Virtual Protocol has become a unique player in the AI X Web3 space, enabling investors to create, co-owned and monetize AI agents, contributing to one of the most promising AI projects in the Web3 space, providing a range of opportunities to win virtual protocol air conditioning through participation and staking.

This guide takes you through how to master locals Virtual Tokens and start to receive rewards through innovative fake models of the protocol.

What is a virtual protocol?

Virtual Protocol is a decentralized AI platform based on Coinbase’s Ethereum Layer 2 solution, and the focus of virtual protocols is to align AI-powered proxy with community-driven incentives. It enables users to create and co-owned AI agents that can be integrated in gaming, data analysis, and creative applications, supporting the development of decentralized applications across multiple sectors.

At the heart of the ecosystem is virtual tokens, which are the primary medium for transactions and points, and can be purchased on supported communications through those who wish to purchase virtual protocols to begin interacting with the Virtuals protocol ecosystem.

The protocol provides a unique put-in mechanism where anyone can lock their virtual tokens to win rewards from Vevirtual – voted tokens, grant governance rights and qualify for Airdrops and Airdrops and Rewards, designed to benefit long-term token holders by active participation. The established structure is also suitable for users who want to be consistent with the project’s airflow mechanism.

The token has a fixed total supply and an actively monitored circular supply, providing transparency and providing healthy market dynamics for token holders. The established structure is also suitable for users who want to be consistent with the project’s airflow mechanism.

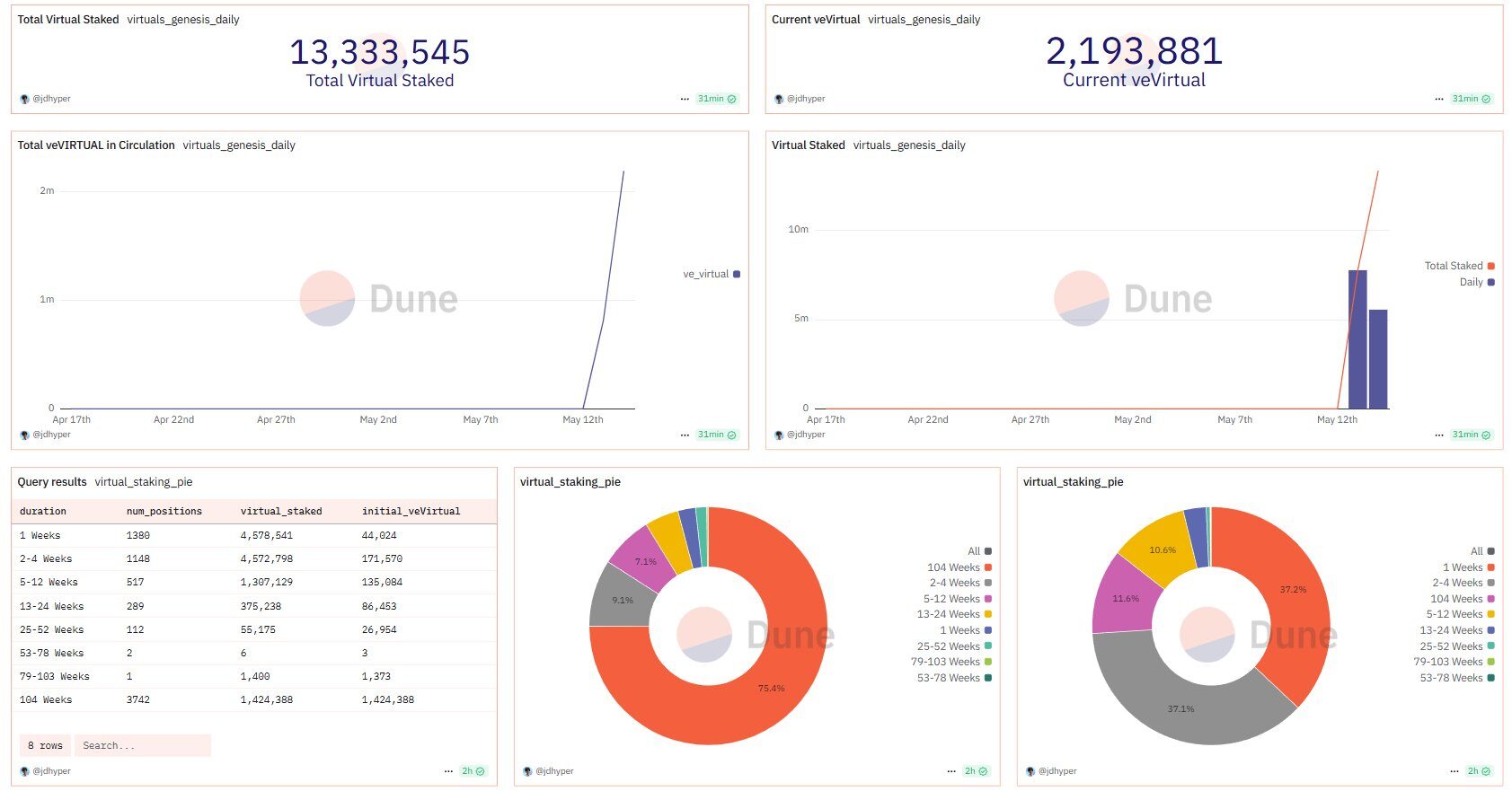

Source: Sand Dunes

Why use virtual protocol?

What is formulated on virtual protocols is not only to earn crypto-flying aircraft, but also involves long-term participation in the growth of the AI agent economy. Here are some compelling reasons:

- Governance capability:Vevitual holders can participate in key governance decisions.

- Airflow qualification: Only Stakers are eligible for Genesis Airdrops and the upcoming Genesis LaunchPad project.

- Generate opportunities: Based on storage duration and commitment, virtual virtual will be awarded to continuous agreement rewards.

- Enhanced influence: The Starks gained more falsehood, which translates into the weight of decisions and benefits.

Where to buy virtual tokens

To start your journey through a virtual protocol, the first step is to purchase a virtual token. Currently, virtual is listed in several scattered and centralized exchanges. One of the easiest options to access is UNISWAP (on the basic network), MEXC and GATE.IO, which provide reliable liquidity.

For users familiar with MetAmask, such as MetAmask, buying on UnisWap is a great option – just make sure you have ETH on the basic network to pay for your gas. Additionally, centralized communications such as MEXC and GATE.IO provide a user-friendly experience and support Fiat payment methods such as credit cards or electronic currencies.

