Not all good news is a buying signal. Sometimes the most positive headlines mark a turning point – a phenomenon where investors are very familiar with “selling news.”

A wave of good news – a rapid market correction

In the first week of May 2025, there were many positive titles pouring into the cryptocurrency market. Bitcoin has soared $103,000 for the first time since January. The Fear and Greed Index rose from 48 to 70 in just three days, while the global cryptocurrency market capitalization increased by $160 billion, exceeding $3.2 trillion.

Source: Alternative

Ethereum’s ecosystem has also been significantly improved as the long-standing pectra upgrade has been successfully deployed, raising ETH to over $2,250, the highest level since late March.

Meanwhile, claims for unemployed U.S. dollars fell to 228,000, below expectations of 234,000, sparking optimism among investors that the Fed could keep interest rates stable and even begin a downgrade cycle in the third quarter. Bullish sentiment spread rapidly, boosting Sol, Avax, Ton and Imp’s altcoins by more than 15% in just four trades.

Source: Coingecko

However, in less than 48 hours, the market reversed sharply. Bitcoin is below $101,800, Ethereum drops to around $2,100, and many altcoins reduce their value by 5% to 10%. Investor sentiment becomes cautious, and capital spins out of the week’s top earners. The crypto community responded again to a familiar phrase: “Sell news.”

Source: Coingecko

Good news doesn’t always mean price increases: Lessons learned in market history

In traditional finance, “buy rumors, sell news” is an unwritten rule that is backed by decades of market behavior. But in cryptocurrencies, the reaction is faster, and greed usually outweighs the fundamentals – this phenomenon becomes more obvious.

One of the most classic examples is the launch of the Proshares Bitcoin Futures ETF (BITO) in October 2021. In the approved lead, BTC rose nearly 40%, from $43,000 to an all-time high of $67,000. But three days after ETFs began trading on the New York Stock Exchange, Bitcoin reversed sharply and made a month-long correction, ending the year’s $47,000. Investors expect good news to drive new inflows, but it marks an emotional top.

In January 2024, the SEC rejected a number of similar models of Ethereum ETFs and markets. Then, ETH rose from $1,650 to $2,300 in just 10 days as the rumor of approval resurfaced in late February. However, after the SEC officially greened four ETH ETFs in March, ETH fell unexpectedly by 12% in the first week after the announcement.

Source: TradingView

Recently, in April 2025, Pudgy Penguins’ $Pengu token soared to $0.48 after the Walmart partnership announcement and Google Trends interest surge. Just one day later, the token crashed 60% as the team unlocked a large number of tokens for the community.

The meme coin market has responded repeatedly to this pattern. In December 2023, Bonk’s Bonk jumped more than 300% in six days as rumors spread the main centralized exchange partnership. However, just two days after the news was confirmed, Bunker lost nearly half of his value within 48 hours.

