As the value of cryptocurrencies rises and trust in them grows, Bitcoin ATMs have become an important link between the digital asset world and traditional Fiat currency transactions. If you are a new user or investor, please ask yourself what is Bitcoin ATM, how to use Bitcoin ATM or what is different from traditional ATMs, and we will provide you with services.

This guide will explain how Bitcoin ATMs work, how to use them to buy and sell Bitcoin, its fees, and whether use is a good crypto investment strategy.

What is Bitcoin ATM (BTM)?

Bitcoin ATM, also known as Bitcoin teller machine (BTM), is a physical electronic information kiosk that allows you to conduct crypto-based transactions, especially with Bitcoin. Unlike traditional ATMs that connect to your bank account, Bitcoin ATMs are directly connected to online Cryptocurrency Exchange Through blockchain technology. There are two types of these BTM physical kiosks, namely:

- One-way (one-way) ATM – Users can only purchase Bitcoin.

- Two-way (two-way) ATM: Users can buy and sell Bitcoin.

Source: Bitcoin Expert

To use them efficiently, you need to understand their capabilities:

- They are mainly located in public places such as airports, convenience stores or shopping malls.

- You must have a cryptocurrency wallet to receive the BTC you purchased.

- Some BTMs allow users to sell Bitcoin in fiat currency.

- The transaction is executed within minutes.

- Transaction fees may vary greatly depending on the quantity.

Benefits of Bitcoin ATM

One of the main benefits of BTMs is that they allow users to bypass traditional banking systems and perform seamless cryptocurrency transactions using cash or debit cards, such as depositing cash or buying bitcoin and other digital assets. If you ask yourself that Bitcoin ATMs are anonymous, the answer is that they provide a certain degree of anonymity because you don’t have to provide personal information every time you make a transaction. Other benefits include:

- Fast deals with traditional Cryptocurrency Exchange

- Even people without banks can use it.

- If the user wants, they can trade in fiat currency.

- Bitcoin teller machine displays transparency of real-time exchange rates.

The risks and limitations of Bitcoin ATMs

With all the benefits associated with Bitcoin ATMs, there are some disadvantages you need to understand. One of the most important challenges is that most ATMs do not support every type of cryptocurrency, limiting the options you may have. Other limitations include:

- Relatively high transaction fees.

- ATMs are available in only a few countries and urban areas and are hardly present in rural areas.

- Some BTMs do not support other cryptocurrencies.

- Technical issues may arise and affect transaction execution.

- Daily withdrawal restrictions may limit the size of transactions.

A brief history of Bitcoin ATM

On October 29, 2013, the first Bitcoin teller machine was installed in a coffee shop in Vancouver, Canada. Soon after that, Bitcoin ATMs were spread throughout North America and Europe. BTM proves to the world that it is possible to convert BTC into cash easily and conveniently and return again, and opens the way to open up the cryptocurrency to openly.

Although the initial adopters were primarily tech-savvy individuals and crypto-assisters, these machines have now become part of the daily financial life of ordinary people. Recently, Bitcoin ATM devices have been expanded worldwide and machines are now available in over 70 countries. Most BTMs are available in the United States, followed by Canada and Europe. By the time of writing, there are at least 38,000 Bitcoin ATMs worldwide. politician.

How does Bitcoin ATM work?

If you want to figure out how to use Bitcoin ATMs, your direct operations may surprise you despite using advanced technology to facilitate transactions. After inserting physical cash, the machine will convert it to BTC and send it to your Digital wallet. You can compare BTM to a vending encryption machine that acts as a bridge between Bitcoin and cash.

How to use Bitcoin ATM

Using a Bitcoin ATM is an easy experience as long as you follow the simple tips given by the machine. The most critical factor is making sure you have a crypto wallet installed on your mobile device, because this is where you buy Bitcoins. Here are the steps to follow:

- Digital wallet: Make sure you have one Encrypted wallet After the transaction is completed on the ATM, store Bitcoin.

- QR CODE: Scan the QR code from your Bitcoin wallet app to connect it to financial transactions.

- trade: Insert cash into the BTM and select the amount of BTC you want to buy or sell. If you plan to sell Bitcoin, enter the amount you want to sell (Make sure you find a two-way Bitcoin ATM so that you can sell cryptocurrencies in traditional currencies.)

