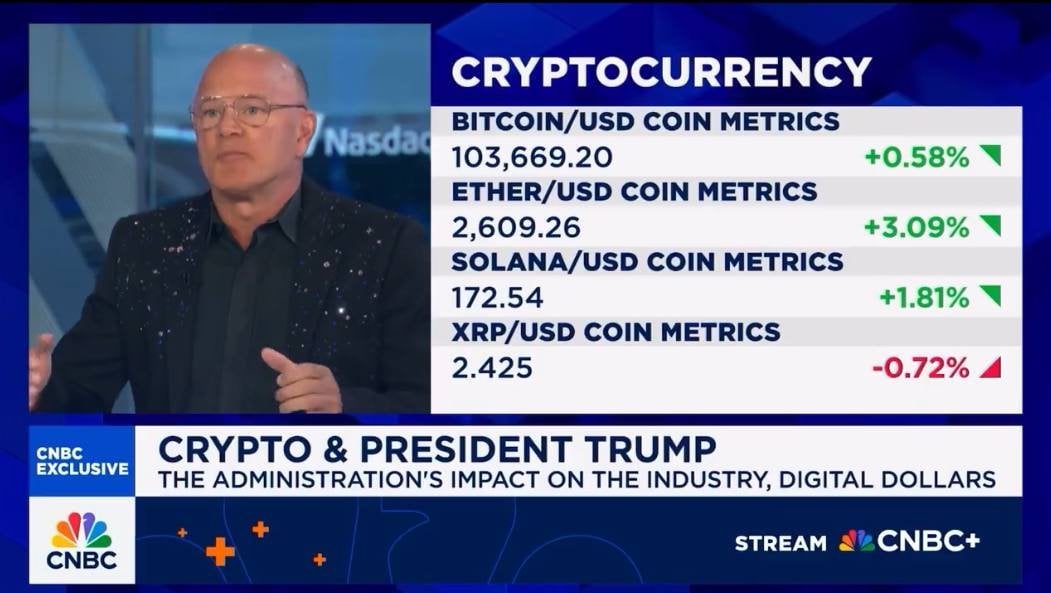

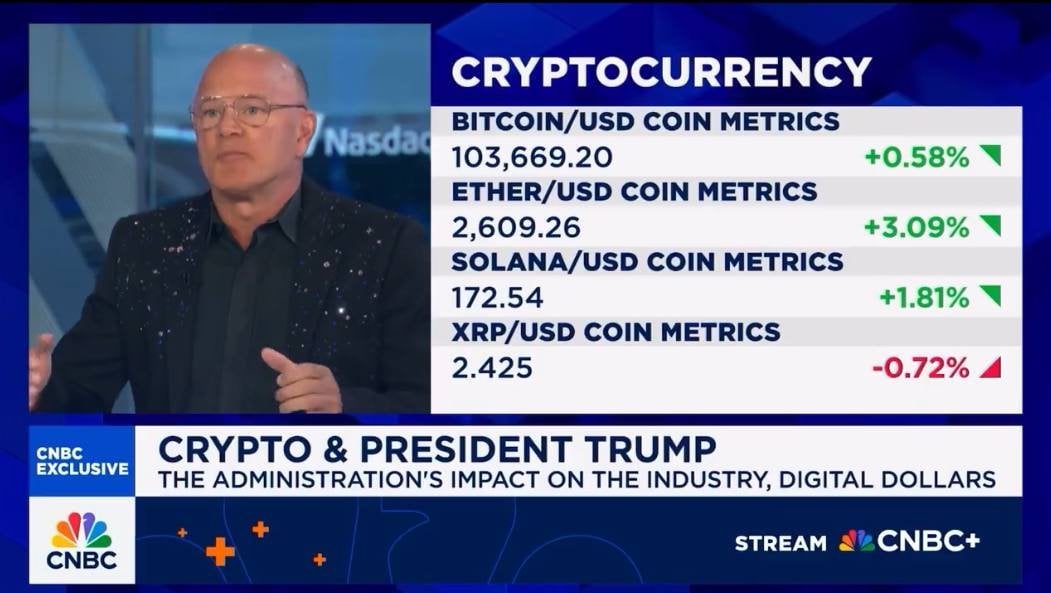

Galaxy Digital CEO Mike Novogratz shared Bitcoin’s optimistic outlook in a recent CNBC appearance, predicting it could increase to $130,000 to $150,000 in the near future.

Mike Novogratz

— CNBC (@CNBC) May 16, 2025

Mike Novogratz’s ambitious prediction for Bitcoin

His insights are discussed in the context of the Trump administration’s impact on the cryptocurrency industry, providing a detailed view of the market trajectory of Bitcoin and its comparison with traditional assets such as gold.

Novogratz highlighted the major rally of Bitcoin since Donald Trump was elected in November 2024, and by May 16, 2025, the price rose by nearly 50% to around $103,700. He attributed the surge to a variety of factors, including boosting investor confidence after Trump’s Pro-Crypto Stance and the market’s response to traditional collections such as gold medals.

