Internet Capital Market (ICM) is a concept that has attracted great attention in the Web3 ecosystem, especially in May 2025, as this narrative outperforms almost all other sectors.

What is Internet Market Capitalization (ICM)?

Internet Capital Markets (ICM) is a capital market system built entirely on blockchain infrastructure that enables developers or startups to raise funds directly from the community by issuing tokens representing future ideas or products.

Unlike traditional fundraising models that rely closely on venture capital firms (VCs) companies, ICM democratizes the investment process, allowing retail users to participate from the earliest stages.

According to Dexu.ai, the price index of tokens under the ICM narrative soared nearly 14% in 24 hours, surpassing categories such as CEX, Lengend, Defi, AI and RWA, indicating a strong influx of capital and attention into this trend.

What stands out from ICM is its rapid deployment, instant liquidity creation and high transparency. However, the model also has high speculation, as token valuations are largely driven by expectations and community concerns rather than actual product value.

Source: dexu.ai

How ICM works

The operation process of Internet capital market projects usually includes the following steps:

The process usually starts with a simple post on X, where developers announce their tokens using syntax such as “$TICKER + NAME”. This triggers the automatic deployment of tokens, which are initialized through a fixed curve, have limited supply and limited early transaction fees to create boot value and block early exports.

From there, the token is surviving, which is the survival of Solana – due to its low fees and rapid settlement, the preferred chain of most ICM activities and seeded with initial liquidity through the bonding mechanism. If market participants find this idea compelling, they can start speculative trading. The more persuasive the narrative or community engagement, the faster the token will be.