- Blockchain: ATM handles transactions on the blockchain.

- Receive Bitcoin/Cash: The cryptocurrency you purchased will be sent to your digital wallet, or if you sell Bitcoin, you will receive a traditional currency. You can receive email confirmation of the transaction.

Bitcoin ATM adjustment requirements

As the spread of Bitcoin ATMs continues globally, it can be noted that the regulations for using them vary depending on jurisdiction. Governments everywhere want to keep users safe and have set rules that promote Bitcoin adoption and consumer safety. While it can be challenging to develop strict cybersecurity measures, most countries have established anti-money laundering (AML) and Knowledge Customer (KYC) laws regarding their installation and use.

Before using Bitcoin teller machines, you need to understand the regulations, so you only use operators that promote security besides innovation. Moreover, different countries and nation There may be different Bitcoin ATM rules. Understand applicable regulations so that you can comply with them before using them. You’d better use Cryptocurrency legal chart Know where you might find ATMs.

Bitcoin ATM Fees

Bitcoin ATMs can be relatively expensive even when buying and selling cryptocurrencies online compared to traditional ATMs. Typical transaction fees range from 4% to 25% of each transaction, depending on the number of machines involved. Some BTMs may charge additional fees, called network or variable miner fees, to process transactions on the blockchain. If you want to buy a lot of cryptocurrency, compare the fees to cryptocurrency exchanges to see if you can save some money.

