Zora – Once known as a promising NFT infrastructure platform, it came under fire after its Zora token Airdrop was launched. The event was not celebrated, but was quickly garnering widespread criticism for its controversial token learning, unclear utilities, and what many users say is a poorly managed execution process.

Lack of utility, lack of trust in “entertainment” tokens

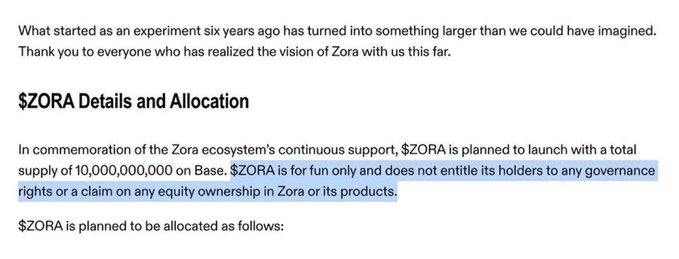

Zora is described as a token with no clear benefits to the holder. The project publicly stated that the token has no governance rights, no fair representation, and does not play any important role in the operation of the platform. Zora even stressed on its official channel that the update is a “funny” version, a non-traditional approach designed to get people’s attention.

However, in an environment where users increasingly expect transparent token distributions, tangible utilities, and alignment with dispersed values, Zora’s positioning is counterproductive. The lack of clear use cases is not seen as a creative experiment, but has led many to view Zora tokens as speculative assets rather than meaningful contributors to the NFT ecosystem.

Source: Zora

The situation raises an important question: Why release the token in the first place if it has no purpose? For a brand that once had a high reputation in the NFT space, launching a token without a clear feature now looks like opportunism, disguised as “funny” guess. Users believe that if Zora has no intention of making the token useful, then the least you can do is ensure fair distribution. However, that’s too short.

Not only is Zora lacking utilities, it also debuted at a relatively high market valuation, although there is no specific benefit to holders. This exacerbates further confusion, especially since the team and early investors controlled the majority of the token supply. Zora has a high price, no utilities and skewed DREW DREW SHARP WEB3 rebounds, Zora has a high price, no utilities.

Some analysts believe the decision is a legal gray area to minimize regulatory pressure. But in this way, Zora may have damaged its reputation, just as Web3 turns to long-term, value-driven architecture.

Skewed Allocation: Zora’s Trust Issues Compared to ZKSYNC and Scrolling

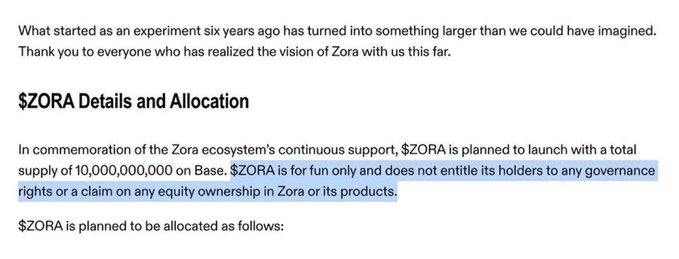

Zora offers 65% of tokens to insiders, 18.9% of tokens to the team, 20% of reserves and 26.1% of investors. This accounts for only 35% of the community, divided into 10% airdrops, 20% community plans, and 5% liquidity.

Source: Zora

This unbalanced distribution caused a rebound, especially since Zora is considered an “entertainment” token and has no real purpose. Critics argue that such launches seem to prioritize insiders rather than really fostering community engagement, as many would have hoped.

ZKSYNC reserves only 33.3% of insiders, leaving 67% of the community, a more balanced one than its peers. This includes 17.5% of the air conditioning and wider ecosystem programs managed by the nonprofit ZKSYNC Foundation. The vesting schedule covers four years and carries a cliff of one year.

The rolling 23% to the team was allocated to 23%, the investors allocated 17% to investors, and its foundation allocated about 50% to insiders. The other 50% belong to the community, with 35% of ecosystem incentives and 15% of air flow distributed during the planning phase.

Both ZKSYNC and reels have previously faced a rebound in internally friendly allocations during the testnet or pre-key phase.

