The Standard Charter Report has increased the exposure of sovereign Bitcoin through MicroStrategy Holdings, with price increases by 2029 and a target price of $500,000 as of May 2025.

SEC Data Backup Bitcoin $500K Target to 2028: Standard Chartering Machine

Standard Charter’s Geoff Kendrick said the recent SEC 13F file supports the possibility of rising Bitcoin to $500,000 by the end of 2028. While ETF holdings decreased directly in the first quarter, government entities increased their strategic stakes…

– *Walter Bloomberg (@deitaone) May 20, 2025

Standard charter flight: Bitcoin exposure caused by sovereign wealth funds through microscopic exposure

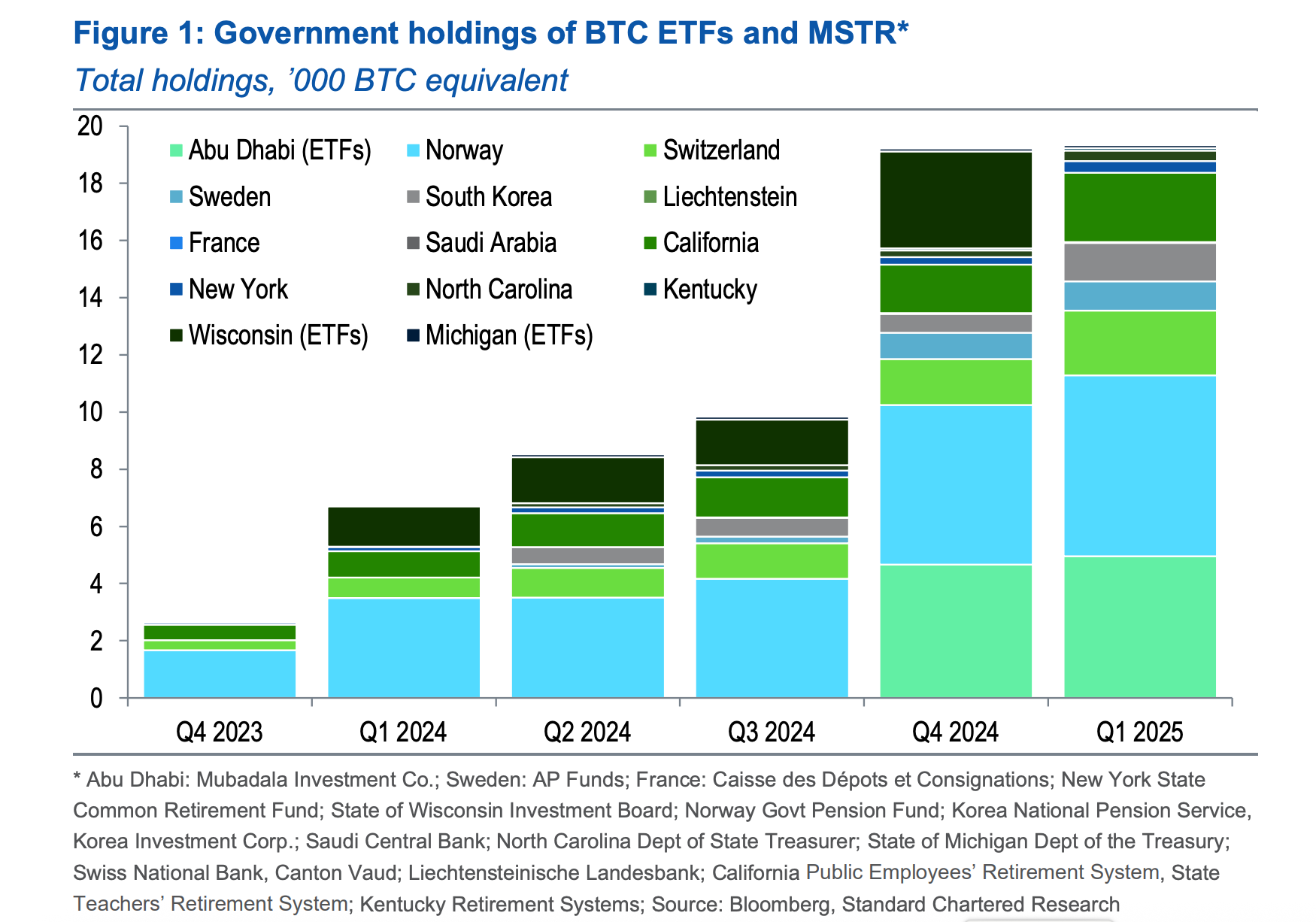

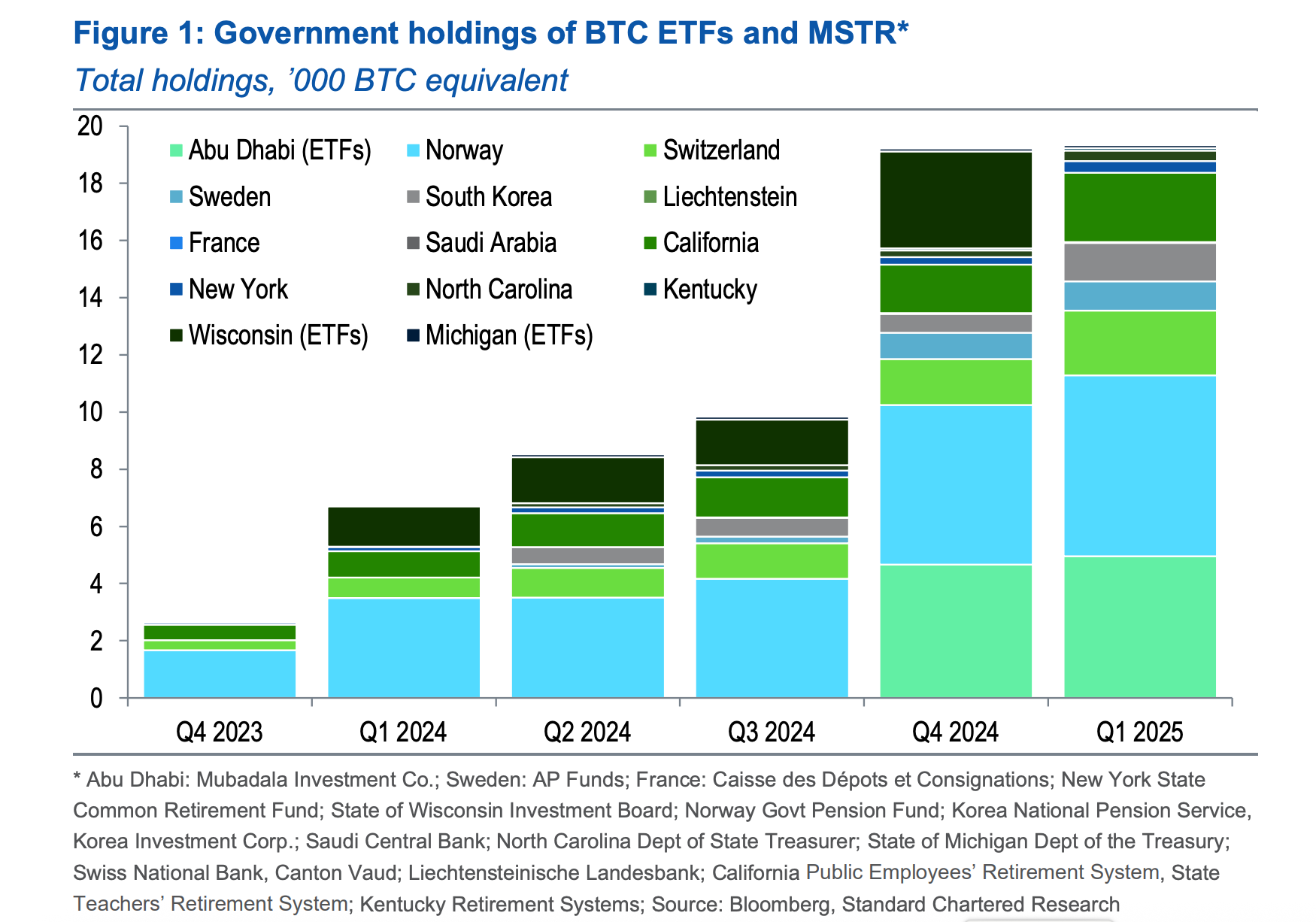

Standard Chartered’s report is based on a quarter 1 2025 SEC 13F document, showing that sovereign wealth funds and government entities have significantly increased their holdings in MicroStrategy, a company known for its large amount of Bitcoin investments.

Source: Standard charter flight

Norway’s government pension funds, Swiss National Bank and South Korea’s pension agencies each added 700 BTC through MSTR shares, while the U.S. state pension funds are collectively referred to as 1,000 BTC equivalent in California, New York, North Carolina and Kentucky. First-time home buyers such as Saudi Arabia and France also entered the space in a smaller position, indicating an expansion of global interest.

MicroStrategy itself holds 576,230 BTC, worth approximately $61.4 billion at the current price of Bitcoin.

Source: Saylor Tracker

