In the fierce competition between layer 1 blockchains, SEI networks measure their position stably with significant progress in both technical performance and strategic vision.

From having one of the fastest trading speeds on the market to bold moves like considering getting a genetic testing company 23andMe, SEI quickly became outstanding in the eyes of institutional investors.

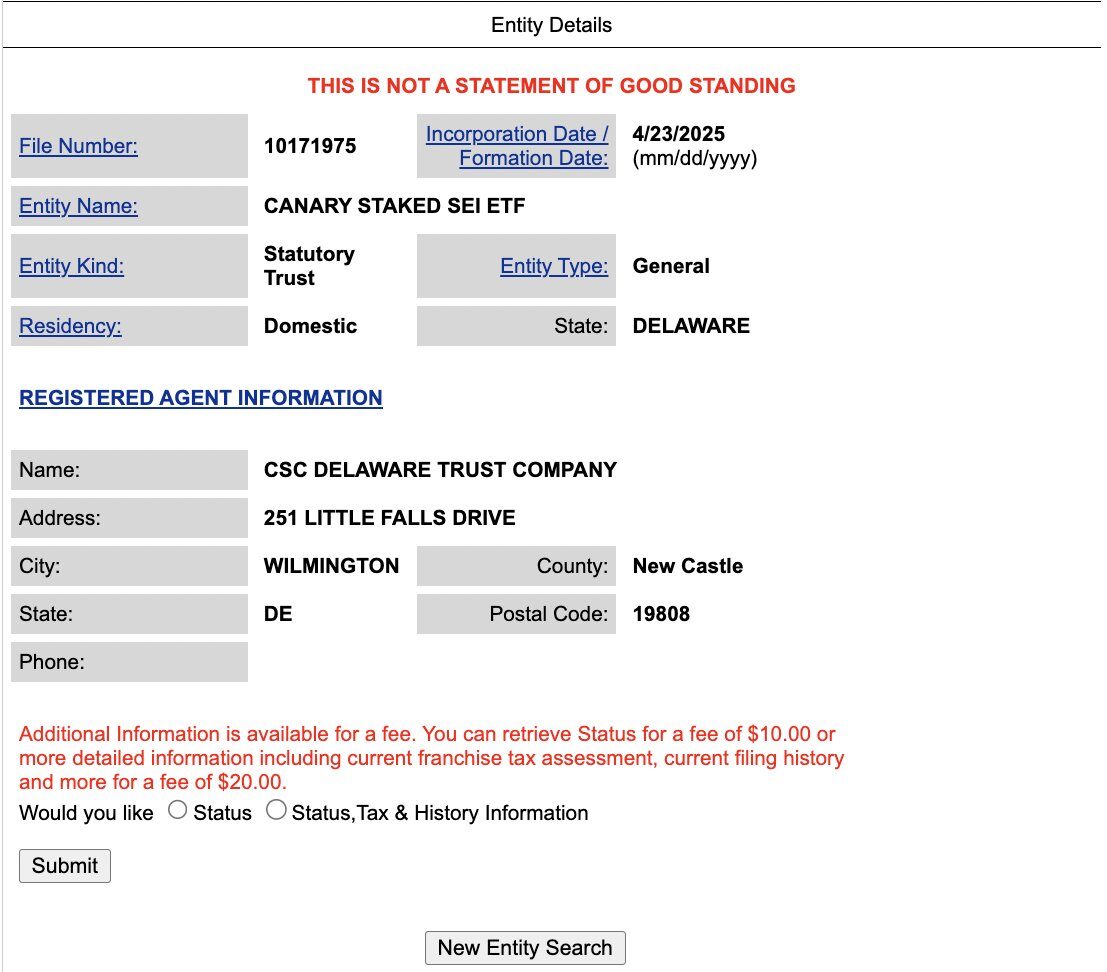

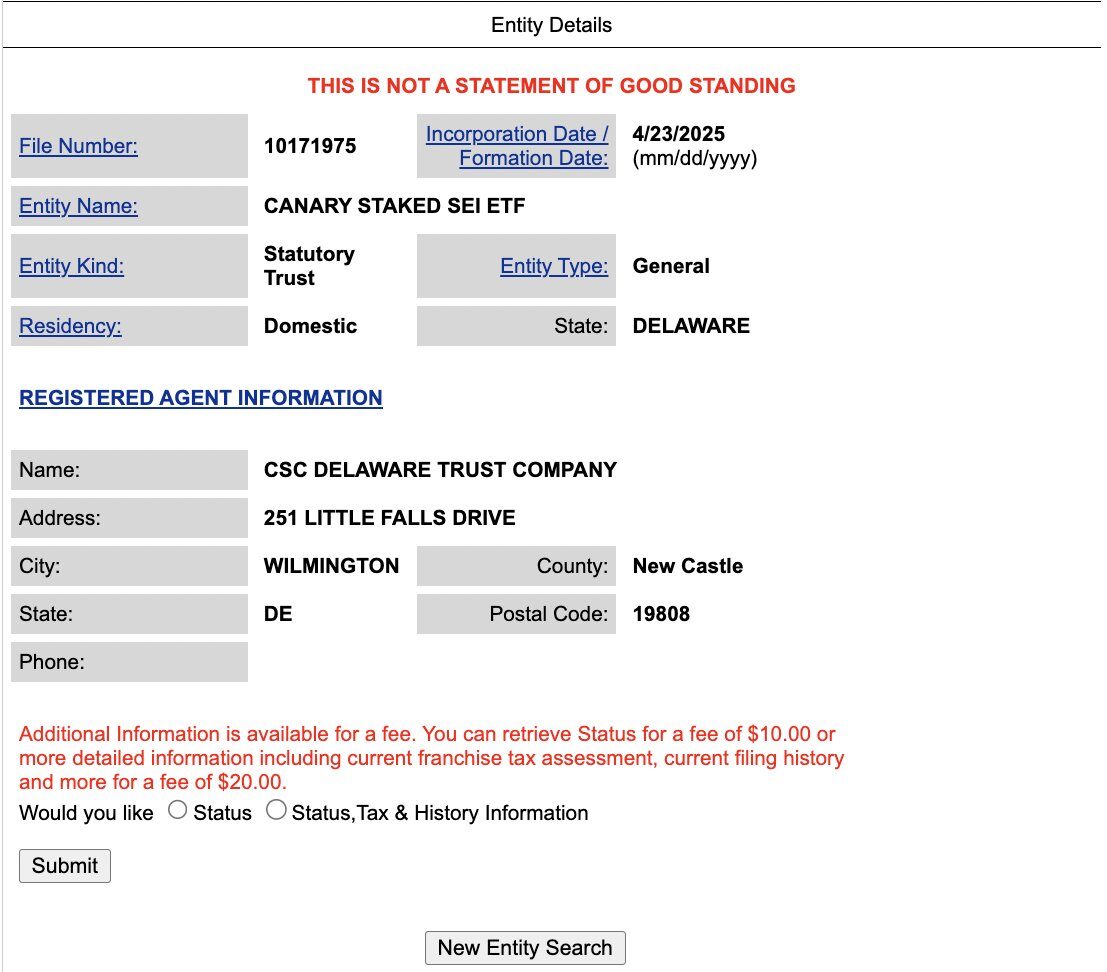

The Canary Capital Archive of SEI Staking ETF, paving the way to Wall Street

In a key development, Delaware-based investment firm Canary Capital has formally applied for approval of SEI-related Staking ETFs. If approved by the Securities and Exchange Commission (SEC), this would mark one of the first Staging ETFs based on Tier 1 blockchain, representing a significant leap forward in integrating SEI into the traditional financial system.

