Binance Wallet has become a leading portal for retail users to participate in high-potential IDOs with minimal capital and maximum upside potential.

So, how does the IDO process work on a binary wallet? How do users get allocations and maximize their returns?

Why You Should Join Idos Binance Wallet

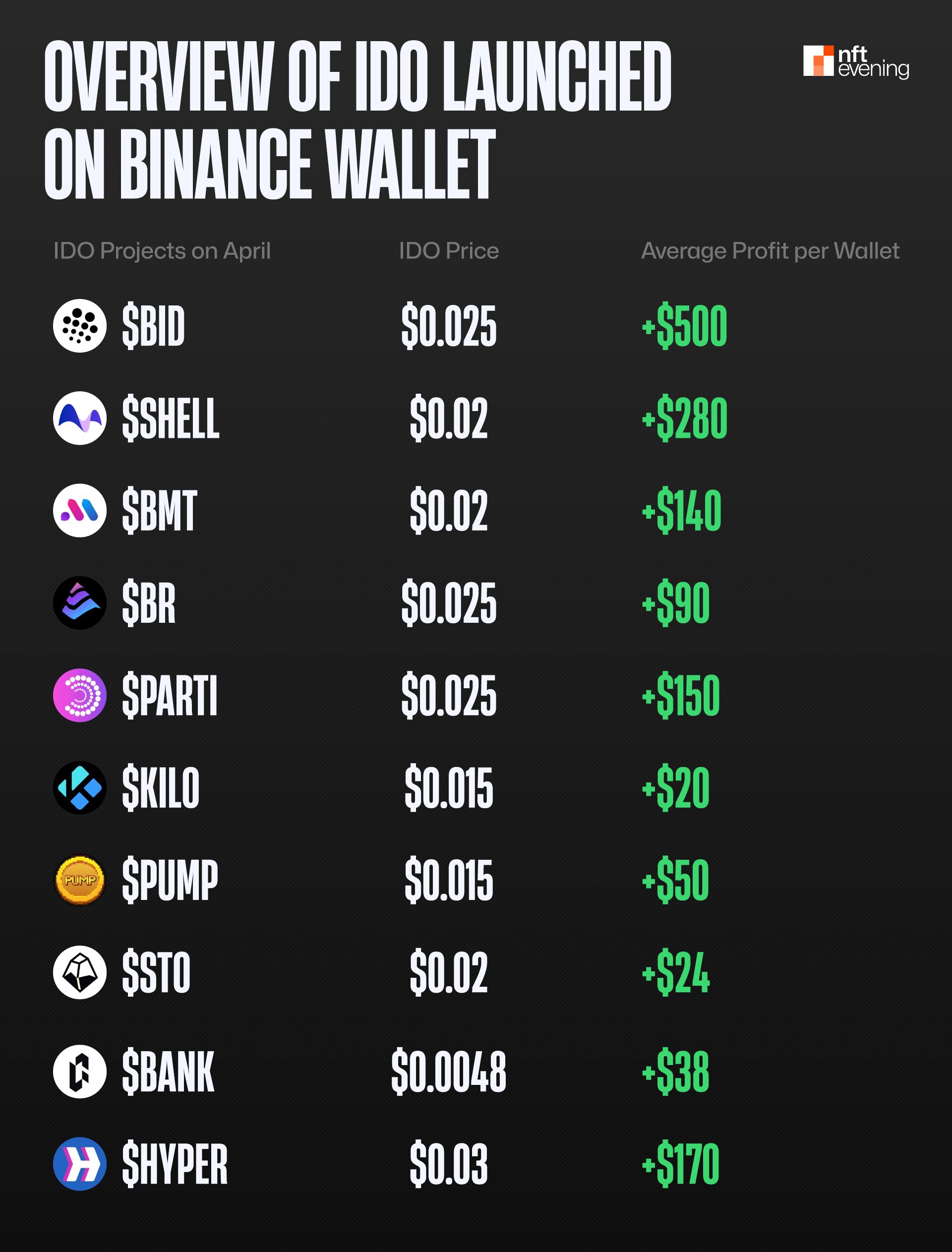

