On May 9, 2025, a strong rally was held in the cryptocurrency market, Bitcoin (BTC) For the first time since January, it has been discounted $103,000. Ethereum (eth) and many Altcoins have also posted huge gains, bringing the global crypto market cap to a total of more than $3.22 trillion.

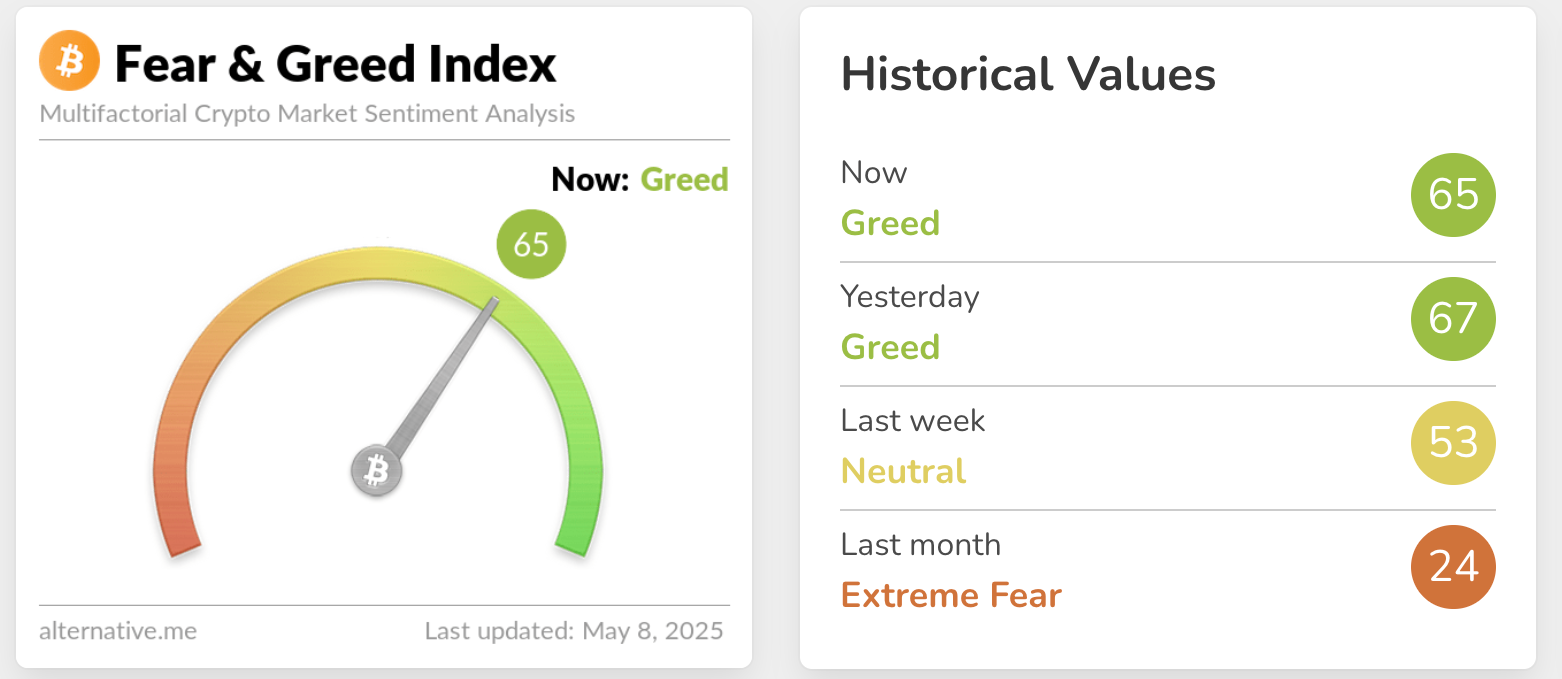

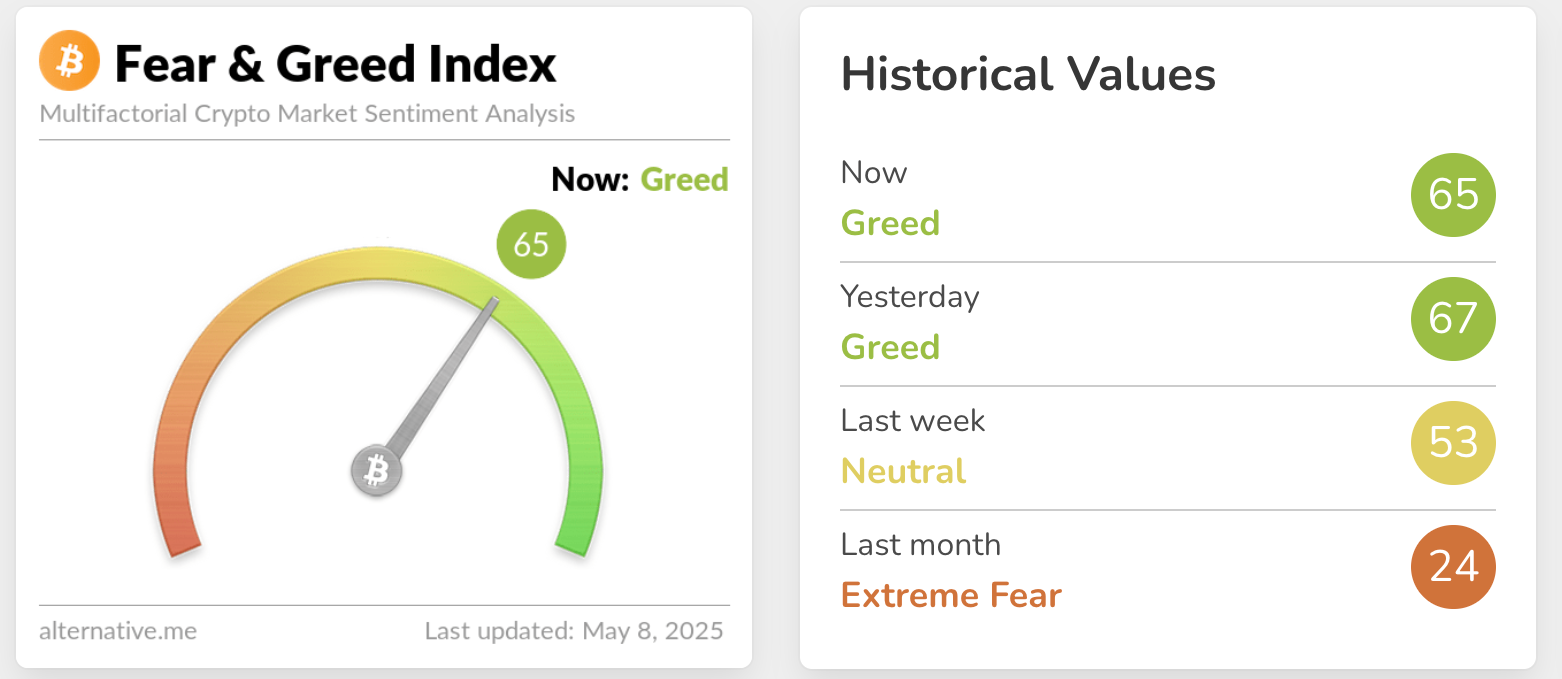

The Fear and Greed Index jumped from 48 (neutral) to 63 (greed) in just three days. According to Santiment, the number of retail wallets that buy BTC and ETH has increased dramatically since the beginning of this week.

So, what drives an impressive recovery?

Source: Alternative

Reduce expense sentiment

Data on U.S. unemployed claims released on May 8 showed a slight drop to 228,000 files, down from 241,000 last week. The earlier spikes were mainly attributed to seasonal factors in New York State and did not indicate a broader trend in layoffs.