Source: Cointelegraph

Combining SEI’s points output with regulated financial products can attract a new era of adopting digital assets. It not only enhances liquidity over the long term, but also shows the legitimacy of SEI in the eyes of major institutional investors.

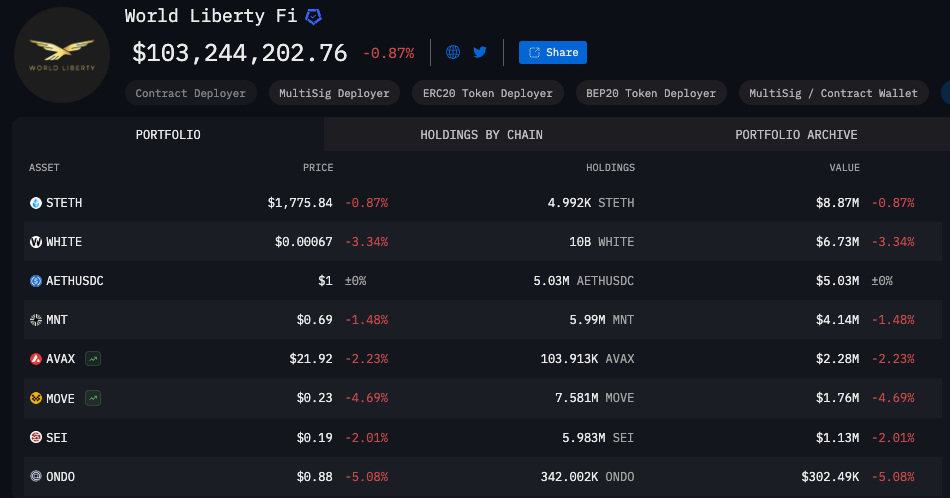

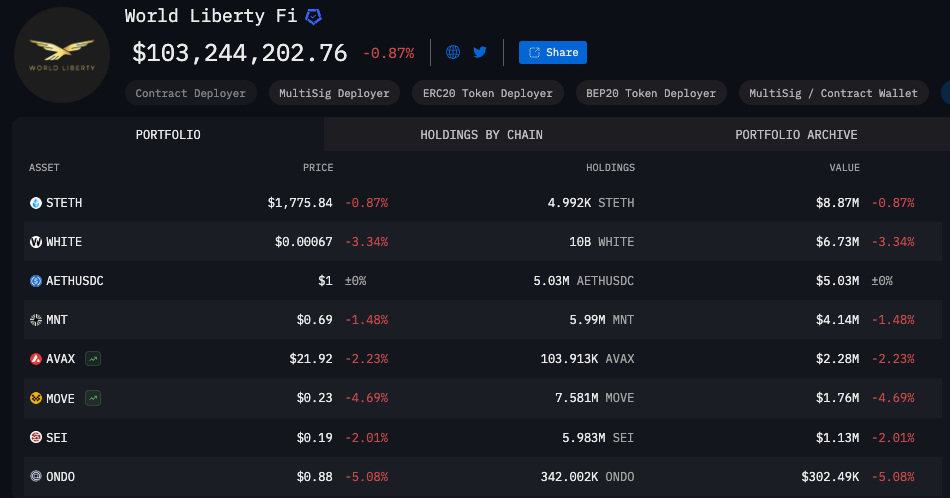

SEI also attracted the attention of World Free Finance (WLFI), an investment organization linked to the family of US President Donald Trump.

According to OnChain Lens, WLFI recently spent $775,000 to acquire about 4.89 million SEI tokens at an average price of $0.158 during the broader market correction period, indicating a long-term conviction of the SEI network. WLFI’s current SEI holdings have grown to nearly 6 million tokens.

WLFI Portfolio – Source: Arkham

The move is part of WLFI’s broader $343 million crypto portfolio, which includes blue-chip funding assets such as Ethereum (ETH), Packaged Bitcoin (WBTC), Chainlink (link), Avalanche (Avax), Aave, Aave, Aave, and emerging tokens, Ena, Ena, ena, ena, ena, na, ena of do ondo ondo, do, mnt, mnt and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei and sei.