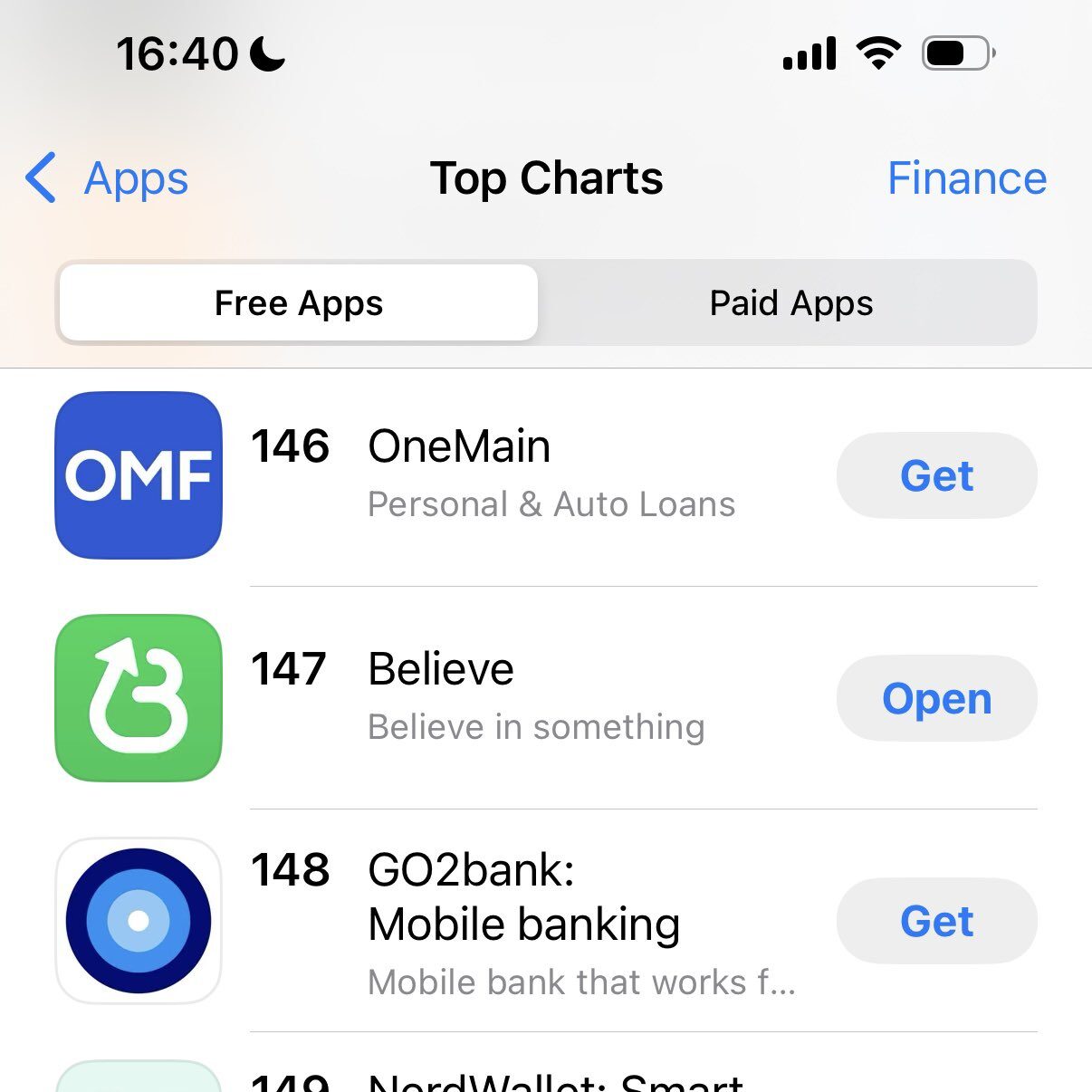

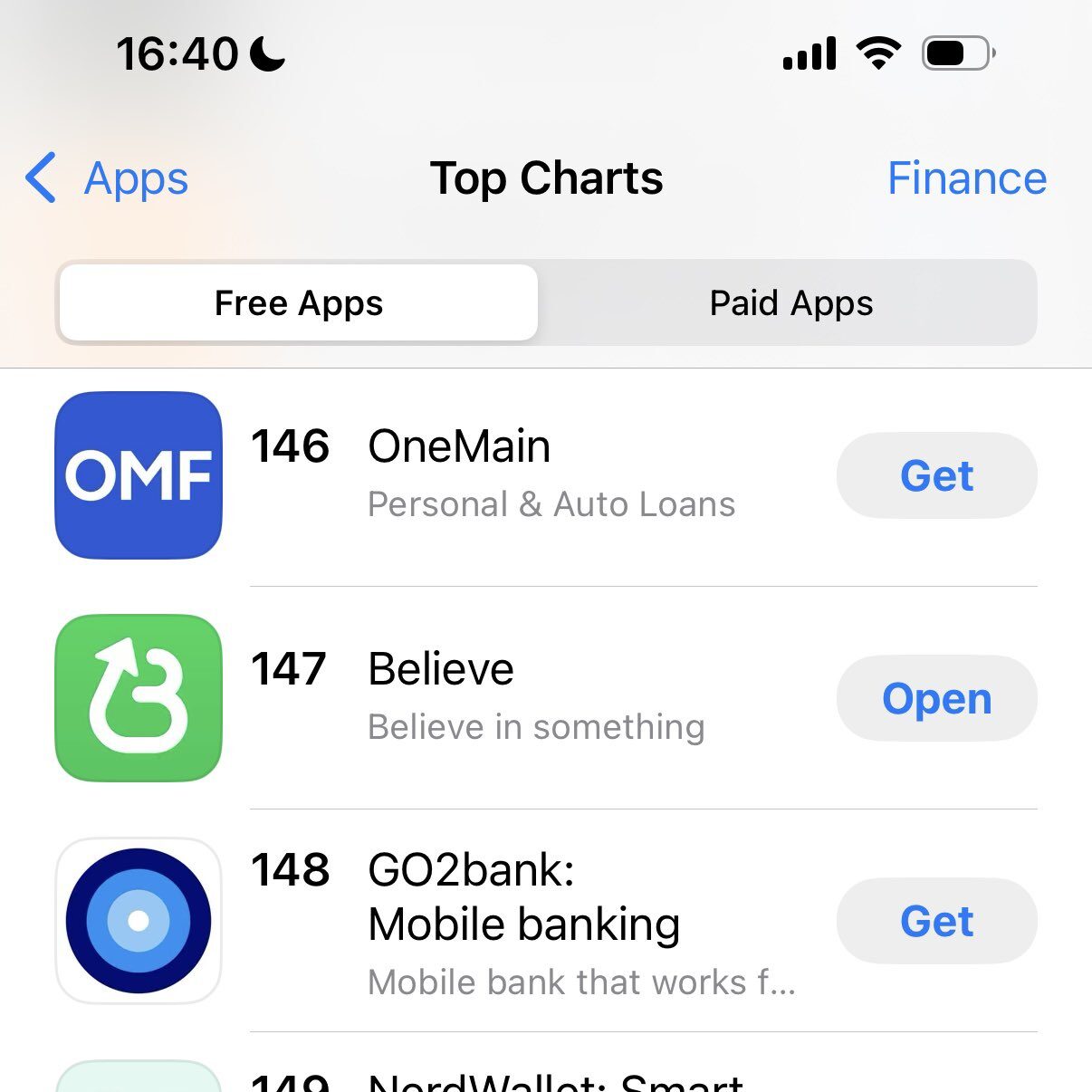

Source: Believe

One of the key milestones is “graduation,” triggered when the token’s market cap reaches $100,000. At this point, through the integration with the Meteora pool, price discovery and stability are enhanced, and liquidity is deepened. The builder can then ask for 50% of all transaction fees, and the other half will believe. Expense allocation time is extended to keep long-term incentives consistent and prevent premature abandonment.