This indirect exposure is consistent with a wider trend in institutional adoption. Geoffrey Kendrick, head of digital assets at Standard Charter, stressed that this trend supports the bank’s $500,000 Bitcoin BTC Price targets by 2029 coincide with the end of President Donald Trump’s term.

However, the report also states that direct Bitcoin ETF ownership has declined, and Wisconsin uninstall Its 3,400 BTC equivalent positions in BlackRock’s IBIT ETF, suggesting a strategic shift to indirect exposure through MSTR.

Institutional momentum accelerates Bitcoin’s global rise

The growing interest in Bitcoin through MicroStrategy has underscores the increasing number of stores of value as a traditional financial entity. MicroStrategy’s strategy to acquire Bitcoin using debt – $42.6 billion in corporate database since 2021 River May 2025 report– Has made it a proxy for Bitcoin exposure, especially for prudent entities that invest directly in crypto. This trend could drive Bitcoin prices to rise as increased demand for sovereign funds may reduce available supply.

Read more: JPMorgan Chase changes its stance, signaling it is Bitcoin’s institutional embrace

However, there are still challenges. When MSTR’s holdings exposed major funds such as Blackrock to Bitcoin volatility, the concentration of Bitcoin exposure in microscopic imaging has caused concerns about the risk of centralization.

Nevertheless, institutional momentum plus halving of Bitcoin in 2024, which reduces issuance to 450 BTC per day (per BlockChain.com), supporting a bullish outlook if institutional flows continue, which could shift Bitcoin to the end of 2025.