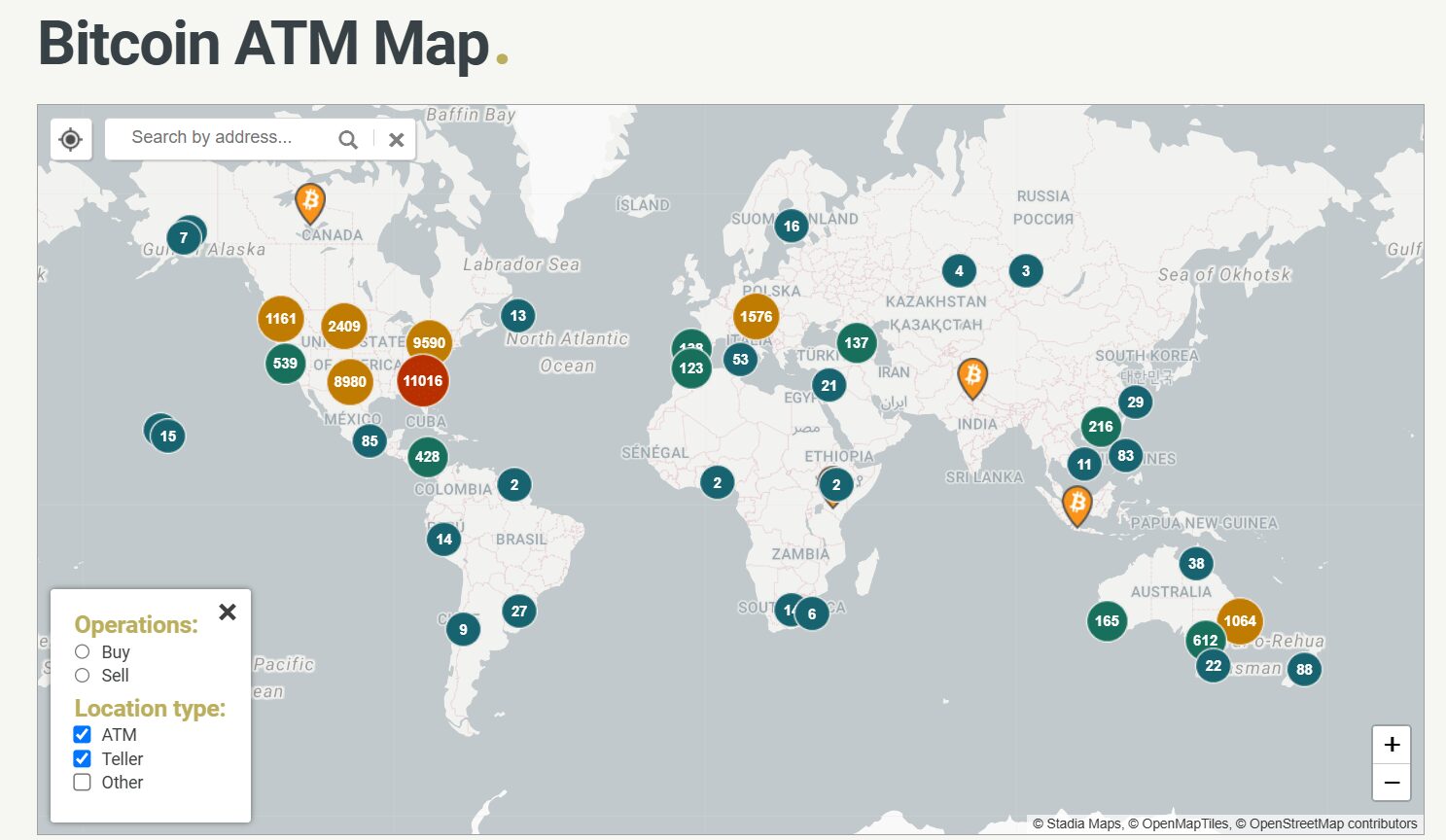

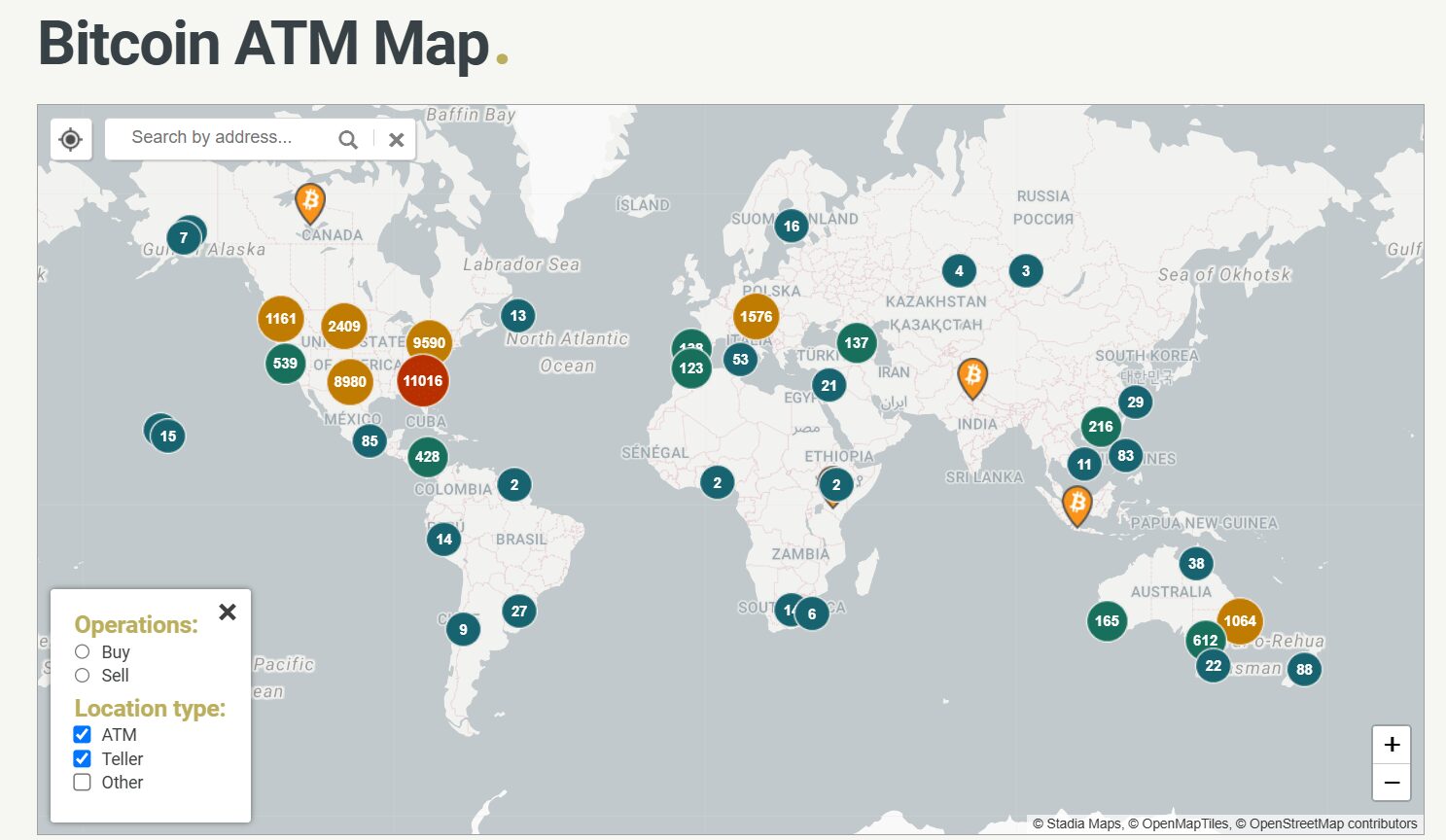

How to find Bitcoin ATM by location

Once you understand how Bitcoin ATMs work, your next task may be to find a Bitcoin teller machine near you. In this regard, the best resources are like Coin ATM radarThis allows you to find nearby Bitcoin ATMs based on location. The site provides most details, including supported cryptocurrencies and the types of transactions you can perform.

Source: Coin ATM radar

Here are the simple steps to find a Bitcoin ATM near you:

- Visit the website: Log in to the Coin ATM radar and enter your city or address.

- Filter your search: You can filter search results by digital asset type (such as Bitcoin, USDT, etc.) whether you buy or sell, as well as your preferred ATM provider.

- Find the ATM: Check out the provided map to find the BTM closest to your location.

Bitcoin ATM scam

Criminals are increasingly using Bitcoin ATMs to deceive unsuspecting people, using BTMs to transfer funds to them by pretending to run real investments. Cybercriminals, especially target older people via email, phone or social media, to convince users to deposit money into Bitcoin ATMs. The criminal mainly instructs the victim to scan the QR code of the wallet or enter its wallet address to direct it to the attacker’s account.

Examples of Bitcoin ATM scams include:

- imitate: The attacker pretends to be a law enforcement officer, government official or utility worker and demands payments for cryptocurrency.

- Fake investment opportunities: Scammers lure unsuspecting users into having non-existent investment opportunities that are expected to receive high returns, requiring victims to deposit funds through Bitcoin ATMs.

How to Avoid Bitcoin ATM Scam

- Treat discounts with caution: Never trust any offer of a stranger with promising investment opportunities and fast wealth.

- Verify legitimacy: Do not make any transactions, you suspect; do not send money from unfamiliar sources to your wallet address and QR code.

