Bitcoin (BTC) is the world’s largest and most influential cryptocurrency, which has been back in the spotlight after pushing its price higher by the $110,000 mark in a sharp episode – a level that has not been seen since March 2025.

This revival has rekindled bullish sentiment in the digital asset market and has attracted new interest from retail and institutional investors. But what exactly is driving the influx of Bitcoin today?

Institutional inflow continues to accelerate

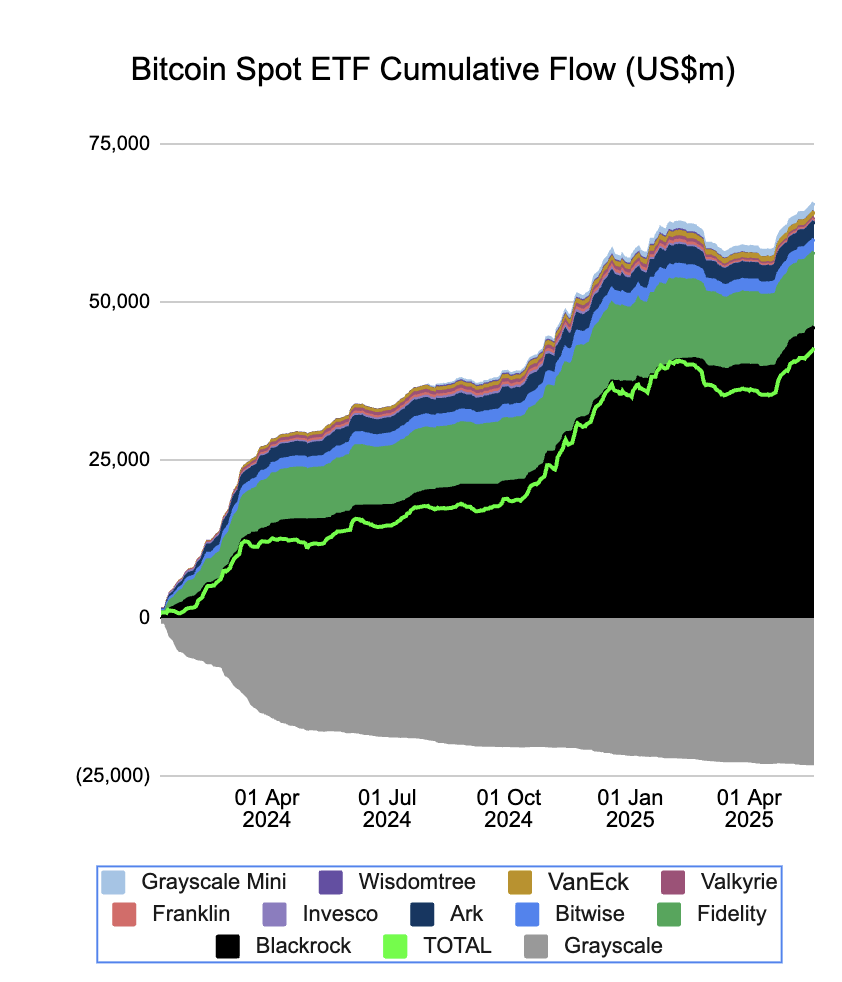

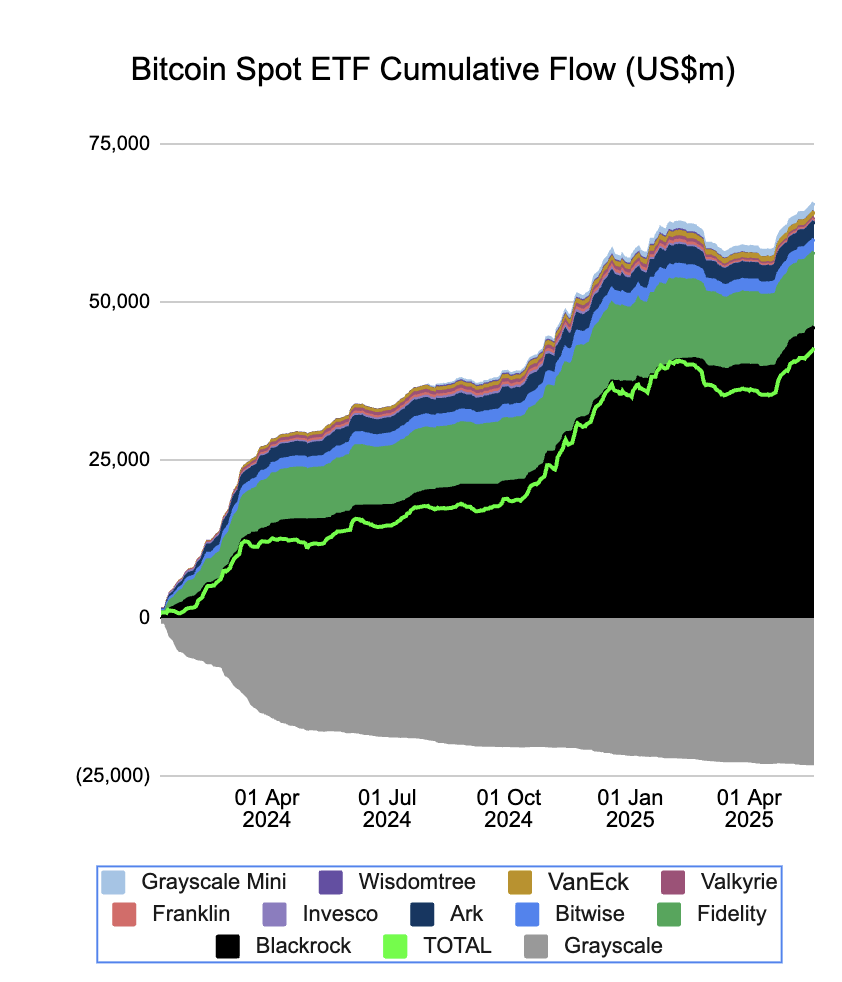

One of the most direct catalysts behind the current Bitcoin price flow is the influx of capital into the spot Bitcoin ETFs in the United States. Institutional adoption has grown rapidly due to the approval of multiple on-site Bitcoin ETFs earlier this year.

Farside Investors’ data had net inflows of $667.4 million on May 19, 2025, with BlackRock’s IBIT leading the surge at $305.9 million, followed by Fidelity’s FBTC at $188.1 million.

Source: Farside Investors

These products reduce barriers to institutional players such as pension funds, asset managers, and home offices to get direct exposure to Bitcoin without dealing with self-clients or regulatory complexity. The surge in demand for these entities is helping create consistent buying pressure to raise the spot price of Bitcoin.

Additionally, analysts now estimate cumulative ETF inflows since January 2025 exceeds $38 billion – Bloomberg Intelligence Agency’s early-year forecast exceeds $15 billion. As these funds accumulate more BTC, the available circular supply in exchange is shrinking, an optimistic dynamic that can amplify price action.

As these funds accumulate more BTC, the available circular supply in exchange is shrinking – a bullish dynamic that can amplify price action.

Read more: Trading with free encrypted signals in the Evening Trader Channel

Soft dollars and full interest to restore risk appetite

Another powerful driver of Bitcoin rally today comes from the wider macroeconomic environment. The U.S. dollar index (DXY) has weakened in the past few trades, with Investing.com data falling from more than 100 times to around 99.40 as of May 22, 2025. This is due to the increasing market expectations that the market will start to lower interest rates before the end of the year.

Source: TradingView

Fed Chairman Jerome Powell admitted in a latest speech by the Chicago Economic Club that it has gradually relaxed despite inflation still exceeding the central bank’s 2% target.

Powell added that the Fed is still dependent on data and is ready to adjust its policies if the incoming economic indicators are worth the shift. He also stressed that new trade-related tariffs could pose additional inflationary pressures and the Fed will closely monitor.

The shift toward a more cautious and potential tone has rekindled investors’ demand for risky assets, including stocks, technology stocks and cryptocurrencies.

Bitcoin is often seen as a macro hedge against Fiat’s depreciation and loose currency, and has historically benefited from this environment. As Treasury expectations for revenue decline and capital is turning towards advanced beta assets with asymmetric upward potential, Bitcoin remains the leading candidate.

