Bitcoin exchange-traded funds (ETFs) have achieved historical milestones, with cumulative inflows of more than $41 billion as of May 14, 2025. This record achievement marks a major shift in funding, which has encountered strong investor confidence in the global economy and faced strong investor confidence and growth around the world, indicating uncertainty in the global economy.

After yesterday’s inflow, spot Bitcoin ETFs are now at a new high level market for lifelong flows. Currently, according to Bloomberg data H/t, the data is $40.33 billion. @ericbalchunas pic.twitter.com/0gkpnlmprs

– James Seyffart (@jseyff) May 9, 2025

Historical milestones of Bitcoin ETFs

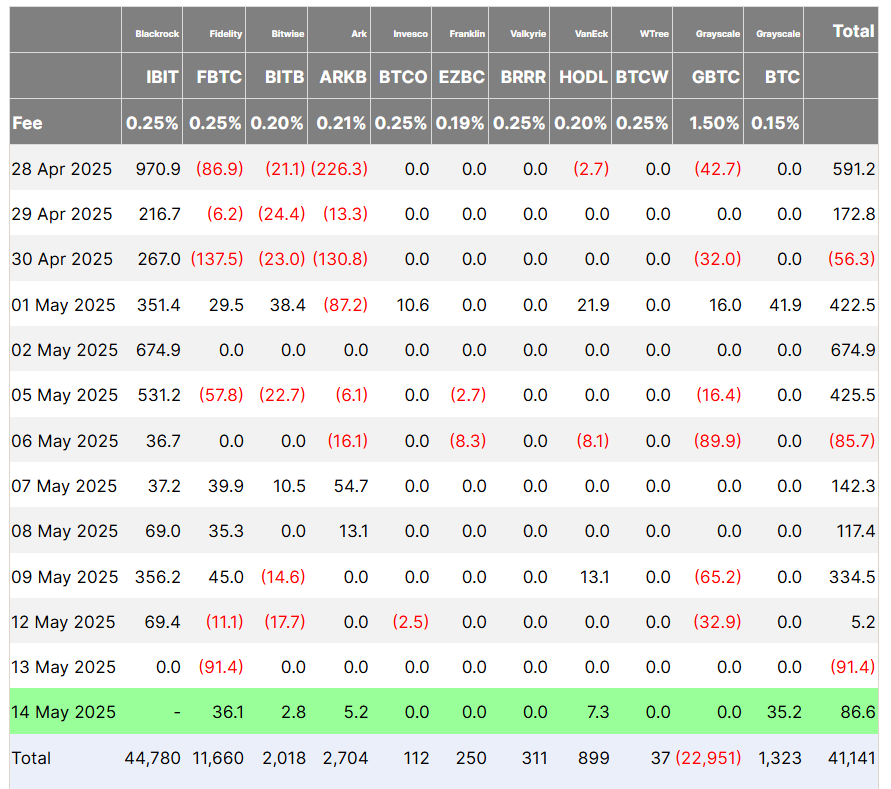

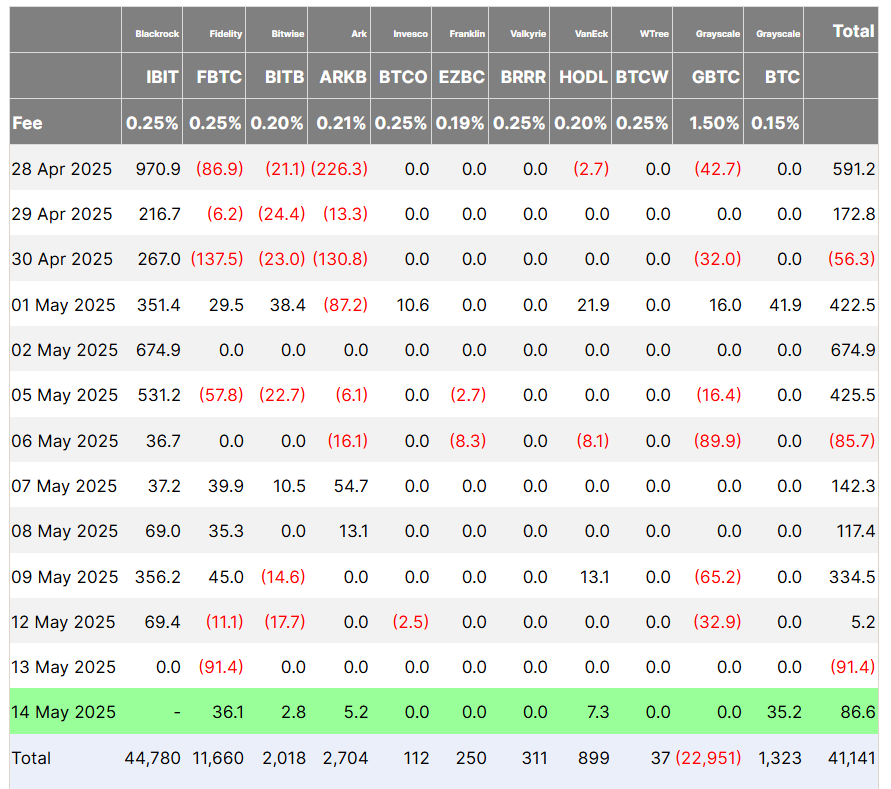

According to Farside Investors, as of May 14, 2025, the U.S. Bitcoin ETF reached an unprecedented peak, with cumulative inflows exceeding US$41.1 billion.

Source: Farside Investors

In January 2024, after a decade of rejection and successful lawsuits by ETF issuer Grayscale, the Securities and Exchange Commission (SEC) approved the on-site Bitcoin ETF for more than a year in January 2024. The launch of these funds marks a critical moment for cryptocurrencies, providing investors with a regulated and accessible way to gain access to Bitcoin BTC No direct ownership of assets.

The journey to this milestone is excellent. Bitcoin ETFs initially encountered suspicion about traditional finance and violated expectations, and major asset management firms like BlackRock led the charge. Blackrock’s Bitcoin ETF, for example, became the fastest growing ETF in U.S. history, demonstrating the growing demand for cryptocurrency-based financial products.

Read more: BlackRock proposes points for Ethereum ETFs to increase ETH price

The net inflow of $41.1 billion reflects a significant reversal of fate, as these funds have previously experienced rapid outflows amid global trade wars and instability in economic uncertainty. The resilience of asset coins proposed by such challenges and the growing stability of trust investors in regulated crypto products emphasizes the resilience of Bitcoin and is thus able to achieve new high-water markers.

Bitcoin ETF is the portal to enter crypto spheres

This surge in inflows is also consistent with broader market trends. According to Coinshares, more than $100 million of institutional investors in management held $27.4 billion worth of Bitcoin ETFs as of the fourth quarter of 2024.

Asset management giants (Millennium Management) and Jane Street account for 20% of Bitcoin’s total assets, further highlighting the institutional embrace of cryptocurrencies. Recording inflow signals suggests that Bitcoin ETFs have become the cornerstone of crypto investments, bridging the gap between traditional finance and digital asset spaces.

The success of ETF Bitcoin Spots also highlights the increase in mainstream adoption of cryptocurrencies. Since its launch, these funds have crushed expectations, thus providing price movements to Bitcoin through spot and futures-based products.

As Bitcoin ETFs continue to attract capital, they may play a key role in shaping the future of cryptocurrency investment and driving further integration into traditional financial systems.