- Avoid urgency: Never let anyone put pressure on you with false claims for limited time offers.

- Report suspicious activity: Report any suspicious activity to law enforcement.

Bottom line

Using a Bitcoin teller machine is a user-friendly way to perform cryptocurrency-based transactions. By understanding how Bitcoin ATMs work, you can buy, sell and send BTC easily, confidently and conveniently. Note that over time, you can learn how to use Bitcoin ATMs with more advanced features. Whether you are a newbie or an experienced crypto user, the resources in this guide will help you create the best automated bitcoin teller machines.

FAQ

Can I get cash from Bitcoin ATM?

Bitcoin ATMs provide a modern way to interact with cryptocurrencies in order to access them in the most practical way. Since they run like regular ATMs, but are designed for crypto transactions, you can convert your Bitcoin holdings and withdraw them in cash in just a few minutes.

Is a Bitcoin ATM costing $500?

Bitcoin ATMs charge between 5% and 25% per transaction and the network is between $1 and $3. If you make a $500 transaction, you might spend $40 to $100 depending on factors like location, time and Bitcoin ATM operator.

How much does it cost per $1,000 Bitcoin ATM?

according to Bitcoin Library$1,000 in Bitcoin transactions will cost about $80 to $200. However, ATMs may charge lower fees, which may be as low as 4% to 20%.

Can I send $10,000 through Bitcoin ATM?

Yes, you can send $10,000 or more over BTM, but in most cases you need to provide authentication for any large transaction. According to the ATM provider, this may be a government-issued ID or any other personal information that a particular ATM provider may need.

Is Bitcoin ATM safe?

Bitcoin BTMs can be used safely as they employ encryption and other forms of authentication to facilitate transactions. However, due to the prevalence of fraudsters, their frauds have deceived users, such as investment scams and romance scams.