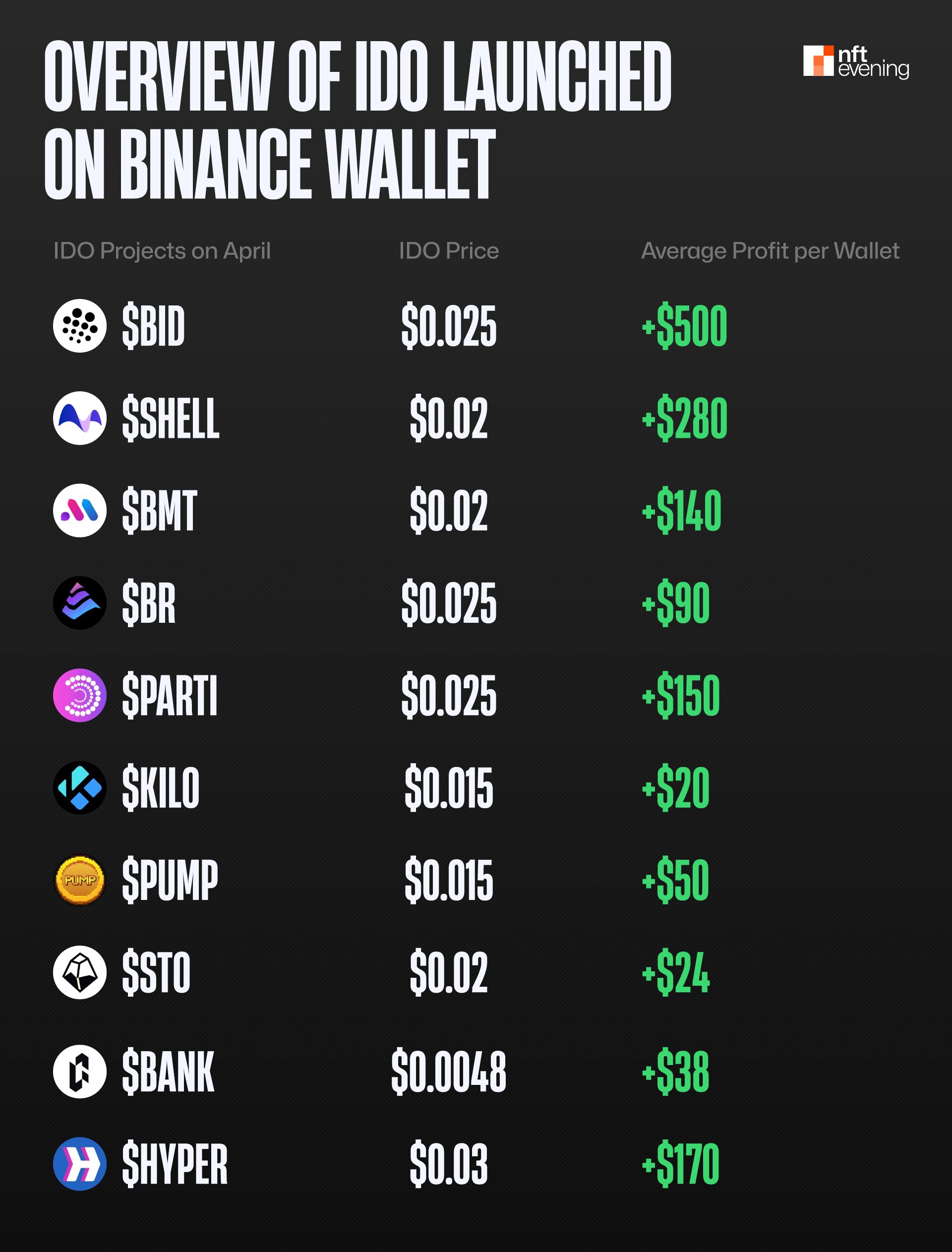

Amid today’s turbulent crypto landscape, Binance Alpha’s initial DEX product (IDO) has become one of the most promising opportunities for retail investors seeking early exposure. According to recent statistics, the IDO project was launched only in April, providing an average return of 3.4 times for early participants, more than 6.5 times.