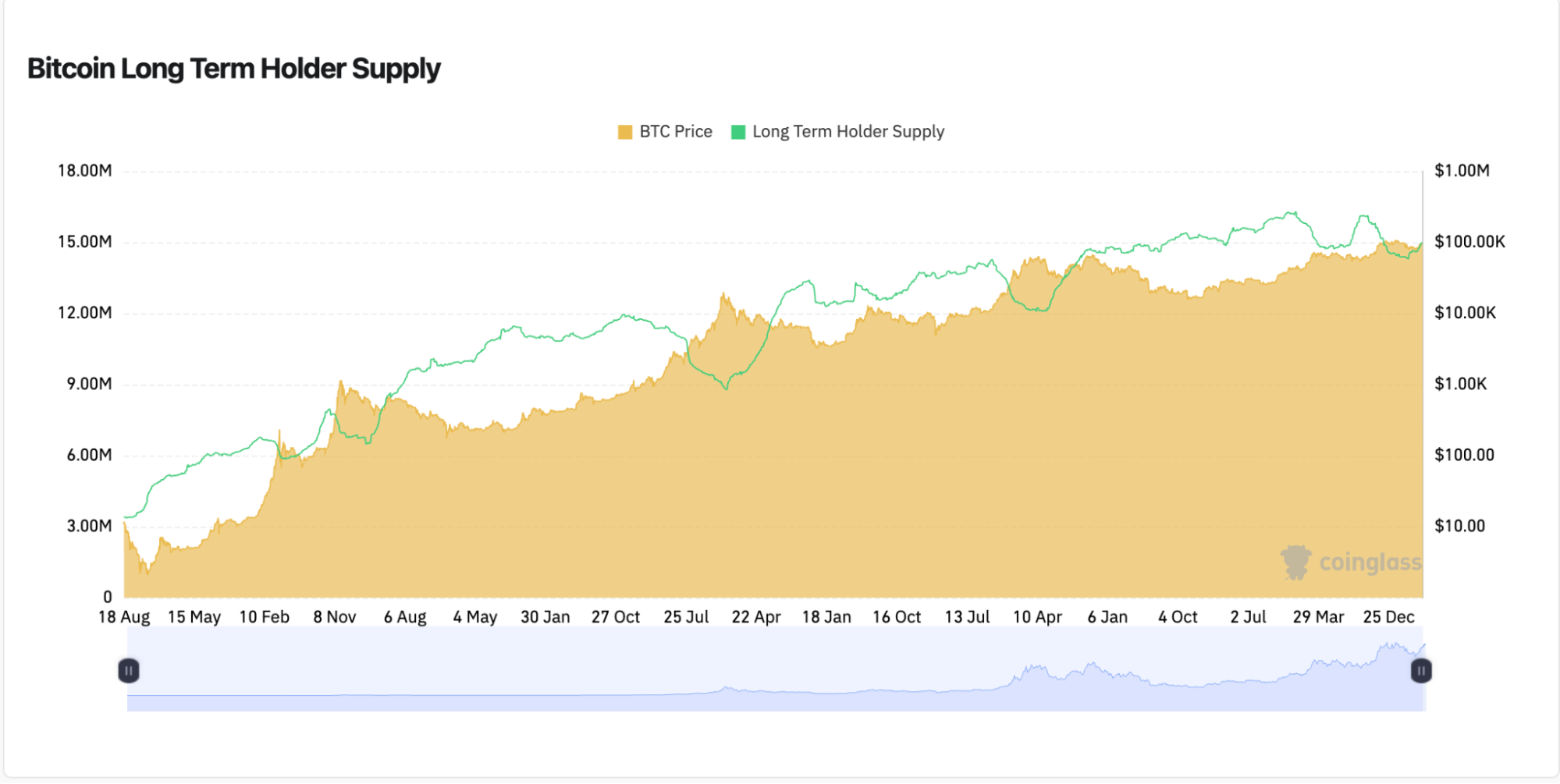

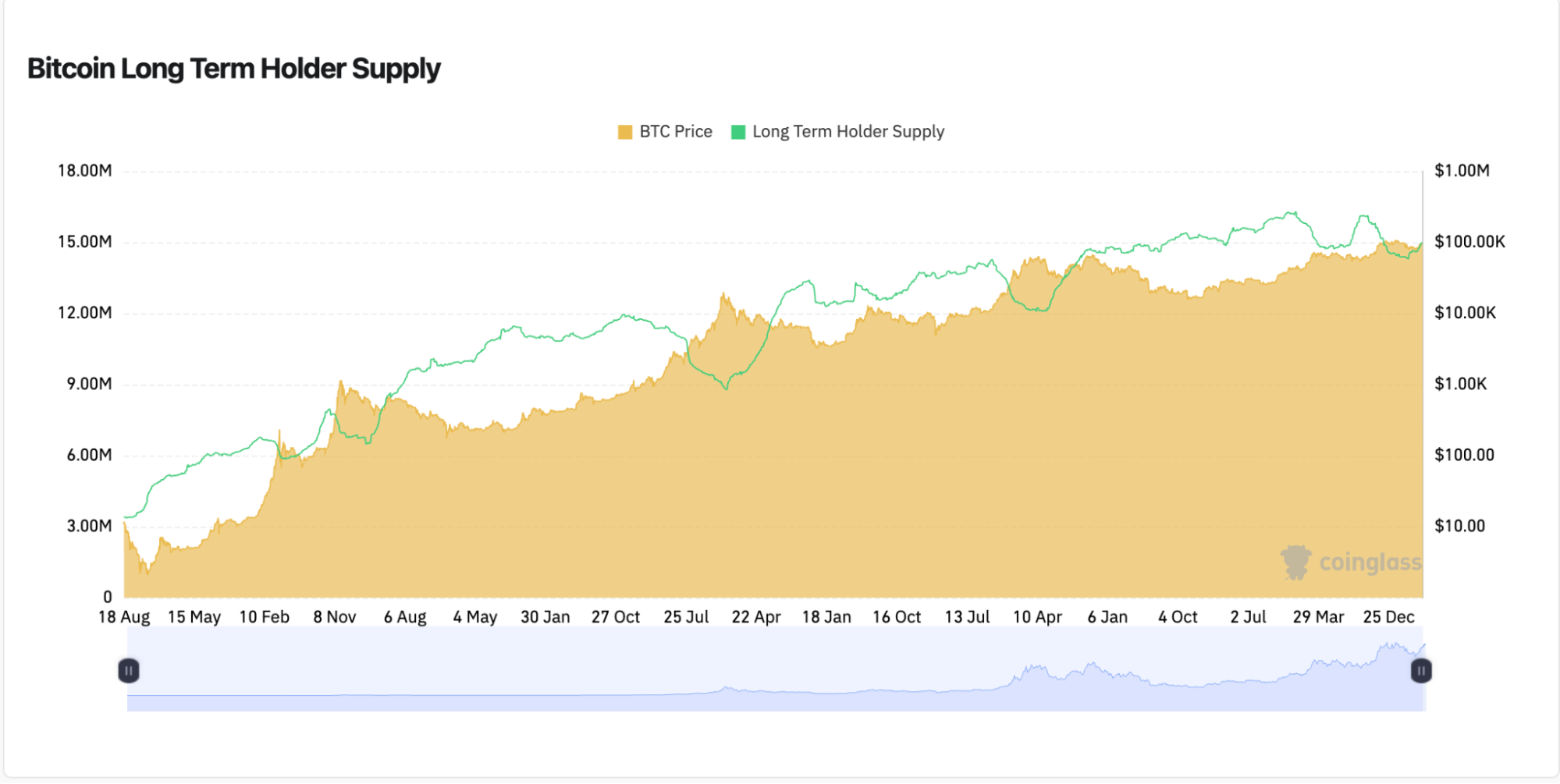

Chain data indicates that it accumulates by statements

On-chain signals are sending more subtle pictures to the current market environment. From Coinglass, supply held by long-term holders (LTH) has dropped slightly for the second straight month, down from a peak of 14.29 million BTC in March.