If the project successfully attracts attention and the transaction volume increases, the developer will receive a portion of the transaction fee as a reward. This provides the motivation to build a real product, creating a self-suppression cycle:

Token → Community Belief → Market Value → Product Development → Value Creation.

Source: Believe

According to celive.app, as of mid-May 2025, more than 9,000 tokens have been launched with a market value of more than $350 million. In some cases, developers earn more than $7 million in transaction fees in the first 24 hours after release.

Top Internet Market Capital Project

The main platform behind current ICM Wave is Speelie.App, which makes it easy for anyone to create creative tokens. The platform’s local token, $ Launchcoin, has reached a market cap of $192 million, making it a flagship representative of the diversified funding trend.

Some other prominent tokens in this ecosystem include:

- $ dupe: It soared 6 times in a week, but has since fallen by more than 55% and its market cap is now around $26 million, highlighting the extreme volatility of tokens in the space.

- $Noodles: A memetic token that experienced high volatility and dropped by 54.5% in 24 hours, highlighting the high risk nature of these assets.

- $GOONC and $BUDDY: Emerging tokens with strong momentum, $Buddy earns 1,146% in one day.

Additionally, data from posts on X suggests that over 31,000 wallet addresses interact with tokens on Spiels.App, suggesting strong community engagement in the Web3 landscape.

| Token | Change 24 hours (%) | Market value | Holder |

| $ lainingcoin | +18% | 250m | 30,000 |

| $ dupe | -59% | 24m | 7,000 |

| $Noodles | -61% | 3.1m | 6,300 |

| $ goonc | -55% | 26.2m | 7,600 |

| $Brother | -65% | 3.8m | 3,700 |

Opportunities and risks of ICM

Opportunities and benefits

For developers, the Internet capital market opens a new path to capital to avoid the need for traditional approvals or fundraising processes. If the tokens get strong community support, they can raise tens of thousands of dollars in just a few hours.

For individual investors, ICM offers an opportunity to get breakthrough ideas early and potentially multiple returns if the project is successful. This is reminiscent of the early ICO boom in 2017 or the summer of 2020.

For everyday users, becoming a “chain shareholder” is not just a simple transaction – including participating in governance, coming up with ideas, and getting rewards from project growth.

Risks and disputes

While the Internet capital market represents a bold reimagining of early crypto fundraising, the model is far from risky. In fact, many industry observers began to compare between ICM and previous speculative bubbles that promised transformation but collapsed under the weight of their own hype.

The first major risk is extreme volatility. Tokens in the ICM ecosystem are usually created and listed in minutes, and there are often no working products or roadmaps. As a result, their prices are often purely driven by emotions. When attention fades or narrative momentum booths, crashes can be cruel.

For example, the token $noodle lost more than 50% of its market value within 24 hours of launch – a pattern reminiscent of the AI token boom in early 2023, when projects using $alyx, $numa, or $gpt alone lost 70-90% in just a few weeks.

The second major risk is fraud. Using platforms like clise.app allows anyone to start a token by simply publishing X with little authentication or accountability. This low barrier leads to the spread of the “pumping” scheme and carpet tension.

Some developers build hype, attract retail capital, and exit before any actual development begins, reflecting events seen during this period Ghibli Finance In late 2023, anime-themed tokens attracted millions of dollars of liquidity and then collapsed almost overnight.

The third and broader risk is the formation of speculative bubbles. The rise of ICM is similar to movements like Desci (Decentralized Science). In 2022-2023, the Desci Project promises to revolutionize scientific research by enabling open funding through crypto tokens. Despite early hype and funding, most tokens fail due to poor delivery and limited actual use.

Some experts warn that ICMs may form a bubble because many tokens lack real products. From a legal standpoint, such public fundraising activities (if not regulated) may soon be subject to scrutiny by regulators.

If ICM survives early fluctuations, it can develop in the long term like AI narrative.

in conclusion

The Internet capital market is in the early stages of the development cycle, bringing huge opportunities and considerable risks. They represent a new wave of democratic fundraising and innovation that turns ideas into tradable assets.

However, for the ecosystem to survive and sustainable, it must develop in terms of governance, legal clarity and product standardization. In this world where “trust” itself can become a tradable asset, ICM is an important test for the cryptocurrency market to mature in the next decade.

Read more: Trading with free encrypted signals in the Evening Trader Channel