Although the portfolio currently has an investment portfolio of approximately $109 million, WLFI allocates SEI with other established assets, but emphasizes rising recognition and institutional appeals to the SEI begins to direct.

SEI V2 Upgrade: Direct Challenge to Solana and High Performance Layers 1

From a technical point of view, SEI continues to consolidate its position by releasing SEI V2, which introduces full EVM compatibility and further optimizes parallel transaction processing. Now with less than 500 milliseconds of transaction terminal time, SEI now occupies the lowest latency blockchain, competitive and some real-world tests, and even outperforms Solana.

SEI V2 also opens up a wider ecosystem for developers by allowing the seamless deployment of Ethereum’s smart contracts. This change attracted a wave of DAPP and blockchain games to migrate to SEI. The rapid growth of projects such as Seiyan Dex, Pixelforge (a metagame) and Arithmetica (a decentralized data protocol) is strong evidence of this momentum.

In early 2025, SEI Labs also conducted major overhauls in its marking model, aiming to reshape the incentive structure of the entire network. Previously, a large portion of SEI token emissions were used to store rewards, which supported cybersecurity but immediately caused sales pressure because rewards were often offloaded to the market.

Now, updated token learning now prioritizes long-term ecosystem alignment. A large portion of SEI tokens are redirecting to builder incentives, open source funds, and protocol rewards to generate sustainable liquidity, transaction volume and user engagement. This shift encourages developers and DAPP operators to stick to their commitment to SEI rather than extracting short-term value.