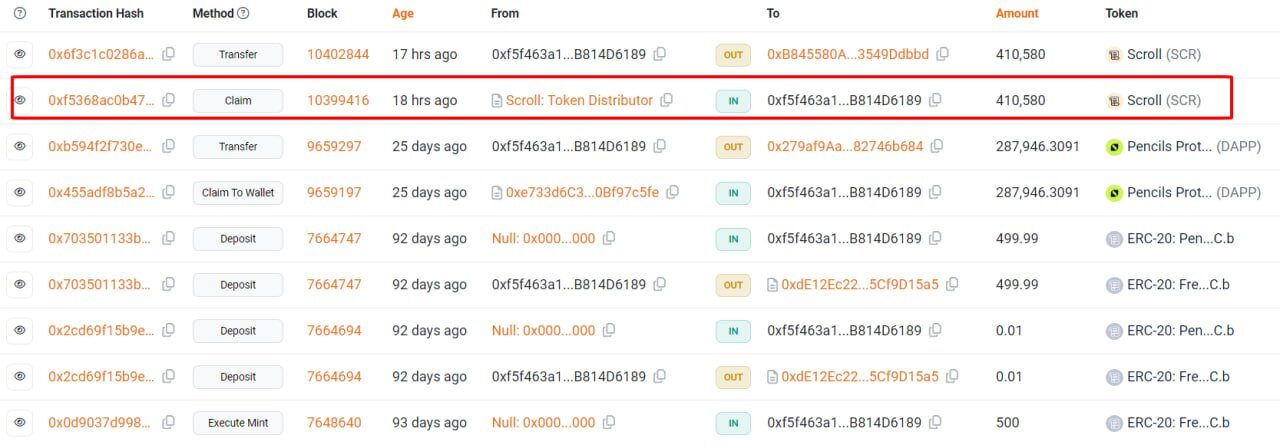

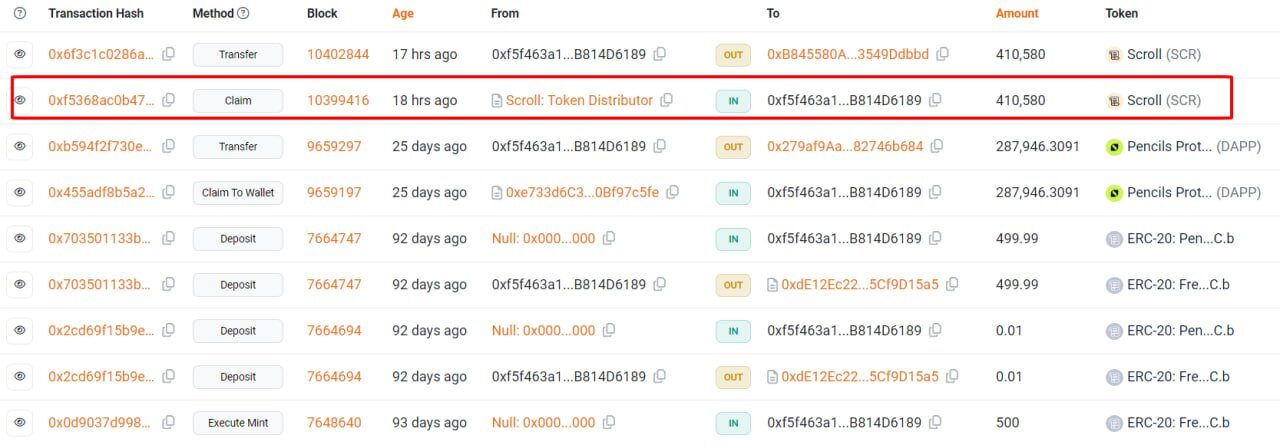

The community criticized Zksync for developing unclear air conditioning rules that missed many long-term test network users. After reports that some internal addresses have obtained early allocation privileges, the rolling also faces a rebound.

Source: Rolling Explorer

In contrast, Zora not only outperforms Zksync’s internal proportion (65% vs. 33.3%), but fundamentally the value proposition is fundamentally based. Although ZKSYNC and scroll link link tokens are related to governance and utilities, Zora does not provide them despite higher internal allocations.

This difference explains the wave of rebounding across platforms like X and Discord. Many people now see Zora as an insider, with a different community priority than Zksync and Scroll.

Throughout the Web3 space, it is usually seen that the internal allocation range is 20-30%. Zora’s 65% distribution makes many call it an invisible token sale, not a gas disc.

Community rebound, chain data and “REKT” stories

Data show that Zora’s price has dropped by more than 50% within a few hours of its listing, indicating a strong sell-off wave. Trading volumes also plummeted – from $31 million to just $9 million in 48 hours, highlighting short-term speculation over the dominance of long-term convictions.

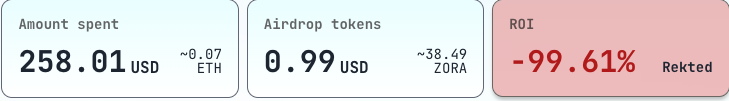

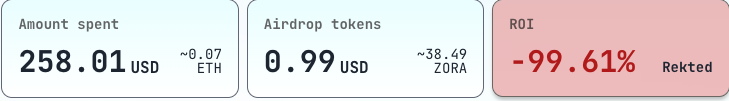

In addition to market indicators, many users also shared their personal disappointments. A wide-circuit case involves a user who spent $258 (~0.07 ETH) to interact with the platform in the hope of obtaining meaningful air conditioning allocation. Instead, they received only $0.99 worth of Zora, equivalent to 38.49 tokens, reflecting a 99.61% cruel negative ROI. The story quickly spreads on X with the word “Rekted” printed on it, a symbol of the collective sense of betrayal echoing throughout the community.

In addition, the community found that many wallets that had little meaningful interaction with the platform still received a large amount of air conditioning allocation. This raises doubts about potential insider participation or so-called “ghost allocation.”

Dune Analytics dashboard tracking recipient wallet activity shows that while there are no link interactions, some addresses get a lot of tokens. Meanwhile, many highly active users (including industry KOLS) receive the least reward, sometimes not enough to cover the gasoline they spend (average cost of over $1,000).

Why are Zora criticized now

1. Zora non-interactive wallet address receives airdrop

– Suspicious insider or team member

– https://t.co/i9hx2hovki (may check)2. Top KOLS spends about $1,000+ on gasoline, but does not generate $100 in revenue

Zora is…

-Naback |Korean KOL (@naback222) April 24, 2025

While some metrics (such as the number of creators and the number of tokens minted by Zora) continue to show growth, the general sentiment on social media remains overwhelmingly negative. Many users believe that airdrops do not create sustainable value, but are mainly used as liquidity for a small group of insiders.

in conclusion

Zora launched airdrops as an easy experiment—“to make the community vibrant “entertainment” token. Instead, it sparked widespread rebound and damaging trust, the platform once considered the cornerstone of the NFT infrastructure movement.

In a market increasingly rewarding transparency, utilities and long-term vision, Zora’s approach raises uncomfortable questions about accountability in Web3. For users and builders, radiation is a distinct reminder: in an era of decentralization, community trust is firm and can easily be lost.

Read more: Top 5 Airdrop Agriculture Projects on Solana (Part 2)