worldcoin(wld) is a cryptocurrency project that co-founded the global digital identity system by OpenAI CEO Sam Altman. As of now, WLD has traded around $1.50, with a total market capitalization of over $2 billion, ranking 68th in the cryptocurrency market.

Internal factors of world currency

WorldCoin was founded in 2019 by Sam Altman, Alex Blania and Max Novendstern, and Altman is the most prominent figure (and CEO of OpenAI). The project has raised more than $250 million in funding from major venture capital firms such as A16Z and Khosla Ventures.

Recently, in May 2025, WorldCoin (now renamed “World”) received an additional $135 million to two venture capital firms (A16Z) and Bain Capital Cragerpto by directly selling WLD to WLD.

Source: Crypto Fundraising

This capital injection demonstrates strong support from major investors and provides the necessary resources for the project to pursue its long-term vision. WorldCoin aims to build the world’s largest identity and financial network, targeting a multi-billion-dollar user base.

The core focus is to solve the problem of “proof of personality”, distinguish actual humans from robots or artificial intelligence, and to take artificial intelligence as the mainstay in the future. After each user downloads the world app and registers, he or she must physically access the ORB (Spheric Device) to scan its iris and create its unique world ID.

The scanning process uses multispectral sensors to verify the uniqueness of the iris and delete images immediately on the device.