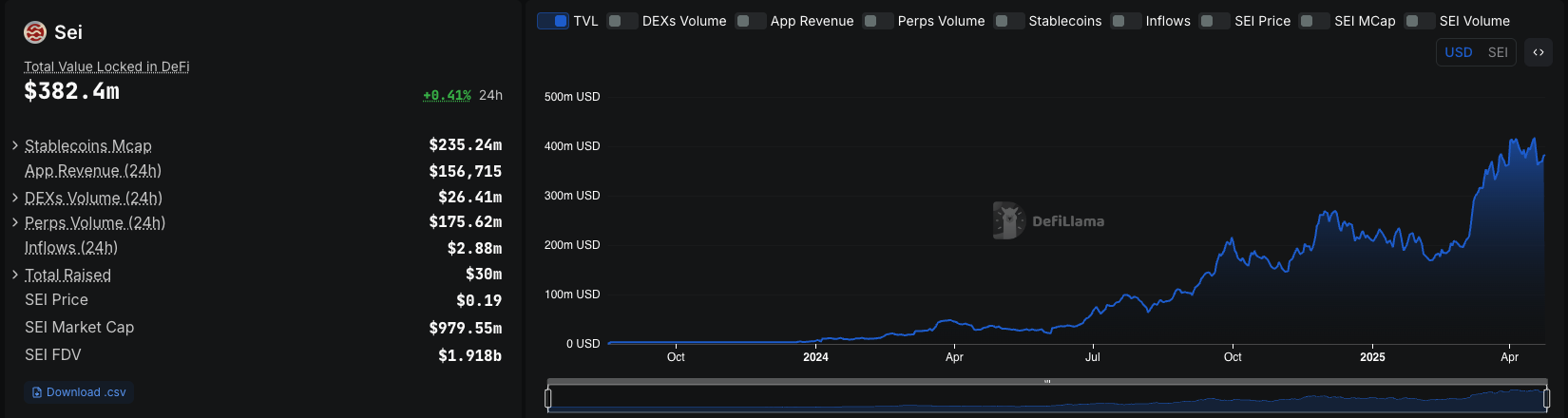

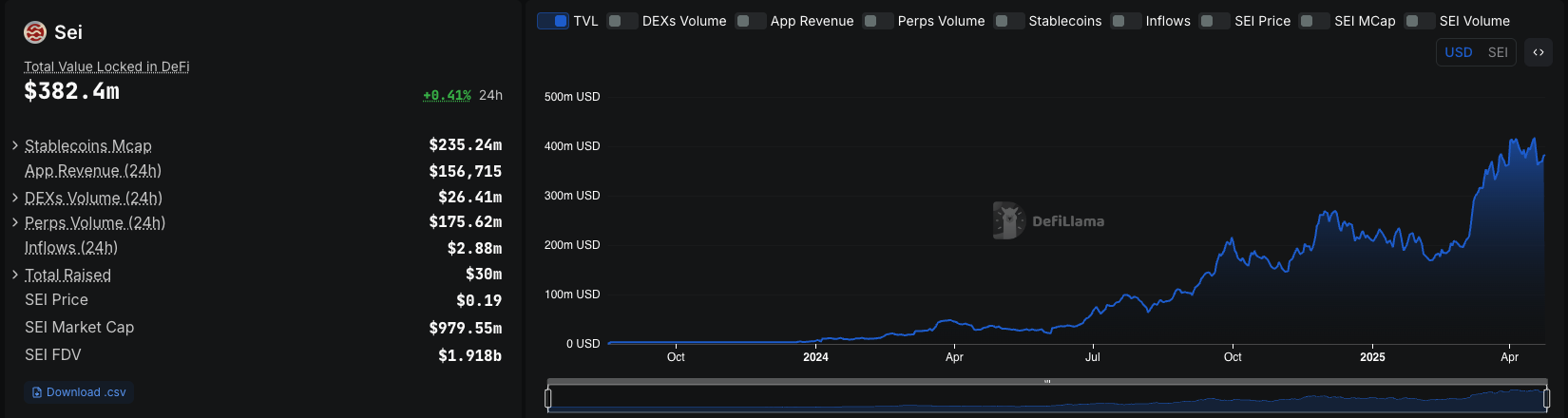

According to DeFillama, the total value of SEI’s Total Value Lock (TVL) soared by $382 million, almost fivefold since 2025 in the first quarter. This peak is driven by new Defi projects initiated on SEI and growing institutional interest in the ecosystem.

SEI TVL – Source: Defilama

These numbers show better liquidity, and SEI’s growing appeal in Tier 1 competitions. SEI’s low market cap makes it a strong competitor in the next tier 1 growth wave.

From Financial Layer 1 to DESCI Infrastructure

On March 27, 2025, Coindesk reported that the SEI Foundation, the nonprofit behind the SEI network, is considering acquiring 23andMe, a consumer genetic testing company currently submitted for Chapter 11 bankrupt consumer genetic testing company. SEI’s goal is to bring genetic data from more than 15 million users to the chain through the SEI network to ensure ownership of personal data and enhance information security.

If successful, the project will mark one of the boldest moves in the decentralized science (Desci) space to date. The SEI Foundation envisions a future in which genomic data is no longer controlled by centralized intermediaries but is directly managed through the blockchain infrastructure. The program also opens the door to wider application of SEI in healthcare and biomedical research.

The SEI Foundation is placing its boldest Desci bet.@sei_fnd Formal Exploration @23andme Defend the genetic privacy of 15 million Americans and ensure their data is protected by future generations.

We believe in user data… pic.twitter.com/c06r2qpyff

– be🔴 (@seinetwork) March 27, 2025

Prior to this, the SEI Foundation had launched a $65 million grant fund dedicated to the Desci project on the SEI Network. This strategic move aims to extend the real utilities of SEI beyond DEFI in areas such as medical data, scientific research, and AI integration.

News of the potential 23andMe acquisition increased the SEI token by about 3% shortly after the announcement, and then slightly corrected. Price action reflects the market’s optimism that SEI can act as a trusted infrastructure to store and protect sensitive personal data.

Read more: Gold and Bitcoin: Two pillars of preserving value, but which one is better?