The US spot Bitcoin ETF recorded inflows for four consecutive days, which demonstrates investor confidence. The net inflow in two days exceeded $900 million, and the market was full of optimism. But is this a real recovery or a temporary surge? Let’s explore the data and factors that drive this trend.

Bitcoin ETF record continuous inflows

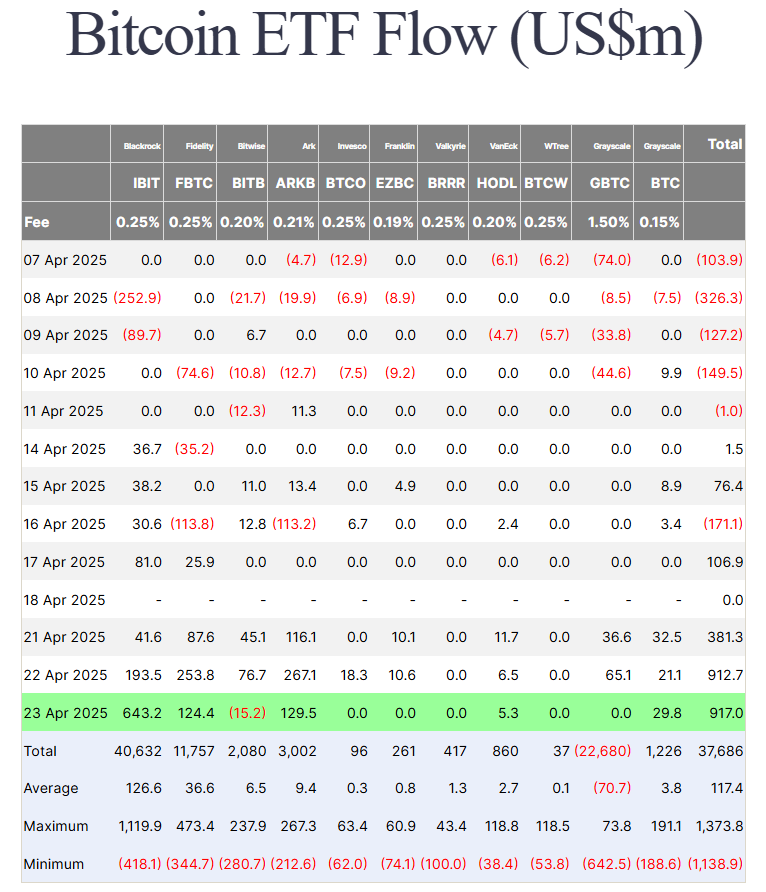

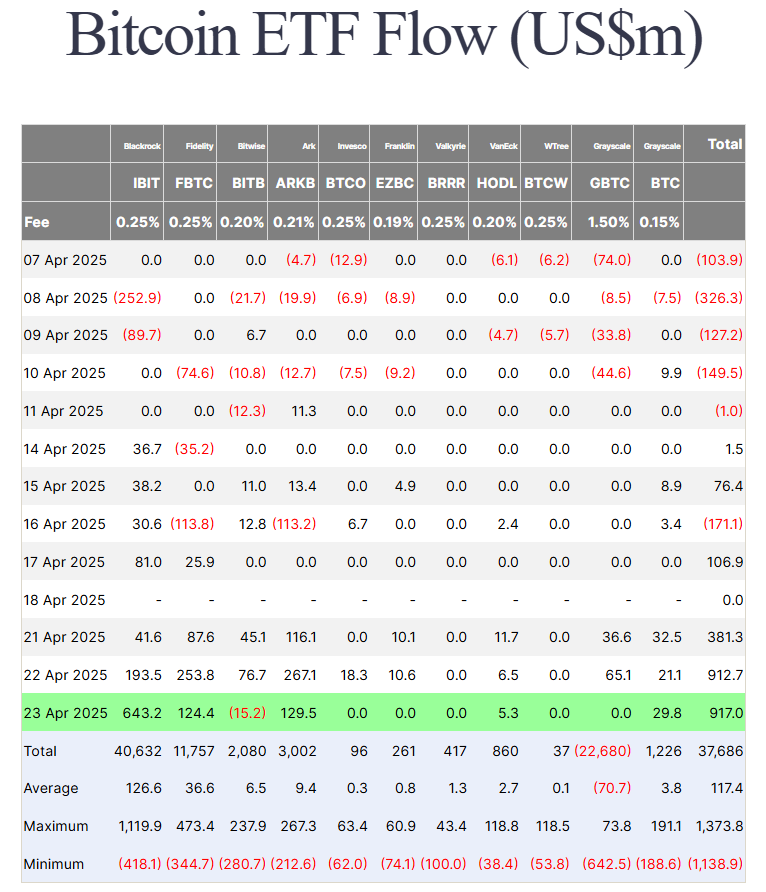

Over the past four days, US spot Bitcoin ETFs have continued to be net inflows, with total inflows reaching US$963.55 million. It is worth noting that for two consecutive days (Tuesday and Wednesday), the largest single-day inflows were inflows of $912 million and $917 million, respectively, which was the highest single-day inflow since President Donald Trump’s inauguration.

Source: Farside Investors

Leading ETFs like Blackrock’s iShares Bitcoin Trust (IBIT), FBTC of Ibit, and ARK 21Shares’ ARKB drove the surge, with IBIT alone recording $193 million inflows and over $4 billion in transaction volume on Tuesday alone. As of April 24, 2025, Bitcoin ETFs continued to have positive flows as of today, with estimated net inflows of $936.43 million on Wednesday, strengthening bullish sentiment. This streak follows the volatile period of outflows, which makes current momentum particularly important.

Has the market really recovered?

Recent developments point to the potential recovery of the BTC market driven by high-profile events and changing economic dynamics.

On April 23, 2025, President Donald Trump announced that U.S. tariffs on Chinese goods could be reduced, which alleviated earlier market concerns by 145%. This development is part of the ongoing U.S.-China trade negotiations, reducing economic uncertainty and creating a more favorable environment for risky assets like Bitcoin.

In addition, Trump clarified that despite prior criticism, he had no intention of firing Fed Chairman Jerome Powell, which demonstrated the stability of U.S. monetary policy. He continued to push for strategic Bitcoin reserves, which further strengthened institutional confidence and pushed strong inflows toward Bitcoin ETFs at the White House crypto summit on March 7. Macroeconomic factors, such as weakening the U.S. dollar index and expected Fed reduction rate in mid-2025, have increased Bitcoin’s attractiveness as an inflation hedge.

Read more: Markets turn to bullish after Trump’s China and Powell’s comments

However, the challenge remains. Continuous concerns over Trump’s proposed trade policies and ongoing inflationary pressures could lead to volatility. The market recovery depends on the ongoing ETF inflows in U.S. crypto regulations, wider institutional adoption and clarity. Investors should closely monitor these evolving dynamics to assess the lifespan of this bullish trend.

The four-day inflow of Bitcoin ETFs, coupled with strong daily traffic, suggests a potential market recovery. Trump’s supportive rhetoric and favorable macroeconomic shifts were key drivers, but volatility and policy uncertainty continued to decline. Investors should monitor ETF traffic and global economic trends to assess whether this bullish trend will persist.