Defi Development Corp. (DFDV), a Nasdaq-listed company formerly known as Janover, has become an active hub in the cryptocurrency space, especially through its massive investment in Solana sol.

Pay close attention to Solana

On May 12, 2025, Defi Development announced the purchase of 172,670 SOL tokens at an average price of $136.81, increasing its total Solana Holdings to 595,988 tokens worth nearly $105 million.

1/We just did it $ sol Buy! 🚀

Today, we announce that Defi Dev Corp. has purchased another 172,670 $ sol ($23.6 million) as part of our cryptocurrency treasury strategy.

The total amount of treasury stocks has officially exceeded US$100 million,

595,988 $ sol. 🤯 pic.twitter.com/qkzhibhkqe-Defi Devt Corp. (@defidevcorp) May 12, 2025

This strategic move is the biggest since last month’s crypto-focused shift, which cements Defi Development’s position as a major institutional player in the Solana ecosystem.

The Florida-based company started as a real estate technology platform, making a huge turnaround under the new leadership of former Kraken executives, including CEO Joseph Onorati. The acquisition coincides with a broader trend for listed companies that adopt cryptocurrencies as fiscal assets, inspired by Michael Saylor’s Bitcoin strategy with MicroStrategy.

Unlike many companies focusing on Bitcoin, Defi Development chose Solana, whose high-speed blockchain, low transaction fees and a strong decentralized financing (DEFI) ecosystem are key drivers. The company plans to save these tokens for a long time and back up them with validators (including their own) to generate revenue, further embed itself into Solana’s infrastructure.

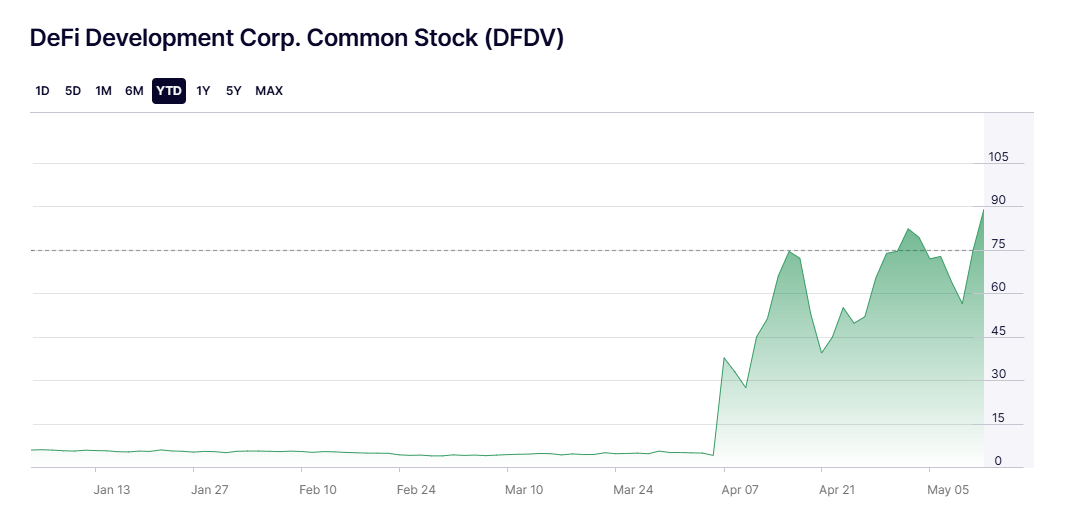

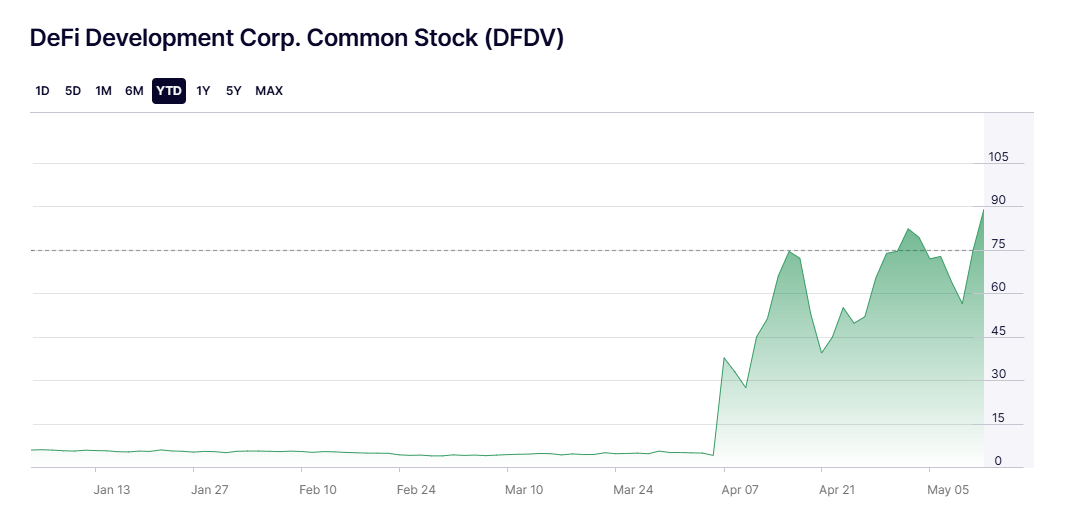

Source: Nasdaq

Bullish sentiment about Solana’s future

The market responded enthusiastically, with Defi Development’s stock rising 20% to $90 earlier on May 12, after receiving a wider intensive ensemble last Friday, with the stock earnings of 30% last Friday. The surge reflects investors’ confidence in the company’s SOLANA-centric Treasury strategy, which now equates to SOL at 0.293 per share, at about $50.42. The company earlier acquired 500,000 SOL ($72.5 million) of Solana validators and plans to raise $1 billion through the securities offered, which provides its ambitions to deepen its Solana exposure.

Read more: Strategy Bolsters Bitcoin Holtings Buy for $1.34 billion

Solana itself has performed strongly, with SOL climbing more than 20% over the past week as a result of increased network activity and institutional interest.

Source: TradingView

Defi Development’s bold bet on Solana emphasizes the convergence of traditional finance and blockchain. As the company continues to expand its cryptocurrency, it provides investors with a unique avenue to gain Solana’s growth exposure and potentially reshapes the perception of corporate cryptocurrency adoption.