Token and chain activities

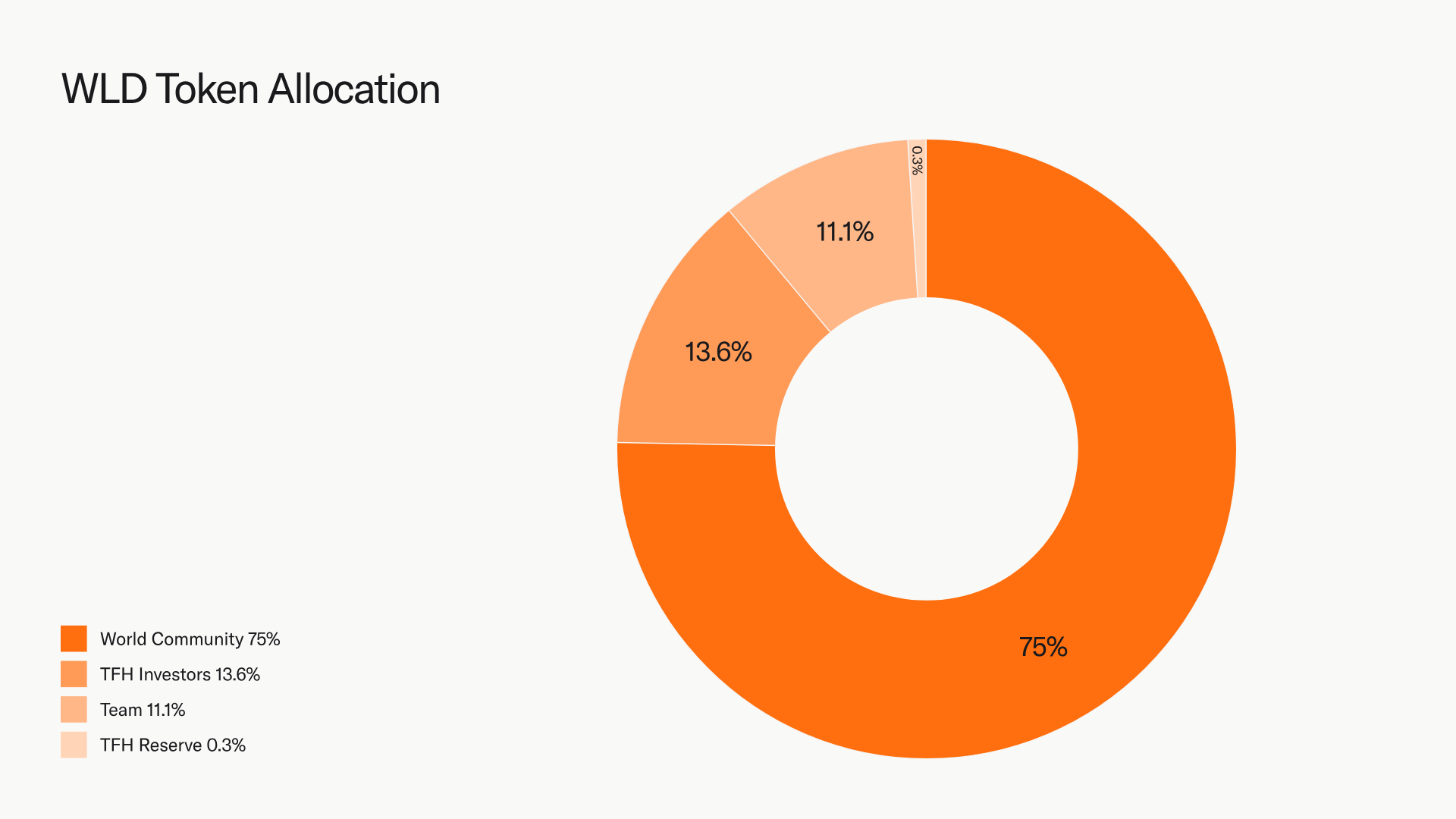

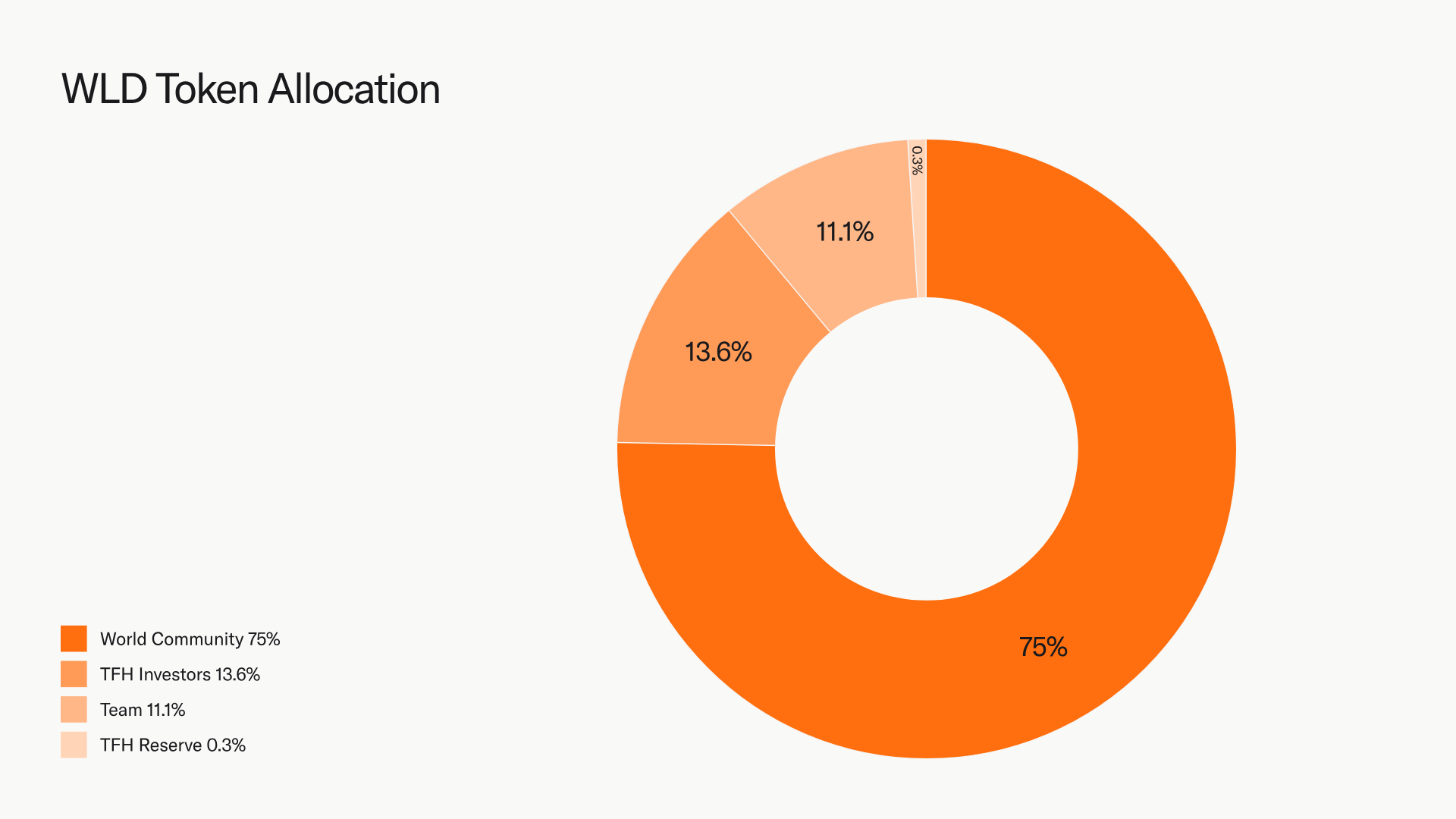

The structure of the initial token allocation of WorldCoin is as follows:

- 75% of the total WLD supply is designated for the WorldCoin community (mainly for user airdrops)

- 9.8% allocated to the development team

- Investors of Human Tools Tools (organization behind the project) 13.5%

- TFH reserve fund 1.7%.

Source: WorldCoin

On-chain data shows that the circular supply of WLD has grown steadily due to the ongoing token distribution. In July 2023, when the token debuted, only about 100 million WLDs were in circulation. By late April 2025, the recycled supply jumped to about 1.3 billion WLD, accounting for 13% of the total supply.

After the token was sold to A16Z and Bain Capital Crypto, the circular supply increased to about 1.51 billion WLD, or 15%.

Although the sale caused a mild dilution, there are now 100,000-1 million WLD wallets now with $798 million, more than half of the supply.

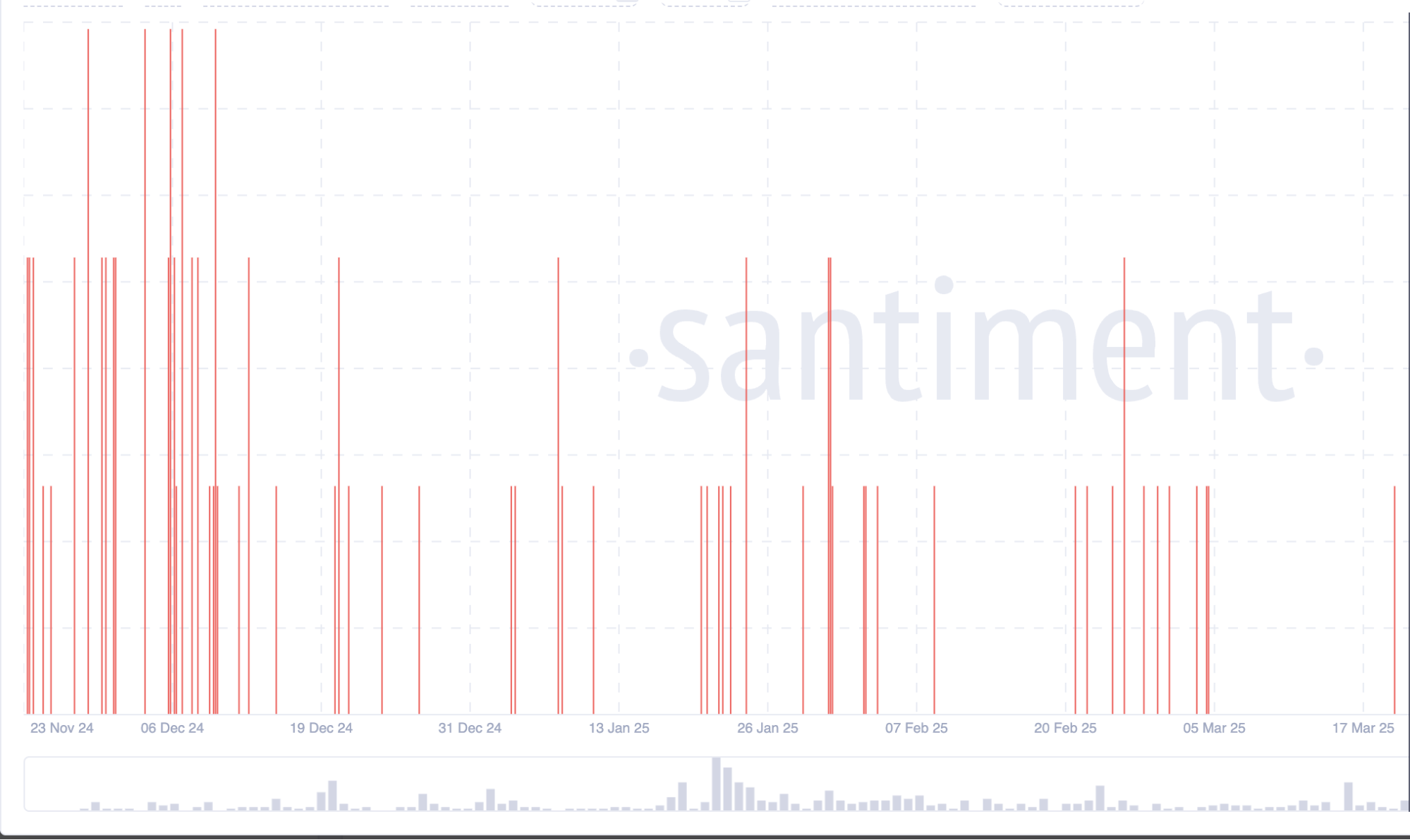

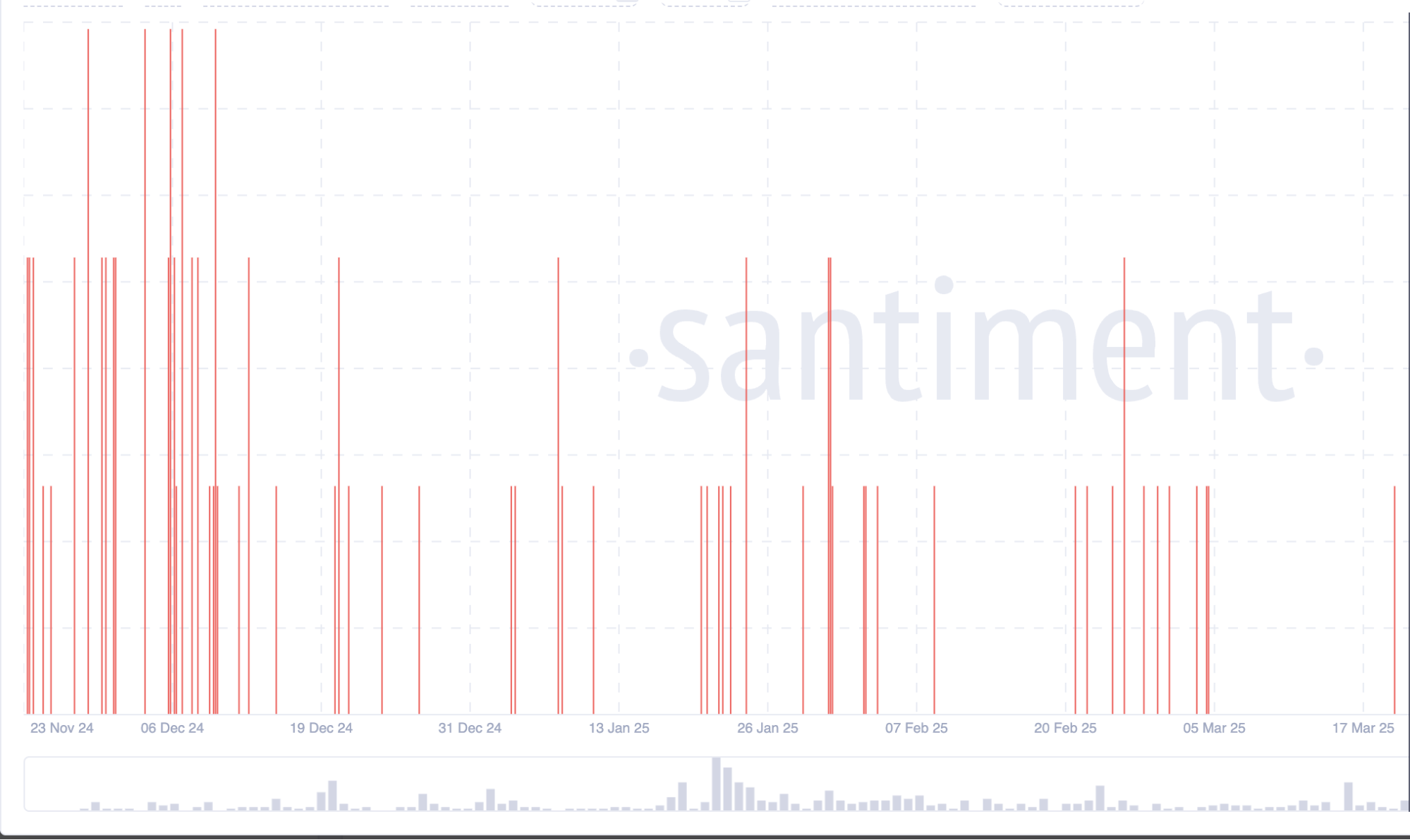

Emotional data show that Whale Wallet increased by 13 million WLD in the last week of April. This steady accumulation shows that major investors trust the long-term value of WLD at current prices – a bullish sign.

Source: santiment

The latest data from Arkham Intelligence also highlights the concentration of WLD holdings among famous entities. Optimistic wallets account for about 2.85% of WLD, while Bithumb holds 1.36%.

These allocations suggest that most of the supply is in the tier 2 and exchange locations, suggesting WorldCoin’s listing strategy.

On the other hand, teams and early investors still account for 23.3% of the total supply. Over time, these tokens are unlocked and sales pressure may increase if stakeholders make a profit.

Learn more: XRP Price Forecast in Q2/2025: Bullish Signals

However, over the next few months, the tokens were unlocked from the team and the Treasury. Additionally, recent purchases by A16Z and Bain suggest that they may hold their tokens for a long time. Now, most sales pressure comes from users who receive monthly token grants and sell them.

Dune Analytics data shows that millions of WLDs are allocated to new and existing users every month. For example, 1 million new users get 16 WLDs and 6 million get 3 WLDs. It may add about 34 million WLD per month.

Source: Sand Dunes

Progress of “Iris Scan” deployment

Since its official launch in July 2023, WorldCoin has greatly expanded its global Orb device network. The project reports that it deploys approximately 1,500 spheres in more than 35 cities in more than 20 countries, with strong operations in Europe, Asia and Latin America.