Learn more: Bitcoin Price Over $100K in a Situation of Trade Optimism

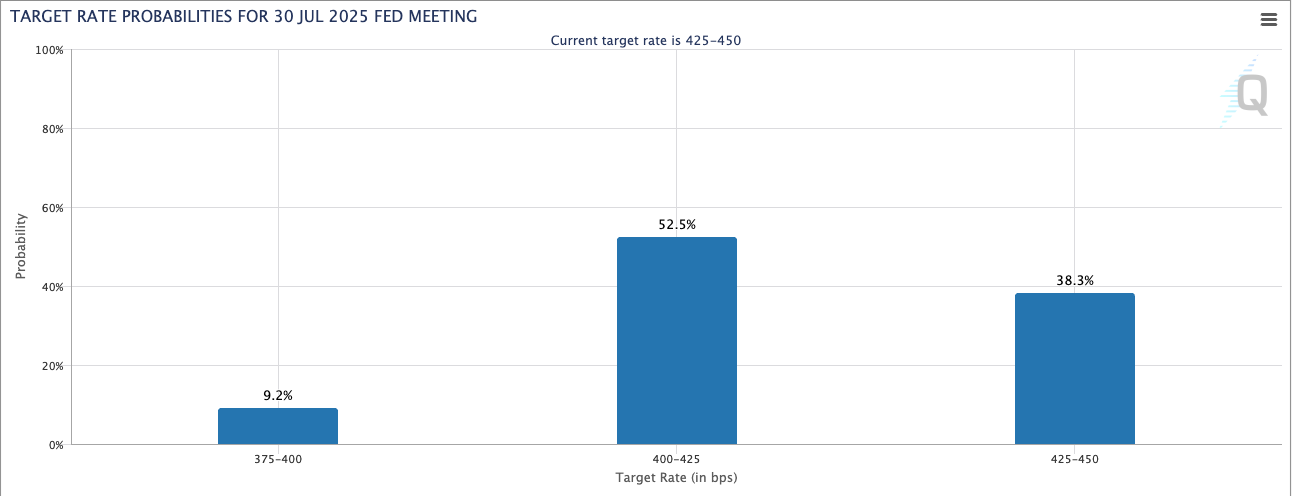

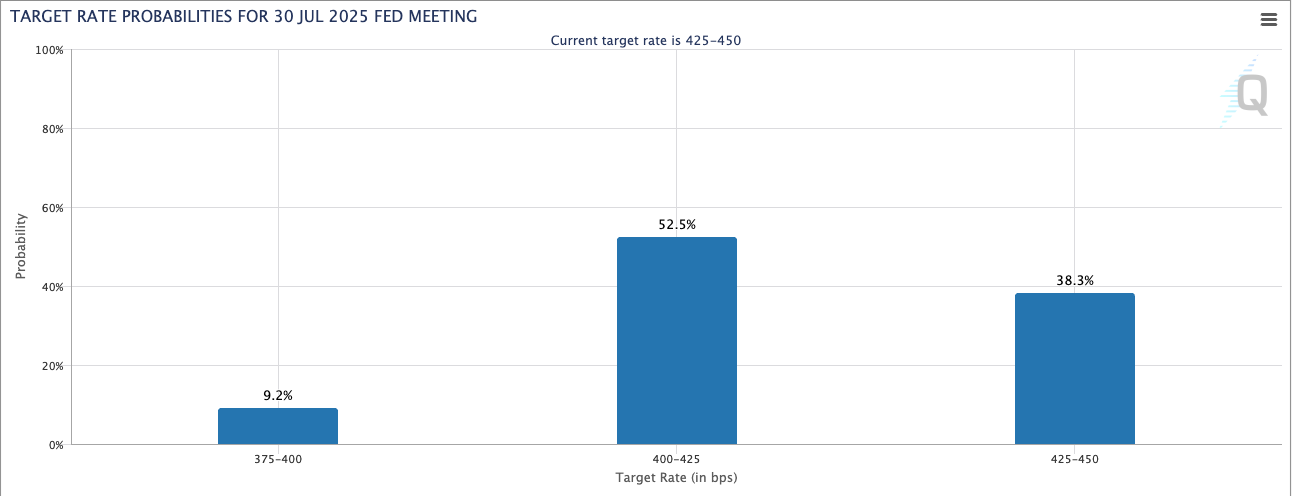

Still, investors are concerned about the health of the U.S. economy, explaining the Fed’s decision to keep interest rates at 4.25%–4.4.50% to show that the risk of recession is being weighed. As a result, expectations of lowering interest rates in the third quarter of 2025 continue to support risky assets, including cryptocurrencies.

Source: CME Group

The U.S. fiscal yield in the 10-year U.S. fell to 4.38%, while the DXY index (measures the strength of the dollar) fell to a three-week low, indicating that capital is moving capital to speculative assets.

