Following a list of several reproduction projects including Corneldot, Soleier and Babylon – Regarding the 2025 binance in Q2, a question arises: Will “reproduction” become the next dominant narrative in the cryptocurrency market?

What is recovery and why is it important?

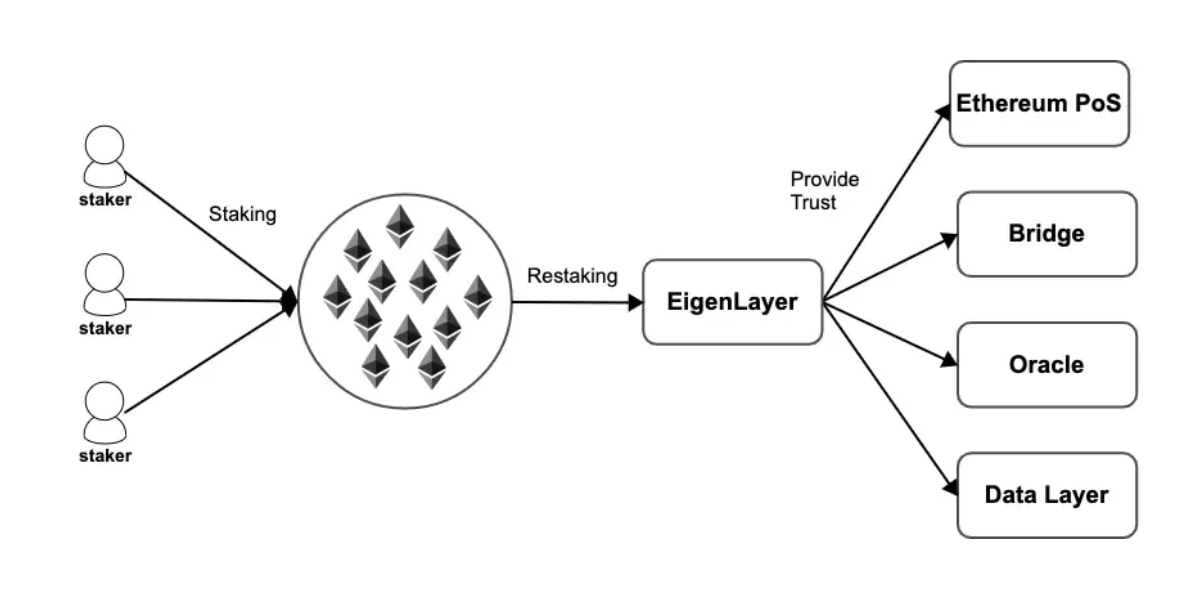

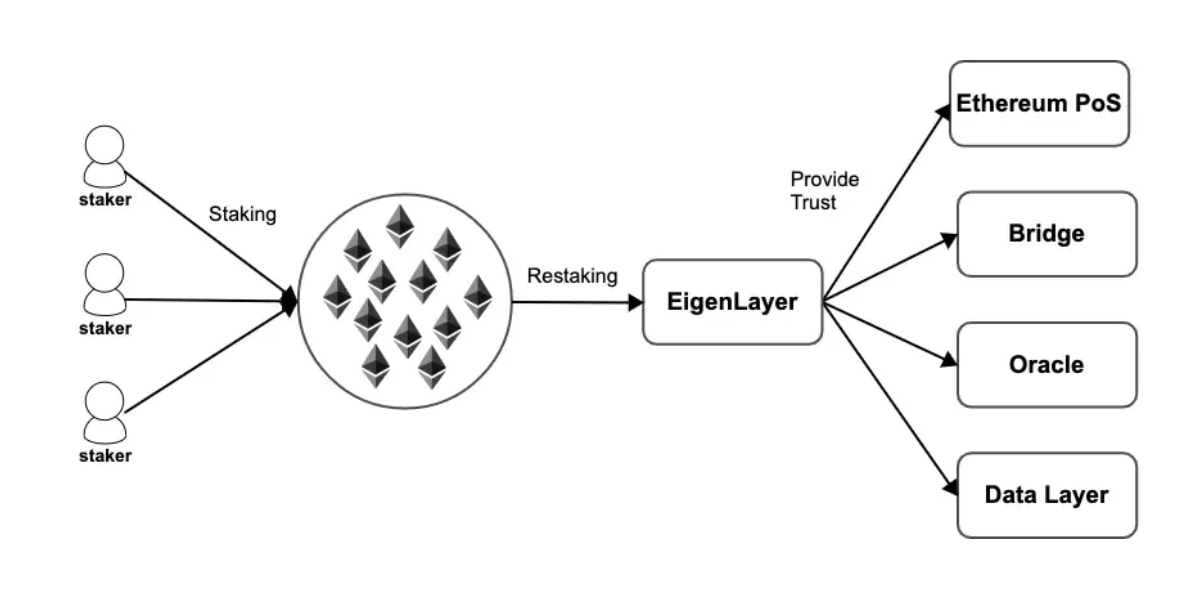

Remake is a mechanism that allows users to reuse stored assets (usually ETH) to protect other networks or applications without extracting them from the original Stataking Platform. This represents a significant breakthrough in capital efficiency within the blockchain ecosystem, as it can use a single asset for multiple security purposes, thereby facilitating the growth of new infrastructure layers without compromising the integrity of the fundamental network.

This mechanism greatly reduces the security barriers to new projects. Traditionally, launching a new blockchain or Appchain means securing a dedicated suite of validators and purchasing new stacked capital. With remastering, projects can be “rented” security from Ethereum or compatible tokens that have been solidified on the compatible chain, reducing issuance time and increasing trust in early trust.

The concept of reproduction was pioneered by Eigenlayer, a project that is widely expected to become a secondary security pillar of Ethereum. eigenlayer allows users to restart ETH that has been fixed on Ethereum to provide security for auxiliary modules such as A, bridge or summary. Initially, Eigenlayer was committed to enabling developers to build plug-and-play security modules, but this has evolved into an entire ecosystem called “Restaking-As-A-Service.”