For example, users who have joined projects such as $pump, $bank or super-reported average profits range from $24 to $170 per wallet – the initial investment was only a few dollars (mainly $20 to $30). Among them, the $pump record is the highest ROI, reaching a peak of 12.1 times, while $Hyper’s current average wallet total returns.

More importantly, data from Cryptorank show that Binance Wallet has the highest average ROI on all IDO platforms over the past 12 months, with an average ROI of about 8 times.

These numbers position Binance Wallet as one of the most efficient and accessible IDO platforms today, especially for small investors looking to acquire high-potential early stage projects.

How to participate in IDO binance wallet

Create a Binance account

In order to participate in any IDO through the Binance wallet, the first step is to create a binance account and complete the authentication (KYC) process.

Here’s how to start:

Go to the official Binance website or download the Binance app from the device’s app store. On the home page, if you are a new user, click Register. Prompt you with a valid email address or mobile phone number, set a security password, and then perform account verification.

Binance will then ask you to upload a government-issued ID, such as a passport or country ID card, to confirm your identity. Once your information has been successfully reviewed and approved, your account will be activated and ready to be used.

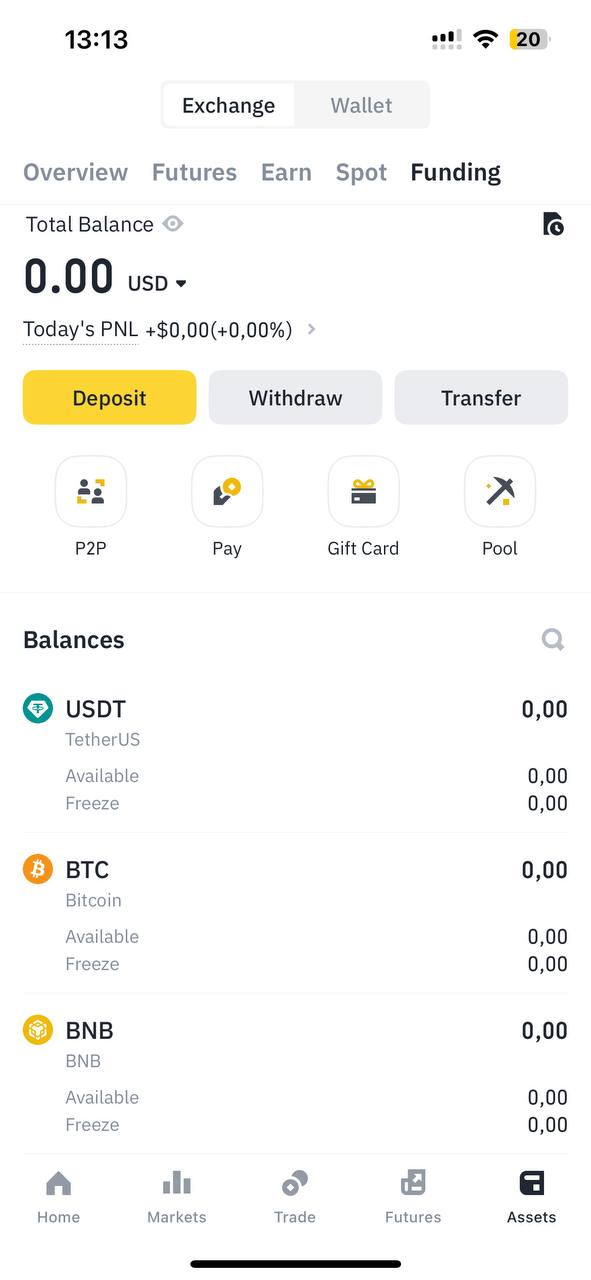

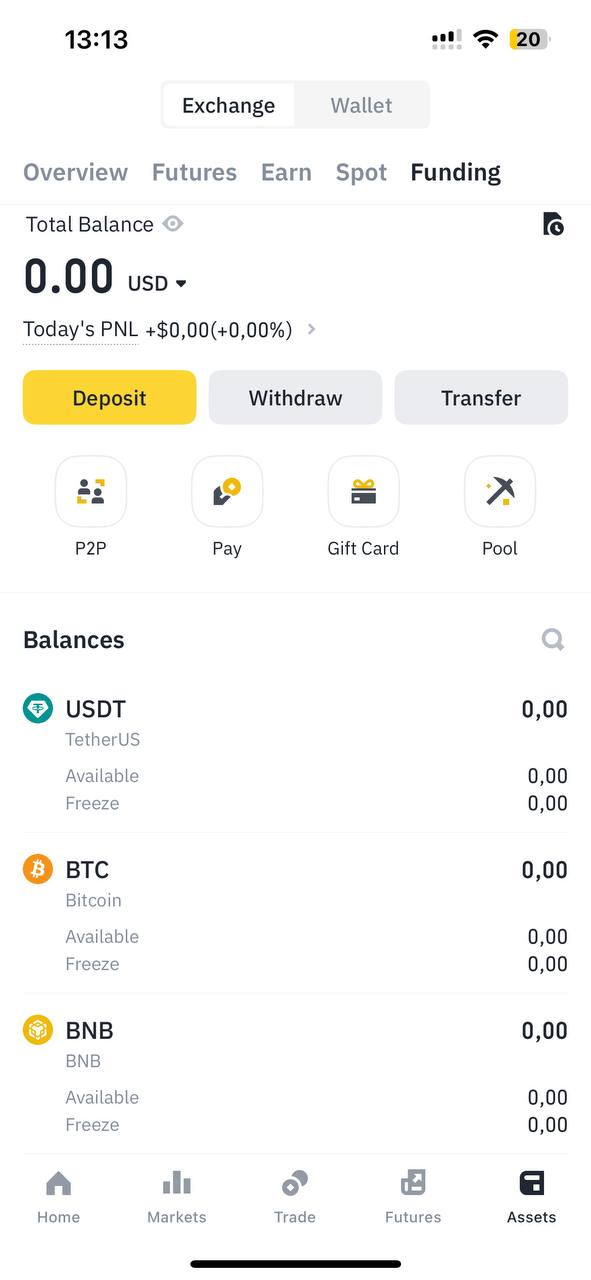

Once your Binance account is active, log in and go to the main dashboard. From there, click the Wallet tab and select the P2P option to add funds to your account – specifically USDT or USDC, which are commonly used StableCoins.

Once you have successfully funded your account, navigate to the spot market section and use your USDT or USDC to purchase BNB, the token you usually need to participate in an IDO on Binance Wallet.

The latest IDO activity enables each participant to commit up to 3 BNB per wallet.