By the end of April 2025, WorldCoin had verified 12.5 million users in 160 countries. In May 2025, the project was officially launched in the United States after a long period of anticipation – deploying spheres in six major cities (Atlanta, Austin, Los Angeles, Miami, Nashville and San Francisco) and establishing “World Space” as a user experience center tailored to the U.S. market.

Source: WorldCoin

In addition, WorldCoin has partnered with Kalshi, a licensed forecasting market platform, and Morpho, a decentralized loan agreement, to explore the integration of world IDs, aimed at augmenting the utility of its unique digital identity system.

WorldCoin’s vision is gradually taking shape: expanding its user base when building real-world applications for World ID, laying the foundation for the long-term value of WLD.

Technical Analysis

In the second half of 2023, WorldCoin (WLD) trades between $1 and $2 in a relatively stable range. But, driven by the sharp push of the AI investment narrative, the focus on Sam Altman and AI-related projects has grown – WLD soared to an all-time high of about $11.74 on March 10, 2024.

This peak proved unsustainable. In the following months, WLD suffered huge downward pressure due to the growing profitability and revolving supply, eventually retreating to around $2 by the end of 2024. It is worth noting that WorldCoin launched its 2-layer blockchain, Worldchain, in October 2024 due to the price drop.

On the daily chart, WLD has recently formed a series of higher highs and higher lows since April 2025, indicating a short-term uptrend. In early May, the price exceeded the 50-day moving average (MA50) and was priced at $0.90-1.00 – a recent bullish indicator.

Meanwhile, the 200-day moving average (MA200) remains above the current price level, hovering around $1.60 at around $1.50, indicating that the long-term trend has not completely reversed to the upside. However, the gap between the MA50 and MA200 is narrowing.

If the upward momentum continues, Golden Cross – The MA50 may form where it crosses above the MA200, further enhancing the bullish momentum.

Source: TradingView

The liquidity and market momentum around WLD are also worth noting. During bullish periods, trading volumes tend to surge, indicating a strong buying interest when prices burst.

Overall, technical indicators show that WorldCoin is in a short-term recovery phase after establishing the bottom earlier this year. Price patterns and momentum indicators point to positive outlook, although confirmation of a sustained upward trend will require WLD to break through the key resistance levels of strong volumes.