Read more: What is cryptocurrency? Beginner’s Guide

Source: self -layer

The model is not limited to Ethereum. Other chains such as Solana and BNB Smart Chain have also begun integrating or enabling similar approaches, leveraging their local tokens (such as Sol, BNB) to scale up the stacking mechanism in a more flexible way – aligning with the modular security requirements of next-generation Web3 infrastructure.

The reecological ecosystem is expanding rapidly

As of April 2025, several major revision projects have made significant progress:

- Kerneldao (BNB Chain): The first native on the BNB chain re-engineered the protocol, supported by Binance Labs. After listing Binance on April 14, the kernel’s token reached a full dilution valuation (FDV) of more than $300 million, and was then significantly corrected to $0.17. However, this clearly proves the appeal of the narrative that has started over in the Binance community.

- Solyer (Solana): Solayer is a pioneer in bringing “liquid reproduction” to the Solana ecosystem, allowing users to continue to participate in DEFI while receiving liquid assets. The project was listed on Binance on April 22, with the initial FDV of about $900 million. Solayer also plans to integrate real-world assets (RWA) and re-device for Web3 games.

- Babylon (Bitcoin): Babylon expands the concept of reproduction to Bitcoin, allowing BTC holders (usually holding non-income assets) to protect Appchains or Rollups. With a modular security model and backed by leading funds like Polychain and Binance Labs, Babylon was listed on Binance on April 25 and quickly became one of the five most recent five new tokens this week.

