JPMorgan Chase has decided to allow customers to buy Bitcoin, despite CEO Jamie Dimon’s suspicion that this reflects the wave of institutional adoption in 2025 as financial giants and governments increasingly support leading cryptocurrencies.

JPMorgan’s pivot allows access to Bitcoin

On May 19, 2025, JPMorgan Chase, the largest bank in the United States, announced that it will enable customers to buy Bitcoin BTCalthough it will not provide custody services, as CEO Jamie Dimon said on Bank Investors Day.

Jamie Dimon: I’m not a fan of Bitcoin, but we will allow you to buy it.

I don’t think you should smoke, but I defend your right to smoke.

I defend your right to buy Bitcoin. Go. pic.twitter.com/ngegsuegwu

– Bitcoin News (@bitcoinnewscom) May 19, 2025

This marks a major turnaround for the bank, which holds $1.7 billion in Bitcoin ETFs, including 263,000 shares of BlackRock’s iShares Bitcoin Trust (IBIT). Despite Dimon’s recent criticism – calling Bitcoin a “Ponzi scheme” and comparing it with “smoking” in a CBS interview in January 2025 – JPMorgan’s move coincides with the environment of American career domination under the Trump administration. The bank’s blockchain platform Kinexys handles a tokenized Treasury transaction through Ondo Finance, demonstrating its growing blockchain engagement.

Institutional adoption is accelerating, with MicroStrategy holding 576,230 BTC and BlackRock’s IBIT management of 633,212 BTC ($66.45 billion) as of May 2025. New Hampshire and Arizona (like New Hampshire and Arizona) reserves, while BHUTAN adds BHUTAN TRANSSREVE to 374,217 BTC (probably 374,217 BTC). In November 2024, the all-time maximum amount of Bitcoin utilization was $91,000.

Source: iShares

Institutional support to drive Bitcoin to the highest level in history

Although there are some Like gold as a safe haventhe institutional momentum of Bitcoin is undeniable. Morgan Stanley’s Bitcoin ETF products and the openness of US banks to stability reflect growing acceptance.