Source: CNBC

Galaxy Digital CEO points to Bitcoin BTC The moves of gold are usually followed, and with the huge gains of gold, Bitcoin is expected to do this. He predicts that Bitcoin may soon break through resistance levels at prices of $106,000, $107,000 and $108,000, and enter the “price discovery” phase, potentially reaching $130,000 to $150,000.

Bitcoin emerges as a digital gold in the macroeconomic landscape

The billionaire also pointed to the joy surrounding Trump’s inauguration and the rise of Trump-themed cryptocurrencies as catalysts for market excitement. However, he warned that this enthusiasm could lead to volatile corrections, as shown by past cycles.

Read more: CEO Pantera Capital predicts explosive growth of Bitcoin over decades

Novogratz is still confident in the long-term prospects of Bitcoin, driven by adoption of young investors and institutional participants.

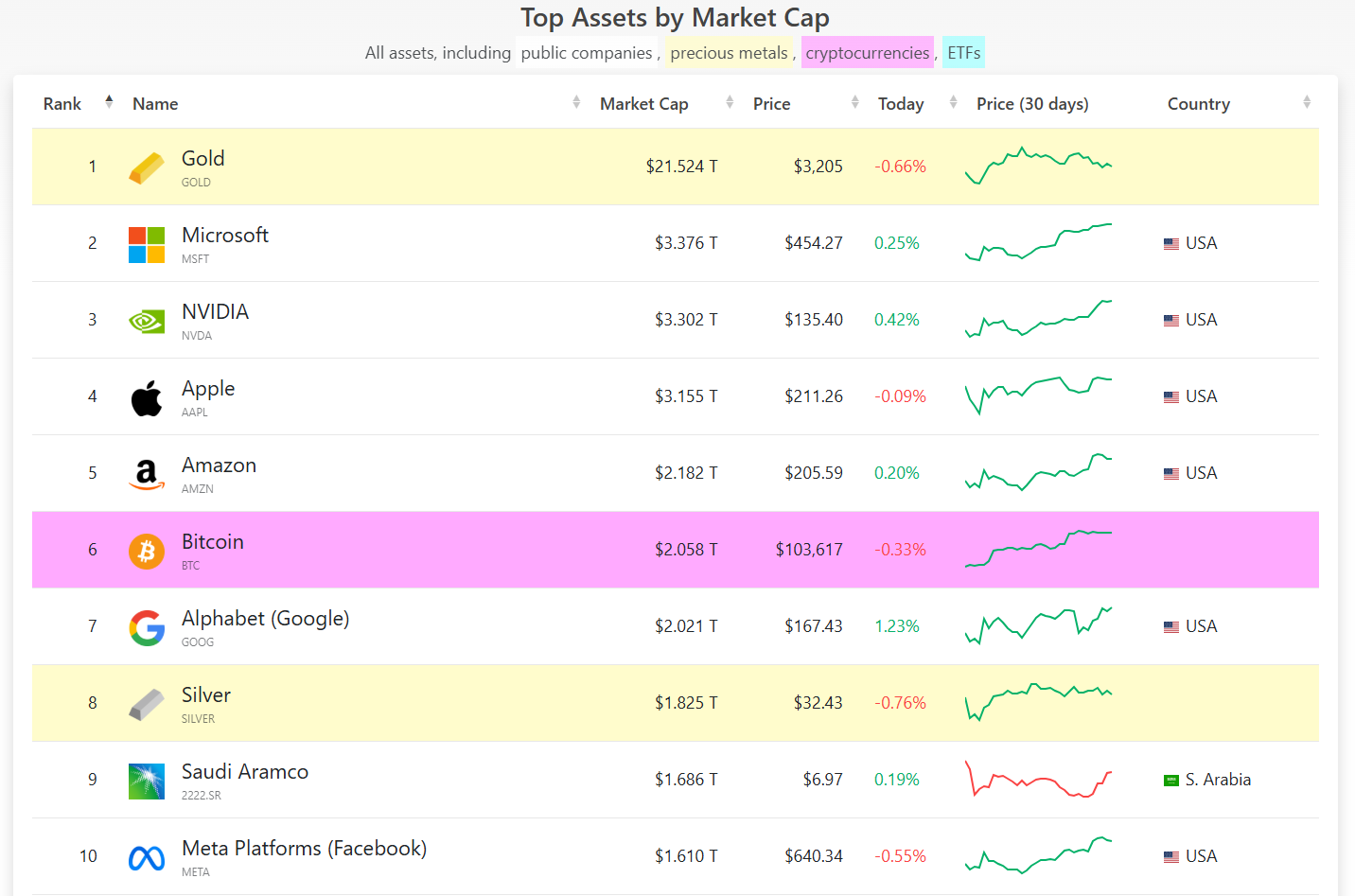

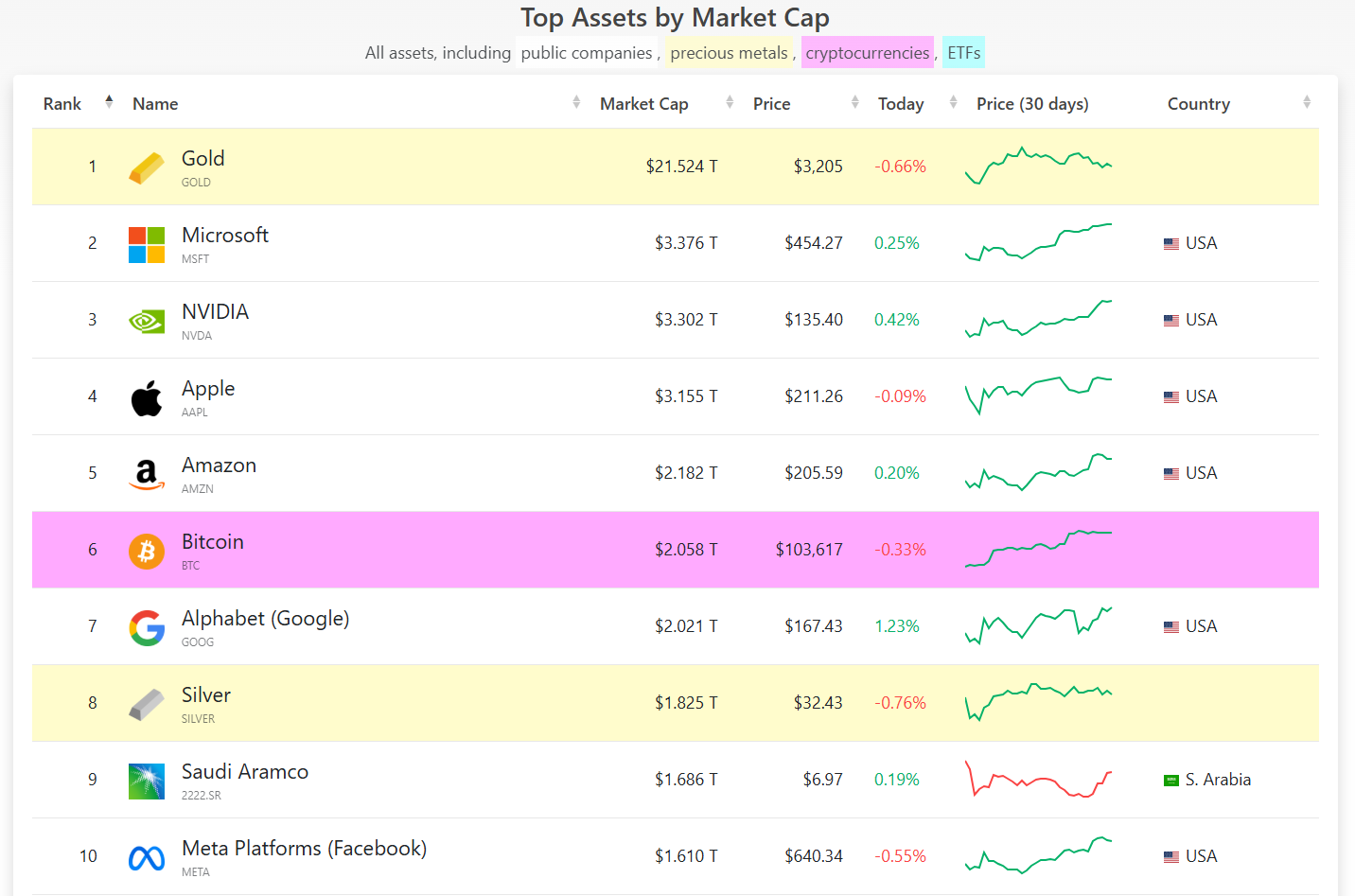

Comparing Bitcoin to gold, Novogratz highlights the emerging role of cryptocurrencies as a digital storage of value. He noted that although gold has a market capitalization of $22 trillion, Bitcoin is currently worth about $2 trillion, but there is a lot of room for growth.

Source: CompanyMarketCap

Novogratz believes that as the younger generation inherits wealth from the older generation, Bitcoin can achieve equality with gold, albeit in the distant future. This view is consistent with broader macroeconomic trends, which have historically strengthened both assets by trends in low interest rates and quantitative easing.

Read more: Tim Draper: Bitcoin hits $250,000 and replaces $250,000 in ten years

The relationship between Bitcoin and macroeconomic factors is complex. Although Bitcoin price movements are often driven by speculation and market sentiment, they are also associated with low volatility and loose monetary policies. For example, the bull run in 2021 matches the currency conditions of the superbuoy and a similar pattern emerges in 2025.