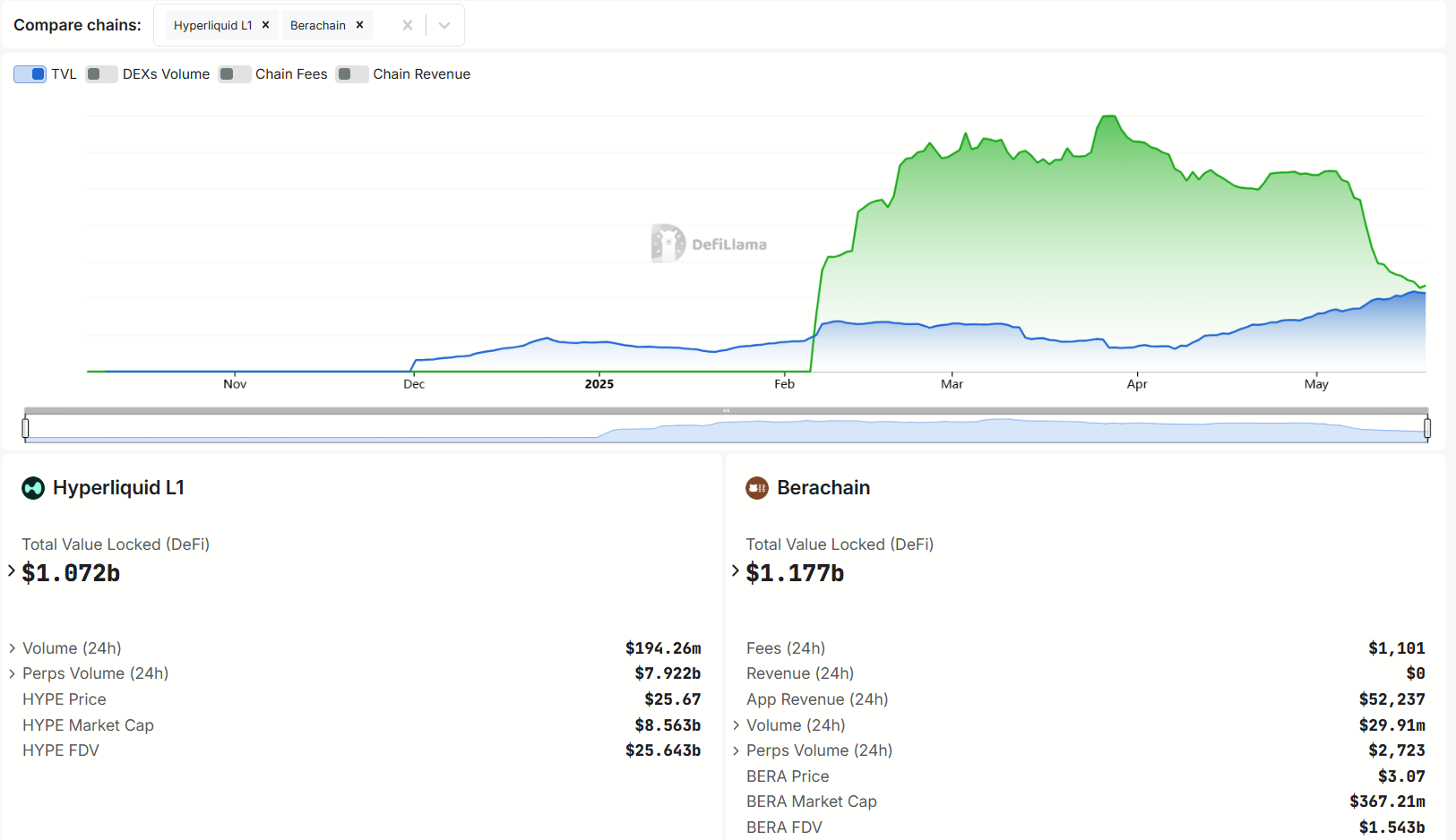

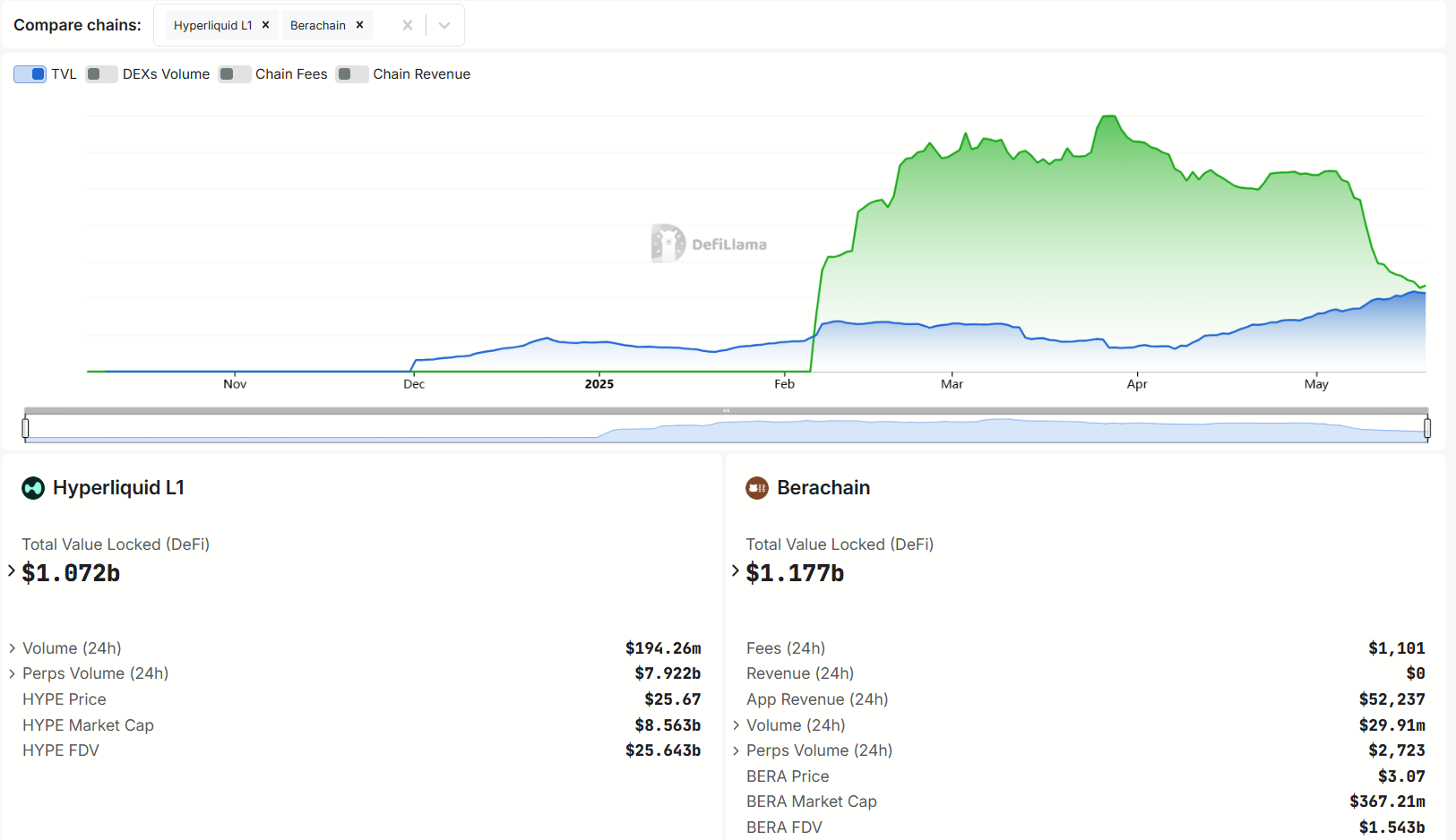

On May 17, 2025, the total value lock-in (TVL) of Hyplliquid L1 is about to surpass Berachain’s data, with data on the chain showing Berachain’s $1.184 billion and super liquidity of $10.85 billion, reflecting the competitive Defi landscape marked by organic growth and market volatility.

Superliquids PERP DEXE dominated by stable TVL growth

Super Liquidity Becomes a Leader in Crypto derivatives Tradingas of May 19, 2025, its TVL reached US$1.085 billion. The super fluent 24-hour number is $195.83 million and the PERPS number is $7.92 billion, which is much higher than Berachain’s $25.29 million.

Source: Defillama

Analysts stressed that Hyplliquid’s growth is largely organic, in stark contrast to Berachain’s dependence on “massive agricultural movements.”

Hyperevm is about to flip Berachain for TVL

One man carried out a huge agricultural movement

A person is completely organic

Super fluid.$Hyphon vs $Same pic.twitter.com/qyvy4cu2ho

– 800.hl (@degennquant) May 17, 2025

Super fluid Hype As of May 19, 2025, the token was priced at US$25.48 and had a market value of US$8.57 billion, emphasizing its market strength and ranks 18th in the world.

Source: TradingView

The platform’s focus on organic activity is demonstrated by its rejection of venture capital and community-driven approaches, which drives it up.