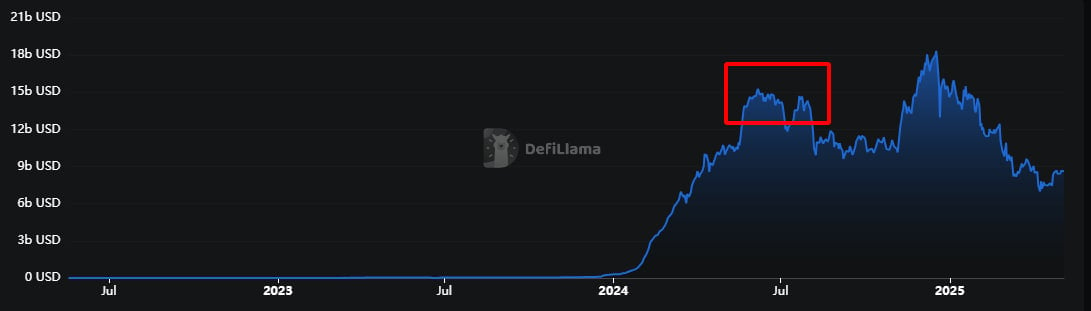

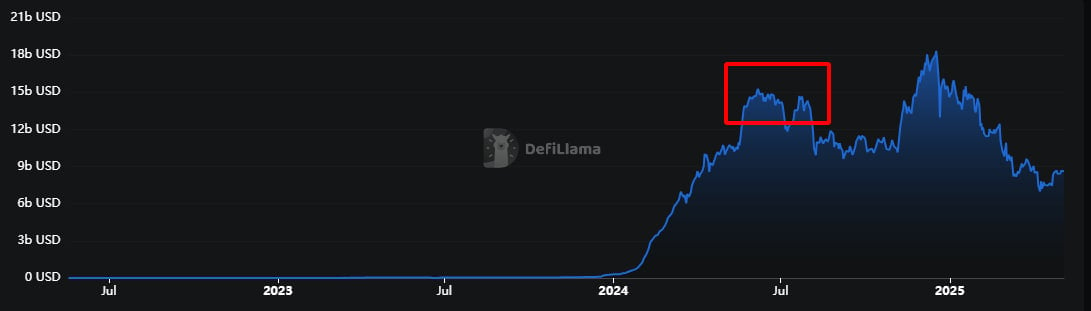

Why reign again in 2024

The narrative of recovery has attracted attention in late 2023 through protocols such as Eigenlayer, which introduces a novel idea: to use fixed assets (especially ETH) to secure other services such as Oracle networks, data availability layers, and AppChains. This concept quickly gained appeal for several reasons:

- Capital efficiency: Users can earn stratified returns by repurposing already solidified assets.

- Safety as a service: New protocols are no longer needed to boot the validator network from scratch.

- Agreement Revenue: Restaking opens new revenue streams for infrastructure and middleware projects.

The rise of the meteorites of Eigenlayer, coupled with the support of strategic venture capital, has restored the infrastructure narrative of the cycle.

TVL for liquid rehabilitation protocols rose significantly in 2024 – Source: Defillama

Can reproduction make a comeback in 2025?

While narratives like AI X Crypto, Socialfi and modular gaming accounted for the headlines in early 2025, the latest list from Kerneldao, Solayer and Babylon suggest that interest in rebuilding infrastructure has rekindled interest. These new contestants reflect the maturity of the narrative, spanning multiple chains (BNB, Solana, Bitcoin) and expanding use cases beyond Ethereum.

However, whether reproduction can restore its status as a top narrative remains uncertain. Depends heavily on:

- True adoption of arranged security Cross volumes, games and RWA.

- Regulatory clarity Around one service.

- Continue to innovate In modular design and cross-chain compatibility.

If these factors are consistent, then remakes can again go from narrative to necessity, providing a backbone for the next stage of the next decentralized security infrastructure.

The rapid continuation of reproduction projects on second-hand bodies turns what once considered a “technology niche” into one of the most important investment narratives of Q2 2025.

Milkyway stands out in the BNB chain, aiming to expand the decentralized security of satellite links in Web3. Instead of traditional BNB points, users are reused to protect the app and earn milk without losing liquidity.

Milk Tokens are launched through Binance Wallet on April 29, 2025 via Wallet Initial Products (WIO). This is more than just the new decentralized fundraising model. It is also a strong signal that Binance has attracted special attention from the Milky people, similar to its support for Kerneldao and Babylon.

Learn more: Milky Price Forecast

Source: Milky

Milkyway uses a multi-layer architecture to achieve cross-chain mean between Ethereum and BNB smart chains. This not only extends its security base, but also enhances compatibility with Defi projects in both ecosystems.

Unlike Puffer and Swell, which face airdrop sell-offs, Milkyway may benefit from a lightweight FDV strategy. Milkyway has maintained its valuation conservative and has steadily grown TVL to support healthy post-listing performance.

in conclusion

Three lists in two weeks – Keneldor, Soleiner and Babylon, showcase the narrative of binance. As the market recovers, the growth of reproduction goes beyond technology and becomes a key pillar of the Web3 ecosystem.

Milkyway may be the next work in this growth trend. Investors should track unlock, TVL growth and binary links to assess the medium-term potential of milk.

Recovery was once a vision. Now, it has become a reality – verified by the market itself.

Read more: The top 5 pre-computing projects supported by Yzi Labs (Binance Labs)