How to join Binance Wallet IDO

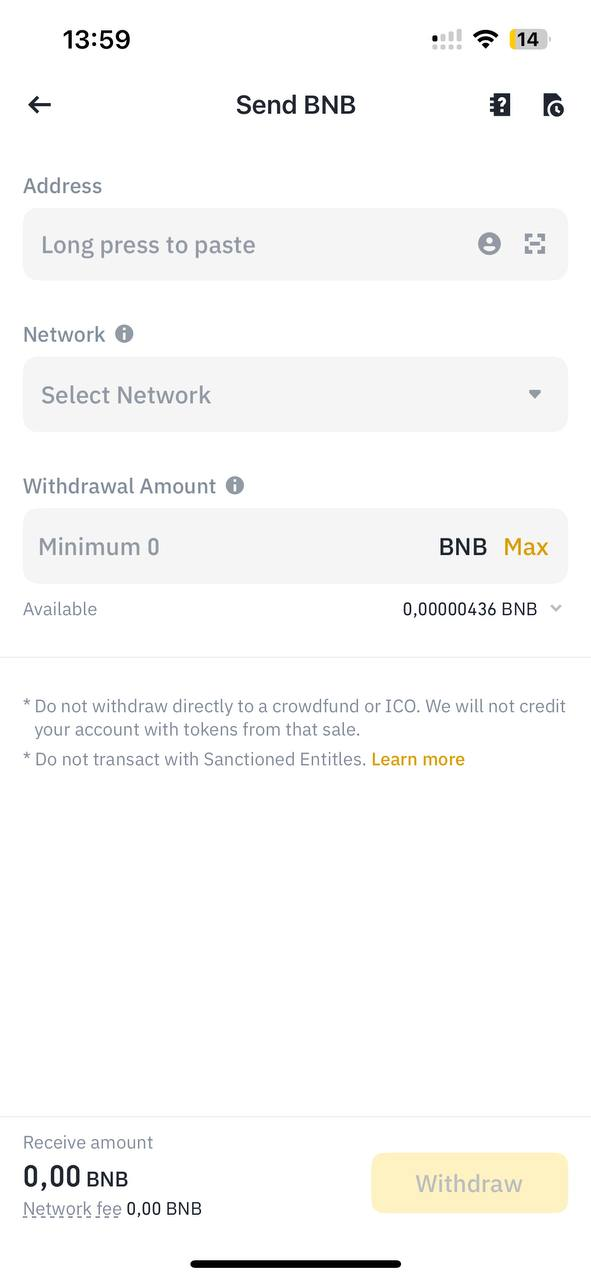

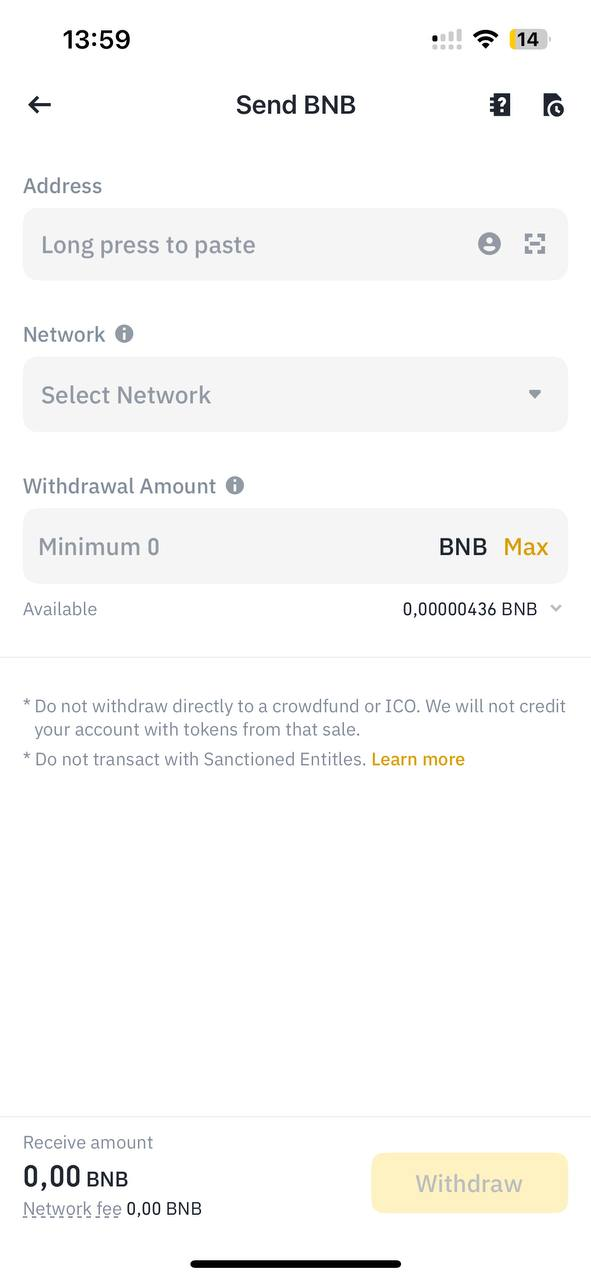

After purchasing BNB, users need to transfer their tokens to the Binance Web3 wallet through the “Retraction (Cheng)” option on Binance.