Berachain’s TVL drop signal indicates sustainability issues

Berachain, once a Defi leader, quickly dropped to $3.351 billion in TVL in March 2025, and today it was just $1.184 billion.

Source: Defillama

Berachain has a liquidity (POL) model and has conducted a large-scale agricultural campaign after its debut in February 2025.

Berachain earned $3.5B of TVL and received points and incentives – now bleeding capital, users and revenue <$10k.

Hyperliquid’s L1 just crossed $1B TVL without grants, ecosystem agriculture or forced liquidity games.

No bribes – only the most reflected flow… pic.twitter.com/pcv5q0lnmc

— Simononchain May 18, 2025

Bellinan’s it Token trades at $3.06 with a market cap of $364.6 million, and a fully diluted valuation of $15.32 billion also struggles, with its ATH nearly 80% dropping by nearly 80% to $14.83 earlier this year.

The platform’s reliance on incentivizing liquidity, including private LP transactions, has raised concerns about sustainability. Compared to super mobile, Bellacin’s $26.28 million sales volume was light, suggesting that Defi user preferences may have shifted towards more organic ecosystems.

As steady growth in super liquidity challenges Berachain’s early dominance, the wider Defi market is paying close attention. This trend may indicate a sustainable, user-driven growth platform rather than a platform that relies on short-term incentives.