As of May 2025, Bitcoin (BTC) continues to prove its dominance in the cryptocurrency market, surpassing traditional fiat currencies such as Dollar (USD) for multiple indicators.

A recent Coinbase ad highlighted that the Fed prints out new dollars every day compared to the limits of Bitcoin supply. If Bitcoin is not a real store of value, what should it be?

Right now: Coinbase releases new #bitcoin Commercial display How many fiats have been printed from thin air

♾/ 21 million pic.twitter.com/ar2unfpddf

– Bitcoin Magazine (@bitcoinmagazine) May 12, 2025

There is no limit on money supply

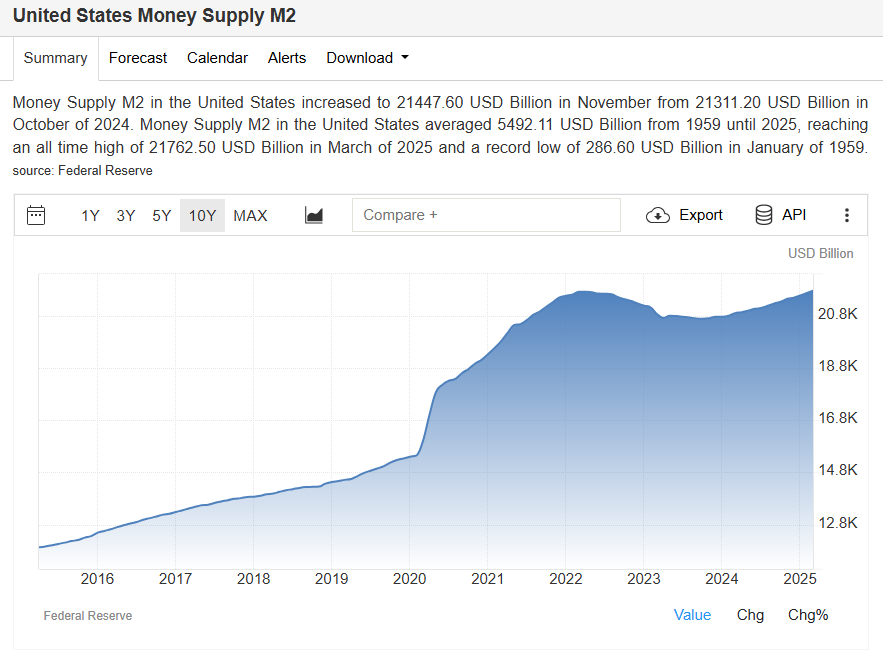

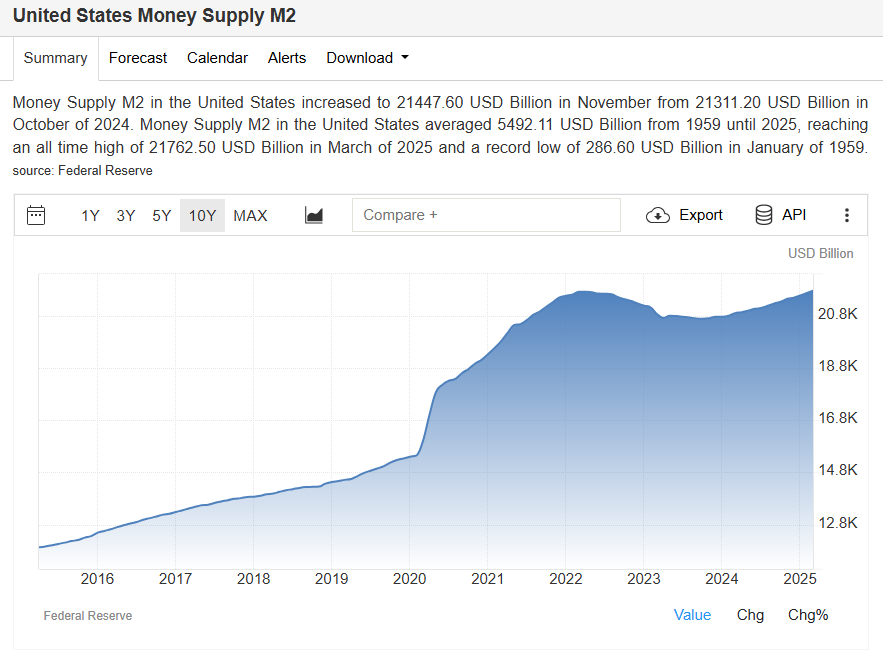

The Fed expands its money supply through tools such as open market operations, quantitative easing or adjustment of reserve requirements. $465 million per day is the monetary base growth, with about $170 billion per year in recent years (based on Fed balance sheet data). This is not literal cash, but digital reserve banks hold, increasing liquidity.

In addition, under the guidance of economic goals (such as inflation control, employment), the Fed can create funds as needed. Since 2008, the monetary base has increased from about $800 billion to about $5.7 trillion to 2025, partly due to crisis response.

Source: Trading Economics

Increased money supply will lead to inflation, thereby reducing the purchasing power of the US dollar. Since 1913, the US dollar has lost 95% of its value. Recent inflation, such as 7% in 2021, reflects this.

Read more: BTC hovers around $106K, ETH and XRP test key resistance levels

Fixed supply of Bitcoin ensures scarcity

Bitcoin BTC The hard hat has 21 million coins and is encoded as a protocol. The new Bitcoin is created through mining and issuance every 4 years (next ~ 2028 halved). Currently, about 19.8 million bitcoins are in circulation, and the final coins will be mined around 2140.

Compared with the US dollar changes, the decentralized nature of Bitcoin provides a hedge for the traditional financial system, compared with the decentralized nature of Bitcoin. Over the past year, the dollar has experienced inflationary pressures, with the U.S. annual inflation hovering around 3-4% (based on historical trends until 2023), while Bitcoin’s fixed supply cap of 21 million coins ensures scarcity, with higher value over time.