Step by step guide: How to bet virtually

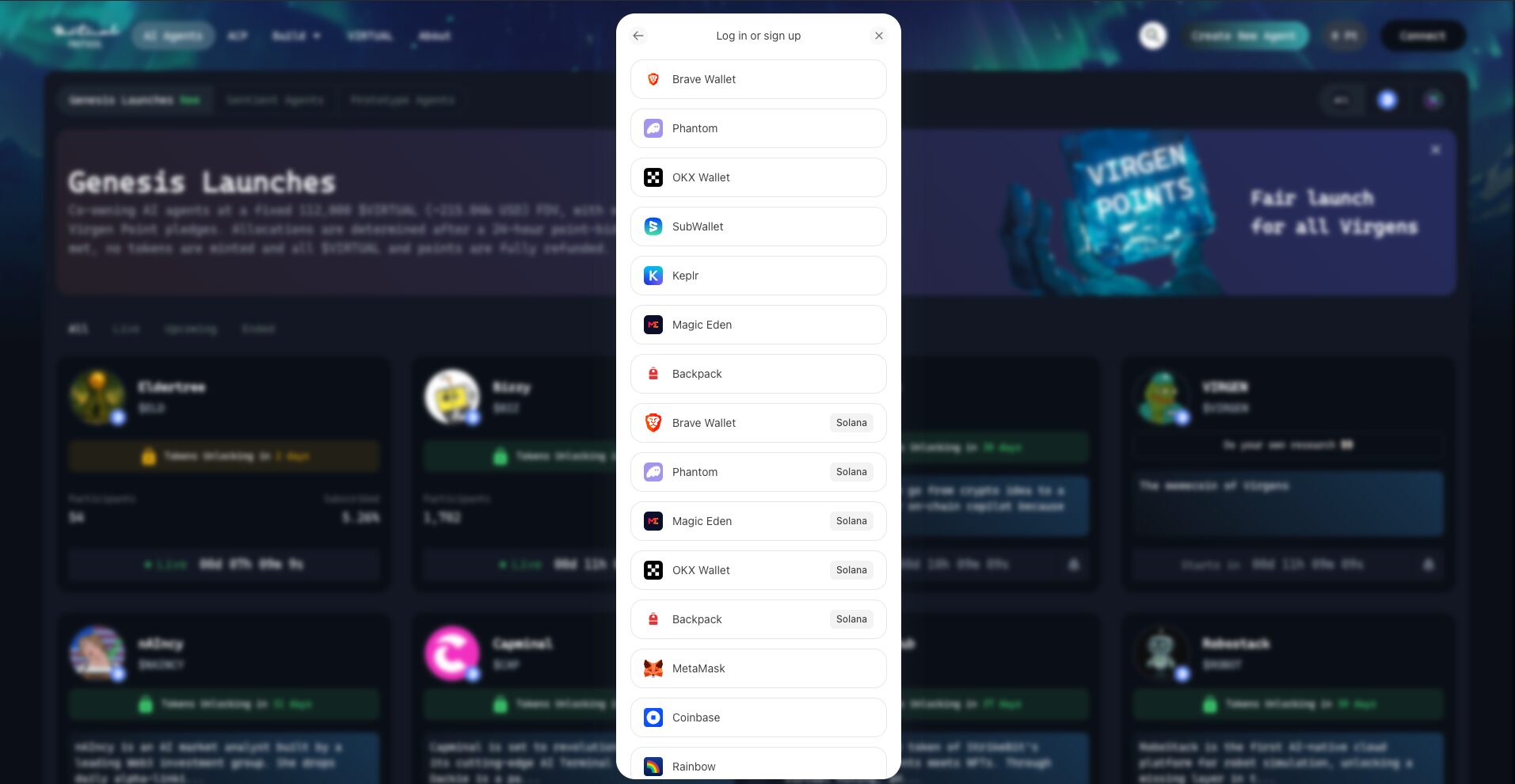

Step 1: Set up a Web3 wallet

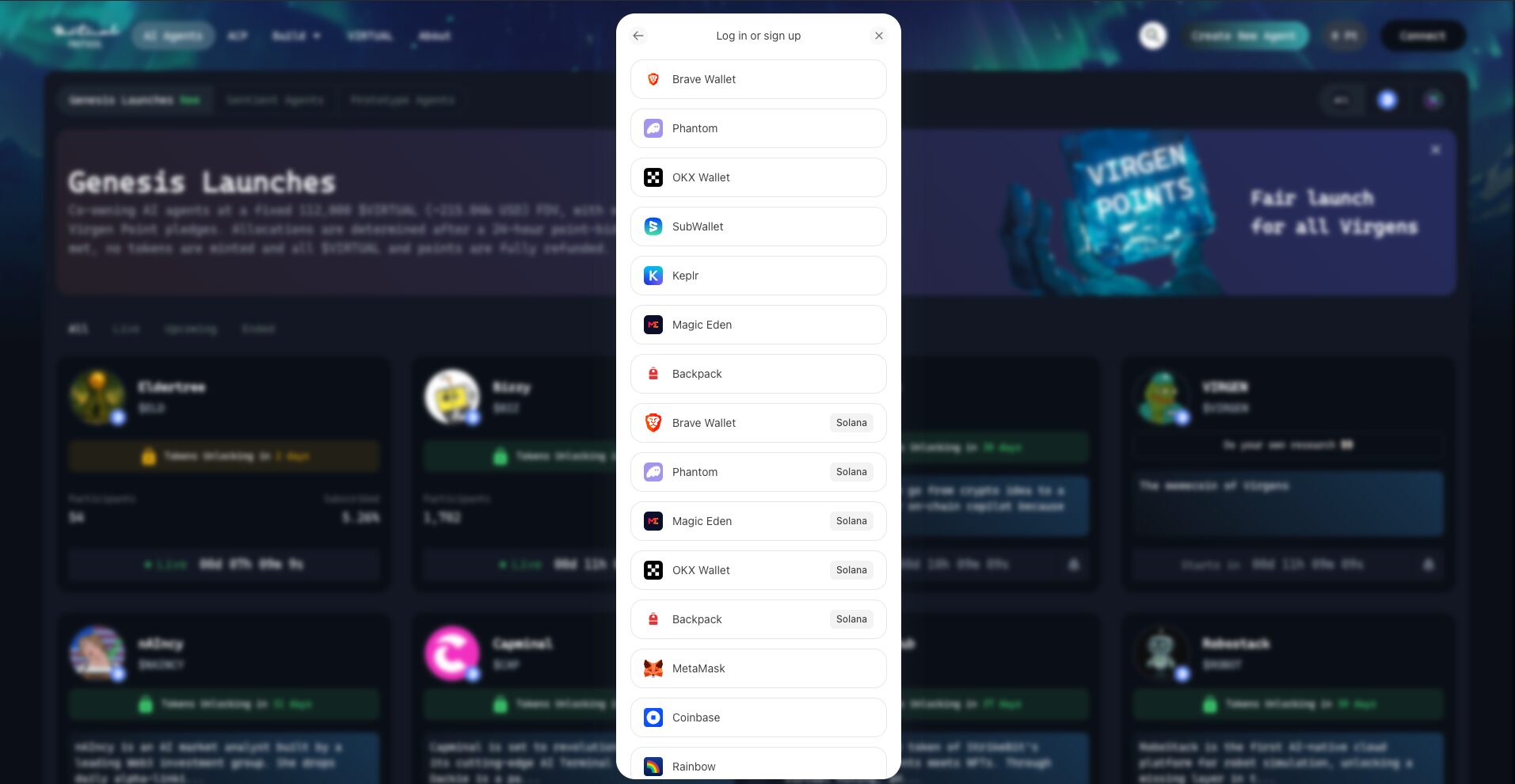

Before storing, make sure you have a Web3 wallet, such as MetAmask, Okx Wallet…fund your wallet with ETH (for gas charges) and virtual tokens.