Market sentiment: When expectations exceed real time

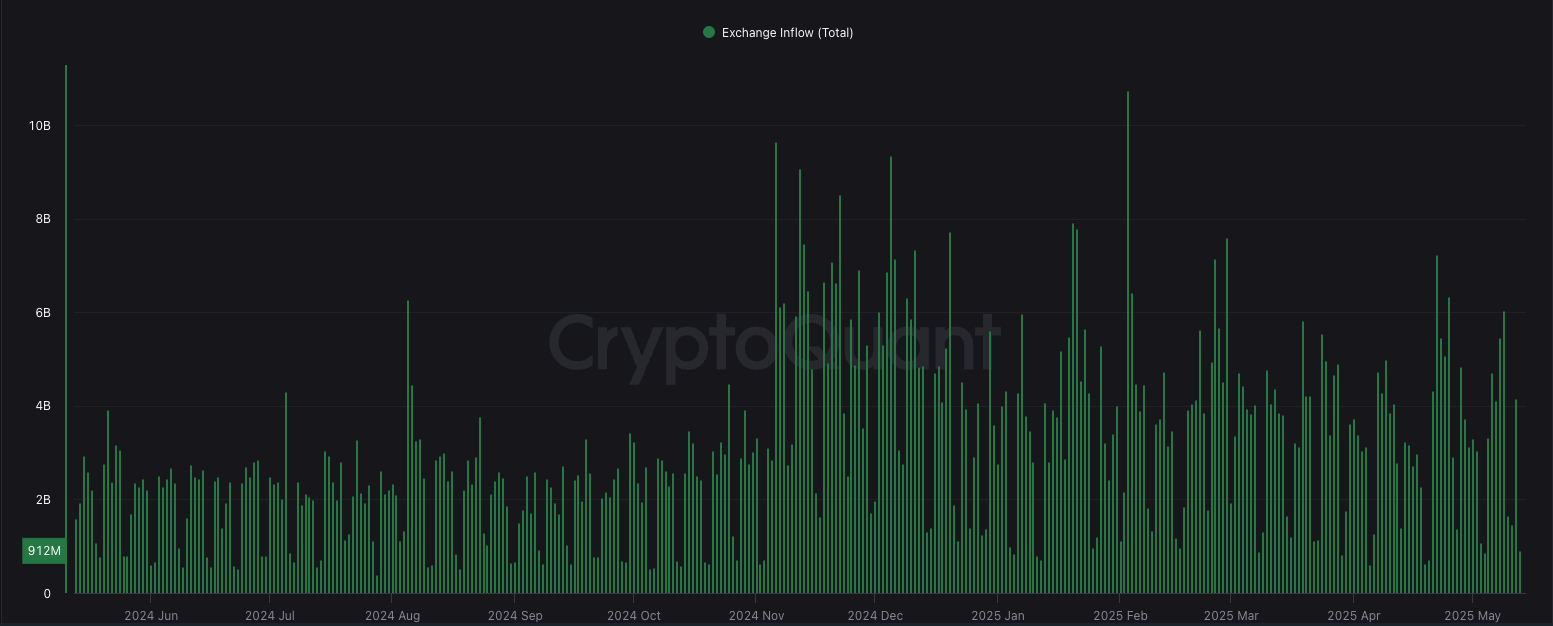

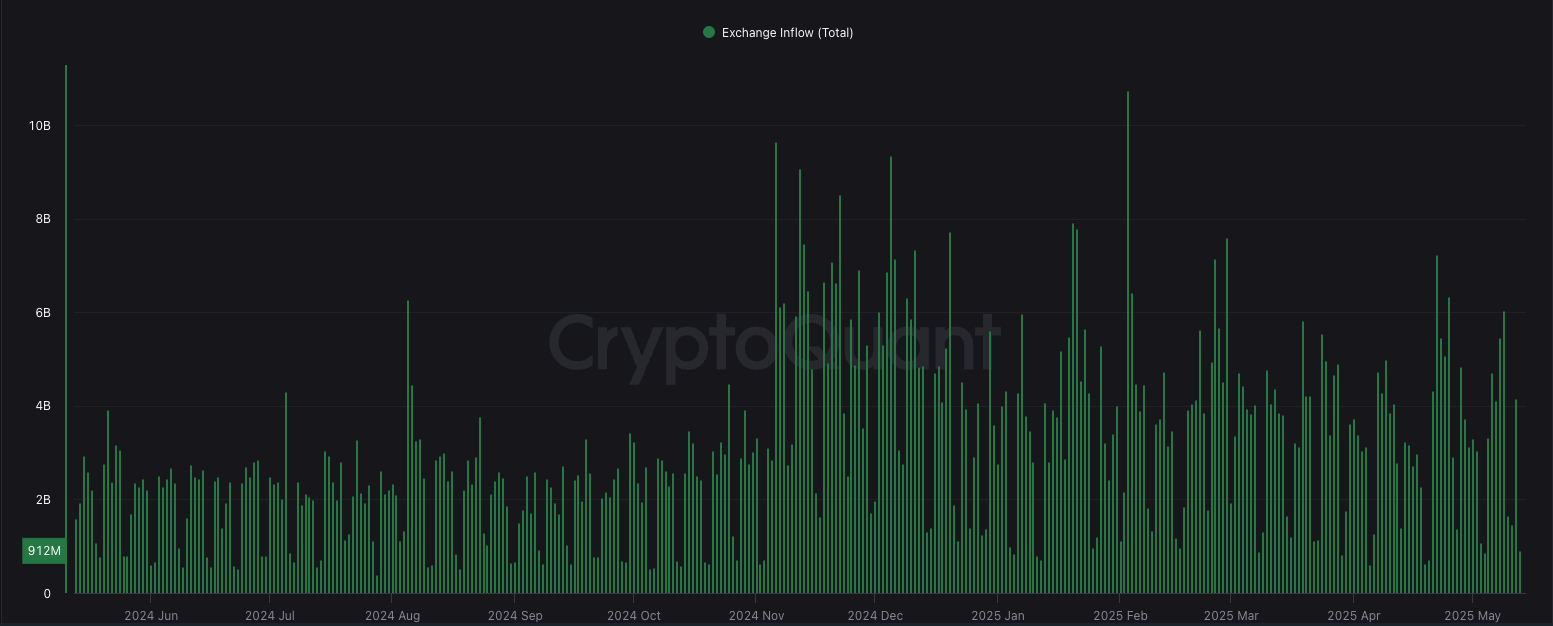

“Sell News” phenomenon rarely happens because the news itself is bad, but because the market has “priced” good news and expectation has been expected until reality. According to CryptoQuant, Stablecoin inflows to exchanges increased by 27% between April 28 and May 10, indicating that investors are actively preparing liquidity to “play the news.”