Source: Xiaodian

This shows that while many LTHS maintain a long-term view, some have begun to realize profits in the recent price surges – a pattern often seen near local tops.

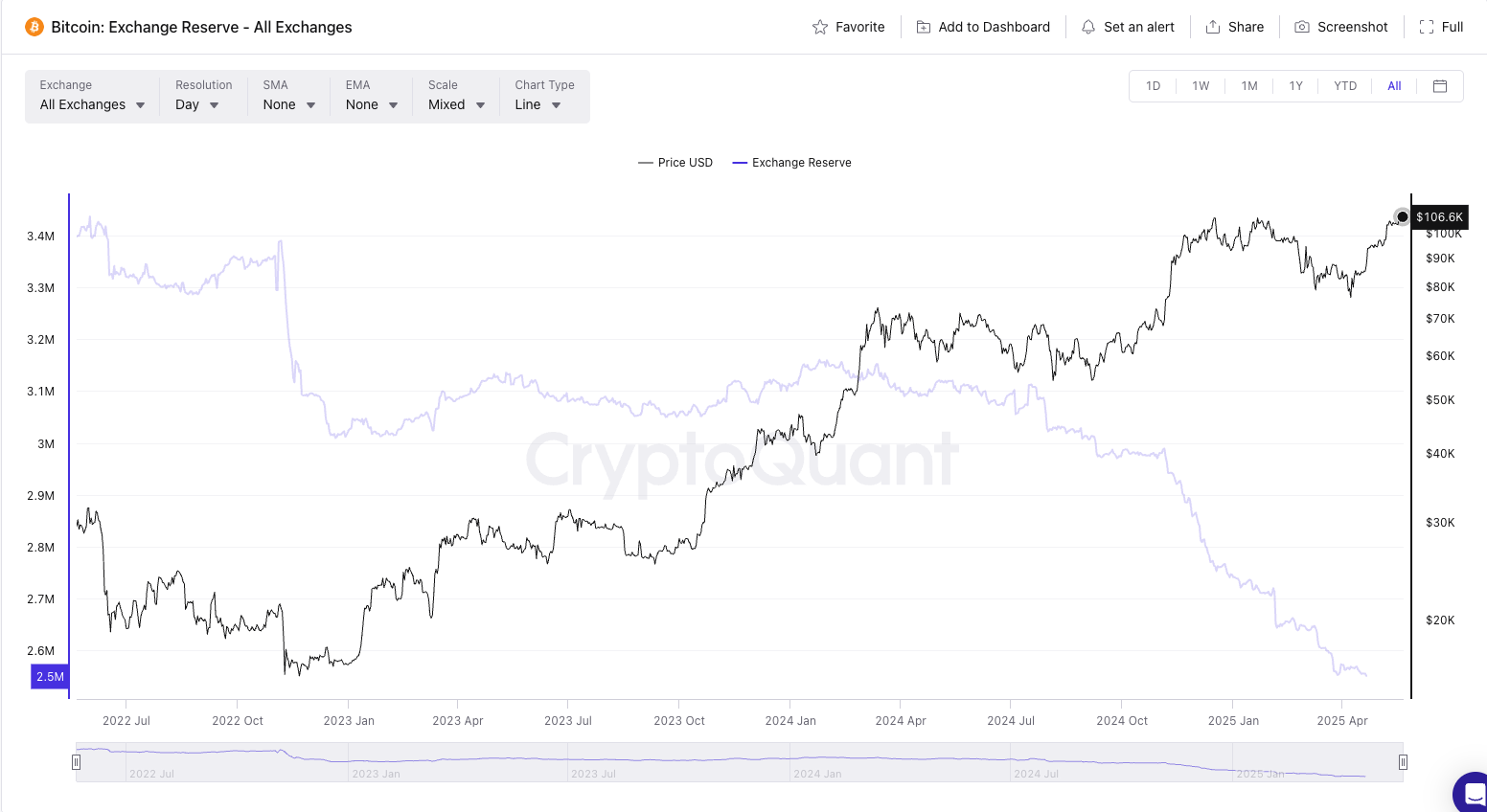

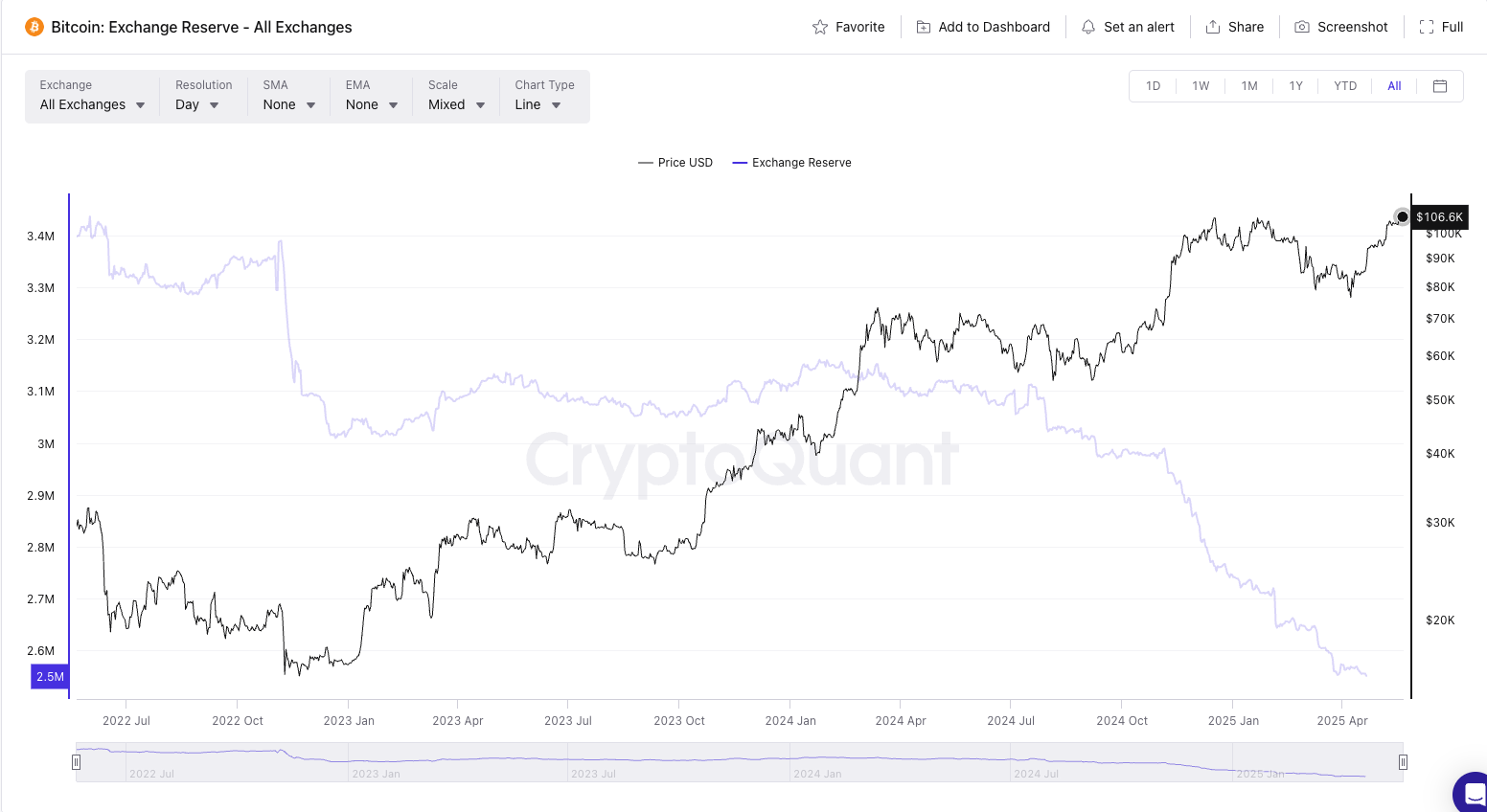

Meanwhile, the exchange balance continues to trend downward. Data from CryptoQuant shows that BTC held on centralized exchanges has dropped to about 2.6 million, down from 3.4 million in 2022.

Source: Encryption

However, analysts warn that part of these outflows may reflect an internal reshuffle between ETF custodial wallets and cold storage rather than a accumulation of direct investors.

On the other hand, whale wallets show obvious signs of accumulation. According to Santiment, wallets holding 10 to 10,000 BTC in the past 30 days were collectively referred to as 83,000 BTC. This intense accumulation of large scale enhances the broader institutional confidence in Bitcoin’s medium to long-term trajectory.