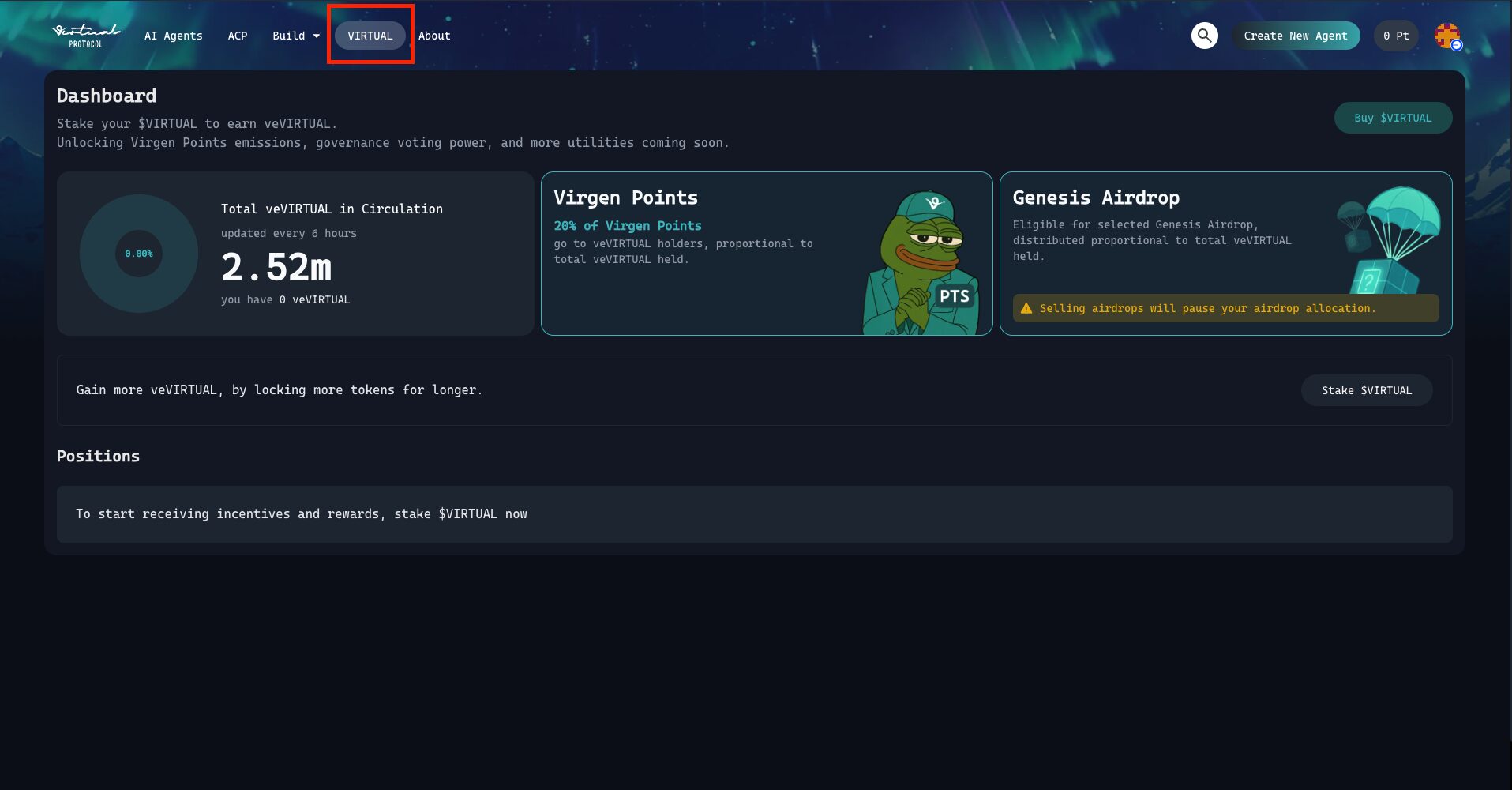

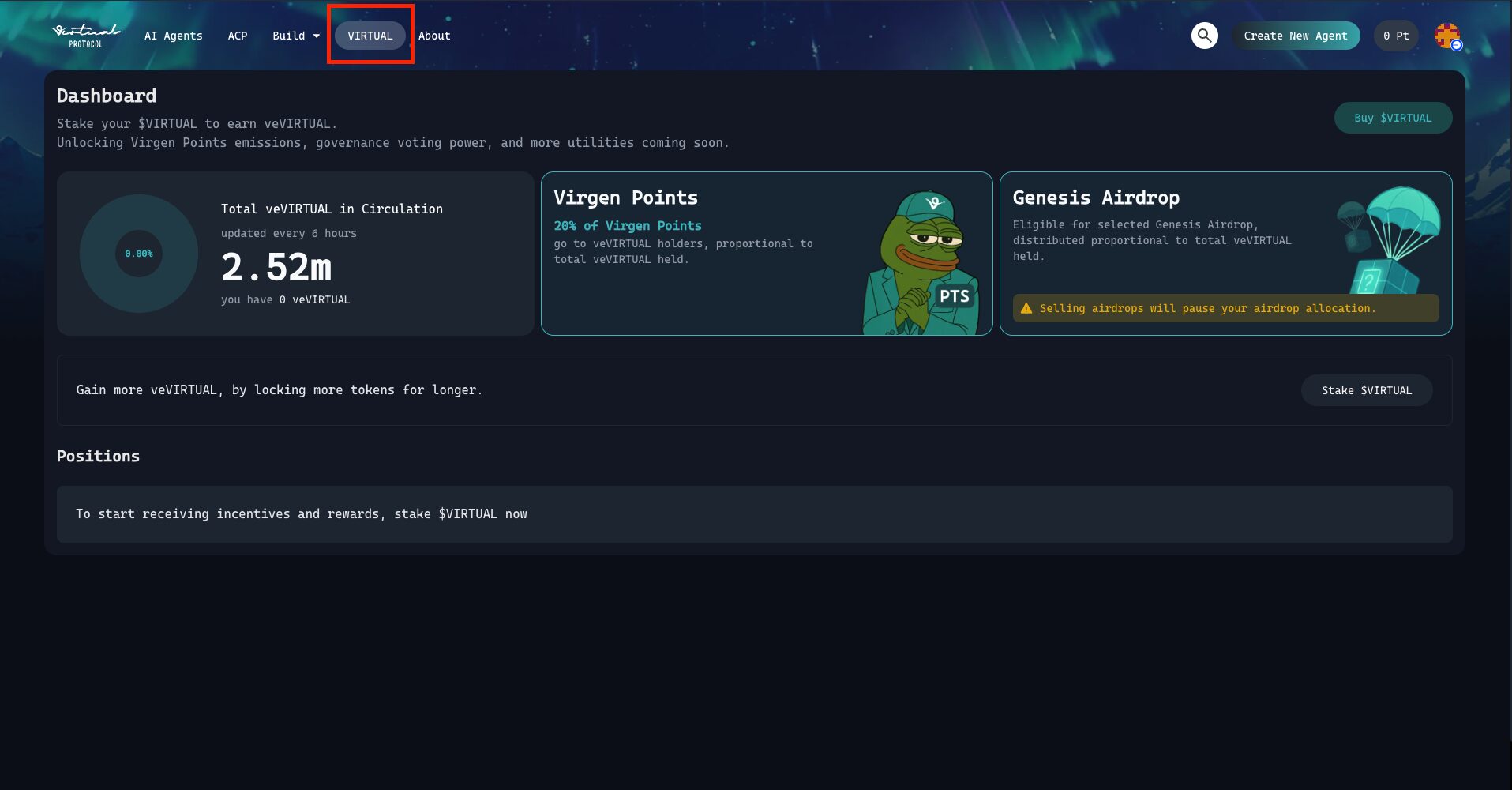

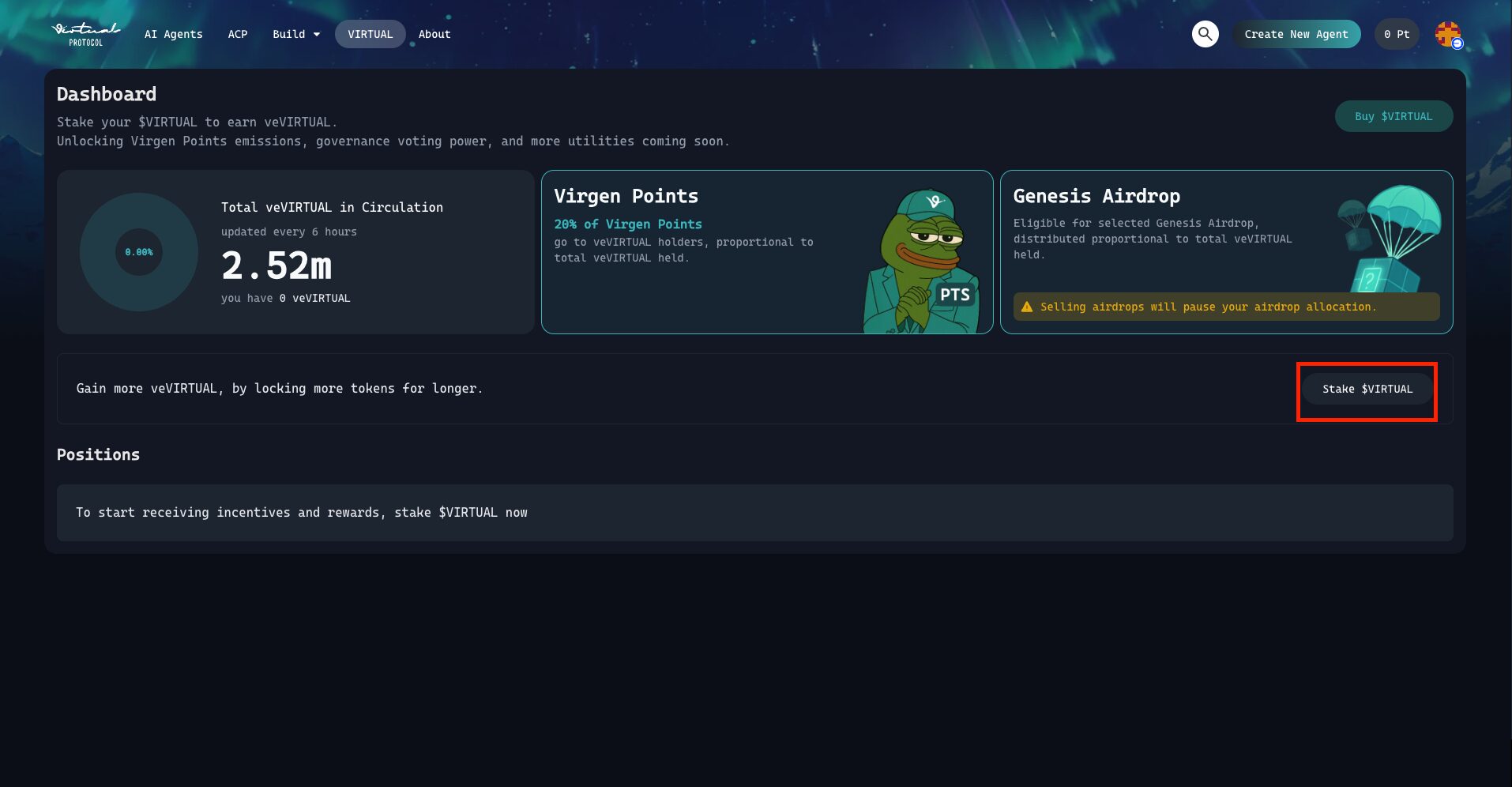

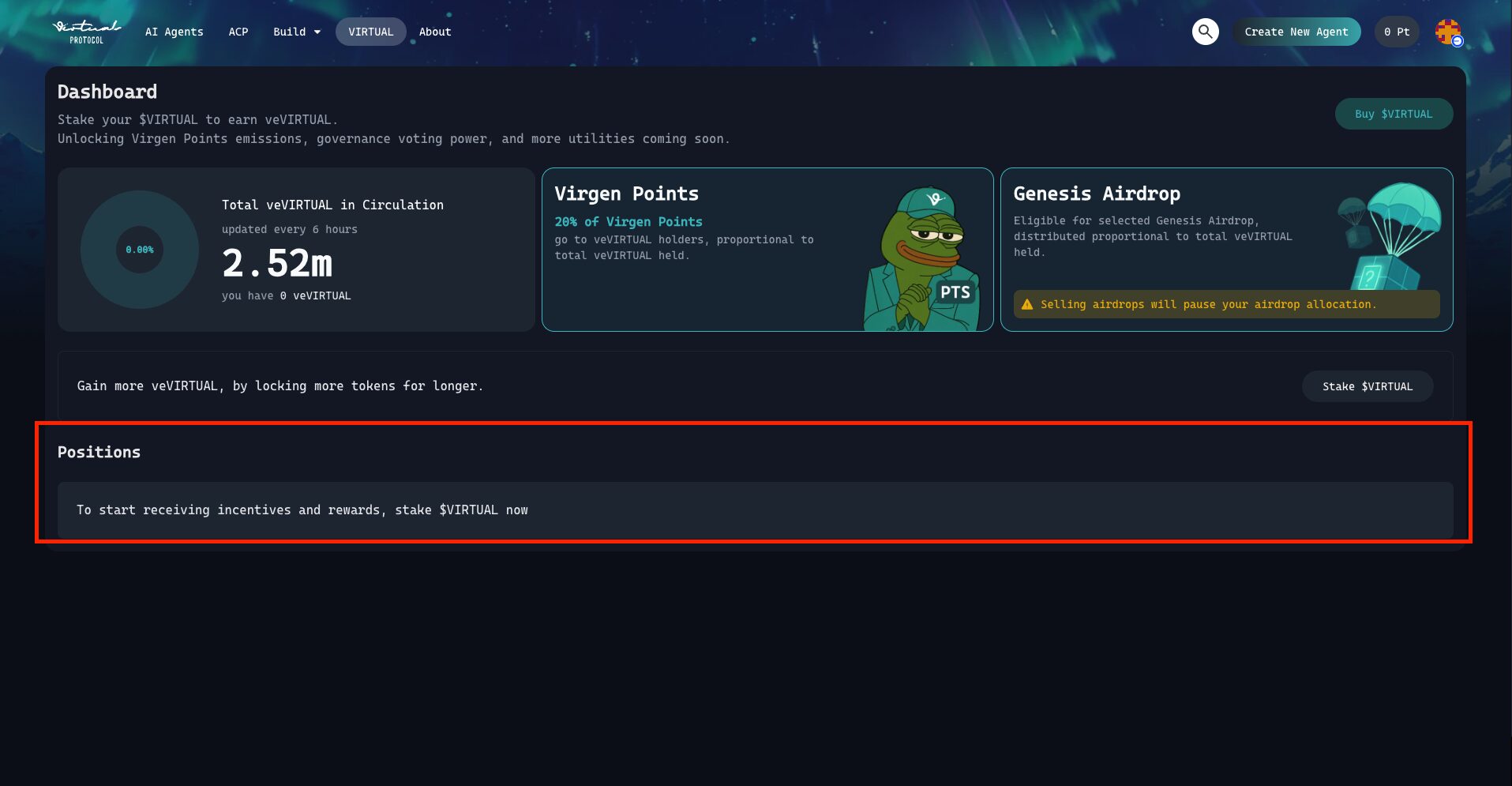

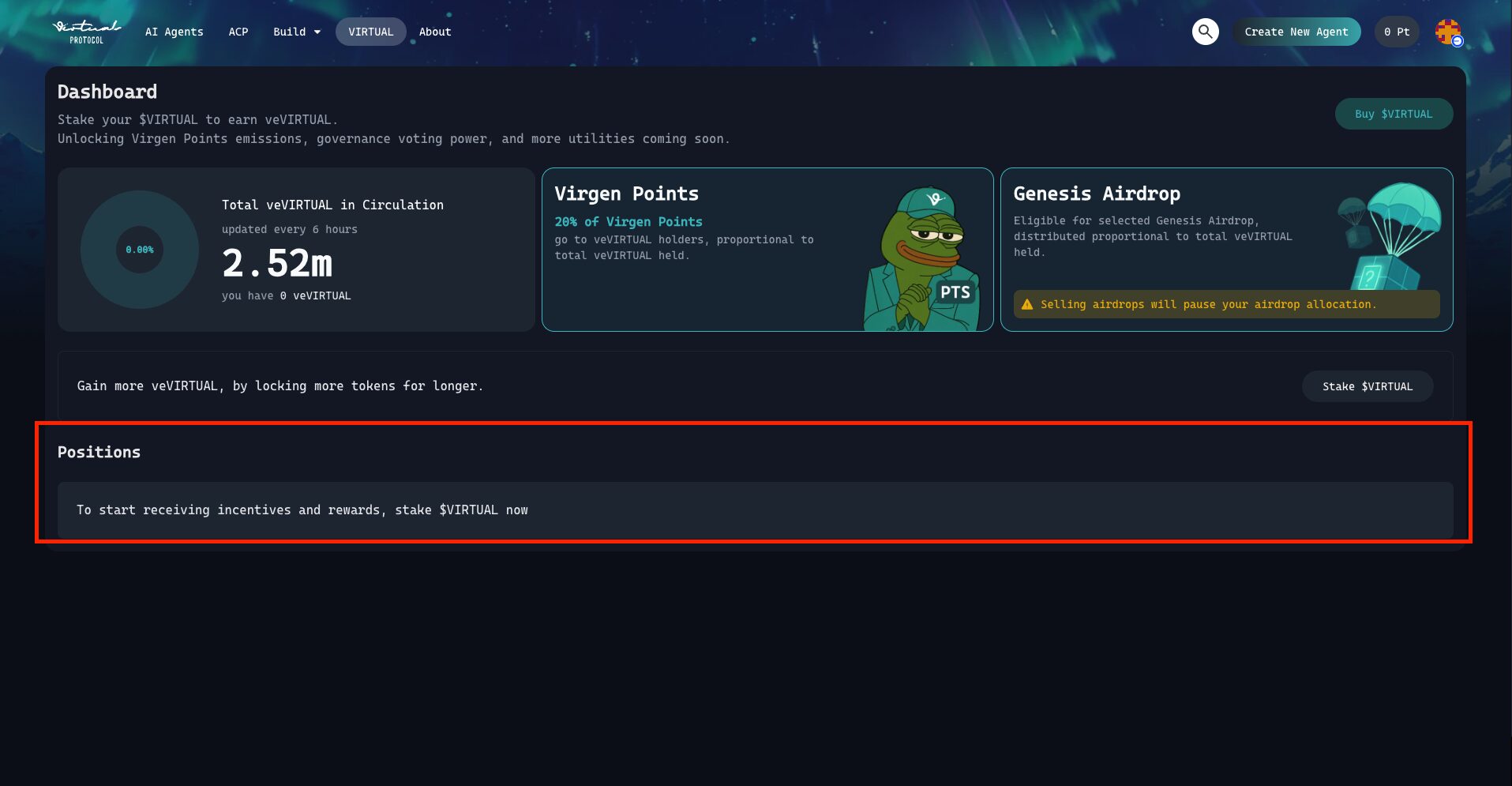

Step 2: Access the Virtual Protocol Dashboard

Navigate to the virtual protocol in the upper left corner to enter the portal. Connect your Web3 wallet and make sure you are on the Basic or Solana network. This ensures rapid and low-cost deployment of fixed measures throughout the protocol.