Source: Encryption

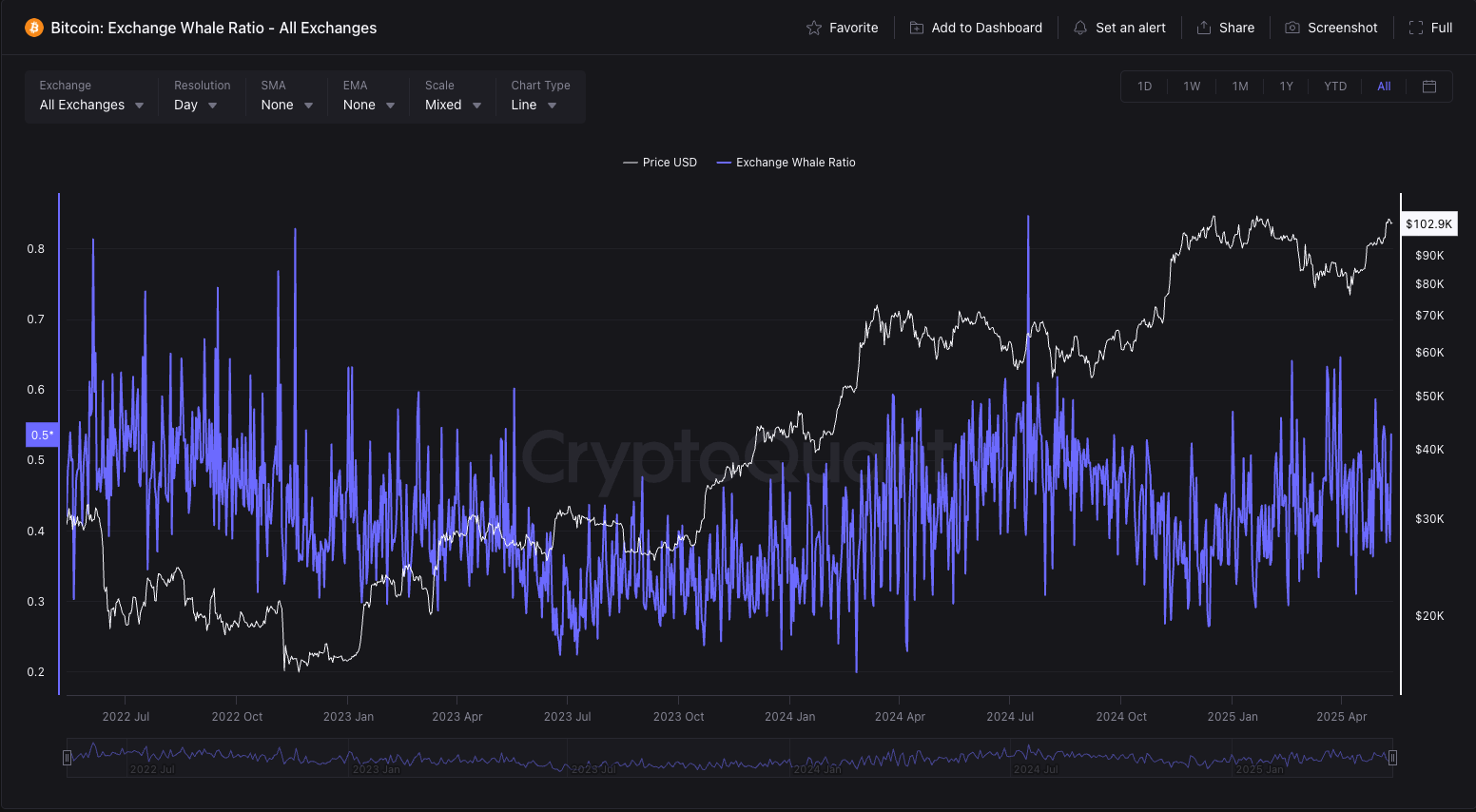

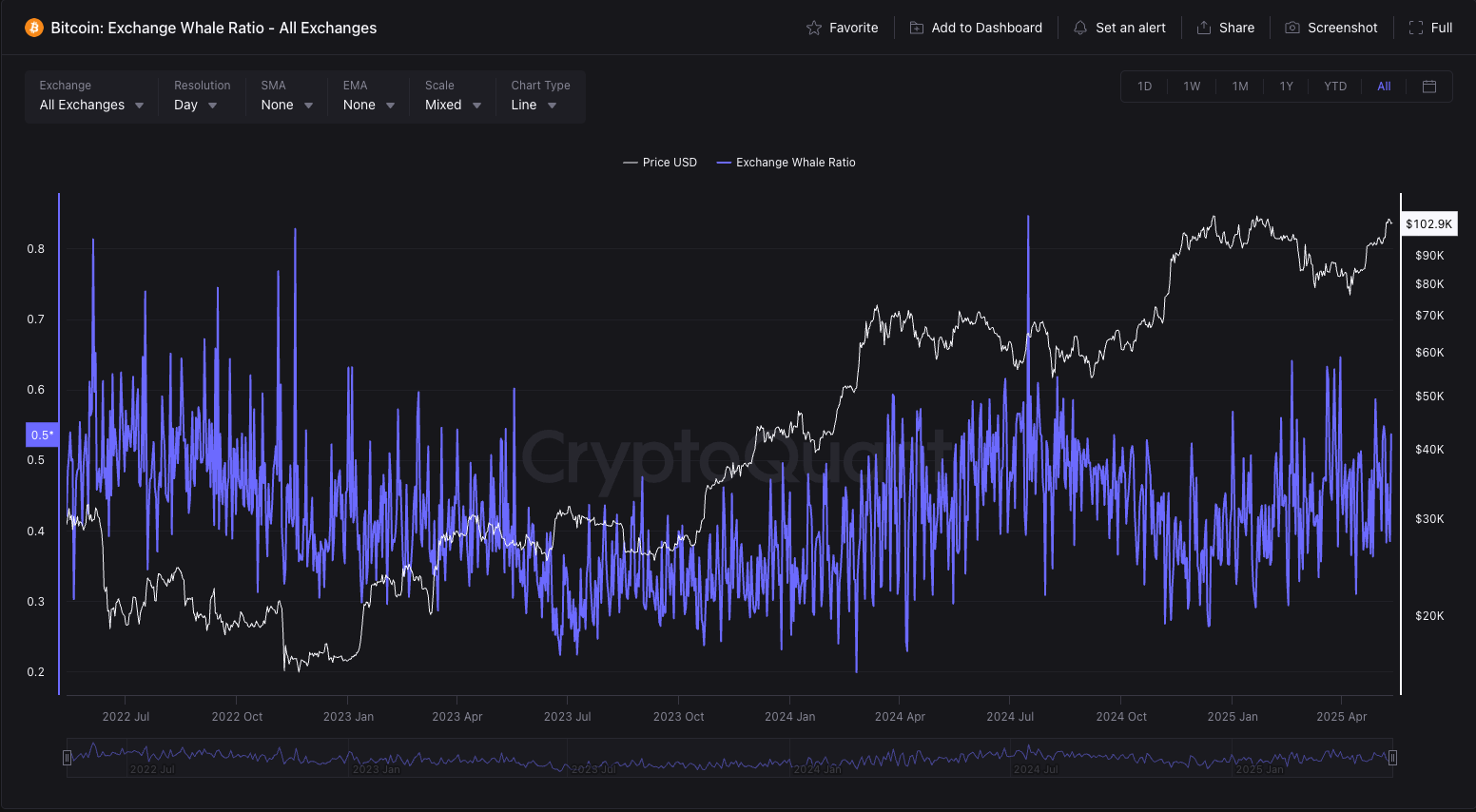

However, during the same period, the number of whale wallets (holding 1,000 to 10,000 btc) remained flat, suggesting that new inflows were mainly from short-term speculators. This is consistent with a common pattern in cryptocurrencies where price rallies are often driven by FOMO more than long-term accumulation.

Source: Encryption

The technical indicators also flashed a warning. On May 9, the daily RSI of Bitcoin and ETH exceeded 70, and the signal exceeded the condition. Meanwhile, even when prices rise, trading volumes start to drop, a classic setting for potential reversals. GlassNode’s data further suggests that BTC sediments were exchanged on May 10, which coincides with the short-term top of the market.

in conclusion

“Selling news” is an inherent part of the market cycle, especially during unsustainable gatherings or when information spreads too quickly. However, this does not mean that every good news should be doubted. The key is to analyze the essence of the news and subsequent capital flows.

There is no one suitable answer to whether you should be held or sold at a good news break. But three basic principles can help guide decisions:

First, evaluate the basic value of information. Technology upgrades, such as Ethereum’s pectra, may provide long-term benefits, while token listing announcements or airdrops usually usually only provide short-term upside.

Secondly, monitor capital flows. If TVL, active users and on-chain metrics remain largely unchanged after major announcements, there is a high possibility of rallying, which is emotionally driven and cannot be sustained.

Finally, build your exit strategy ahead of time – including clear profit levels or exploit reductions. Making decisions in turbulent market shifts often lead to emotional reactions and unexpected losses.

Read more: Trading with free encrypted signals in the Evening Trader Channel