Another key factor is the increasing focus on scattering – a situation in which economic growth slows down inflation remains high, prompting investors to seek value-store assets like Bitcoin.

As the Fed’s holdings are stable and there is no clear guidance on June cuts, the market is increasingly priced in the coming quarter.

In this environment, Bitcoin, commonly known as “digital gold,” has become a striking hedge, especially as the dollar weakens and macro uncertainty rises.

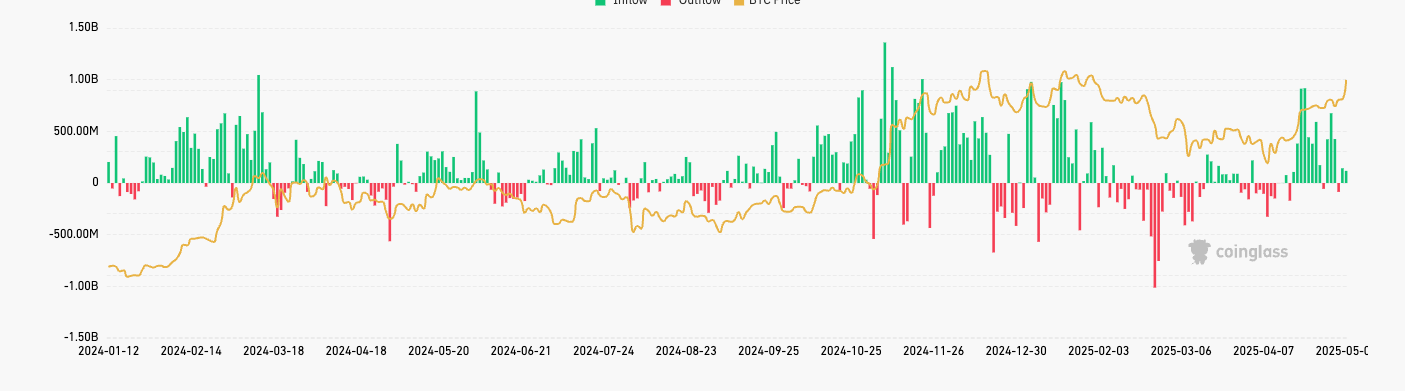

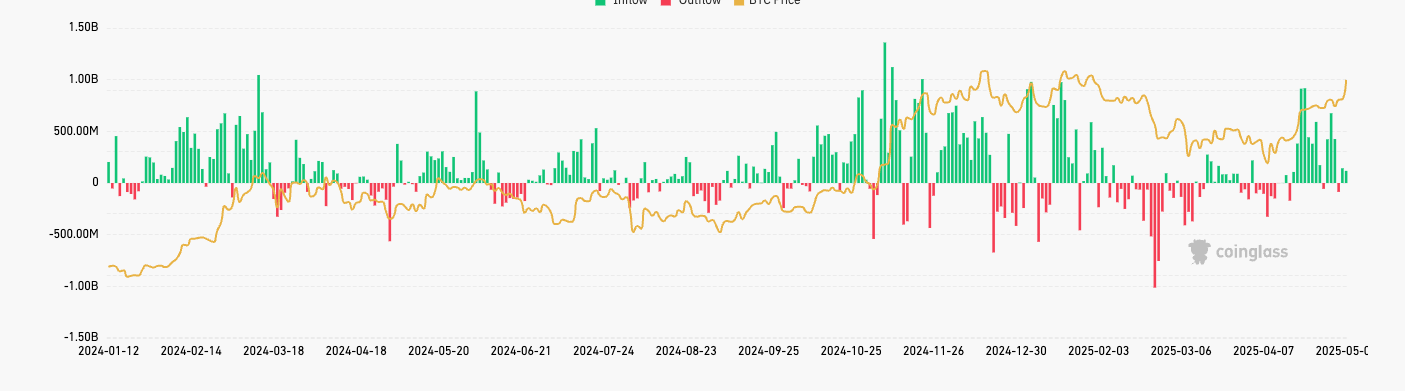

Large inflows into Bitcoin ETFs: The key catalyst behind market rally

In the first week of May 2025, U.S.-listed Bitcoin ETFs witnessed strong inflows, highlighting the growth in institutional interest in digital assets.