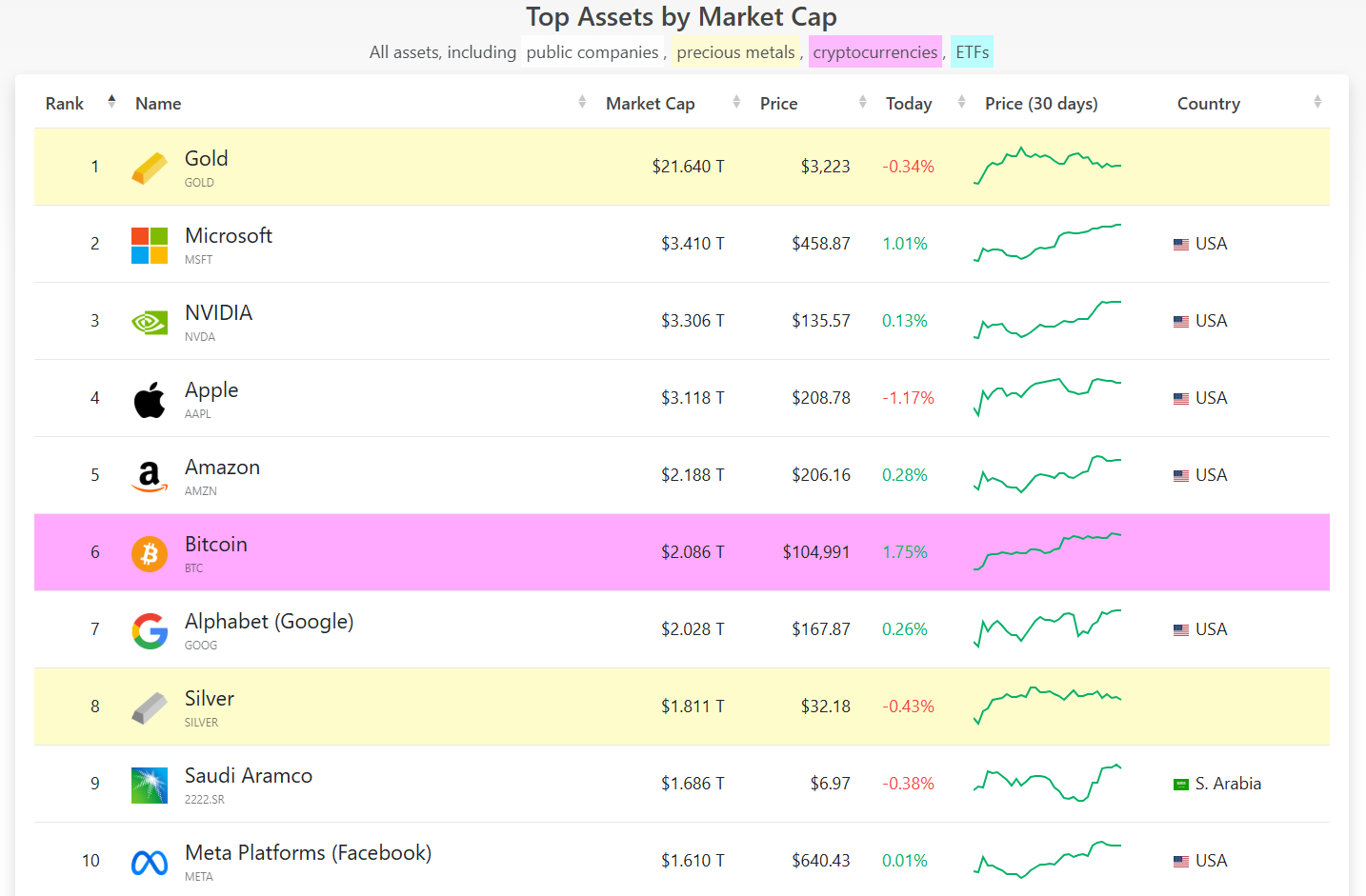

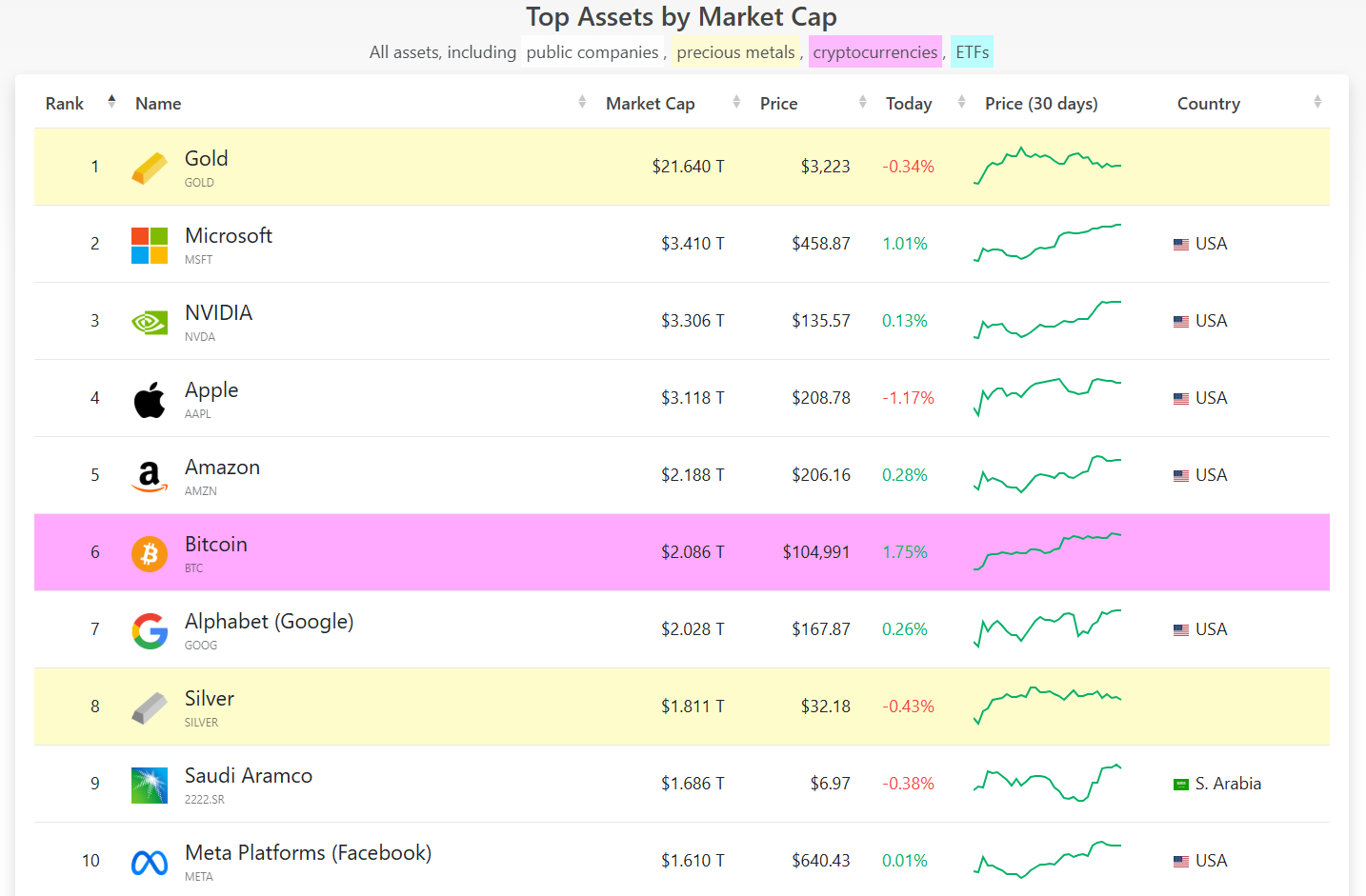

Bitcoin’s market capitalization reached $2 trillion in 2025, with the U.S. spot Bitcoin ETF holding $125.89 billion, accounting for 5.6% of its 21 million supply. Blackrock’s Larry Fink now champions Bitcoin, in stark contrast to his previous skepticism, while Kevin O’Leary, who was once a critic, allocated 1.5% of his portfolio to BTC.

Source: Company MarketCap

Analysts like Nic Puckrin of the Coin Bureau called Bitcoin’s adoption “unstoppable”, citing JPMorgan’s move is a milestone. However, challenges persist, including regulatory scrutiny and market volatility, such as in April 2025, Bitcoin price fell 7.8% to $77,100. The abolition of SAB 121 has eased restrictions on bank custody, but Dimon is reluctant to say he is cautious. Nevertheless, with pro-Cretto policy and institutional support, Bitcoin’s role as a portfolio asset has been strengthened.