After purchasing BNB, the next step is to send the token to your Binance Web3 wallet. To do this, use the on-chain withdrawal feature available directly on the Binance app or website.

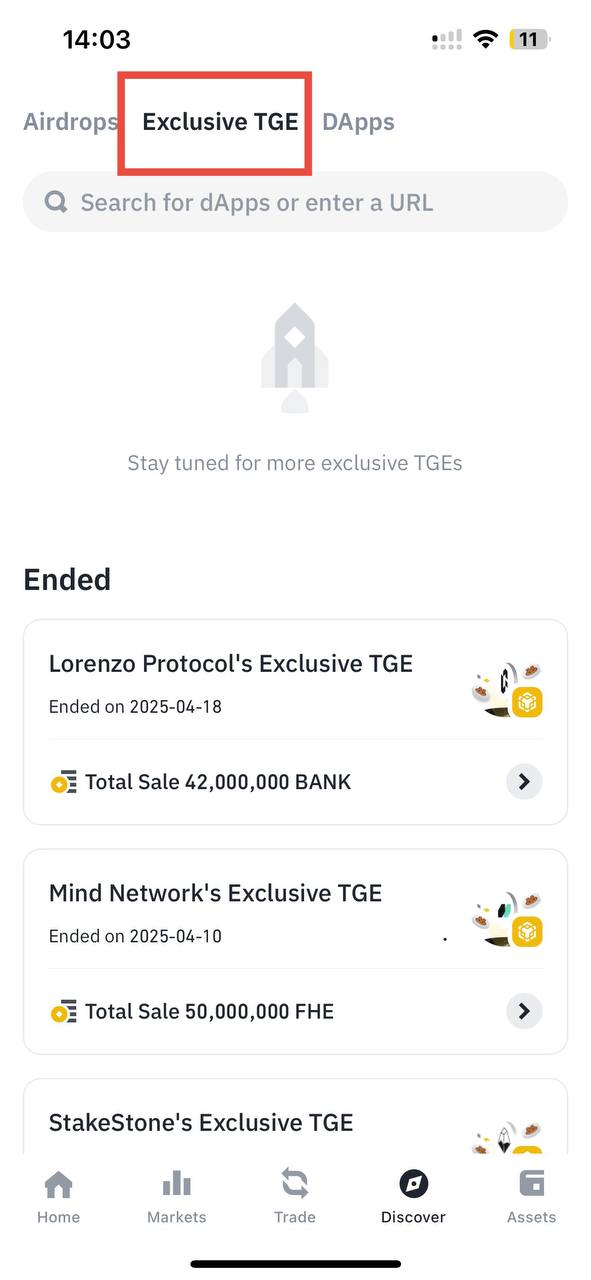

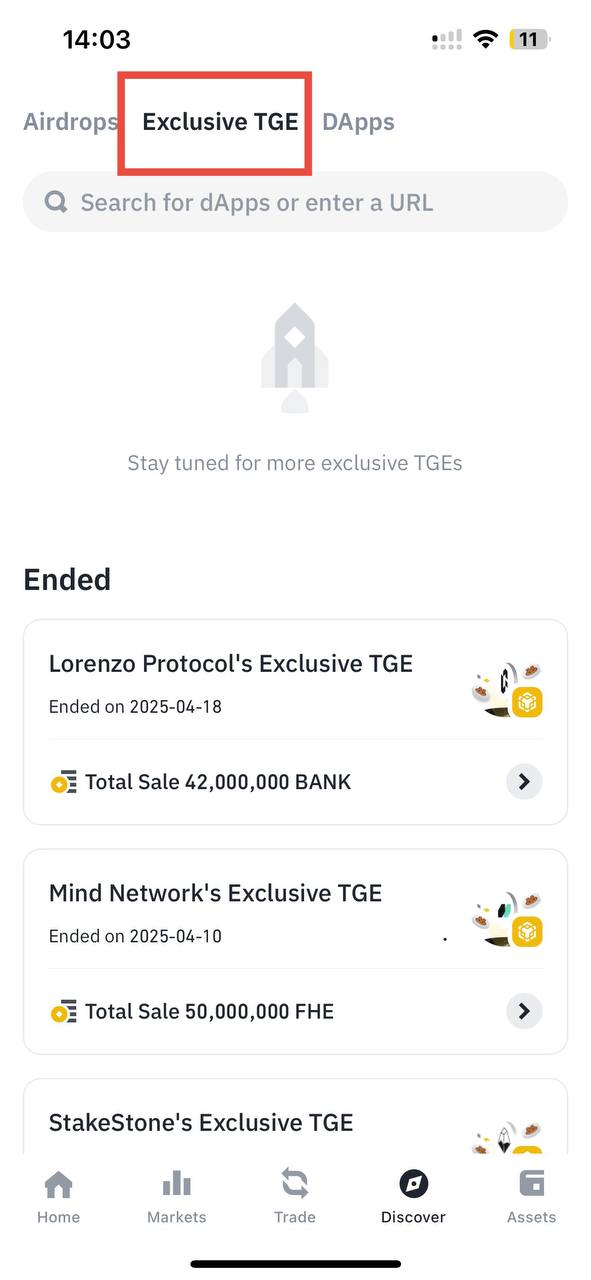

After BNB arrives in the Web3 wallet, open the wallet interface and click on the “Discover” tab on the homepage. Then, check the “exclusive tge” section, which is where Binance usually has an IDO.

Borrow BNB by Binance or Aster (Astherus)

Additionally, to avoid slippage or delay caused by converting assets to BNB at the last minute, users can take advantage of the platform lending option. For example, using USDT or other tokens as collateral, binary users can borrow BNB through crossed edges or flexible loan features.

If you use the Binance Web3 wallet, the Aster protocol can also perform instant BNB borrowing through the integrated Defi liquidity pool. These tools allow users to stay agile during fast moving token sales while enhancing interaction with the wider binary ecosystem.

This will only cost the user’s borrowing fee; after which they can easily return the borrowed BNB after claiming Airdrop tokens.

Tips for maximizing your IDO qualifications on your Binance wallet

The recent IDO round on Binance wallet shows a clear pattern: Binance prioritizes wallets with real ecosystem activity.

One of the most influential factors is your involvement in Binance Alpha, the platform’s early token discovery center. The items listed here are usually test sites that identify active and interested users. After a project, make a small purchase or use the TestNet feature to show promises and improve opportunities for white people.

Take the recent Hyperlane (super) IDO as an example. To qualify, users need to purchase at least $20 worth of tokens under Binance Alpha. In other cases, keeping the minimum balance in your binance wallet at $100 and the major second-hand shares are part of the eligibility criteria for seven consecutive days.

To stay prepared, you should keep a balance of $50-$100 USDT in your dining venue or Web3 wallet. This range is often a common threshold for many recent IDOs.

Finally, while not requiring a lot of investment, it is helpful to maintain regular activities. A small transaction or two usually takes place every week, especially those involving Alpha listing tokens, is usually sufficient to demonstrate consistent participation – a key metric is often considered when selecting IDO participants.

in conclusion

Participating in Binance Wallet’s IDO provides retail investors with a unique opportunity to access early stage projects with high growth potential in a secure and simplified environment.

With consistent link activity, the average ROI significantly outpaced other platforms and clear avenues to qualify, so Binance Wallet has positioned itself as the best option for strategic IDO engagement.

Read more: Cultivated airflow for breeding Alpha: Low risk, high reward