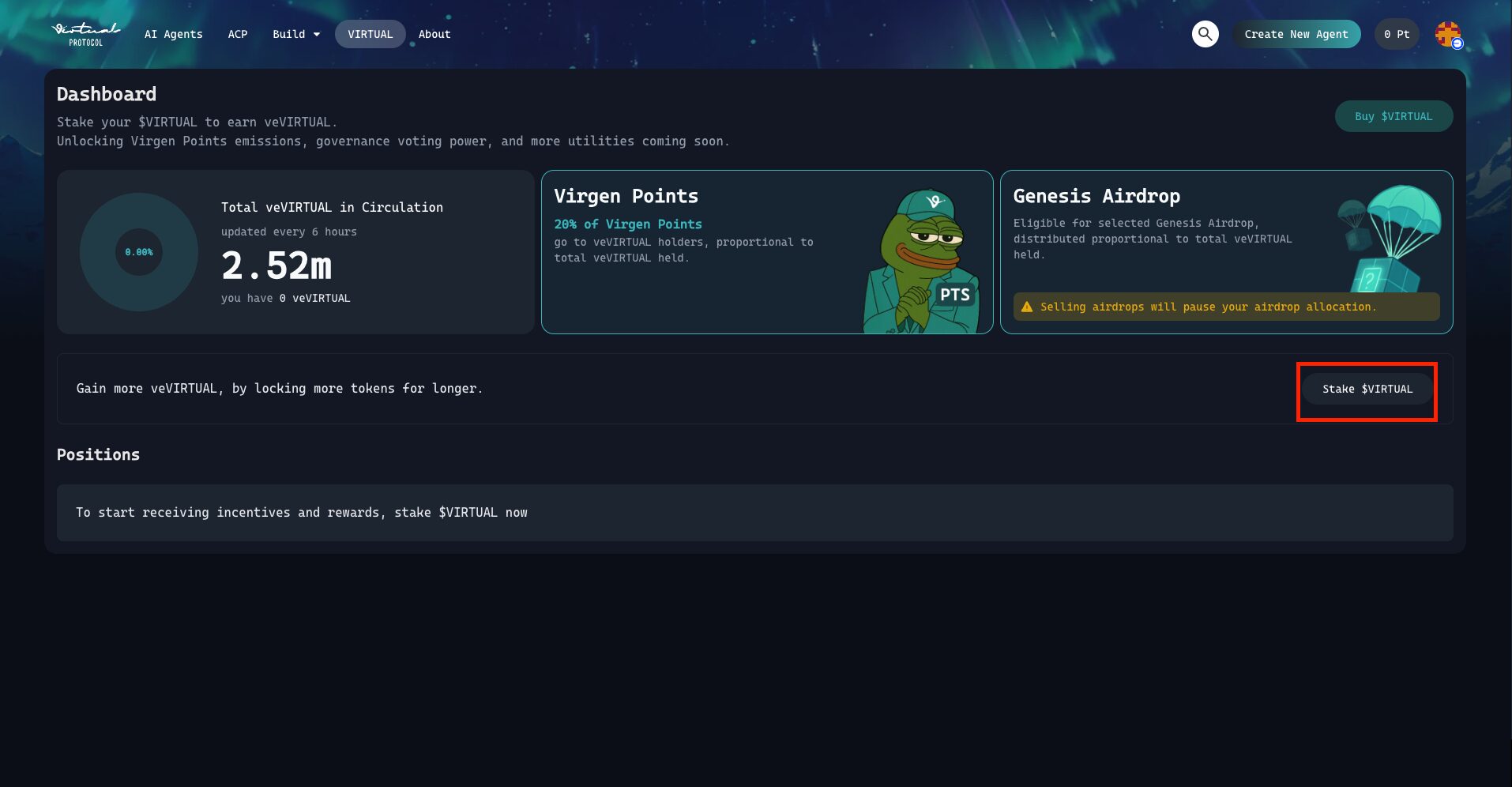

Step 3: Navigate to the stacking section

Once connected, go to the “Staking” section. You will find an interface that allows you to store virtual tokens.