On May 8, 2025 alone, the total amount of all inflows into Bitcoin ETFs reached US$117.4 million, of which:

- Blackrock’s iShares Bitcoin Trust (IBIT) leads this with $69 million,

- Next is Fidelity’s Smart Origin Bitcoin Fund (FBTC), $35.3 million

- and Ark 21shares Bitcoin ETF (ARKB) for $13.1 million.

Bitcoin ETFs have attracted more than $5.3 billion in cumulative inflows over the past three weeks, underscoring the surge in demand among traditional investors.

It is worth noting that since the beginning of 2025, IBIT has surpassed SPDR Gold stock (GLD) by more than $6.96 billion, indicating that the shift from gold to bitcoin is the preferred store of choice for value assets.

Source: Xiaodian

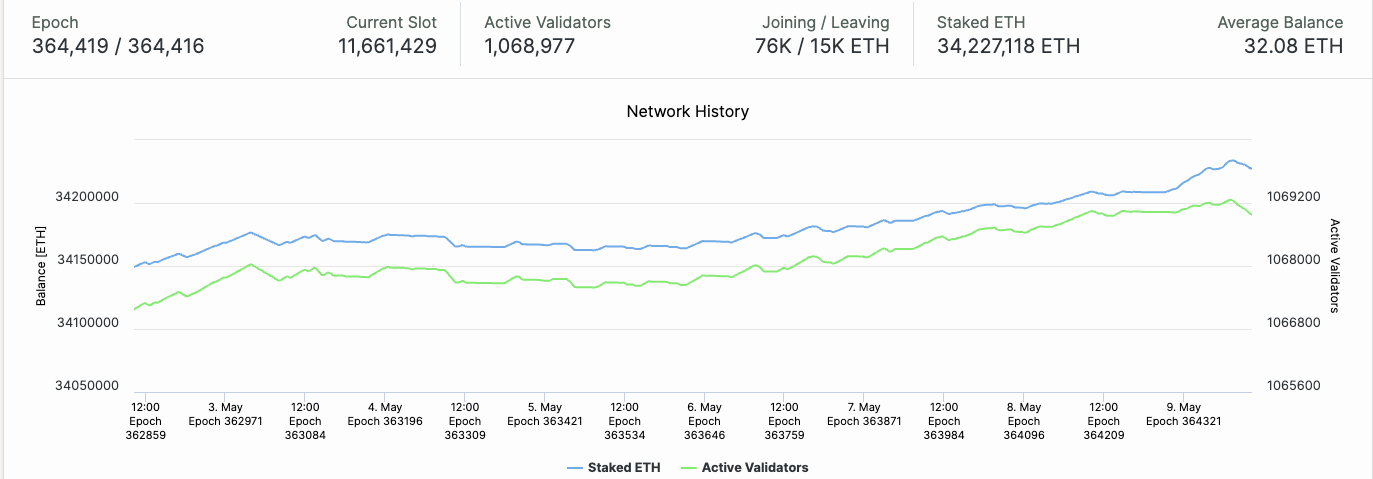

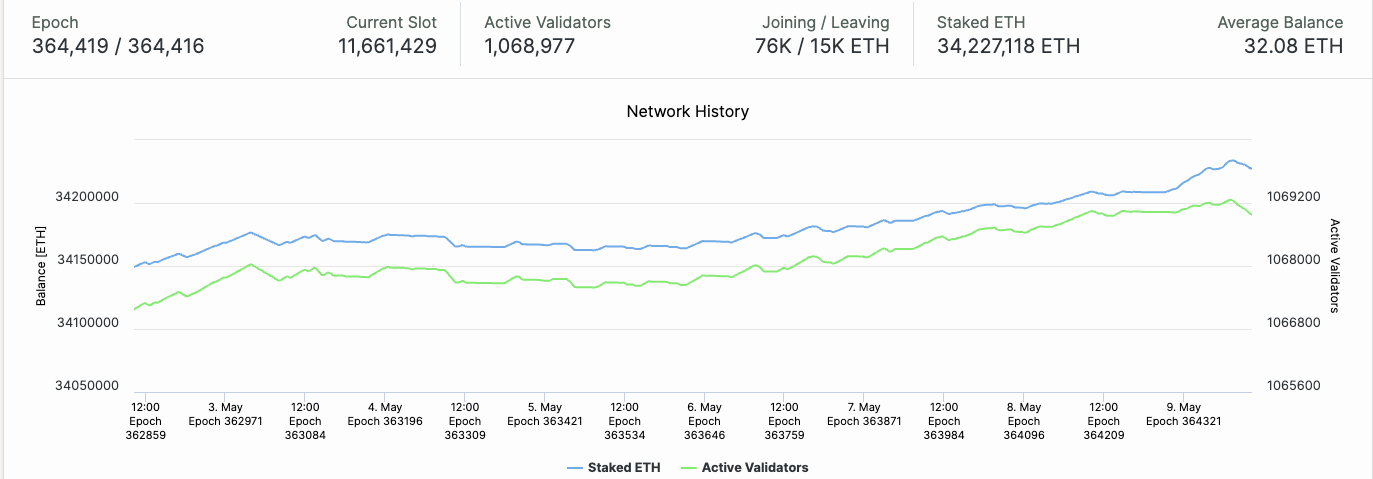

ETF hopes to upgrade enhanced Ethereum with Pectra

Over the past seven days, Ethereum’s set has dropped by nearly 20%, driven primarily by two key catalysts. On May 7, the successful launch of the Pectra upgrade has improved network performance and streamlined points, and speculation that the SEC may approve one or more live Ethereum ETFs by the May 23 deadline.

The Pectra upgrade not only enhances trading experience and scalability, but also modifies stacking parameters to make it easier for retail investors to participate in ETH stating, a factor that can drive long-term holding demand.

Learn more: ETH price forecast after Pectra upgrade in May

According to Beaconscan, more than 400,000 ETH was added in three days after the upgrade, the biggest spike since January 2024.

Number of Ethereum Verifiers After Pectra – Source: Beaconcha

Additionally, Bloomberg reported that the SEC held several closed-door meetings with ETF issuers last week, sparking speculation about potentially favorable surprise decisions – just like the recognition of spot Bitcoin ETFs earlier this year.

U.S. trade deal hopes to raise risk sentiment

Amid ongoing global geopolitical uncertainty, a new statement by U.S. President Donald Trump helps boost market sentiment. Trump announced that the United States is preparing to establish a major trade agreement with “very respectable” countries, widely interpreted by analysts as the United Kingdom.