Basic Analysis

Bitcoin has been setting new all-time highs, recently surpassing $112,000. The total capitalization of cryptocurrency market capitalization also climbed to $3.6 trillion, up more than 10% in just a few weeks. The signal that emerged this time suggests that the return on capital is the return of risky assets in a situation where a bear market driven by optimism may have ended and a new growth cycle is emerging.

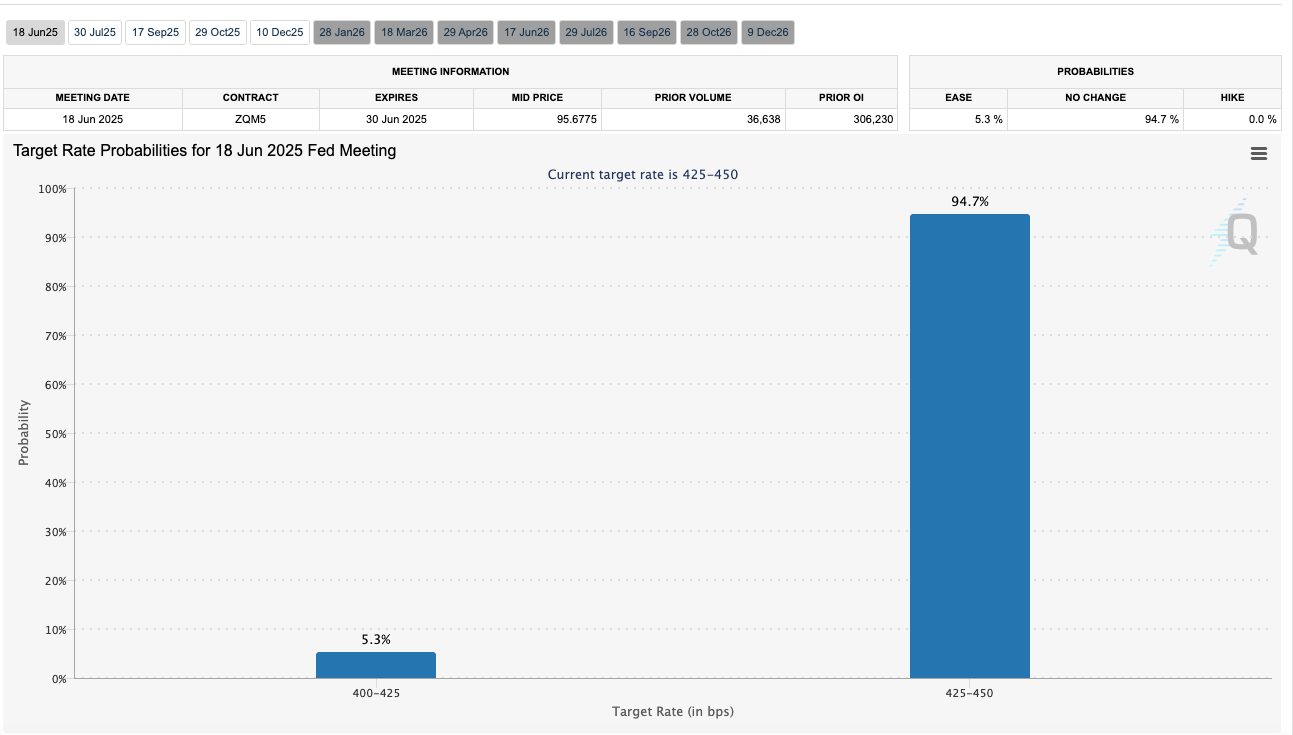

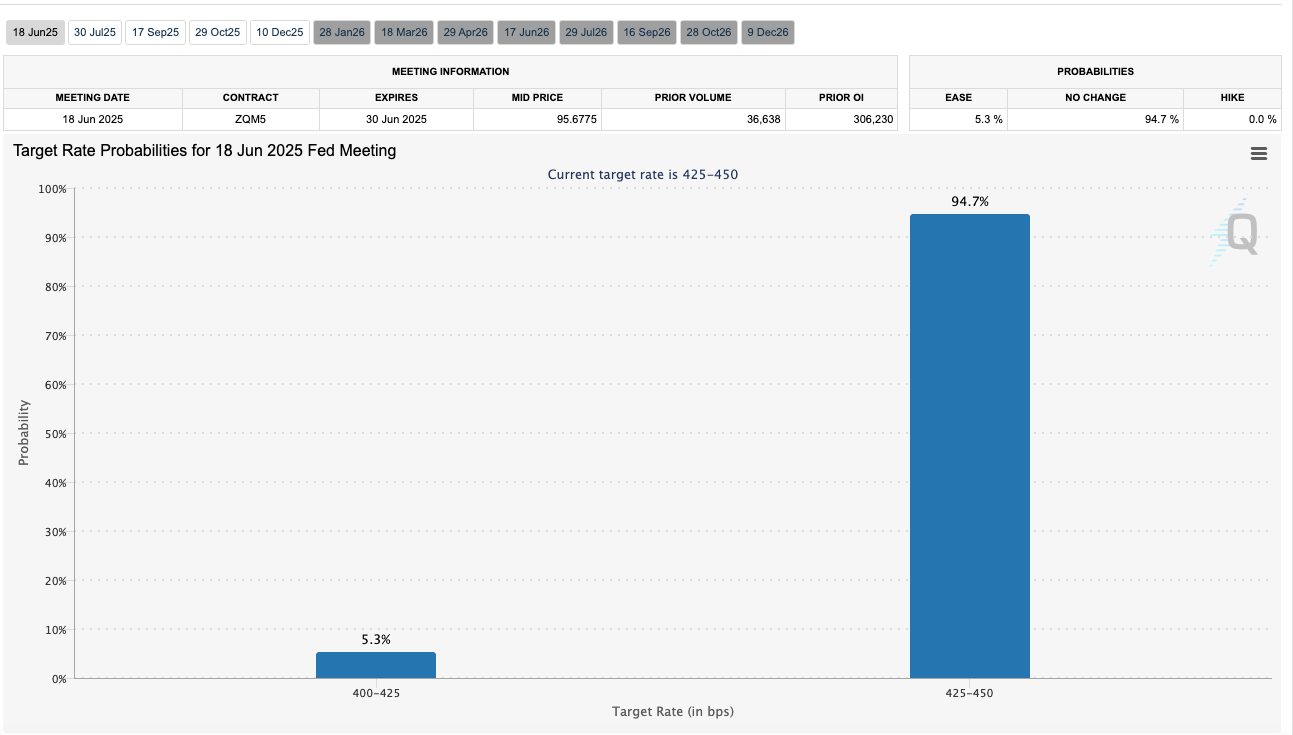

Meanwhile, the global interest rate environment appears to be stabilizing compared to volatility in 2022-2023. After a positive tightening cycle to curb inflation, the U.S. Federal Reserve suspended interest rate hikes. Now, market participants expect potential interest rates to be lowered by the end of 2025, depending on the reserved inflation.

Source: CME Group

However, a key macro factor is the regulatory landscape. As mentioned earlier, WorldCoin is located at the intersection of several highly sensitive topics: biometric data, digital identity, privacy, and cryptocurrency. This puts the project under scrutiny by regulators around the world. A global transformation is underway to establish a legal framework around digital identity and data privacy.

For example, the EU has implemented strict general data protection regulations (GDPR) and plans to introduce stricter rules for projects that process sensitive data such as WorldCoin.

If authorities in Germany, France and other countries conclude that the world currency violates data protection laws, it may require the project to change its operating model and even stop its activities within the EU.

From the perspective of market sentiment, the world currency occupies a unique position. The project spans today’s most outstanding technological narratives – AI and blockchain. As a result, any development related to Sam Altman or the broader AI sector could indirectly affect WLD’s price action and investor perceptions.

WorldCoin price forecast: WLD price outlook short-term outlook

Over the next few weeks, an optimistic scenario suggests that WLD can continue its upward trajectory, targeting the $2.00-2.40 range, and may revisit the last seen highs at the end of 2024 over the next 1-2 months.

A more likely basic case: WLD is driven by guesswork in the short term of $1.00-$2.00.

Investors should keep an eye on the level of around $1.30 as it represents nearby resistance where a technical pullback is likely to occur. When it comes to support, $1.00 (or deeper back horseback) is a powerful mat. If WLD can maintain support above these thresholds after a smaller correction, the sustained bullish structure will be strengthened.

Anyway, WorldCoin is currently at a critical point. If the project follows its roadmap and headwinds in the ride market, WLD may see short-term growth.

Read more: Trading with free encrypted signals in the Evening Trader Channel