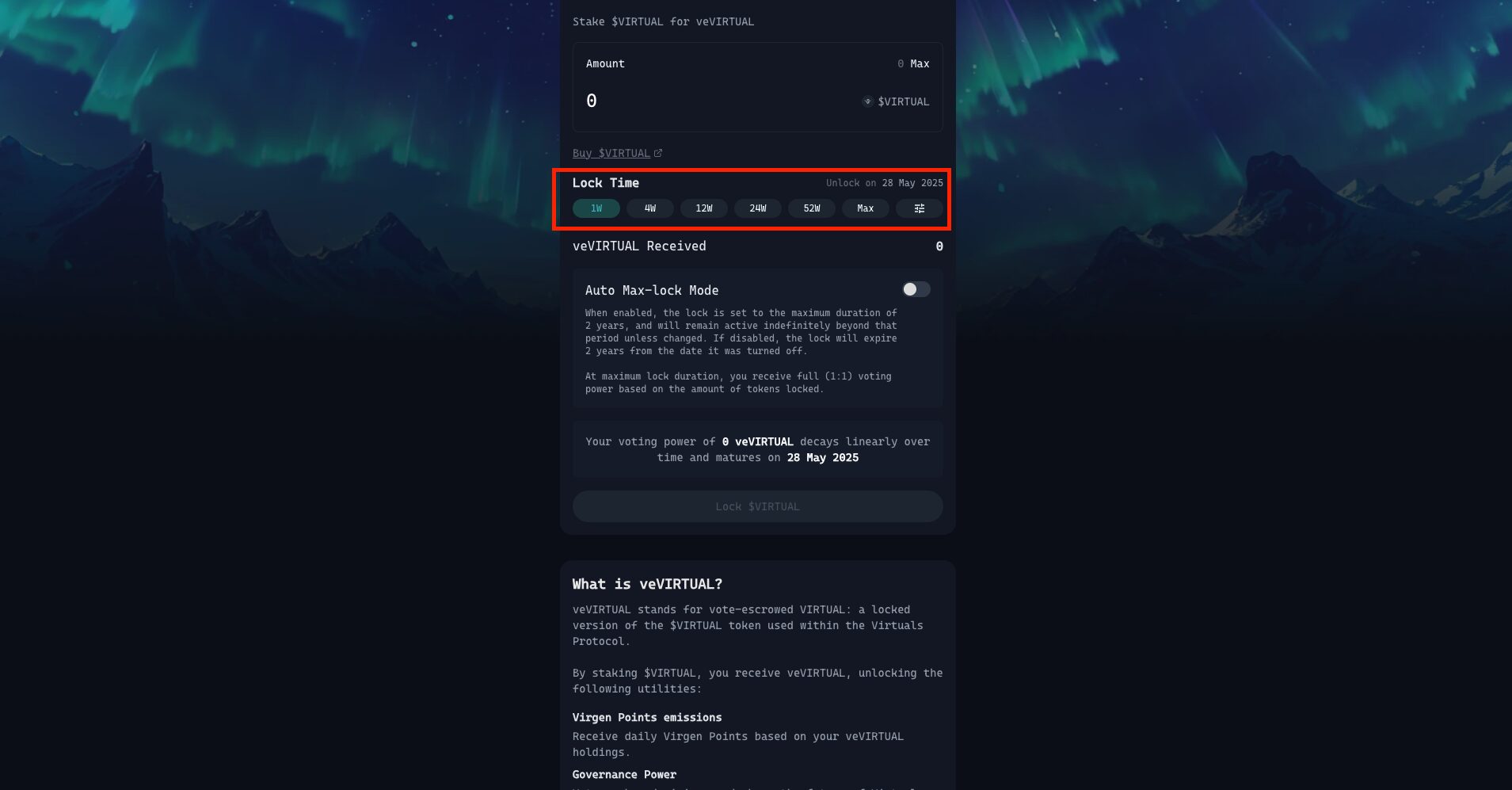

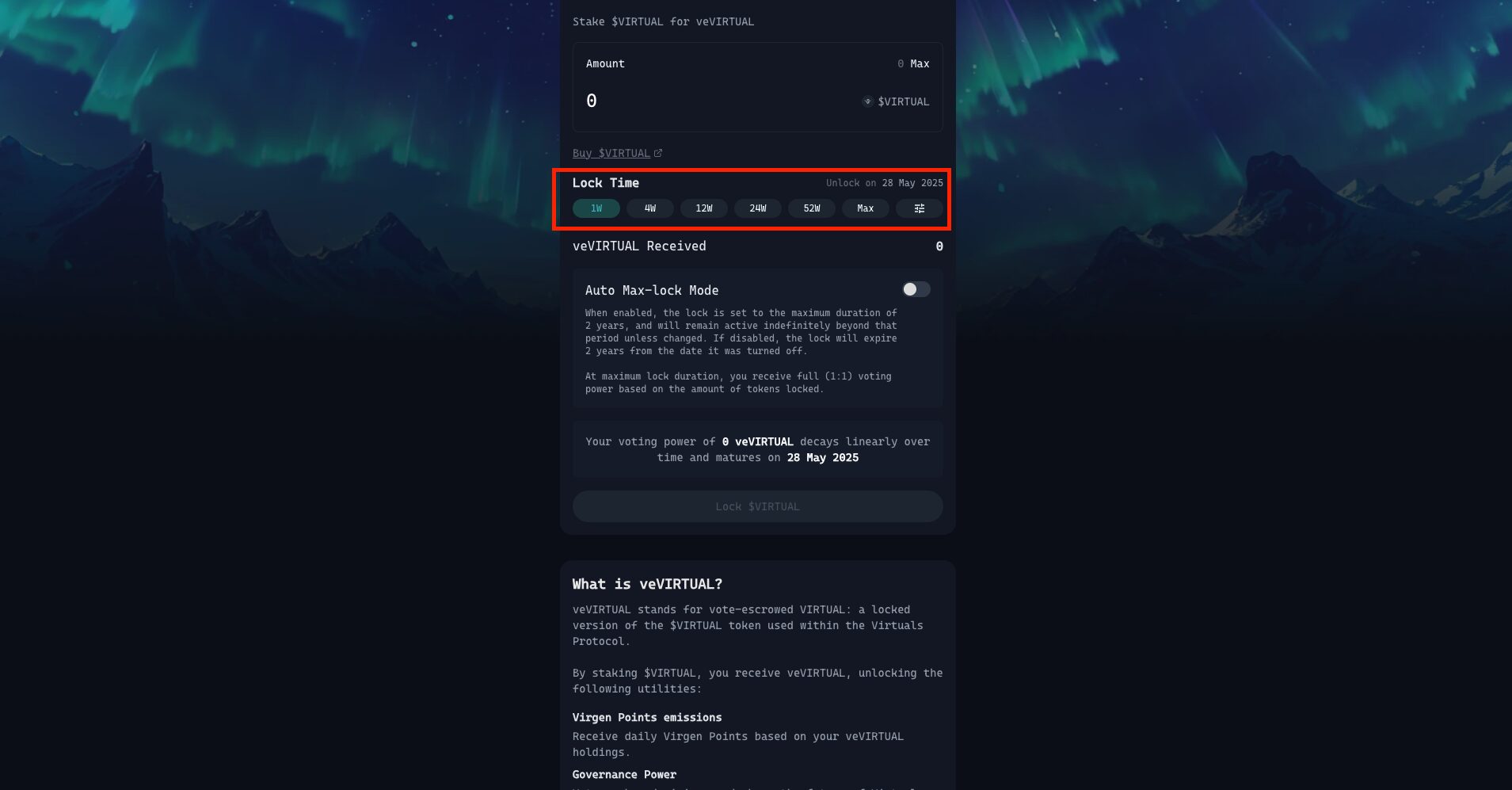

Step 4: Select the lock duration

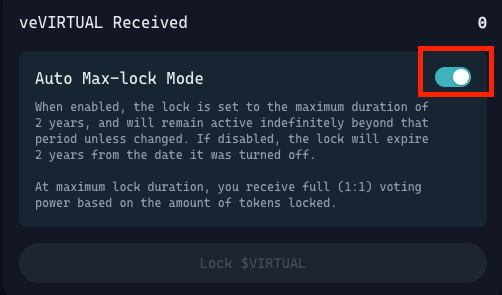

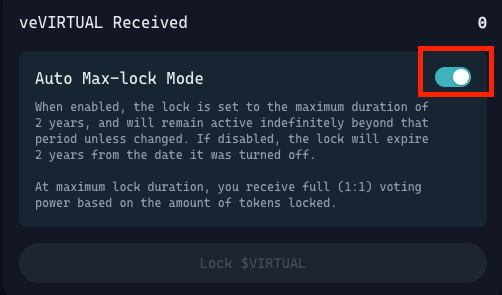

Select the virtual amount you want to store, and then select the lock duration. The longer you lock the token (up to 2 years), the more annoyances you will receive. Users can also select the “Auto Maximum Lock” feature to automatically lock the entire semester and get a 1:1 Vevirtual to Virtual ratio.

Step 5: Confirm the transaction

Approve established transactions in your wallet. You may be prompted to sign two transactions: one for approving token spending and the other for locking tokens.

Step 6: Check your viviral balance

After confirming the transaction, your fake balance will be seen on the dashboard. This token represents your shares and voting rights.

The utility of points

The practicality of making on virtual protocols lies not only in the token rewards, but also in the access to the grants it grants exclusive ecosystem features and governance impacts.

1. Genesis airflow

The Virtuals team has released Genesis Airdrops specifically reserved for Vivirtual holders. These airdrops come from partner projects, internal plans and new agreement integrations.

2. Governance participation

False holder:

- Financial part allocation

- Incentives related to agency

- Protocol upgrade

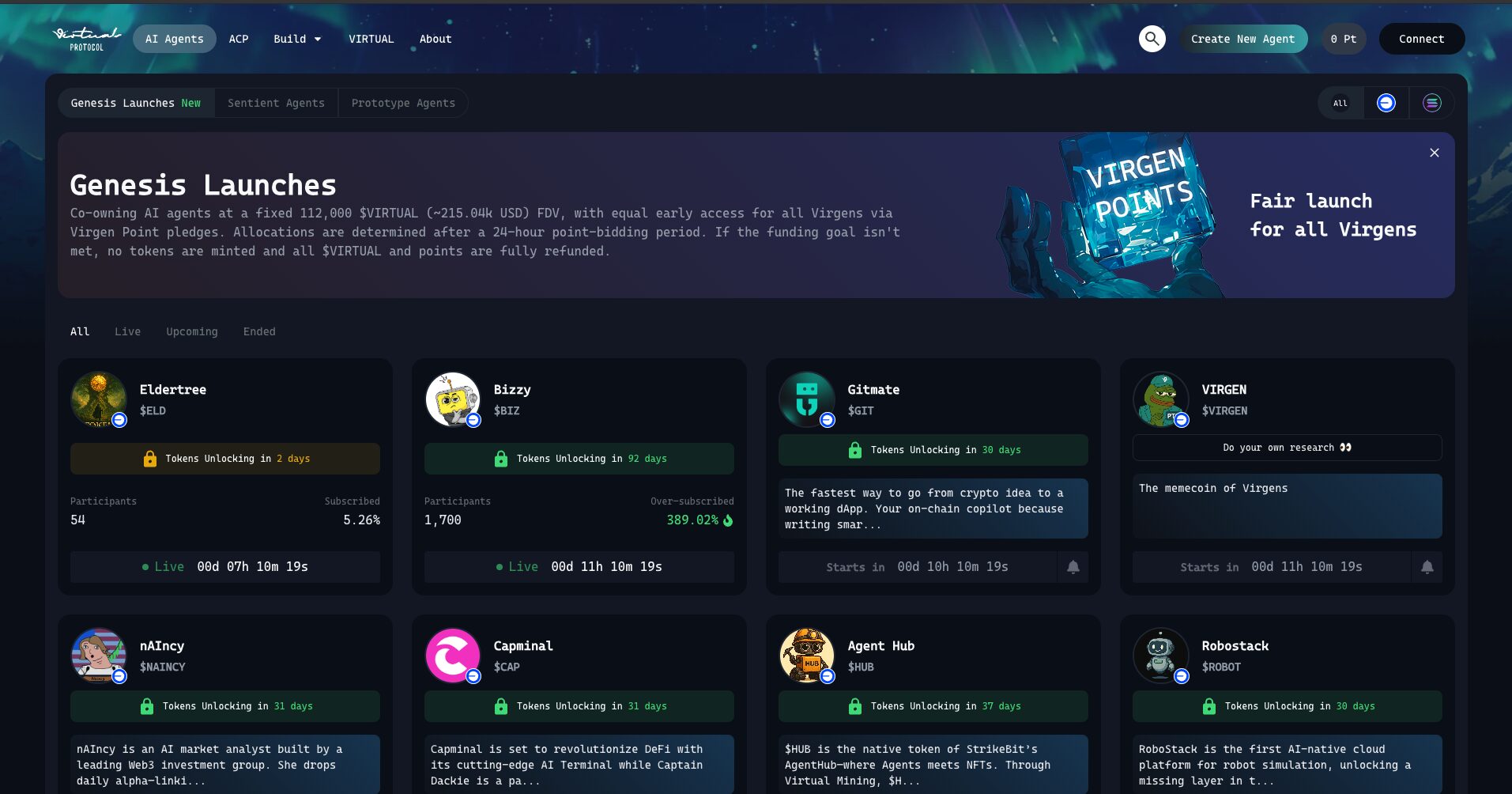

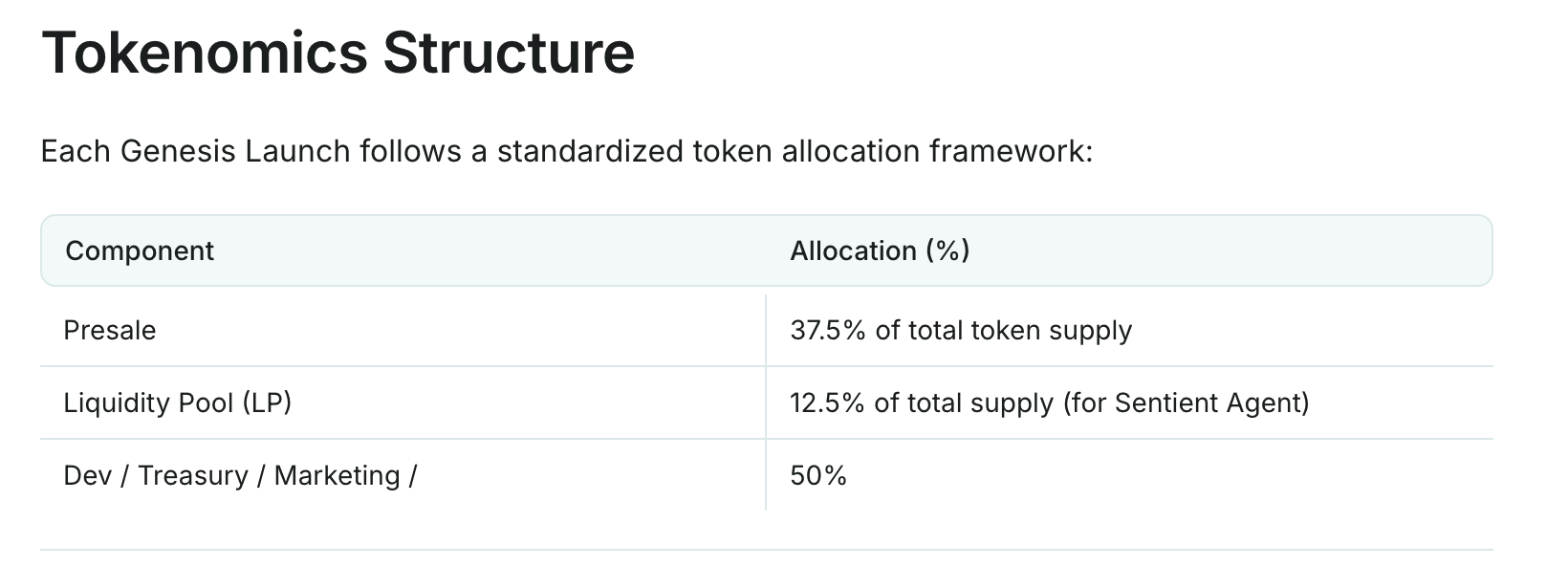

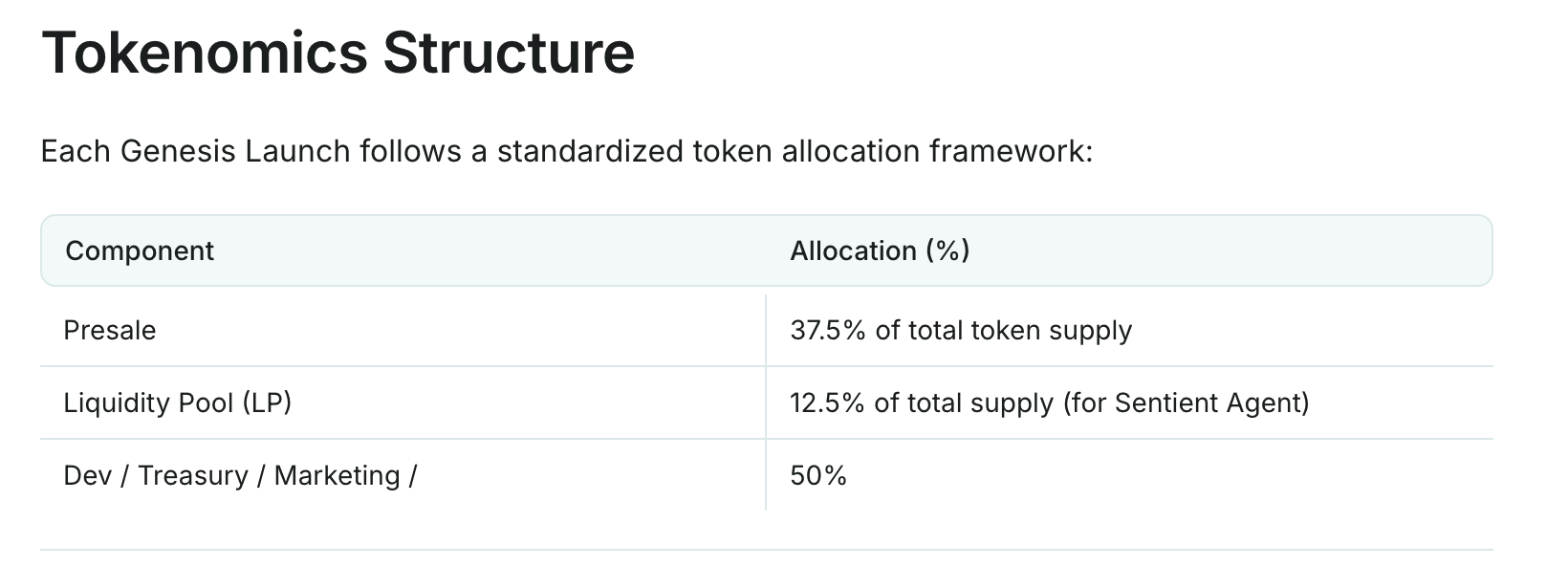

3. Genesis LaunchPad access

Projects launched in a virtual ecosystem typically conduct community sales or allow listing activities for case holders.

4. Agreement Reward

The longer the lock time, the higher the reward multiplier. Rewards are distributed regularly and may include other virtual tokens or tokens from ecosystem partners.

How to Earn Virgen Points

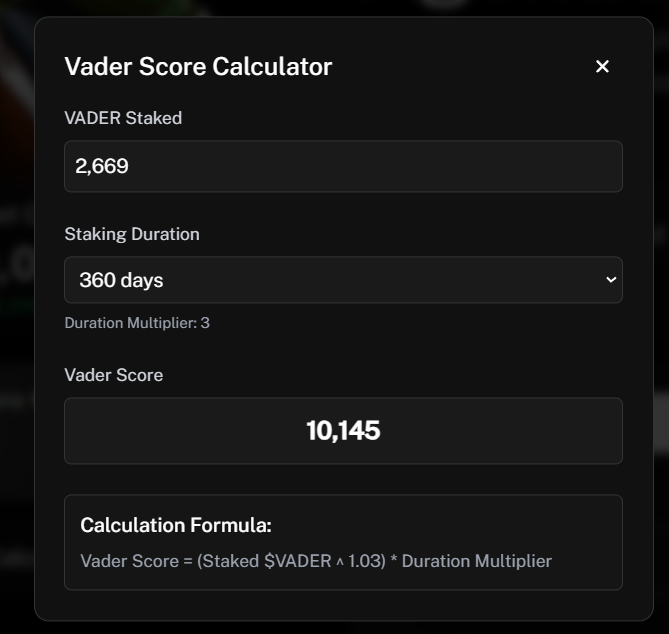

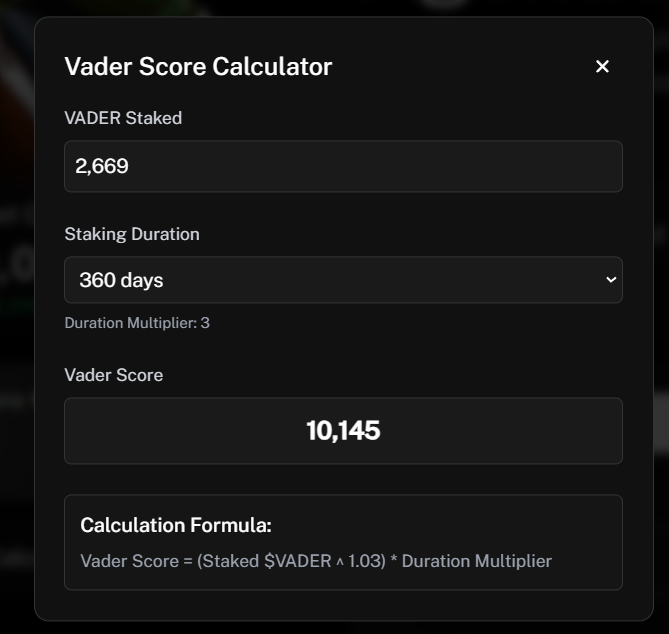

To participate in the Genesis launch, users must accumulate Virgen points, which is the same as accessing tickets for early token sales. More points mean higher allocation and better pricing.

Points can be earned in a variety of ways – by holding or placing virtual, participating in activities such as virtual tides, Stakeking partner tokens (e.g., $vader or $aixbt), or contributing content about virtual on social platforms. Holding over 24 hours of Genesis tokens or other points that induce community participation.

Please note that Virgen points usually expire after 14 days and must be used in time to prevent hoarding and encourage ongoing activities.