Markets soon see it as a signal that the U.S. may be softening its trade stance, which could ease tensions with key partners after extending tariffs and protectionist policies.

🇺🇸Only: President Trump announced a press conference on a “major trade deal” scheduled to be held at 10:00 a.m. tomorrow in the Oval Office with “a big and respected nation.” pic.twitter.com/irsood0jrz

– Cointelegraph (@Cointelegraph) May 8, 2025

Positive sentiment spreads to risky assets such as stocks and cryptocurrencies. The dollar weakened, while stocks and Bitcoin soared, reflecting the return of speculative capital as optimism grew about a more stable global trade environment.

Technical analysis confirms bullish momentum

From the $2.4 trillion support zone, the total rebound in cryptocurrency market capitalization (total) is strong and is now stable at over $3.2 trillion. This recovery is outbreak with the RSI shed territory and is close to 70, indicating a strong bullish momentum.

In addition, the move above the 200-day moving average further confirms that the short-term uptrend has been firmly established.

This rally is not alone and isolated – traditional financial markets are also getting higher and higher:

- Nasdaq gains 1.8%

- Gold price exceeds $2,380/oz

These moves reflect an increasing appetite for safe havens and speculative assets. In this case, encryption appears to benefit from the broader global market dynamics rather than gathering in isolation.

Source: TradingView

in conclusion

The strong rally on May 9 was the result of several convergence factors: expectations of the Fed’s tax reduction, ongoing institutional inflows into Bitcoin ETFs, successful Ethereum upgrades, and rapid improvement in investor sentiment.

However, for the gathering to become sustainable, the market still needs further confirmation. Two upcoming events will be crucial:

- Federal Reserve’s monetary policy decision in June

- And the SEC’s ruling on live Ethereum ETFs is expected to be in late May

These will be key turning points that can shape the short-term trajectory of the cryptocurrency market.

Read more: Bitcoin price hits $100,000, triggering another sold out?