Short liquidation adds fuel to rally

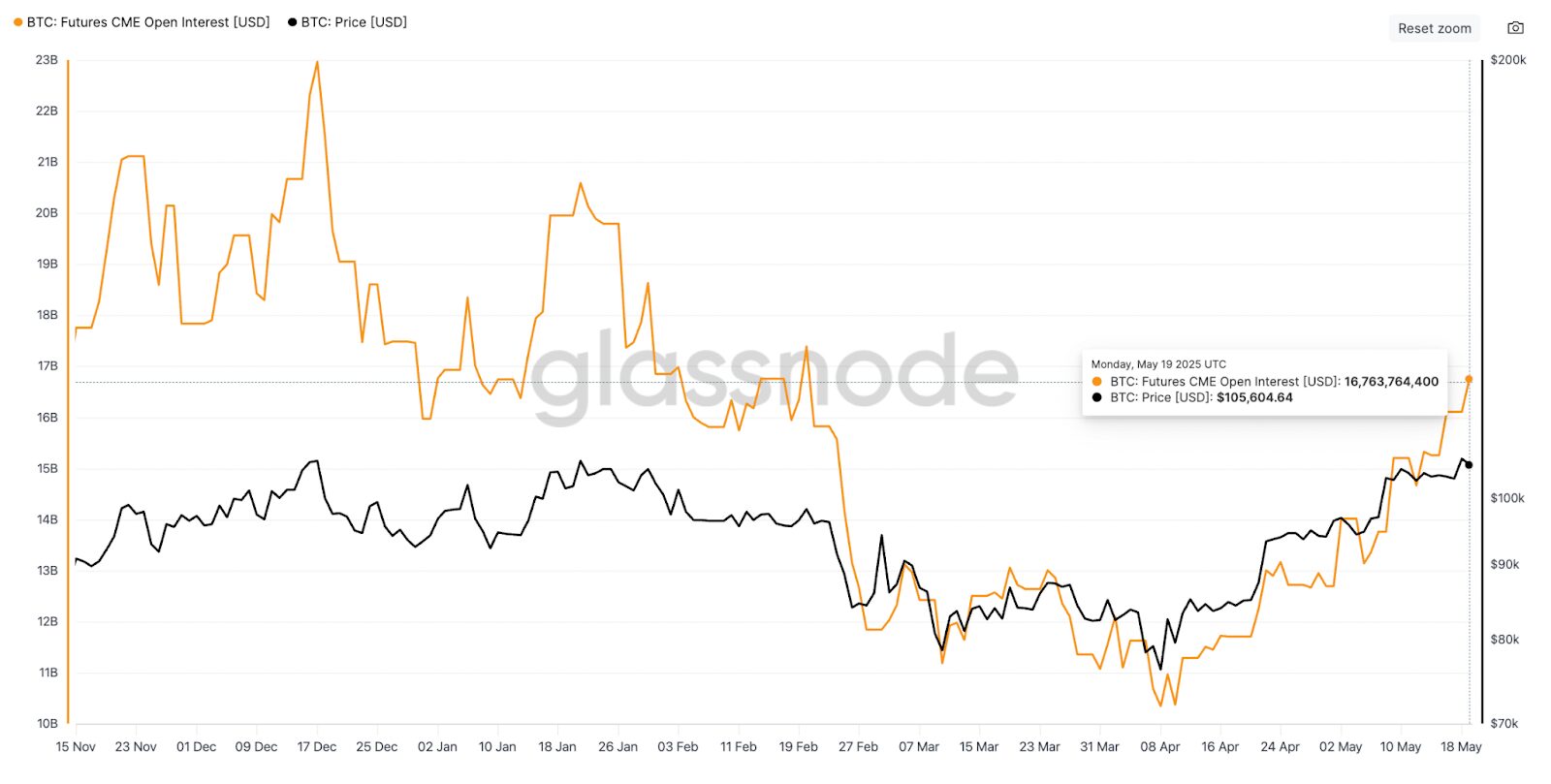

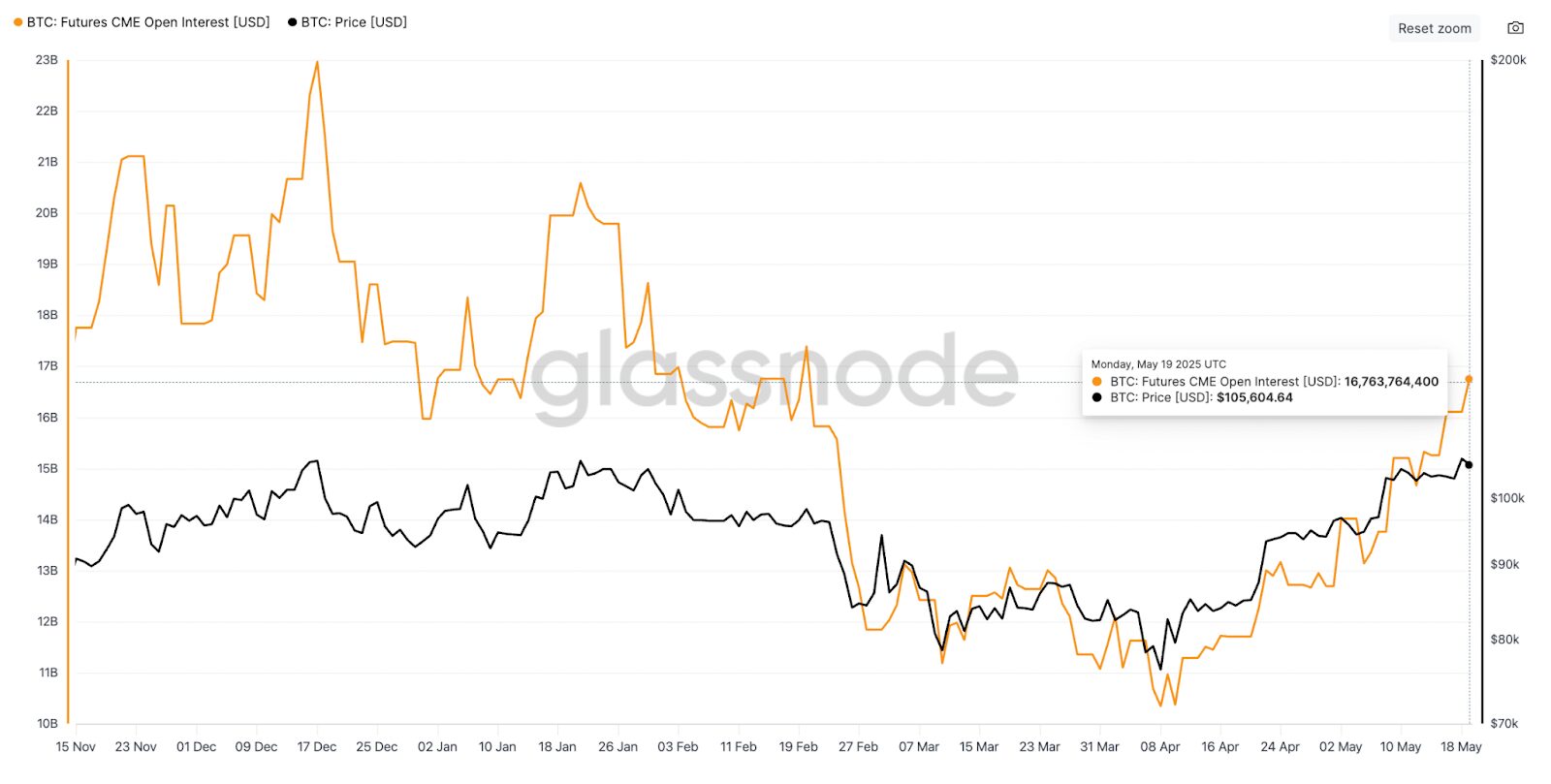

Bitcoin’s rapid upward movement has also been expanded by the derivatives market dynamics. Data from Coinglass shows that as of May 21, 2025, BTC short positions worth more than $262 million were liquidated in the past 24 hours. With Binance alone, $66.3 million was recorded in a brief liquidation on the BTC/USDT pair, marking the largest day-to-day clearance on the exchange this year.

Source: Glass Festival

Such a short squeeze event is common in the cryptocurrency market, especially after low volatility. Combined with the thin liquidity of some exchanges, these dynamics can greatly accelerate price movements, which seems to have been shown in the latest rally.