Continuous demand from first-time buyers

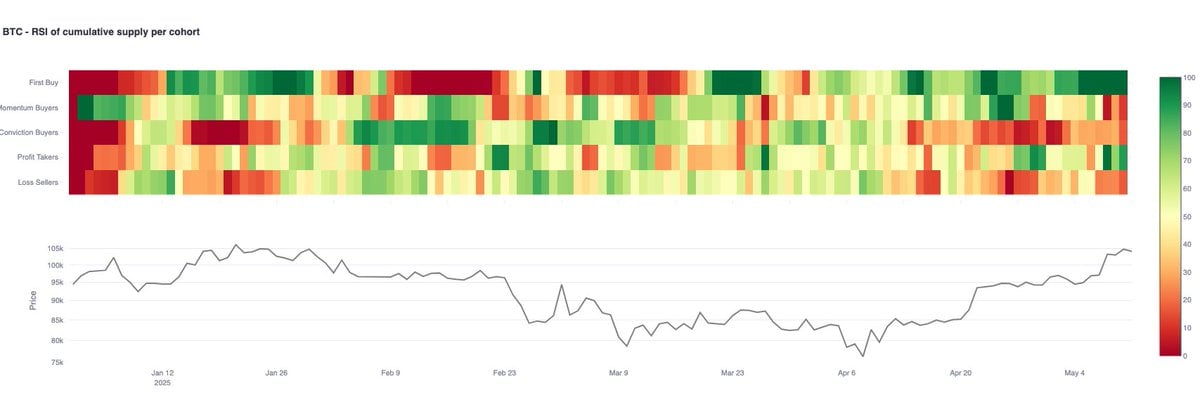

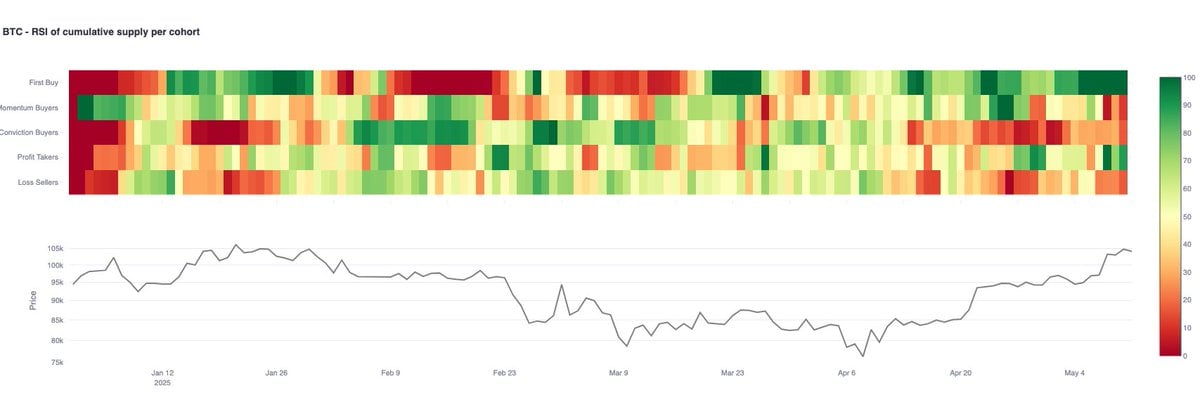

GlassNode’s recent supply mapping analysis provides a deeper understanding of Bitcoin’s market dynamics. On May 12, 2025, GlassNode reported that the relative intensity index (RSI) for first-time home buyers was 100 over the entire week, indicating unprecedented demand for the Bitcoin market by new entrants.

This metric is illustrated in the GlassNode’s cumulative supply RSI cumulative chart, showing a massive influx of fresh capital, a bullish signal for Bitcoin’s long-term growth. The heat map reveals the green areas that are continuing for first-time buyers, even when prices rise, reflect their active buying behavior.

Source: X

However, the same report noted that momentum buyers were weak, with an RSI of about 11, indicating that investors in the trend range have not intensified the rally. Additionally, profiters are rising, which may indicate that this could be selling pressure if new inflows slow down.

Nevertheless, the overall trend of new buyers entering the market shows confidence in Bitcoin’s future value at such high RSI levels, further cementing its performance against the US dollar.

Speculative momentum and hot capital inflows

GlassNode’s early analysis from April 30, 2025 highlights the surge in “hot capital” inflows into Bitcoin, driven by first-time home buyers and motivational buyers. This speculative enthusiasm suggests that Bitcoin is entering a new stage of market interest, and short-term capital is spinning faster.

Since April 21 $ btc Hot Capital rose from $20.7B to $39.1B – an increase of $18.7B or +92%. This is one of the fastest rises in short-term caps achieved in recent months, indicating a surge in positive capital turnover. pic.twitter.com/vm1lrghjj7

– Glass Node (@GlassNode) April 29, 2025

Although Ethereum also saw growth in earner activity, the surge in demand for Bitcoin seems to be stronger, with fewer obstacles to its upward momentum. This trend further supports Bitcoin’s performance against the US dollar as investors increasingly turn to digital assets to resist the depreciation of fiat currencies.

Source: Glass Festival

Bitcoin is the digital store of value

Bitcoin’s basic design also makes it better than the US dollar. With a fixed supply and a decentralized network, Bitcoin is often compared to digital gold, a store of value that is not disturbed by inflation and government.

Coinbase notes that Bitcoin can be divided into smaller units called satoshis (1 satoshi = 0.00000001 btc), making it highly flexible for transactions. Additionally, the ability to send, receive and store Bitcoin using encryption keys enhances its privacy and control capabilities that are a feature that the dollar cannot be copied in traditional forms.