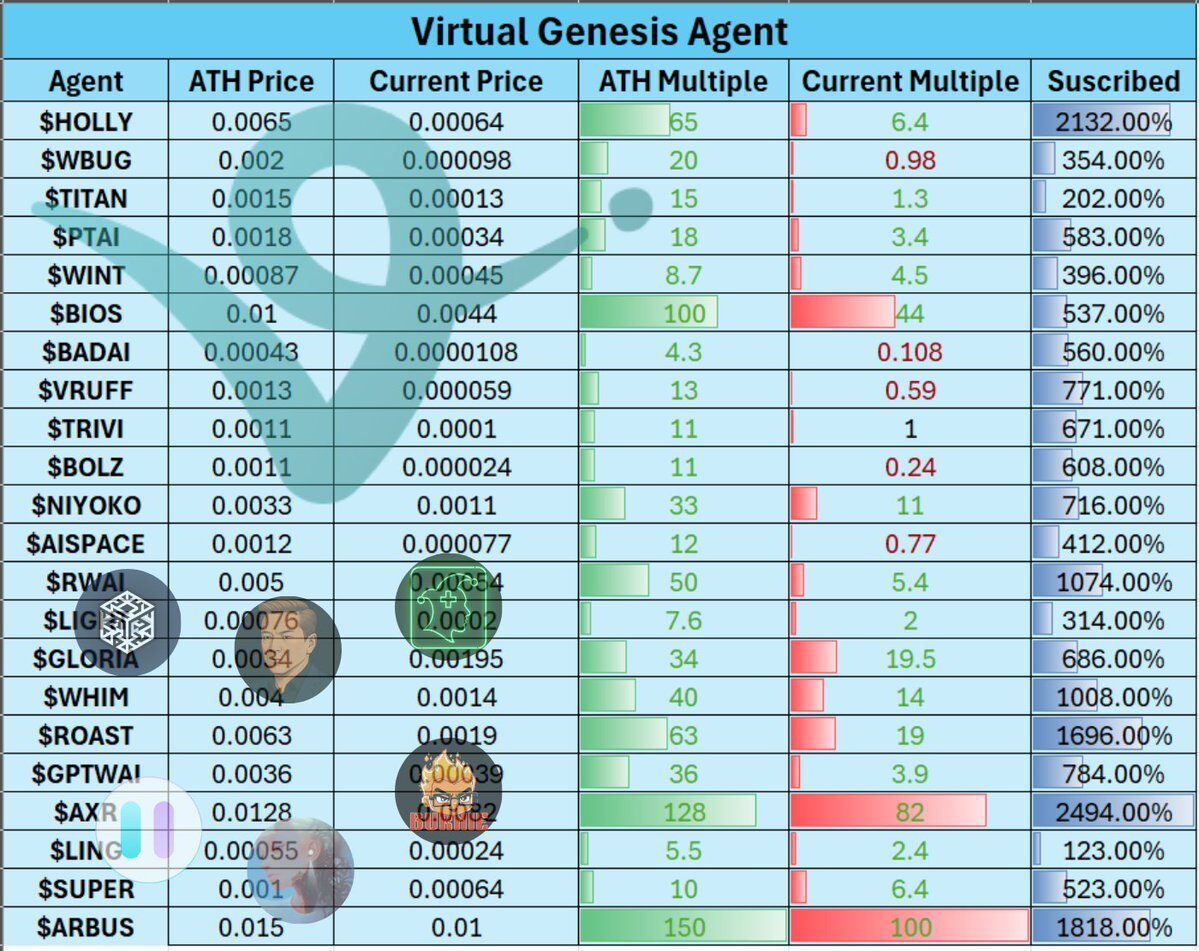

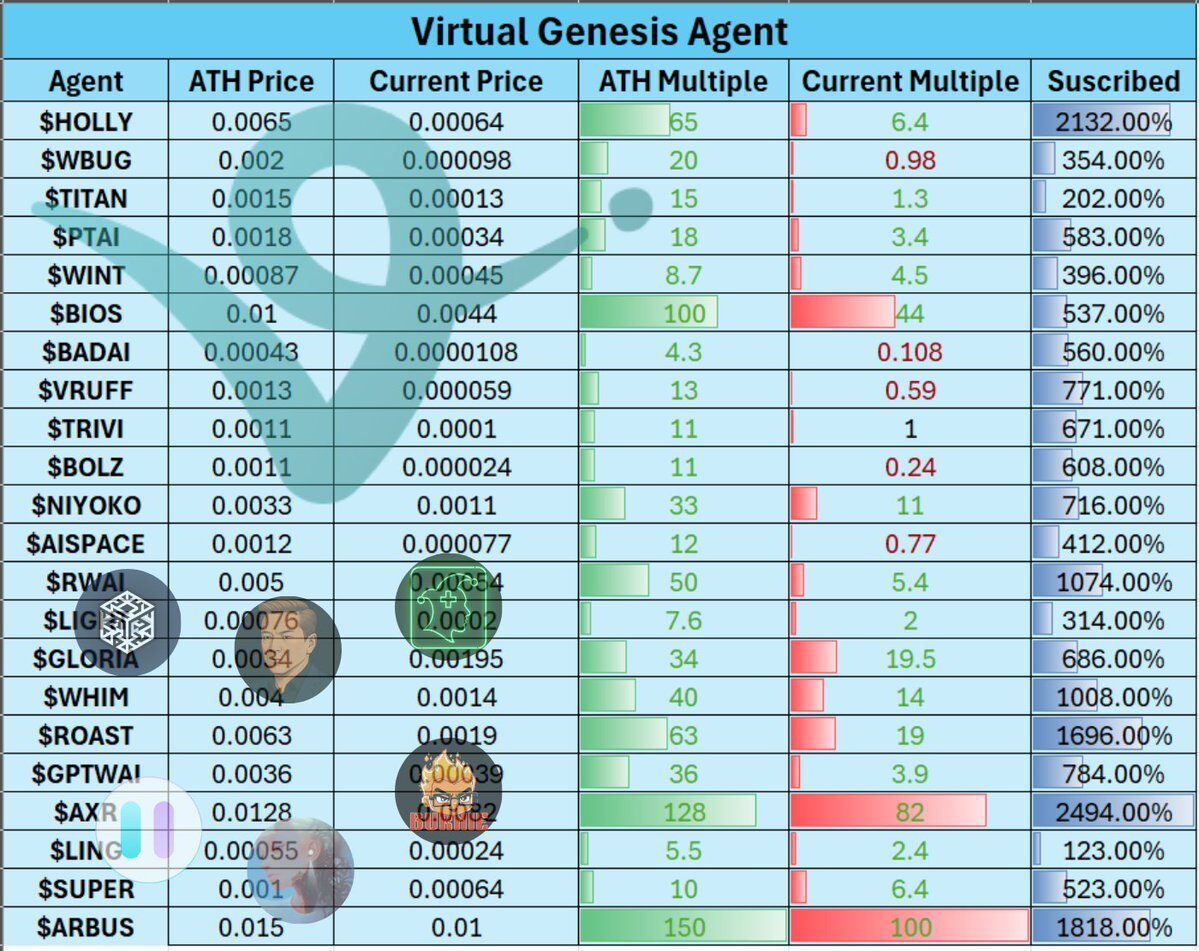

Recent Staking & Airdrop Return

During the Genesis launch of Arbus AI (Arbus) in mid-May 2025, many participants reported massive returns. One investor shared that they used 460 points and a small amount of virtual to buy Arbus, with an estimated return of 20 times.

Just a few days ago, the sales of Axelrod (AXR) tokens also brought great benefits. One participant contributed approximately 1.2 virtual and 7,100 points to earn a 9,503 AXR, which was worth about $170 at the time.

These examples demonstrate the potential of double-digit ROI for active participants. The market sentiment of these launches is very positive, which enhances confidence in the protocol reward mechanism. These not only determine how incentives are allocated, but also affect investors’ behavior.

While there is no fixed APR like traditional Defi pools, Virtuals’ model emphasizes meaningful contributions. Investors no longer have a stable yield, but instead receive new tokens at discounted prices and can obtain airdrops of tokens based on participation.

Source: Smart Ape

Although these returns are difficult to quantify using conventional metrics, the success of recent events shows that possession of a virtual ecosystem is attractive for anyone actively involved and supports the platform’s long-term vision. Contributors who help build, test or promote virtual-based tools and content also play a crucial role in maintaining ecosystem momentum.

Disadvantages to consider

While accumulation is generally believed to be a safe and passive strategy, it is not without risks. The first major problem is liquidity – once you place the virtual tokens, they are locked and cannot be withdrawn until the term is over.

This means that if market conditions change, you will not be able to sell or move tokens. If virtual prices drop sharply during this period, you will not be able to exit your position or limit losses, making Sting a potentially high-risk strategy in volatile market conditions.

Another key danger is the vulnerability of smart contracts, and although the agreement is reviewed, no system is completely immune to security flaws that can put investor funds at risk. Like any decentralized financial (DEFI) protocol, virtual protocols rely on code-based smart contracts that can damage funds if flawed or exploited.

Finally, there is an opportunity cost. Locking your tokens in deposit means that these assets cannot be deployed elsewhere, such as in other generated protocols or investments, which can lead to lost financial opportunities.

Before choosing a long-term lockdown period, you must evaluate your risk tolerance and fully understand your commitment.

Tips for maximizing rewards

To make the most of the virtual protocol, you can consider some practical strategies. First, using the automatic maximum lock feature ensures you get the maximum possible number of false information, thereby increasing your future air conditioner qualifications and improving your governance capabilities.

Secondly, actively participate in governance. By voting on suggestions and contributing to discussions, you can not only shape the future of the agreement, but also position yourself as a potential retrospective reward.

Finally, for those who don’t intend to hold virtual for a long time, Staking still offers attractive utilities. By locking in tokens to earn fake metal bonds, users can use their false stance as collateral to borrow other assets or participate in secondary earnings opportunities, turning short-term exposure into production capital without completely giving up liquidity.

in conclusion

Virtualization through virtual protocols is not just a passive income strategy, it is an invitation to co-create and co-owner the future of AI on blockchain. By locking your tokens and participating in governance, you contribute to the success of your agreement while enjoying tangible rewards. This also supports your ability to create long-term value in a decentralized AI economy.

Whether you’re an experienced Staker or a newbie to Web3, the friendly interface of virtual protocols, strategic incentives, and a fast-growing ecosystem make it a compelling choice for those seeking passive income and long-term engagement.