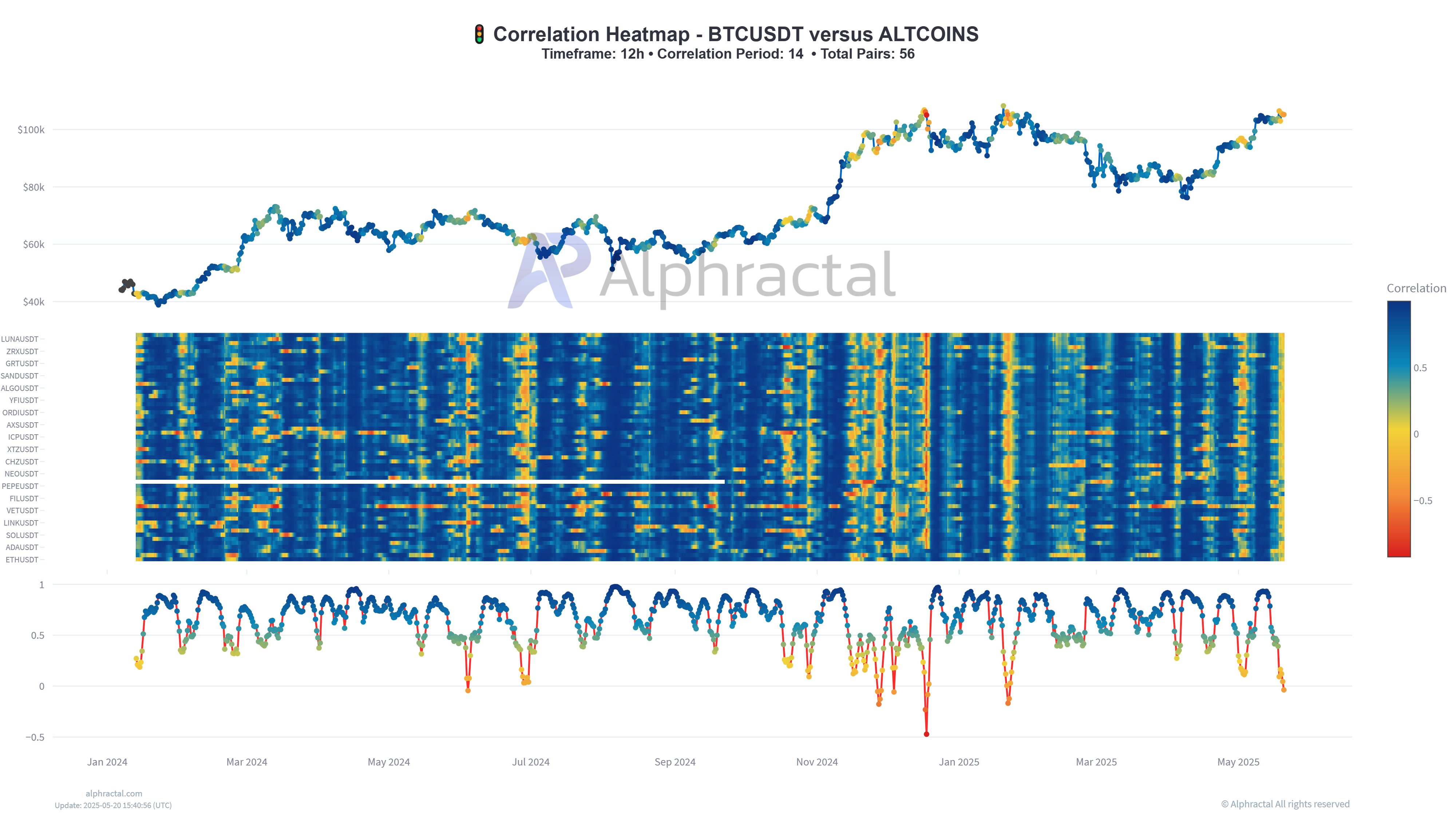

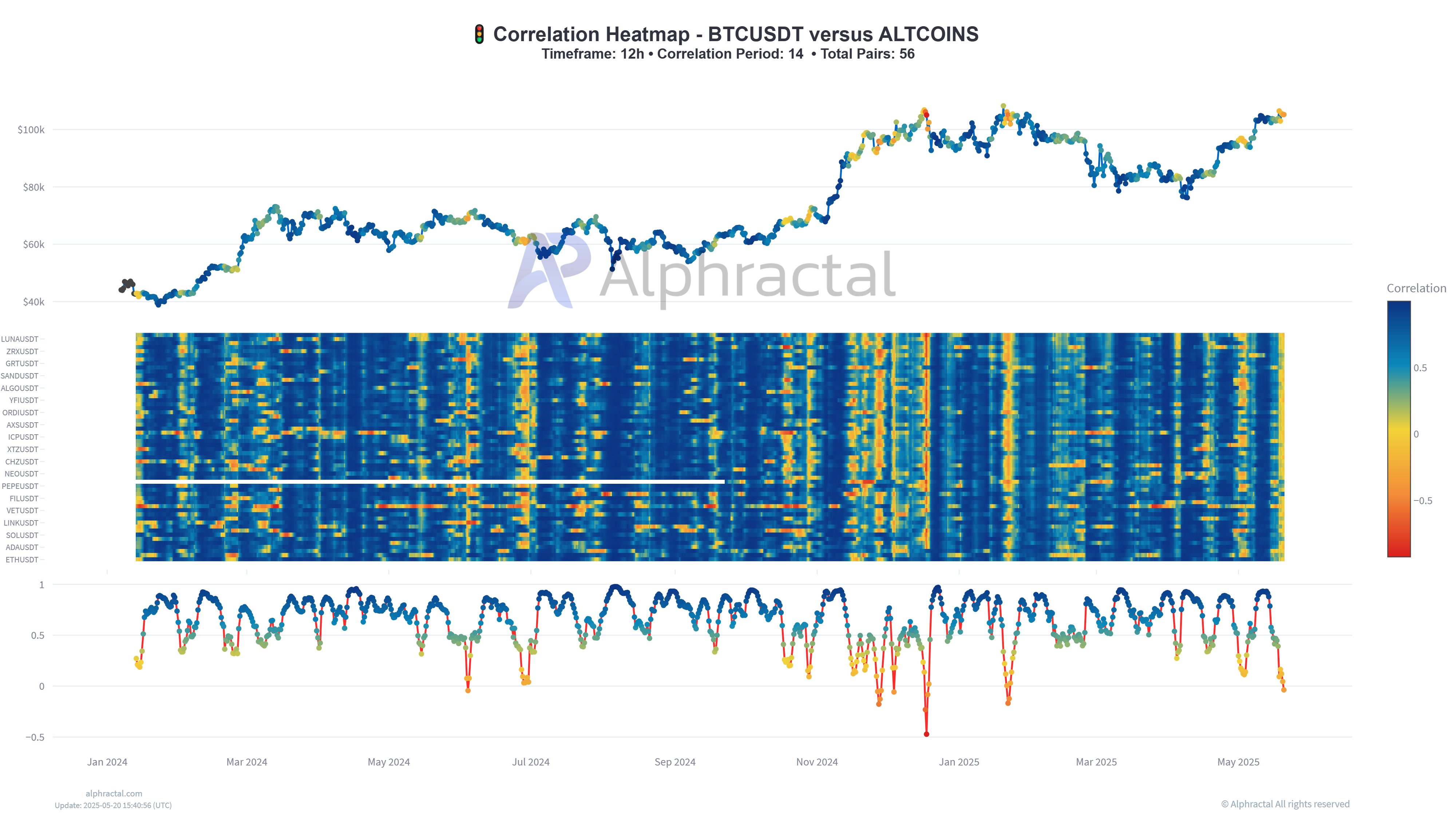

Bitcoin advantage rises in Altcoin merger

Another sign of updating Bitcoin’s strength is the rise in its advantage index – a metric reflects the increasing share of Bitcoin’s total capitalization of cryptocurrency market capitalization and indicates the shift in investors’ BTC rather than the riskier Altcoins. According to TradingView, it is currently about 64%.

Souce: TradingView

But while Bitcoin continues to climb, many Altcoins are unable to follow the momentum on it. According to relevant heat maps, the relationship between Bitcoin and the wider altcoin market has been significantly weakened in recent courses. This difference can be interpreted as a warning signal.

One possibility is that the current gathering is driven by a small number of large participants or ETFs inflows rather than based on broad market participation. In this case, assembly can prove vulnerable and susceptible to sudden corrections. Additionally, this trend may indicate that Bitcoin is entering a separate price discovery phase, temporarily disconnecting from the rest of the market as investors’ preferences turn into assets that are considered safer or more fundamentally reasonable.

Either way, Altcoins’ lack of confirmation indicates an increase in risk, especially for those close to the historic climax. Investors may want to take a more measurable stance, waiting for a stronger confirmation signal or technical backtrack before increasing exposure. In such a turbulent market stage, patience and discipline are often more valuable than chasing motivation.

Source: Letters

in conclusion

Today’s Bitcoin rally is not the result of a single event, but a convergence of supportive factors – strong ETF inflows, weak dollar, good macro signals, bullish chain data…

However, Bitcoin not only holds more than $110,000 in stake, but also attempts to make a decisive breakthrough to new all-time highs, possibly beyond March 2025.

Read more: How to read a clearing heat map: Basic analysis tools for derivative trading