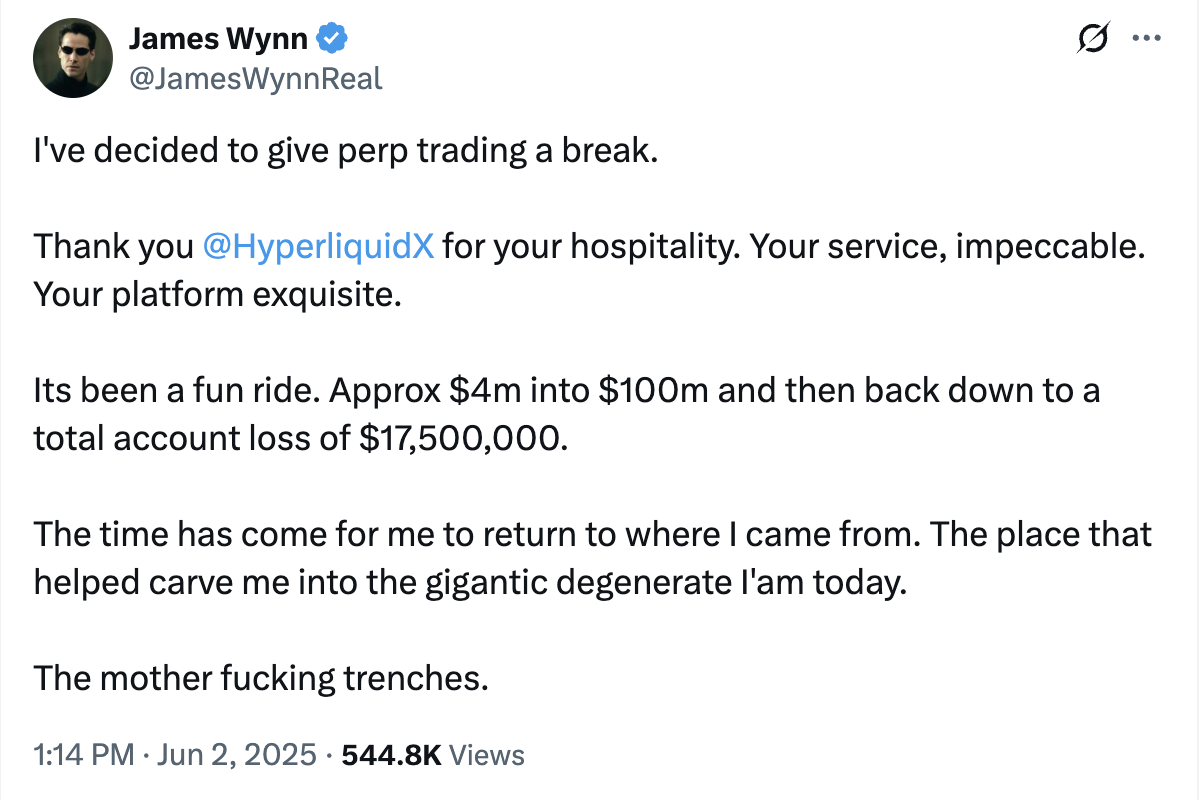

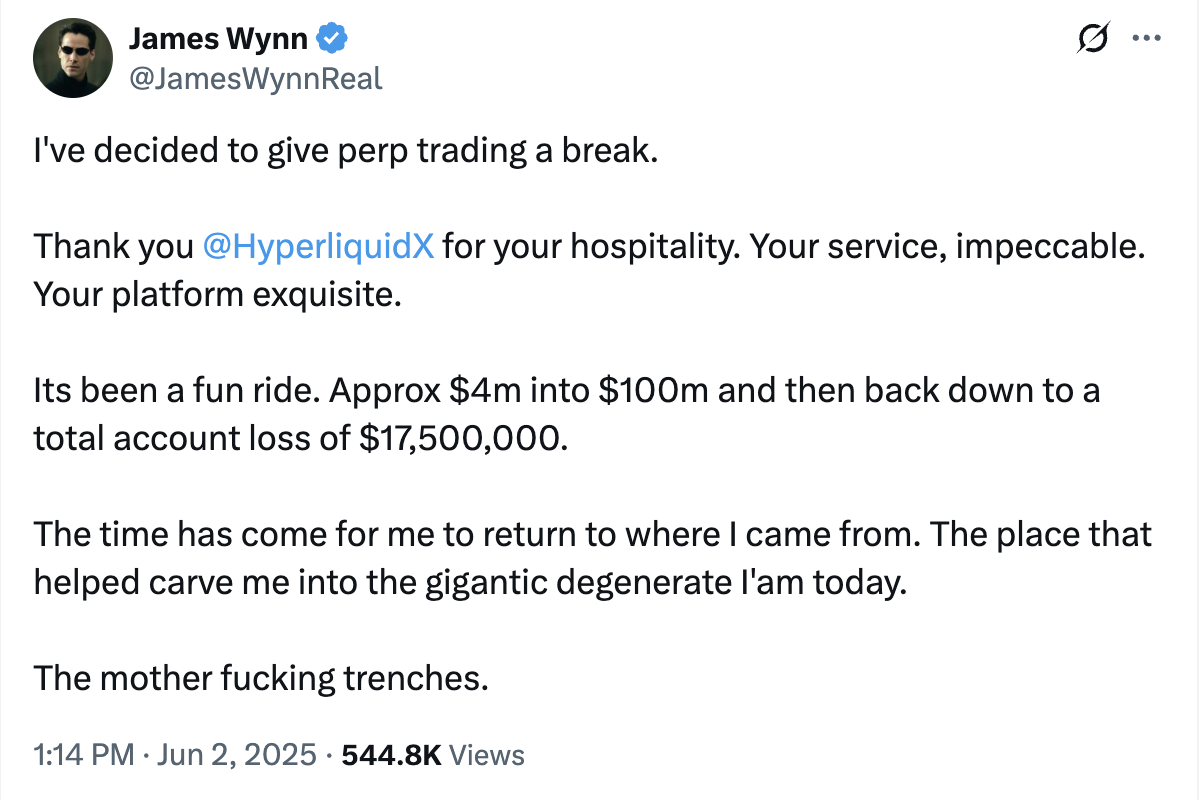

Wynn’s wealth quickly reversed by turning the initial $4 million investment into more than $100 million earlier this year. His losses eventually totaled more than $17.5 million, a legend that led to his now-deleted statement announcing the end of his stock trading day:

“I decided to exit the permanent deal. Thanks to Hyplliquid for his journey.”

But Wynn’s farewell was short-lived.

Read more: Bitcoin Whale James Wynn faces mass liquidation worth $100 million

From the depths of liquidation to the edge of another gambling

After several hours in, Wynn returned to his selection platform Hyproliquid, and now he seems to be trying to make a comeback. The newly opened 40 times long position has shown a floating loss at press time of more than $900,000.

As Bitcoin hovers around $104,000, his position will be liquidated if the price drops further.

Wynn reportedly further intensified the buzz, which was not fixed before returning to the futures space and sold $4.1 million worth of yass to USDC. He then placed a huge Bitcoin, estimated to be worth nearly $100 million. He has fallen 73% in the position so far, highlighting the extreme volatility of his trading strategy.

Source: Arkham

The controversy behind fame

Despite being regarded as an idol in the hypermobile trade community, Wynn has not escaped criticism. Some community members accused him of promoting low-quality “meme coins” for economic gains, just quietly exiting his position as prices rise. Although such claims have not been proven, they have been added to the polarized image of Wynn trading roles.

Critics also point out that most experienced traders who own Wynn Capital will often divide their capital into multiple transactions and maintain discretion to avoid targeted liquidation. However, Wynn took the opposite approach – publicly showing off large-scale positions and frequently posting updates to X, effectively turning his portfolio into live media events.

This public strategy not only attracted attention from his industry, but also tokens associated with him, such as Memecoin Moonpig.

Although it is not clear whether his actions are market manipulation, there is no doubt that Wynn has created one of the most effective marketing channels in the Memecoin space.

Some even speculate that Wynn operates multiple wallets to hedge or balance behind-the-scenes transactions. Some people think he will only publicly promote the most successful wallets to build a reputation and attract followers.